Fillable Printable Application Form for Maternity Benefit

Fillable Printable Application Form for Maternity Benefit

Application Form for Maternity Benefit

How to complete this application form.

• Please use this page as a guide to filling in this form.

• Please use black ball point pen.

• Please use BLOCK LETTERS and place an X in the relevant boxes.

• Please answer all questions that apply to you.

• You need a Personal Public Service Number (PPS No.) before you apply.

Employee or Self-Employed:

If you are an employee or self-employed fill in Parts 1, 2, 3, 5, 7 and 8 as they

apply to you. When form is completed, read Part 9 and sign declaration in Part 1.

Please note photocopies of this declaration are not acceptable.

To qualify for the maximum period of 26 weeks maternity leave, an employee

must take at least 2 weeks before the end of the week in which her baby is due.

Doctor:

Please only complete and stamp Part 6 after the 24

th

week of pregnancy.

Employer:

Please only complete and stamp Part 4 after the 24

th

week of pregnancy.

It is acceptable to forecast your employee’s PRSI contributions for any period

after the 24

th

week of pregnancy up to the date she starts maternity leave.

If your employee has been working for you for less than 12 months before the

start of her maternity leave, please forward a copy of her P45 from her previous

employment.

If you need any help to complete this form, please contact Maternity Benefit

Section, your local Citizens Information Centre, your local Intreo Centre or your

local Social Welfare Office.

For more information, log on to www.welfare.ie.

Important:

Submit this form at least 6 weeks (12 weeks if self-employed) before you intend

to start maternity leave.

Please do not submit this form more than 16 weeks before the end of the week in

which your baby is due.

