Fillable Printable application for rural job tax credit for State of New Mexico

Fillable Printable application for rural job tax credit for State of New Mexico

application for rural job tax credit for State of New Mexico

RPD - 41238

Rev. 10/23/2014

STATE OF NEW MEXICO

TAXATION AND REVENUE DEPARTMENT

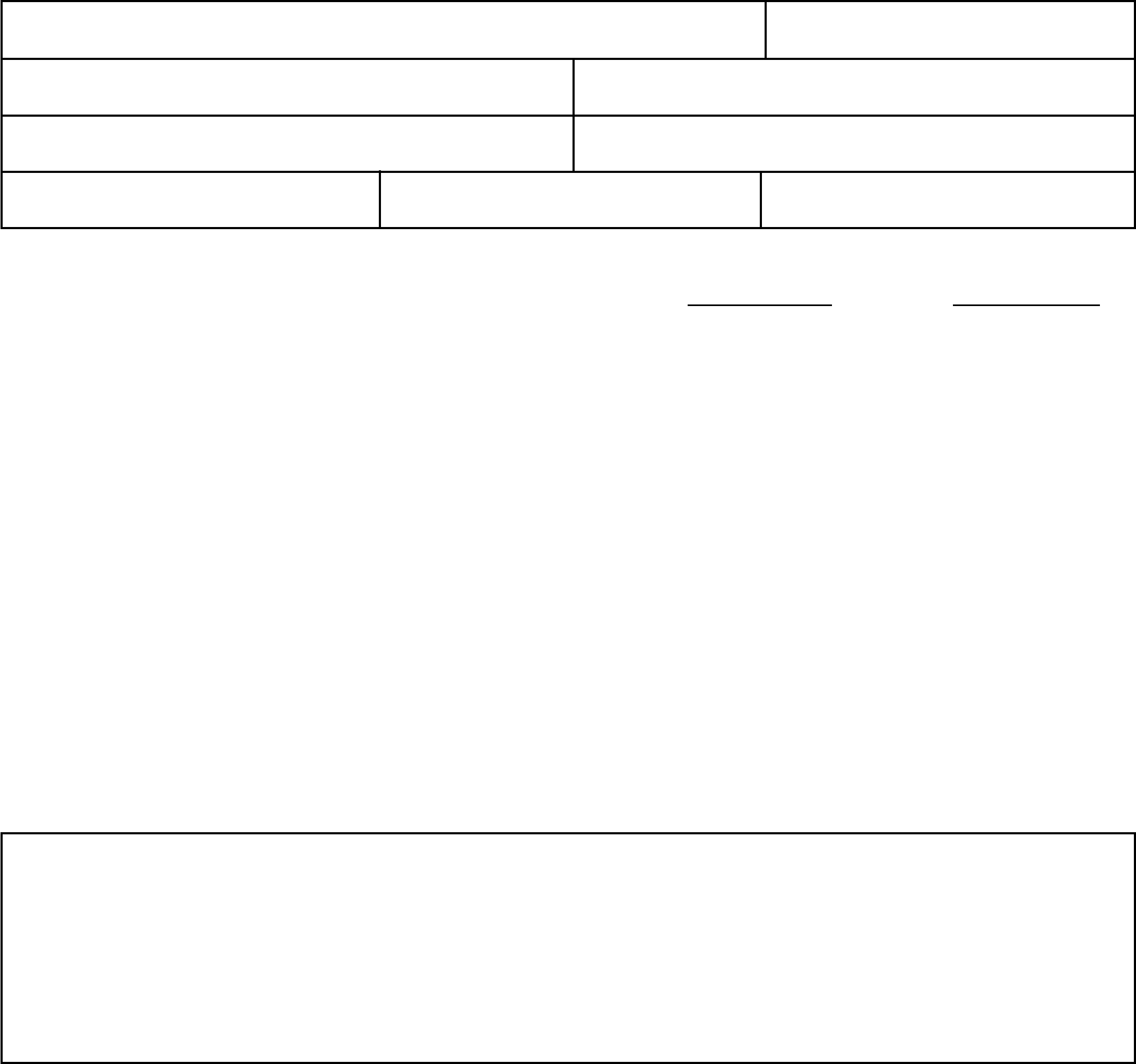

APPLICATION FOR RURAL JOB TAX CREDIT

A Rural Job Tax Credit is offered to employers who are eligible for Job Training Incentive Program assistance. It is based on the wages

earned in qualifying jobs occupied by an eligible employee for at least forty-eight (48) weeks during a qualifying period.

