Fillable Printable Asset Purchase Statement

Fillable Printable Asset Purchase Statement

Asset Purchase Statement

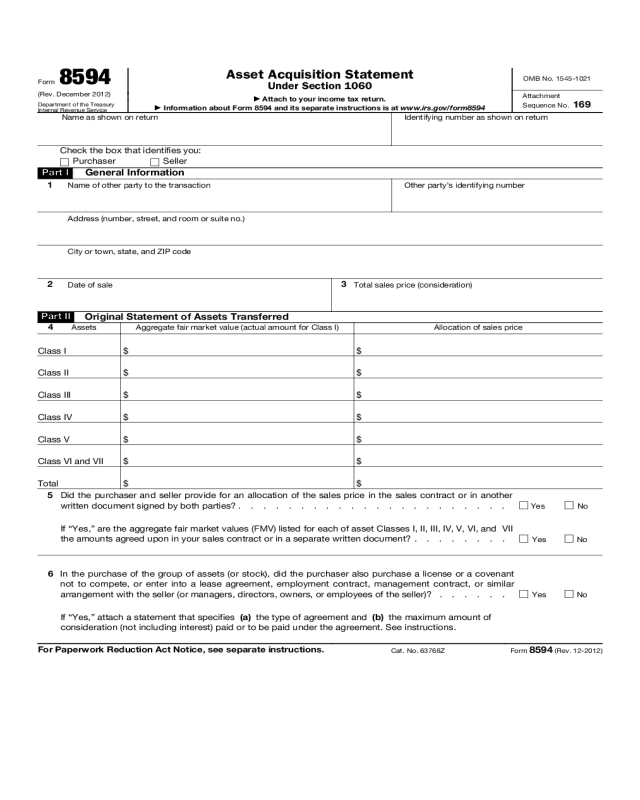

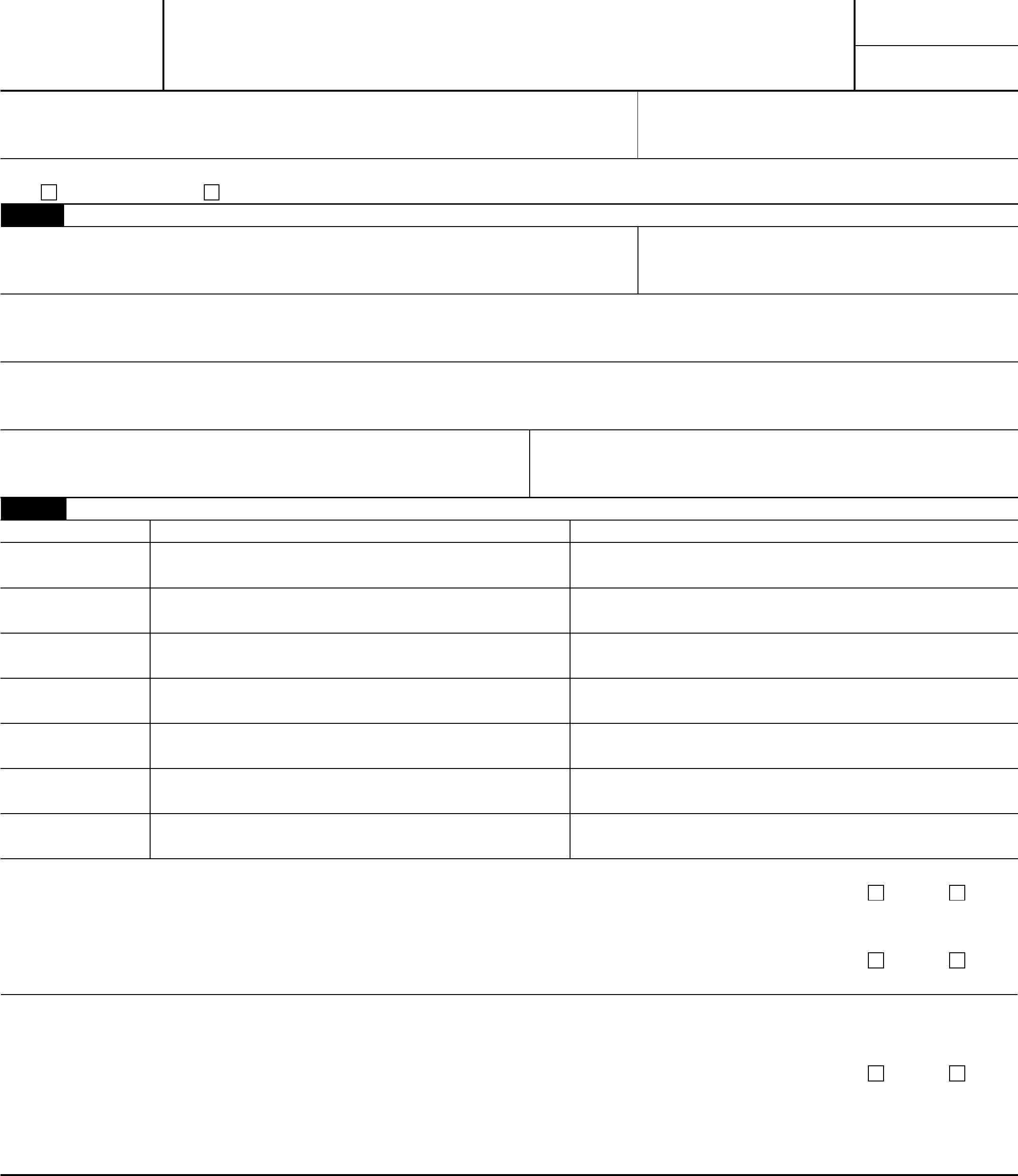

Form 8594

(Rev. December 2012)

Department of the Treasury

Internal Revenue Service

Asset Acquisition Statement

Under Section 1060

▶

Attach to your income tax return.

▶

Information about Form 8594 and its separate instructions is at www.irs.gov/form8594

OMB No. 1545-1021

Attachment

Sequence No. 169

Name as shown on return Identifying number as shown on return

Check the box that identifies you:

Purchaser

Seller

Part I

General Information

1

Name of other party to the transaction Other party’s identifying number

Address (number, street, and room or suite no.)

City or town, state, and ZIP code

2

Date of sale

3

Total sales price (consideration)

Part II

Original Statement of Assets Transferred

4 Assets

Aggregate fair market value (actual amount for Class I)

Allocation of sales price

Class I $ $

Class II $ $

Class III $ $

Class IV $ $

Class V $ $

Class VI and VII $ $

Total $ $

5

Did the purchaser and seller provide for an allocation of the sales price in the sales contract or in another

written document signed by both parties? . . . . . . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” are the aggregate fair market values (FMV) listed for each of asset Classes I, II, III, IV, V, VI, and VII

the amounts agreed upon in your sales contract or in a separate written document? . . . . . . . .

Yes No

6

In the purchase of the group of assets (or stock), did the purchaser also purchase a license or a covenant

not to compete, or enter into a lease agreement, employment contract, management contract, or similar

arrangement with the seller (or managers, directors, owners, or employees of the seller)? . . . . . .

Yes No

If “Yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of

consideration (not including interest) paid or to be paid under the agreement. See instructions.

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 63768Z

Form 8594 (Rev. 12-2012)