Application form for

Maternity Benefit

Data Classification R

Social Welfare Services

MB 10

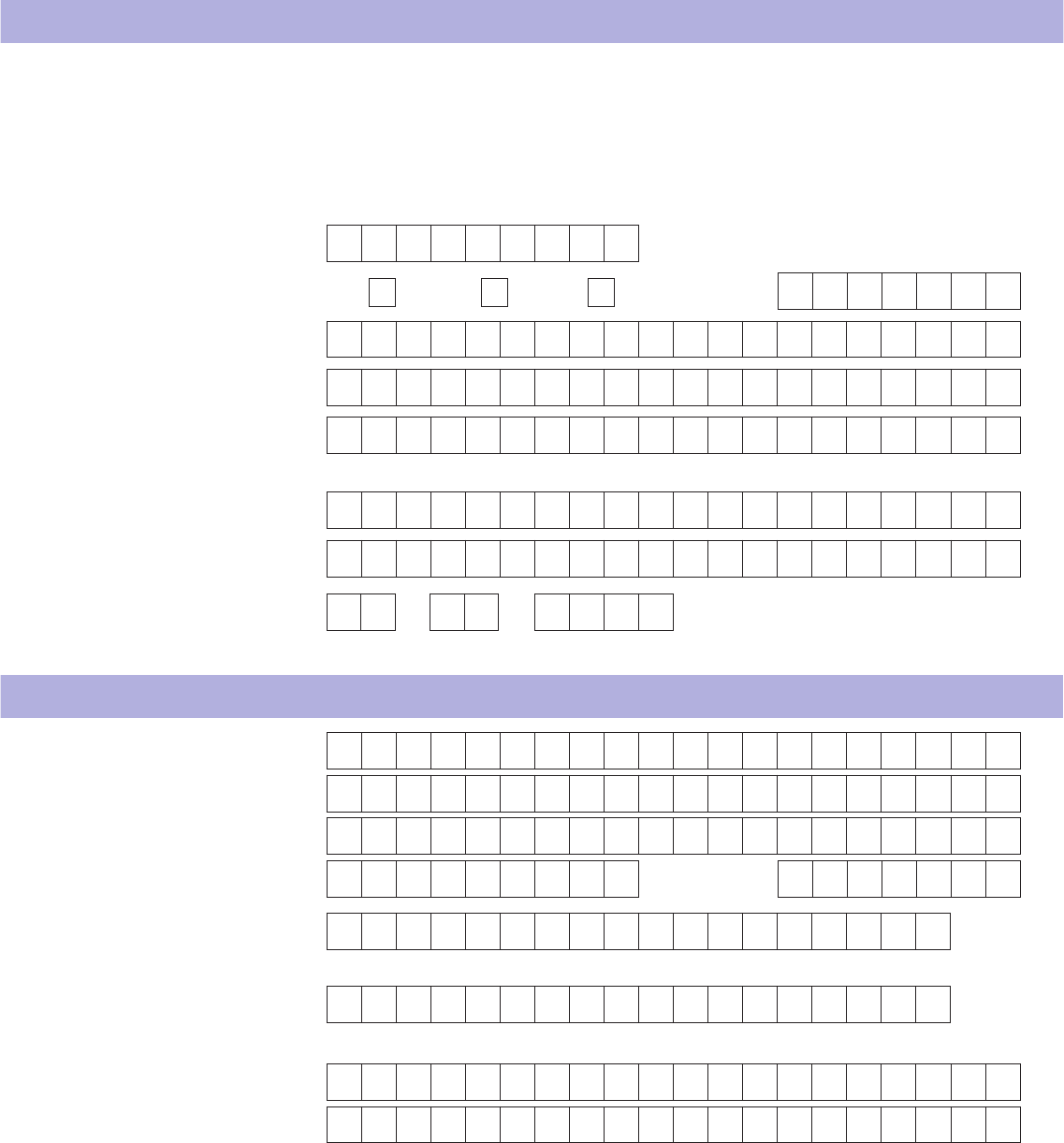

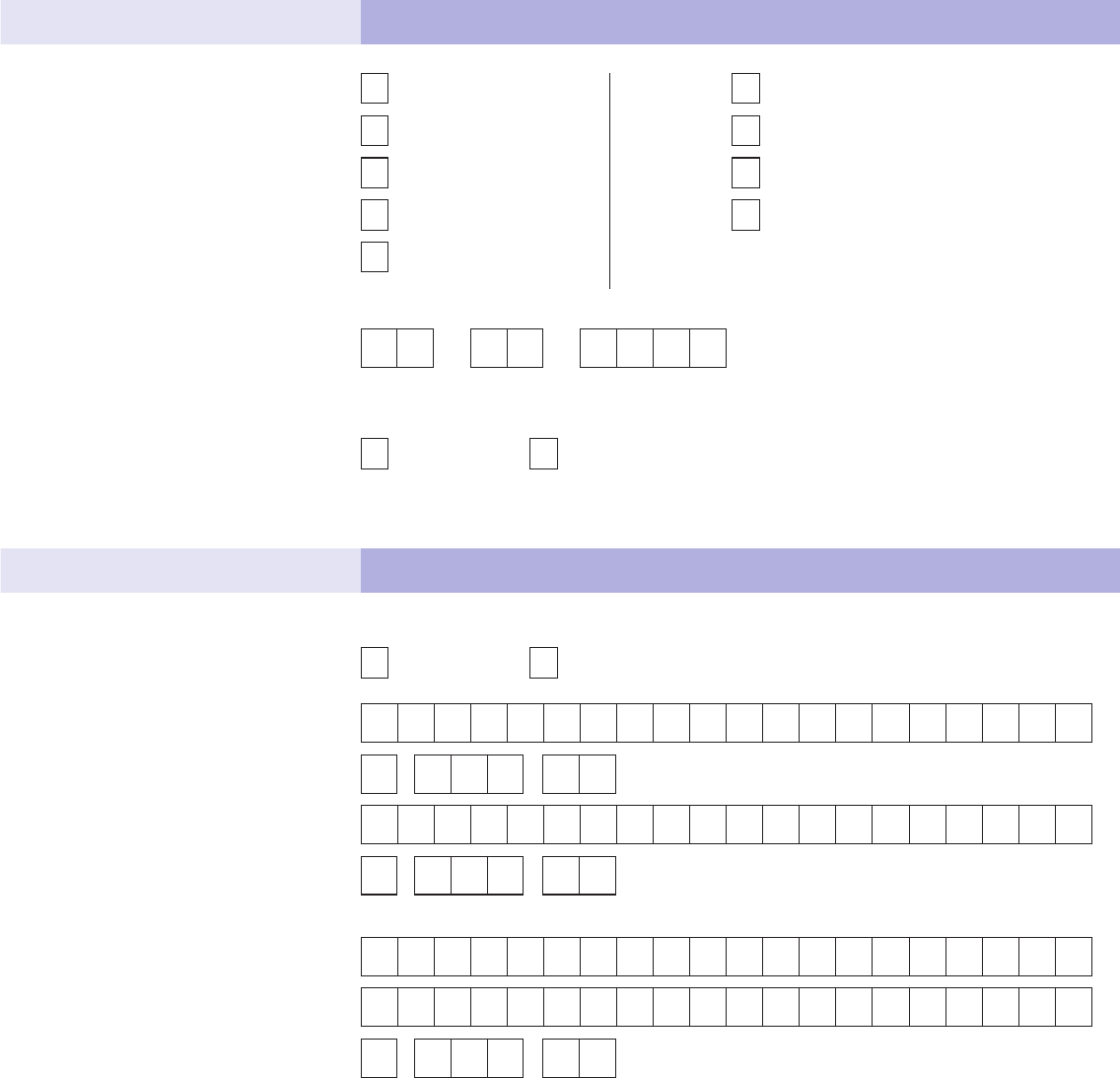