Mail to: New Mexico Taxation and Revenue Department (TRD), ATTN: Director's Ofce, P.O. Box 8485, Albuquerque, New Mexico 87198-

8485. For the status of the credit application call (505) 383-0184 or (505) 383-0171.

PLEASE PRINT OR TYPE

TIER ONE AREA TIER TWO AREA

1. Number of eligible jobs claimed* ______________ ______________

A certicate is required for each eligible job

2. Total Eligible Wages: ($16,000 maximum per job certicate)* ______________ ______________

Pursuant to Paragraphs (1), (2), and (3), 26 U.S.C. Section 51(c).

3. Rural Job Tax Credit: ______________ ______________

Multiply line 2 by .0625

* Attach Form RPD-41247, Certicate of Eligibility for the Rural Job Tax Credit, for each job for which credit is claimed in

an eligible period.

_________________________________________ _______________________________

Taxpayer's Signature Title

_________________________________________ _______________________________

Telephone Number Date

NEW MEXICO RURAL JOB TAX CREDIT

This credit may be sold, exchanged, or otherwise transferred.

Use Form RPD-41365, Notice of Transfer of Rural Job Tax Credit, to

report to TRD a transfer or distribution of approved rural job tax credits. The parties to such a transaction shall notify TRD of the sale,

exchange or transfer within ten days of such transaction. The holder of this credit may apply all or a portion of the rural job tax credit to

gross receipts tax (excluding local option taxes imposed by a municipality or county), compensating or withholding tax, less the amounts

of any other credit applied. The holder also may apply the credit to personal or corporate income tax liability. The credit may be carried

forward for a period of three years from the date issued as referenced above.

Enter the information requested under the tier area column that describes the location of the job.

(Tier areas are dened on the back of this form.)

Name of business

New Mexico CRS identication number

Physical address

City, state and ZIP code

Mailing address City, state and ZIP code

Name of contact person Telephone number Email address

Rural Job Tax Credit - Authorized by the New Mexico Taxation and Revenue Department

Approval by the New Mexico Taxation and Revenue Department Claim No. __________________

Department authorization: ____________________________________ Title: __________________________________

Date issued: ________________________________________ Credit sequence number: ______________________

Total amount approved: ________________________________

RPD - 41238

Rev. 10/23/2014

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Application for Rural Job Tax Credit Instructions

Page 1 of 2

ABOUT THIS CREDIT

The purpose of the rural job tax credit is to encourage

businesses to start new businesses in rural areas of New

Mexico.

The Rural Job Tax Credit Act, Section 7-2E-1.1 NMSA 1978

provides a credit for eligible rural employers for wages paid

to an eligible employee for each qualifying job the employer

creates after July 1, 2000. The amount of the rural job tax

credit is 6.25% of the rst $16,000 in wages paid for the

qualifying job in a qualifying period. An eligible employee

must occupy the qualied job for at least 48 weeks.

The Rural Job Tax Credit may be claimed for each qualify-

ing job for a maximum of four qualifying periods if the job

is performed or based at a location in a tier one area, and

two qualifying periods if the job is performed or based at

a location in a tier two area.

Denition of Tier Areas and Rural Area

A rural area excludes Albuquerque, Corrales, Farmington,

Las Cruces, Los Alamos County, Los Ranchos, Rio Ran-

cho, Santa Fe, or Tijeras, or any area within a ten-mile

zone around any of these municipalities. A tier two area is

within the cities of Alamogordo, Carlsbad, Clovis, Gallup,

Hobbs, and Roswell. A tier one area is anywhere within

New Mexico not listed above.

Denition of Eligible Employer

An employer who is eligible* for Job Training Incentive

Program (JTIP) assistance by the New Mexico Economic

Development Department, pursuant to Section 21-19-7

NMSA 1978. To learn more about JTIP assistance contact:

New Mexico Economic Development Department, Joseph

M. Montoya Building, 1100 So. St. Francis Drive, Santa

Fe, NM 87505-4147 or call: (505) 827-0300 or (800) 374-

3061. Their Internet address is: www.gonm.biz/.

*Prior to July 1, 2013, the employer needed to be ap-

proved for JTIP assistance. Effective July 1, 2013, an

eligible employer qualies when they can show that they

are eligible for JTIP assistance.

Denition of Qualifying Job

A job established by an eligible employer that is occupied

by an eligible employee for at least 48 weeks of a qualify-

ing period.

A qualifying job shall not be eligible for a rural job tax credit

pursuant to this section if:

1. The job is created due to a business merger, acquisi-

tion or other change in organization;

2. The eligible employee was terminated from employ-

ment in New Mexico by another employer involved in

the merger, acquisition or other change in organiza-

tion; and

3. The job is performed by:

a. The person who performed the job or its functional

equivalent prior to the business merger, acquisi-

tion or other change in organization; or

b. A person replacing the person who performed

the job or its functional equivalent prior to the

business merger, acquisition or other change in

organization.

