Fillable Printable Assets Transfer Tax Declaration - New Jersey

Fillable Printable Assets Transfer Tax Declaration - New Jersey

Assets Transfer Tax Declaration - New Jersey

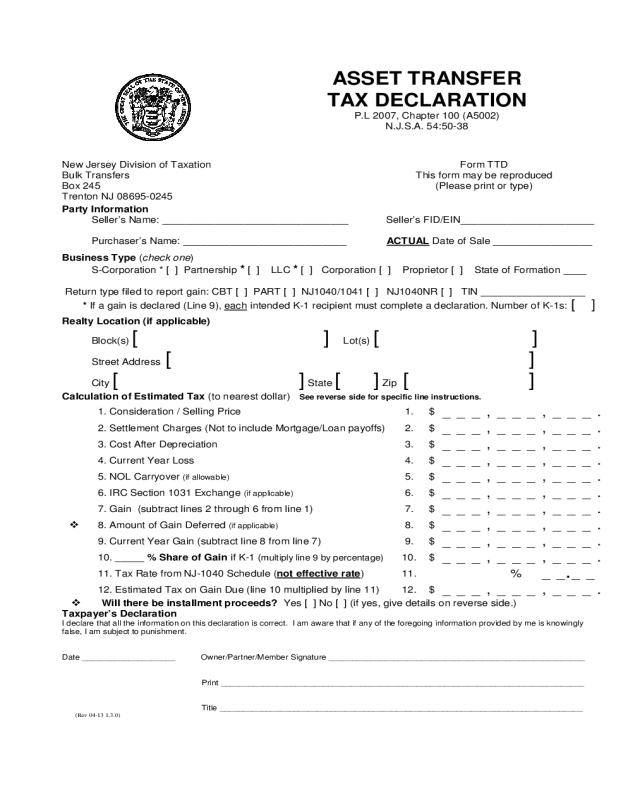

ASSET TRANSFER

TAX DECLARATION

P.L 2007, Chapter 100 (A5002)

N.J.S.A. 54:50-38

New Jersey Division of Taxation

Bulk Transfers

Box 245

Trenton NJ 08695-0245

Form TTD

This form may be reproduced

(Please print or type)

Party Information

Seller’s Name: ________________________________ Seller’s FID/EIN_______________________

Purchaser’s Name: ____________________________ ACTUAL Date of Sale _________________

Business Type (check one)

S-Corporation * [ ] Partnership * [ ] LLC * [ ] Corpor ation [ ] Proprietor [ ] State of Formation ____

Return type filed to report gain: CBT [ ] PART [ ] NJ1040/1041 [ ] NJ1040NR [ ] TIN __________________

* If a gain is declared (Line 9), each intended K-1 recipient must complete a declar ation. Number of K-1s: [ ]

Realty Location (if applicable)

Block(s) [ ] Lot(s) [ ]

Street Address [ ]

City

[ ]

State

[ ]

Zip

[ ]

Calculatio n of Estimated Tax (to near est dollar)

See reverse side fo r specific line instructions.

1. Consi deration / Selling Price 1. $

___,___,___.

2. Settlement Charges (Not t o inc lude M ort ga ge/Loan payoff s ) 2. $

___,___,___.

3. Cost After Depreciation 3. $

___,___,___.

4. Current Year Loss 4. $

___,___,___.

5. NOL Carryover (if allowable) 5. $

___,___,___.

6. IRC Secti on 1031 Exchange (if applicable) 6. $

___,___,___.

7. Gain (subtract lines 2 through 6 fr om line 1 ) 7. $

___,___,___.

8. Amount of Gain Defer r ed (if applicable) 8. $

___,___,___.

9. Current Year Gain (su bt ract line 8 from li ne 7) 9. $

___,___,___.

10. _____ % Share o f Gain if K-1 (m ult iply line 9 by perc ent age)

10. $

___,___,___.

11. Tax Rate from NJ-1040 Schedule (not effective rate)

11.

%

_ _._ _

12. Estimated Tax on Gain Due (line 10 multiplied by line 11) 12. $

___,___,___.

Will there be installment proceeds? Yes [ ] No [ ] (i f yes, give details on revers e sid e.)

Taxpayer’s Declaration

I declare that all the information on this declaration is correct. I am aware that if any of the foregoing information provided by me is

knowingly

false, I am subject to punishment.

Date ____________________ Owner/Partner/Member S ig nat ure ____ _____ ____ ____ ____ __________________________________

Print ______________________________________________________________________________

T it le ____ ____ ____ __________________________________________________________________

(Rev 04-13 1.3.0)

N. J.S.A. 54:50-38 instructs t he D irector, Division of Taxation, t o notify the pur chaser , transferee

or assignee of bu siness assets of any pos sible claim f or State taxes. This directive includes all

final business tax returns and payment.

Procedure

The estimated tax on the gain portion

of the escrow to be held at closing is initially calculated by

multiplying t he gross consideration by the tax rate of the taxpayer.

Upon co m pletion of this declaration, submission t o and re view by the Division, the estimated tax

on the gain portion of the escr ow may be r educ ed appropriately.

Upon closing of the t ransa ction, the escr ow wil l be held by the transferee’s attorney and the

estimated tax on t he gain portion

of the escr ow wi ll be demanded by the D ivision to be applied to

t he appropriate tax type and year. A confirmation of receipt and the application of the estimated

tax payment will be sent to the transferor’ s attorney.

The taxpayer files their year end business tax return, claims credit for the payment and pay s any

addit ional tax due. They may requ est a refund or credit if an overpayment exists.

Specific Line Instructions for Estim ated Tax Calculation

Special Note: Lines 1 through 9 est ablish gain. Line 10 assigns share .

Li ne 1: Total sale price or consider ation of all asset s currently being transferred.

Li ne 2: Total amount of sett lement charges to transferor asso ciated with this transaction.

Line 3: If full y depreciated enter zero.

Li ne 8: C alculate amount deferred ba sed on inst allment or sh ort term notes.

Li ne 9: For N J106 5 filers: I f any me mber/p artner is not an individual or if t he number of

nonr esident m ember/partners excee ds five (5) st op here and att ach the most current

membership directory. The Division will calculate and communicat e the e stimated t ax

f or resident filers and/or withholding amo unt for nonresident filer s.

Li ne 11: I ndividual tax rates may be found in t he most current NJ -1040 instructions.

Corpor ate tax rate 6.5% ($1-$50, 000), 7.5% ($50,001-$100,000) or 9% ( above

$100,000).

Li ne 12:

•

C-Corporation - use the greater of declar ed tax or minimum tax. ($500, $750, $1,00 0,

$1, 500 or $2,000 based on NJ Gross Receipts.)

•

S-Corporation - minimum t ax applies in addition to any tax on gain.

This is the declared amount that the Division will demand from escrow to be applied to the

t axpay er’s account(s).

Details o f In st all ment pro ceeds:

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

___________________________________________________________________