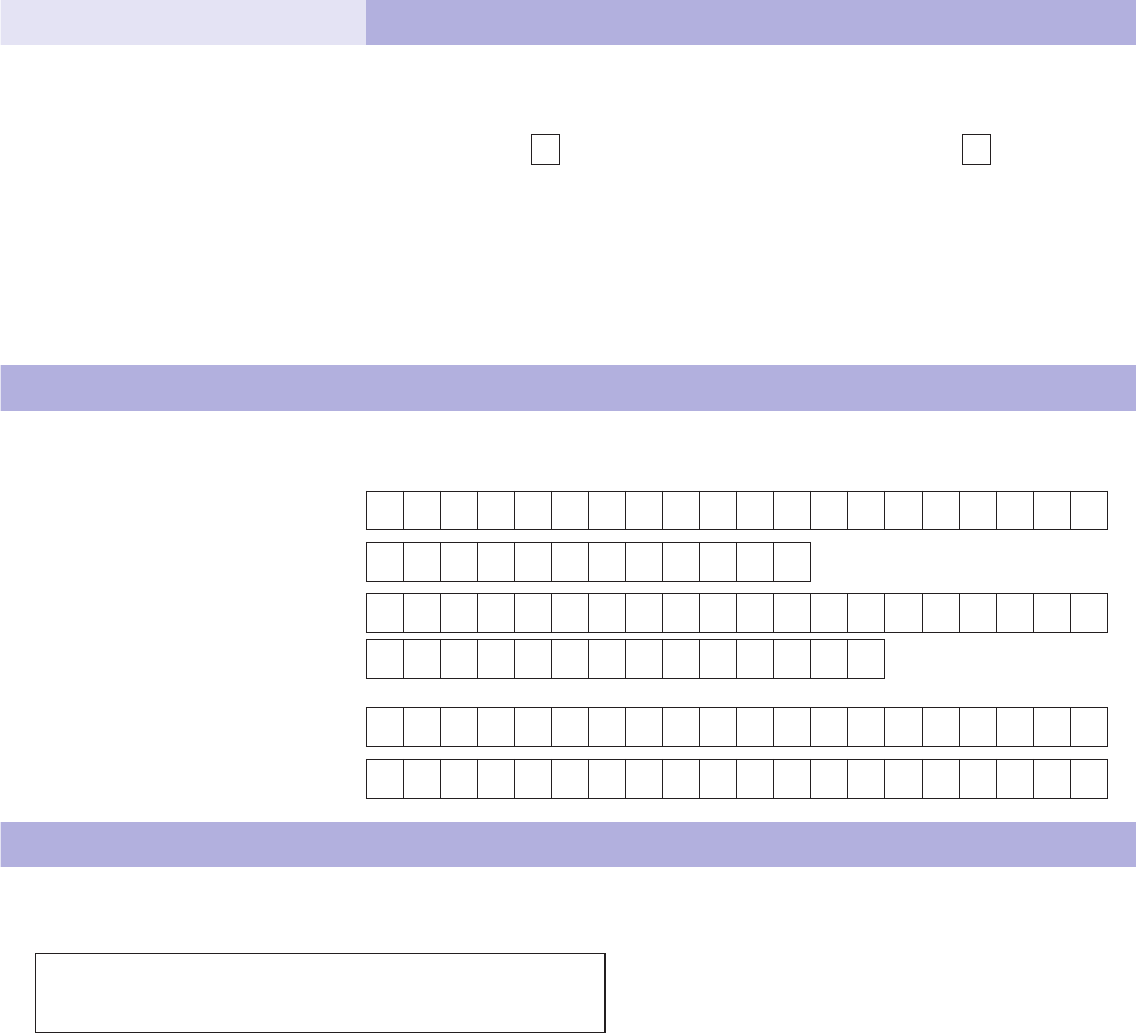

How to fill in first page of this form

To help us in processing your application:

• Print letters and numbers clearly.