If, however, a qualifying job that was created by another

employer and for which the rural job tax credit claim was

received by the Taxation and Revenue Department prior

to July 1, 2013, and is under review or has been approved

shall remain eligible for the rural job tax credit for the bal-

ance of the qualifying periods for which the job qualies

by the new employer that results from a business merger,

acquisition or other change in the organization.

A job shall not be eligible for a rural job tax credit pursuant to

this section if the job is created due to an eligible employer

entering into a contract or becoming a subcontractor to a

contract with a governmental entity that replaces one or

more entities performing functionally equivalent services

for the governmental entity in New Mexico unless the job

is a qualifying job that was not being performed by an

employee of the replaced entity.

Denition of Qualifying Period

A period of 12 months beginning on the day an eligible

employee began working in the qualifying job, or a period

of 12 months beginning on the anniversary of the day an

eligible employee began working in a qualied job.

Denition of Wages

Effective July 1, 2013, wages means all compensation paid

by an eligible employer to an eligible employee through

the employer's payroll system, including those wages the

employee elects to defer or redirect, such as the employee's

contribution to 401(k) or cafeteria plan programs, but not

including benets or the employer's share of payroll taxes.

CERTIFICATIONS

The employer shall certify the amount of wages paid to

each eligible employee during each qualied period, the

number of weeks during the period the position was oc-

cupied, and whether the qualifying job was in a tier one or

a tier two area. Form RPD-41247, Certicate of Eligibility

for the Rural Job Tax Credit, must be completed for each

eligible job within an eligible period. Certicates must be

notarized and submitted with the application.

APPLICATION

Apply to the Taxation and Revenue Department (TRD)

for the credit by completing Form RPD-41238, Applica-

tion for Rural Job Tax Credit. Complete Form RPD-41247,

Certicate of Eligibility for the Rural Job Tax Credit, for

RPD - 41238

Rev. 10/23/2014

each eligible job within an eligible period. On the applica-

tion, summarize the wages reported on the certicates

and calculate the amount of credit. Attach certicate(s)

to the application and submit to TRD. TRD may approve

the credit and issue to the applicant a document granting

the tax credit.

FORM INSTRUCTIONS

Complete all information requested in the address block.

1. Enter the number of eligible jobs for which credit is

claimed. (A certicate must be attached for each

eligible job).

2. Enter the sum of the wages for each eligible job as

certied by the applicant. (Maximum $16,000 of wages

paid for each qualifying job per qualied period.) The

Rural Job Tax Credit may be claimed a maximum of:

a. Four qualifying periods for each job performed or

based at a location in a tier one area, or

b. Two qualifying periods for each job performed or

based at a location in a tier two area.

3. Multiply line 2 by .0625 to compute the total Rural Job

Tax Credit.

Attach a Form RPD-41247, Certicate of Eligibility for the

Rural Job Tax Credit, for each eligible job included in line 1.

Complete taxpayer signature, title, telephone number

and date

.

Mail to: Taxation and Revenue Department, ATTN: Direc-

tor's Ofce, P.O. Box 8485, Albuquerque, New Mexico

87198-8485. For status of the application call, (505) 383-

0184 or (505) 383-0171.

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Application for Rural Job Tax Credit Instructions

Page 2 of 2

USING THE RURAL JOB TAX CREDIT

The holder of the credit may apply all or a portion of the Rural

Job Tax Credit to gross receipts less any taxes collected

with respect to local option gross receipts taxes (5.125%

of taxable receipts), compensating, and withholding taxes

due, less the amount of any credit other than the Rural Job

Tax Credit applied. The holder may also apply the credit

to personal or corporate income tax liability. If a PTE is

a holder of the credit, the PTE may pass the credit to its

owners so that the owners may claim the credit against

their corporate or personal income tax liabilities. Use Form

RPD-41365, Notice of Transfer of Rural Job Tax Credit, to

report to TRD a distribution of approved rural job tax credit

to the owners, members or partners of a PTE.

To claim approved credits against tax liabilities, complete

Form RPD-41243, Rural Job Tax Credit Claim Form, and

submit the form with the return to which the taxpayer wishes

to apply the credit. The credit can be carried forward for

a period of three years from the date the credit is issued.

TRANSFER OF CREDIT

This credit may be sold, exchanged, or otherwise trans-

ferred.

The parties to such a transaction shall notify the New Mexico

Taxation and Revenue Department within ten days of the

transaction. Use Form RPD-41365, Notice of Transfer

of Rural Job Tax Credit, to report to TRD a transfer or

distribution of approved rural job tax credits.

Mail the notication of transfer to: New Mexico Taxation

and Revenue Department, PIT Edit Error, P.O. Box 5418,

Santa Fe, New Mexico 87502-5418.