Fillable Printable Application for Tax Clearance - New Jersey

Fillable Printable Application for Tax Clearance - New Jersey

Application for Tax Clearance - New Jersey

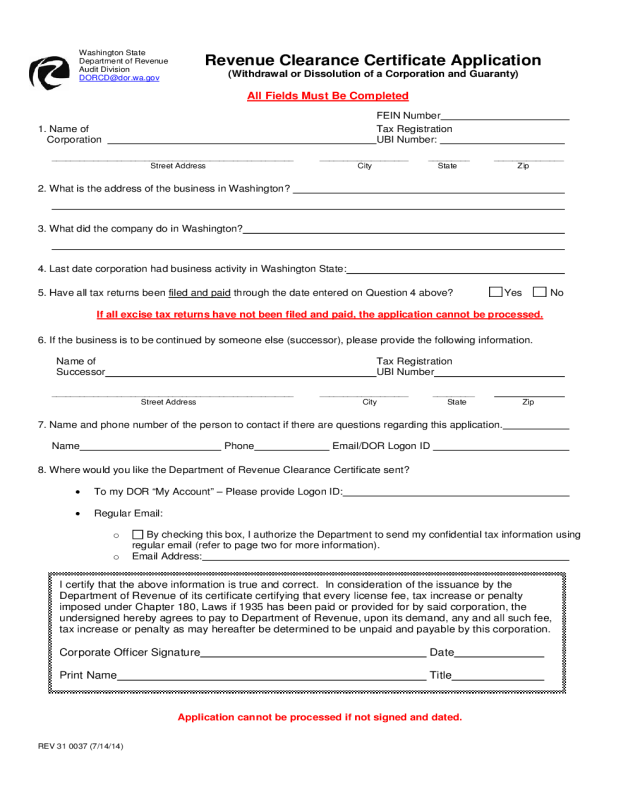

REV 31 0037 (7/14/14)

Revenue Clearance Certificate Application

(Withdrawal or Dissolution of a Corporation and Guaranty )

All Fields Must Be Completed

FEIN Number

1. Name of Tax Registration

Corporation

UBI Number:

____________________________________________________ ___________________ _________ _______________

Street Address City State Zip

2. What is the address of the business in Washin gton?

3. What did the company do in Washin gton?

4. Last date corporation ha d business ac tivity in Washington State:

5. Have all tax returns been filed and paid

through the date entere d on Question 4 above? Yes No

If all excise tax returns have not been filed and paid, the application cannot be processed.

6. If the business is to be continued by someone else (successor), please provide the following information.

Name of Tax Registration

Successor

UBI Number

____________________________________________________ ___________________ _________

Street Address City State Zip

7. Name and phone number of the person to contact if there are question s regarding this a pplication.

Name

Phone Email/DOR Logon ID

8. Where would you like th e Department of Revenue Clearance Certificate sent?

To my DOR “My Account” – Please provide Logon ID:

Regular Email:

o

By checking this box, I authorize the De partment to send my confidential tax informatio n using

regular em ail (refer to page two for more information).

o Email Address:

Application cannot be processed if not signed a nd dated.

I certify that the above information is true and correct. In consideration of the issuance by the

Department of Revenue of its certificate certifying that every lic ense fee, tax increase or penalty

imposed under Chapter 180, Laws if 1935 has been paid or provided for by said corporation, the

undersigned hereby agrees to pay to Department of Reven ue, upon its demand, any and all such fee,

tax increase or penalty as may hereaft er be determined to be un paid and payable by this corporation.

Corporate Officer Signature Date

Print Name

Title

Washington State

Department of Revenue

A

udit Division

DORCD@dor.wa.gov

REV 31 0037 (7/14/14)

REVENUE CLEARAN CE CERTIFICATE

Purpose: This form is to obtain a Revenue Clearance Certificate needed to dissolve a corporation with the

Secretary of State.

If your business is an LLC, LP or an LLP, this application is not necessary. If your company is not registered

with the Secretary of State, a Reven ue Clearance Certificate is not required.

Question #1

– Name of Corporation and Tax Registration No. (UBI No.) should be listed as it is registered with

the Secretary of State’s Office http://www.sos.wa.gov/corps/

.

Question #2

– Please provide the physical address of the business location in Washington. If there are

multiple locations, please provide the primary address.

Question #3

– Describe the Washington business activities engaged in.

Questions #4 & #5

– Give the actual date the company ceased taxable business activities in Washington and

be sure to have all

excise tax returns filed through that date. If closing mid-month, mid-year, etc., an excise

tax return is still needed even if there was no activity. Please visit http://dor.wa.gov

for additional information.

Question #6

– Per RCW 82.04.180, "Successor" means:

a) Any person to whom a taxpayer quitting, selling out, exchanging, or disposing of a business

sells or otherwise conveys, directly or indirectly, in bulk and not in the ordinary course of the

taxpayer's business, more than fifty percent of the fair market value of either the (i) tangible

assets or (ii) intangible assets of the taxpayer; or

b) A surviving corporation of a statutory merger.

c) Any person obligated to fulfill the terms of a contract shall be deemed a successor to any

contractor defaulting in the performance of any contract as to which such person is a surety

or guarantor.

Question #7

– This information can be used to contact you about questions pertaining to your application

and/or business activities.

Tax information is confidential and cannot be shared with anyone without the taxpayer’s express permission.

Therefore, a Confidential Tax Information Authorization form will be necessary if you wish to authorize the Dept

of Revenue to share your tax information with any third party person(s) listed in Question #7.

DOR Logon ID (defined) – This is the Logon ID to access My Account on the Department of Revenue’s

website. Once in My Account, you can communicate with the Department through Secure Messaging.

Question #8

– Please provide a DOR My Account Logon ID or Email Address to receive your certificate.

Additional information about providing your email address: I am aware of the Department’s secure

message system available in My Account. I know regular email is not secure, and confidential

information may be intercepted by unauthorized persons. I accept these conditions and waive any

violation of the Secrecy Clause resulting from use of unsecured email. (RCW 82.32.330)

The application must be signed by a corporate officer or a stockholder of the company listed in Question

#1.

The Revenue Clearance Certificate and other required documents must be sent to the Secretary of

State’s Office to dissolve your corporation.

If you have any questions about completing this application, please call Corporate Dissolutions at (360) 704-5704. Visit

our website (dor.wa.gov

), or email us at [email protected]a.gov. Email all applications to DORC[email protected].gov.

To ask about the availability of this form in an alternate format for the visually impaired, please call 1-800-647-7 706.

Teletype (TTY) use r s may use the Washington Relay Service by calling 711.