• Use one box for each character (letter or number).

Please see example below.

SAMPLE

Contact Details

1 2 3 4 5 6 7 T

M U R P H Y

M A U R

E E N

M C D E R M O T T

2 8 0 2 1 9 7 0

1. Your PPS No.:

3. Surname:

8. Your date of birth:

4. First name(s):

D D MM Y Y Y Y

Mr. Mrs. Ms.

Other

2.

Title: (insert an ‘X’ or

specify)

6. Birth surname:

5. Y

our first name as it

appears on your birth

certificate

:

X

M A R Y

7. Your mother’s birth

surname:

K E L L

Y

L A N D L I N E

M O B I L E

O N E C H A R A C T E R P E R

B O X

10.Y

our telephone number:

11.Your email address:

O N E N U M B E R P E R B O X

O N E N U M B E R P E R B O X

1 N E W S T R E E T

O L D T O W N

D O N E G A L T O W N

9. Your address:

County D O N E G A L Postcode

Application form for

Maternity Benefit

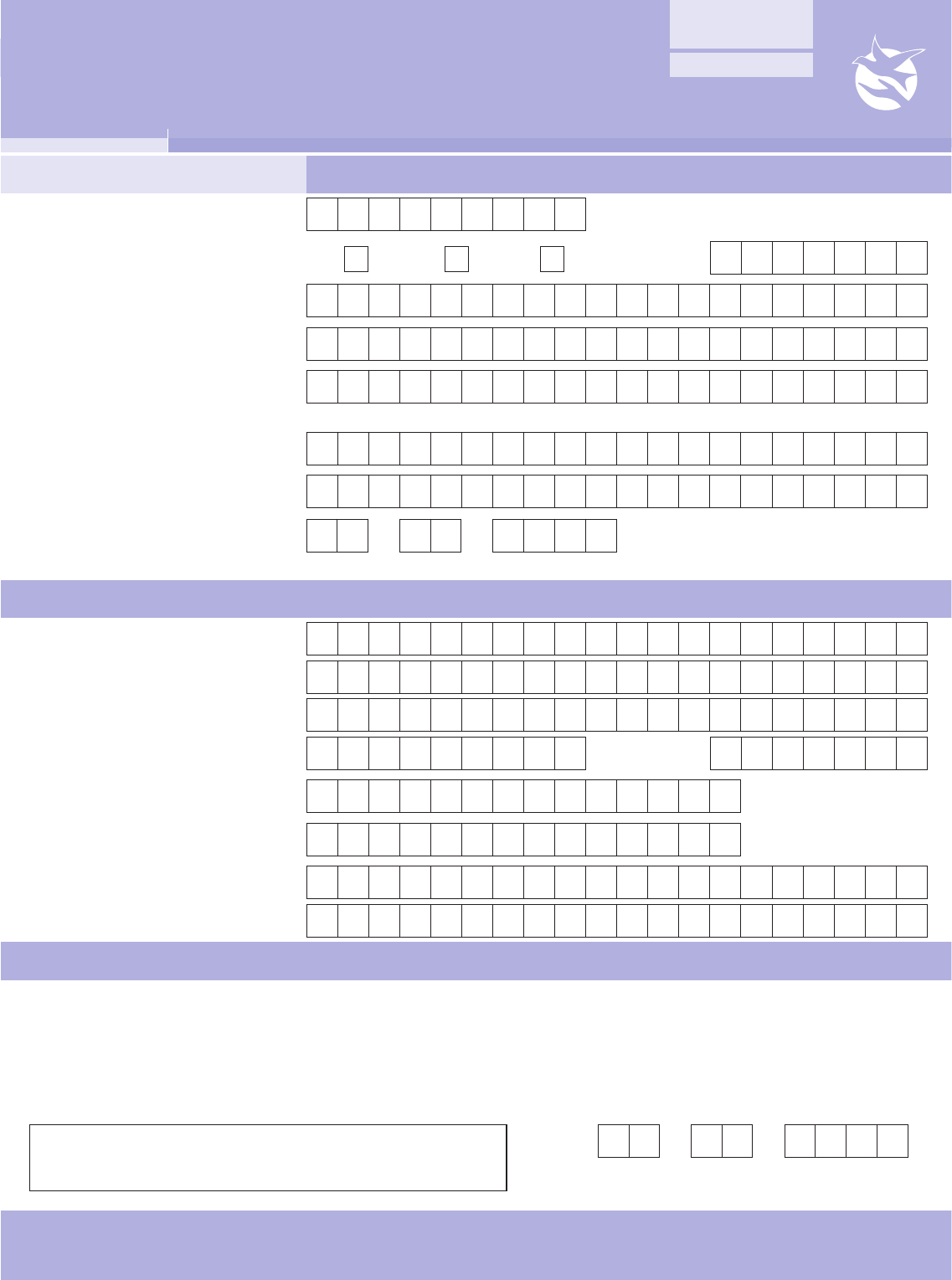

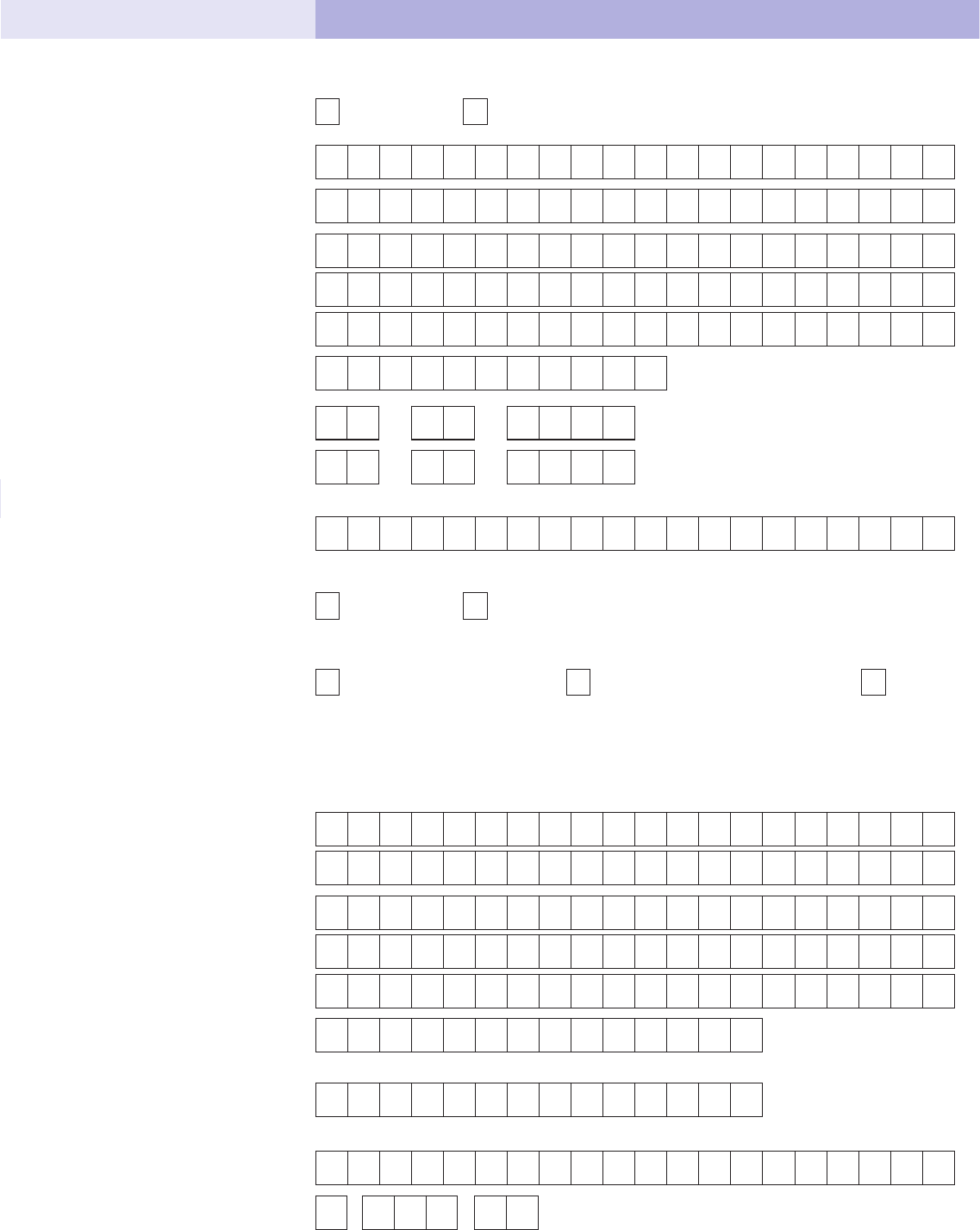

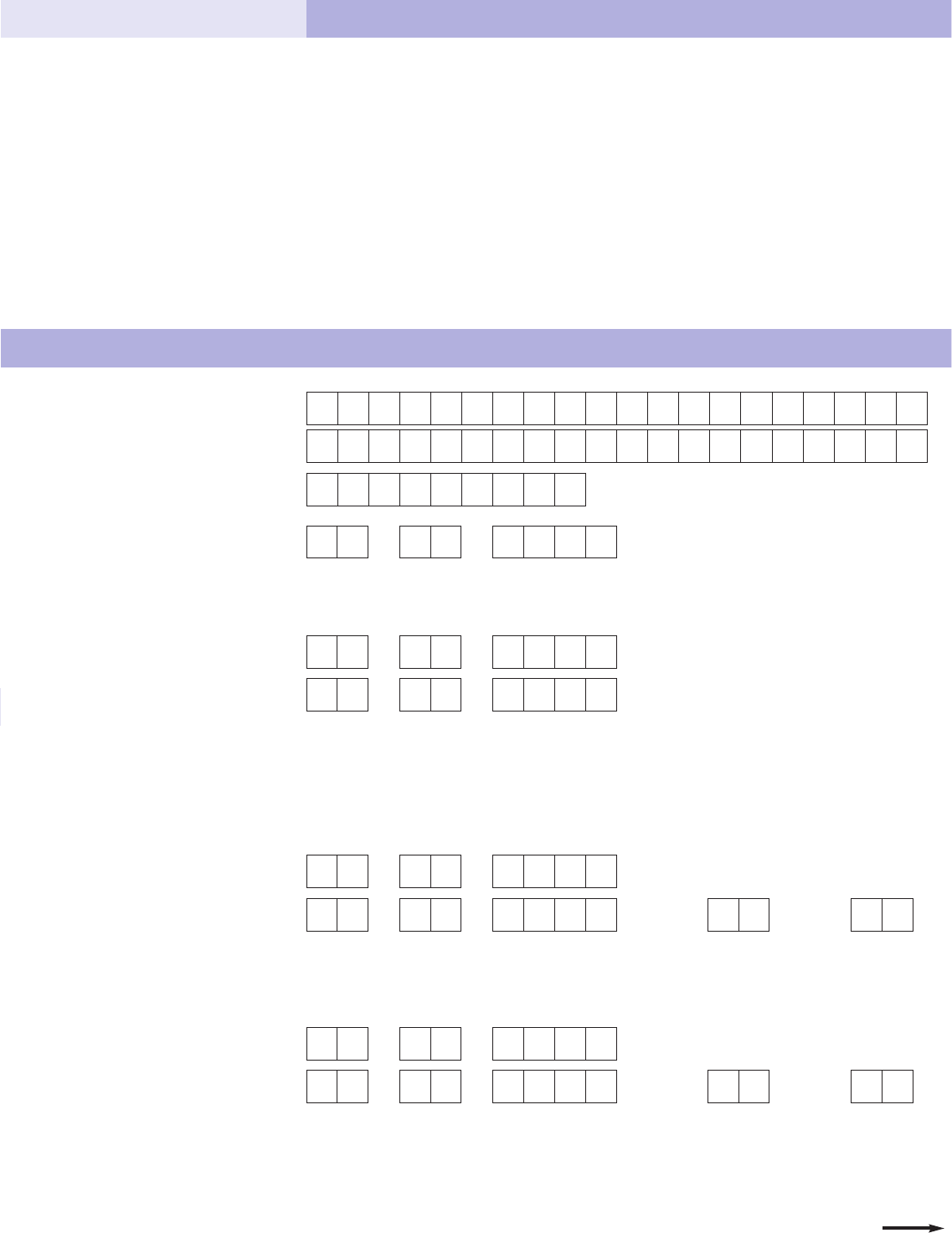

Part 1

Your own details

1. Your PPS No.:

3. Surname:

8. Your date of birth:

4. First name(s):

Mr. Mrs. Ms.

Other

2.

Title: (insert an ‘X’ or

specify)

6. Birth surname:

5. Y

our first name as it

appears on your birth

certificate

:

Original signature only (not block letters and no photocopies)

Date:

D D MM Y Y Y Y

2 0

9. Your address:

Declaration