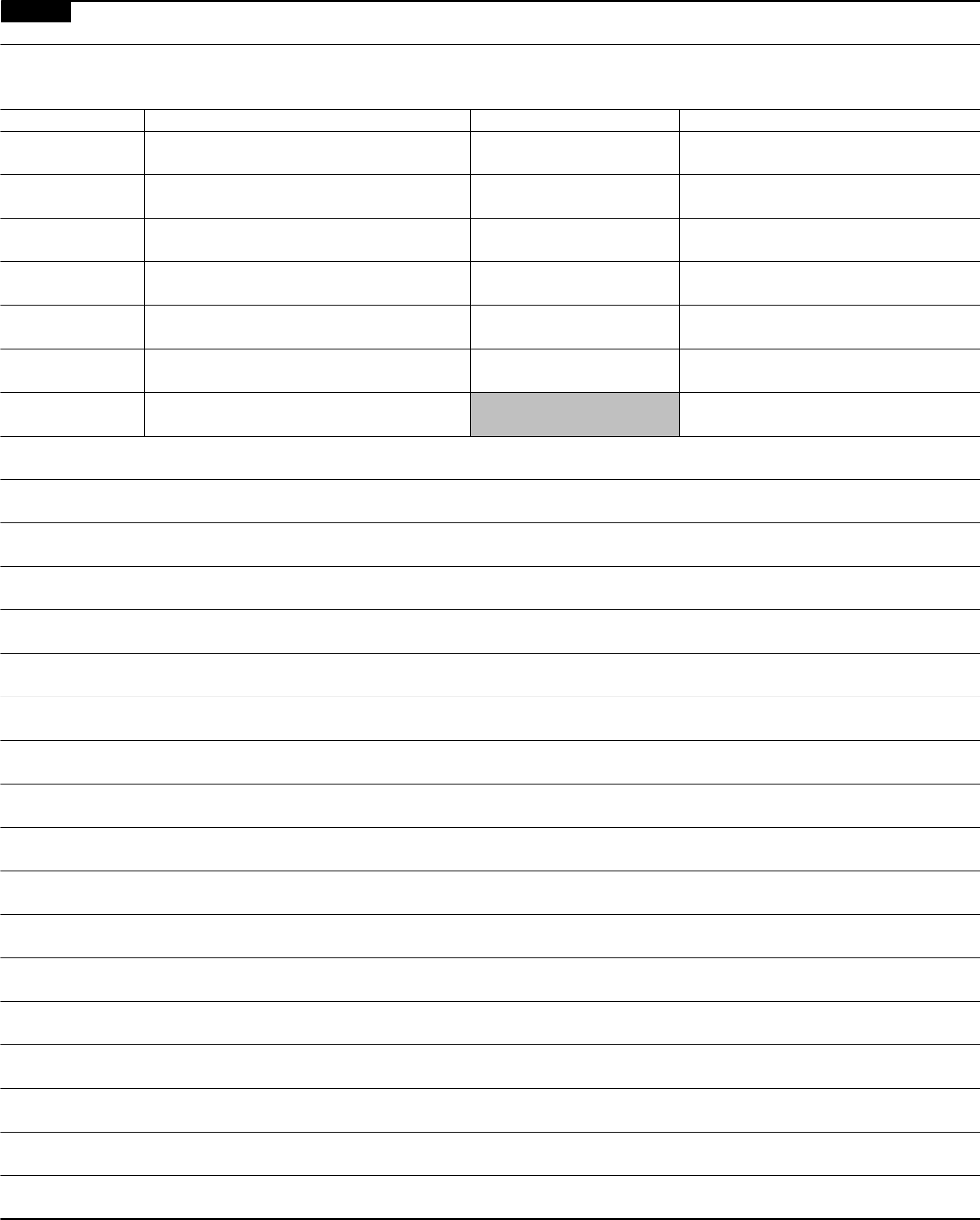

Form 8594 (Rev. 12-2012)

Page 2

Part III

Supplemental Statement—Complete only if amending an original statement or previously filed supplemental

statement because of an increase or decrease in consideration. See instructions.

7

Tax year and tax return form number with which the original Form 8594 and any supplemental statements were filed.

8 Assets

Allocation of sales price as previously reported

Increase or (decrease)

Redetermined allocation of sales price

Class I $ $ $

Class II $ $ $

Class III $ $ $

Class IV $ $ $

Class V $ $ $

Class VI and VII $ $ $

Total $ $

9 Reason(s) for increase or decrease. Attach additional sheets if more space is needed.

Form 8594 (Rev. 12-2012)