7. Your mother’s birth

surname:

D D MM Y Y Y Y

Contact Details

Data Classification R

Social Welfare Services

MB 10

I declare that the information given by me on this form is truthful and complete. I understand that if

any of the information I provide is untrue or misleading or if I fail to disclose any relevant information,

that I will be required to repay any payment I receive from the Department and that I may be

prosecuted. I undertake to immediately advise the Department of any change in my circumstances

which may affect my continued entitlement.

I authorise the Department to disclose details of my Maternity Benefit claim to my employer.

10.Y

our telephone number:

11.Your email address:

M O B I L E

L A N D L I N E

The Department is required, by legislation, to share information with the Office of the Revenue Commissioners.

Warning: If you make a false statement or withhold information, you may be prosecuted leading

to a fine, a prison term or both.

County

Postcode

Part 1 continued Your own details

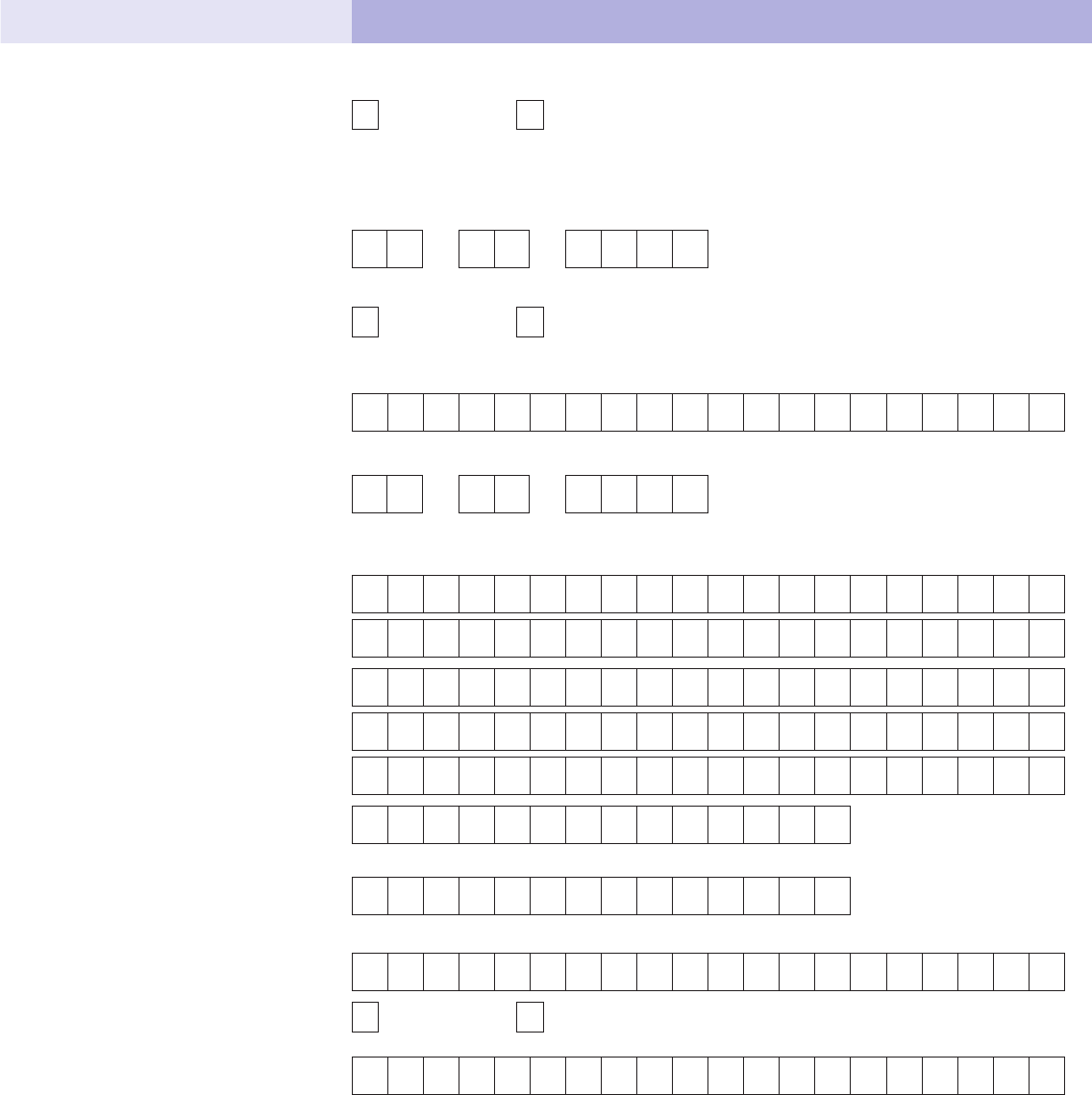

Your work and claim details Part 2

13.From what date are you married, in a civil partnership or cohabiting?

D D MM Y Y Y Y

15.Are you getting or have you applied for any social welfare payment(s)?

Name of payment:

Amount: a week

€

,

.

Name of payment:

Amount: a week

€

, .

12.Are you?

Single

Married

Separated

Divorced

Widowed

Cohabiting

In a Civil Partnership

A surviving Civil Partner

A former Civil Partner

(you were in a Civil Partnership

that has since been dissolved)

16.If you are getting a pension or allowance from another country, please state:

Name of country:

Your claim or reference

number:

Amount:

a week

€

,

.

14.Were you married in the Republic of Ireland?

Yes

No

If ‘No’, please submit a verified copy of your marriage certificate (See Part 9 Checklist for

details).

Yes

No

If ‘Yes’, please state:

Your work and claim details Part 2 continued

You are ‘employed’ when you work for another person or company and you get paid for this work. If

you are employed, please continue to complete the questions below. If you are currently self-employed

only, please go straight to question 24. If you are not employed, please go straight to question 23.

‘Gross pay’ is your pay before tax, PRSI, union dues or other deductions.

19.If you are currently employed, please state:

Employer’s name:

Employer’s address:

Gross weekly earnings: a week (approximately)

€

, .

Employer’s telephone

number:

Job title:

18.Are you currently

employed?

If ‘Yes’, please state:

Are you?

Employed only

Self-Employed only Both

Yes No

If ‘Yes’, please state:

D D MM Y Y Y Y

Dates you worked

there:

Type of work:

From:

To:

Note: A separate sheet of paper can be used for more details if needed.

17.Have you lived, been employed, or received a social welfare payment in another EU country

in the last 4 years?

Country:

Employer’s name:

Your social insurance

number while there:

Employer’s address:

M O B I L E

L A N D L I N E

Yes No

Part 2 continued Your work and claim details

21.If you started work for the first time within the last 3 years, when did you start?

22.Are you related to your

employer?

If you are an employee your employer(s) must complete Part 4.

How are you related to

them?

D D MM Y Y Y Y

Yes No

Your last employer’s

telephone number:

Job title:

23.If you are no longer in

employment, please state

the date you last worked:

D D MM Y Y Y Y

Your last employer’s name:

Their address:

Please enclose a copy of your P45 showing the date you last worked.

M O B I L E

L A N D L I N E

20.Do you currently have more than one employment?

Yes

No

Please note that if you have more than one employer, each employer must complete Part 4 (a

photocopy of Part 4 or a letter signed by your employer containing the same information will do).

Were you related to this

employer?

If ‘Yes’, how were you

related to them?

Yes

No

If ‘Yes’, please state:

Your work and claim details Part 2 continued

25.Please state your:

Your

business registration

number:

Business name:

Business address:

Your business telephone

number:

26.When do you intend to

start maternity leave?

D D MM Y Y Y Y

M O B I L E

L A N D L I N E

27.Date you intend to return

to self-employment after

your maternity leave?

D D MM Y Y Y Y

28.Is your company a limited

company?

If ‘Yes’, please attach a copy of your P35 for the relevant tax year (this is two years’ prior to

the year in which your maternity leave starts).

Yes

No

29.Are you a sole trader?

If ‘Yes’, please attach your self-assessment acknowledgement form you will have received

from the Revenue Commissioners and accompanying Form 11 for the relevant tax year (this

is two years’ prior to the year in which your maternity leave starts).

Yes

No

Remember to send in the relevant certificates and documents with this application.

24.Are you or have you ever

been self-employed?

Your occupation:

Date you started self-

employment:

If you recently started self-employment, please send confirmation of registration from Revenue.

If you are no longer self-

employed, when were you

last self-employed?

Yes

No

If ‘No’, please go to Part 3.

If ‘Yes’, please complete fully the remainder of this section.

D D MM Y Y Y Y

D D MM Y Y Y Y

If you are a sole trader, we accept your PPS number as your business registration number.

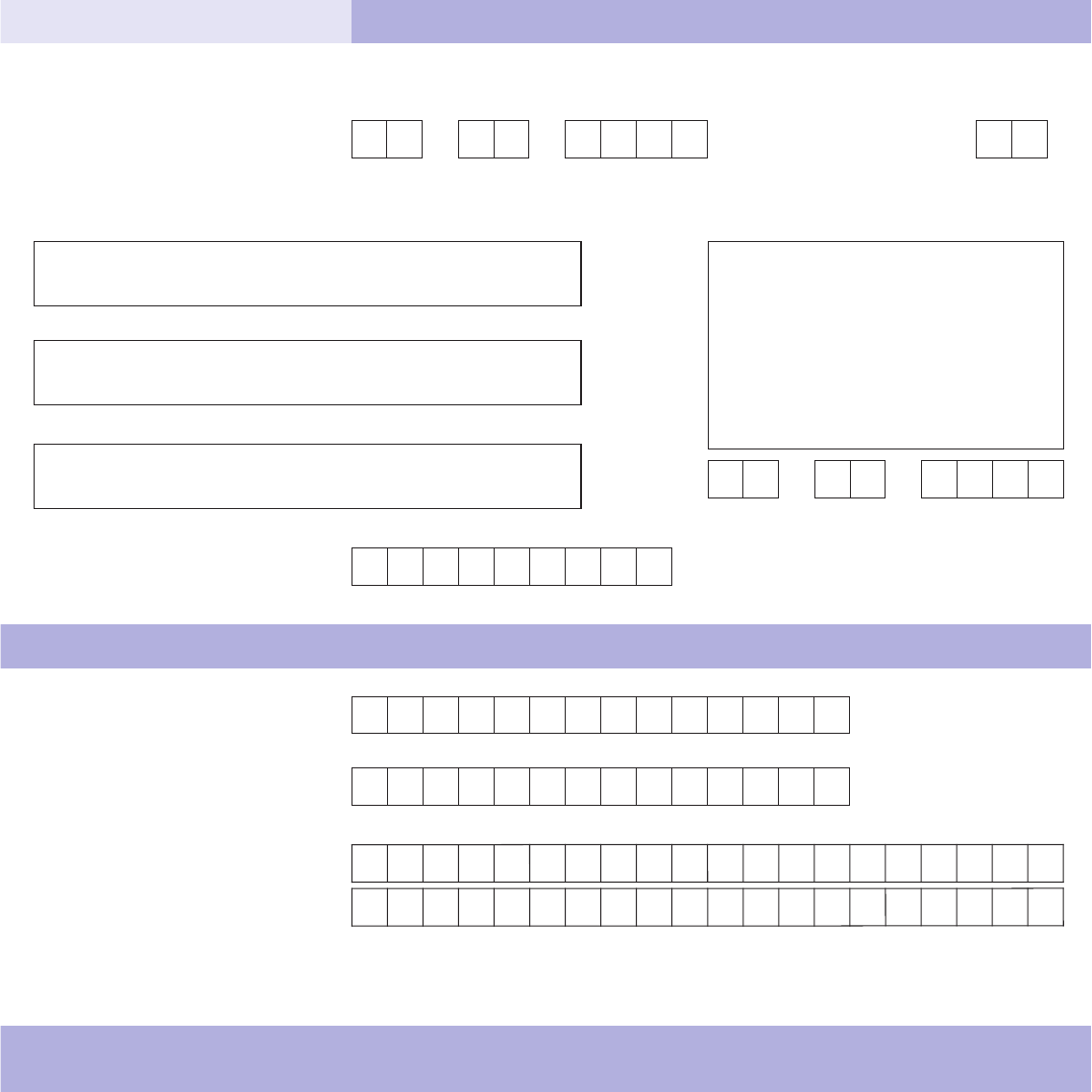

Part 3 Your payment details

If you want to get your payment direct to your current, deposit or savings account

in a financial institution, please fill in your account details below. Alternatively, if

you want us to make your payment to your employer, please fill in your employer’s

account details and sign the declaration below (payments can only be made to

accounts held in the Republic of Ireland).

I authorise the Department of Social Protection to pay my Maternity Benefit to my employer’s

account in a

financial institution

.

Signature (not block letters)

Payment direct to my employer

Financial Institution

Name of financial institution:

Bank Identifier Code (BIC):

International Bank Account

Number (IBAN):

Name(s) of account holder(s):

Name 1:

Name 2 (if any):

You will find the following details printed on statements from your

financial institution.

Please state clearly who you wish your payment to issue to.

This payment should issue to: You OR Your employer

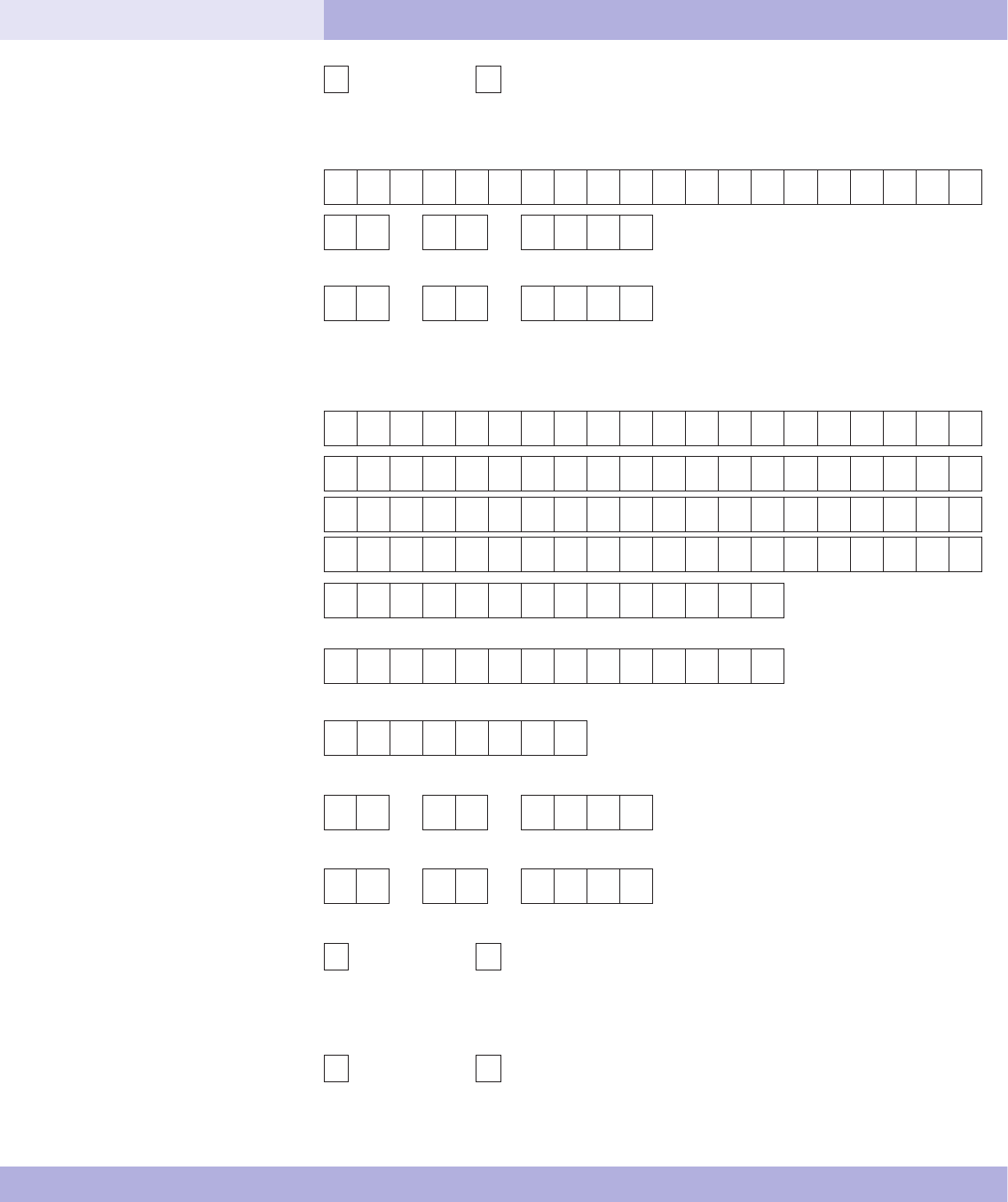

Employer’s information Part 4

30.What is your employee’s

full name?

31.Please confirm their PPS

No.:

32.Please confirm the date

employee first started

working for you:

D D MM Y Y Y Y

D D MM Y Y Y Y

D D MM Y Y Y Y

34.Please give details of your employee’s PRSI record for the 12 month period immediately

before her maternity leave starts (e.g. If your employee’s maternity leave is due to start on

06/07/2015, you should provide her PRSI details for the period 06/07/2014 to 05/07/2015). The

forecasting of contributions is acceptable for any period after the 24th week of pregnancy.

35.If your employee has more than one class of PRSI (for example, if their PRSI changed from

Class A to Class J), please give details.

Period of

employment:

From:

To:

Number of weeks:

PRSI class:

Period of

employment:

From:

To:

Number of weeks:

PRSI class:

33.Please give full details of your employee’s maternity leave dates.

D D MM Y Y Y Y

From:

To:

Employer’s section continued overleaf

Your employer should only complete this section after your 24

th

week of pregnancy.

Note for Employer:

To qualify for the maximum 26 weeks Maternity Benefit, an employee must take

at least 2 weeks and at most 16 weeks leave before the end of the week in which

her baby is due. If your employee wishes to take the minimum 2 week period of

maternity leave prior to the birth of her baby, she should commence her

maternity leave on the Monday prior to the week in which her baby is due.

For example, if the due date is Wednesday 14/10/2015, the latest date the

employee should commence maternity leave is Monday 05/10/2015.

Employer’s information Part 4 continued

Warning: If you make a false statement or withhold information, you may be

prosecuted leading to a fine, a prison term or both.

Employer’s telephone

number:

Empl

oy

e

r’

s

e

mai

l

addre

ss:

If you make any alterations after you complete the form, you must initial and

date them otherwise the information supplied cannot be accepted.

M O B I L E

L A N D L I N E

Employer’s Contact Details

PRSI class:

D D MM Y Y Y Y

D D MM Y Y Y Y

I/We certify that the employee is entitled to the period of maternity leave stated above.

Signature (not block letters)

Employer’s official stamp

Position in company or organisation

Date:

2 0

Your name (IN BLOCK LETTERS)

36.Please confirm the date your employee was last present in the workplace and the class of

PRSI paid on that date:

Employer’s registered

number:

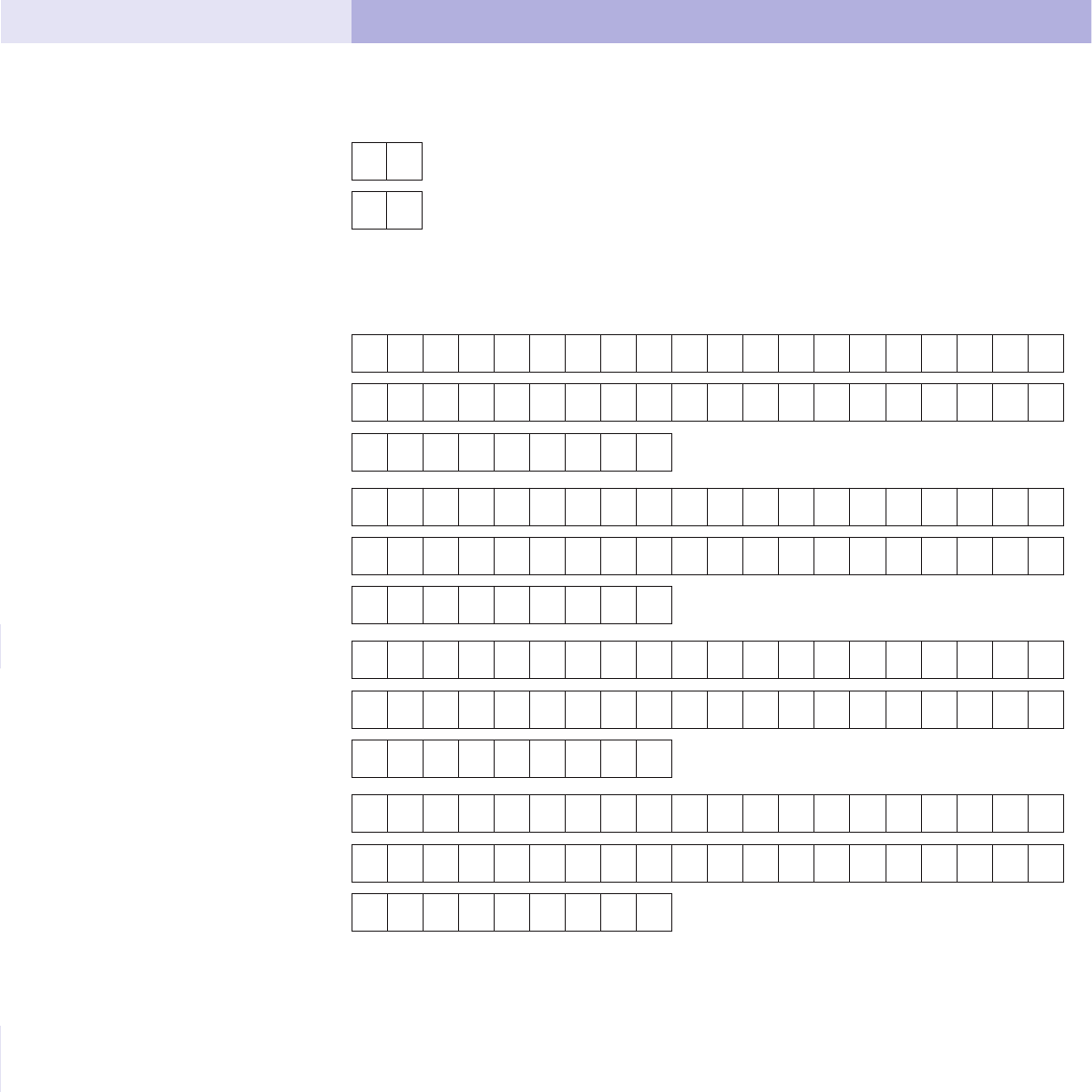

Details of your child(ren)Part 5

under age 18

age 18 - 22 in full-time education*

* You must attach written confirmation from the school or college

for the children aged 18 - 22

38.Please state child’s:

Surname:

PPS No.:

First name(s):

Surname:

PPS No.:

First name(s):

Surname:

PPS No.:

First name(s):

Surname:

PPS No.:

First name(s):

Note: A separate sheet of paper can be used for more details if needed.

37.How many children do you currently have who normally live with you and who are being

supported by you (this does not include any unborn child(ren))?