Fillable Printable Attendance Allowance Form - UK

Fillable Printable Attendance Allowance Form - UK

Attendance Allowance Form - UK

1. Where to send the completed form

2. Print the form

Please print the form and fill it in with a pen.

Please send the completed form and any supporting documents to:

Attendance Allowance Unit

Mail Handling Site A

Wolverhampton

WV98 2AD

Please return the completed claim form as soon as you can as we can only

consider paying benefit from the day we receive it.

Check you have signed and dated the consent at question 18 and declaration

at question 51.

For help or advice you can call the Attendance Allowance Service Centre

on 0345 605 6055.

Calls to 0345 numbers cost no more than a standard geographic call, and

count towards any free or inclusive minutes in your landline or mobile

phone contract.

Textphone: 0345 604 5312 for people who do not speak or hear clearly.

We cannot accept claim forms returned by email.

Claiming Attendance Allowance

for people aged 65 or over

AA1A June 2015

Attendance Allowance

for people aged 65 or over

Notes

If you want help filling in the claim form,

phone the Attendance Allowance Service Centre on 0345 605 6055.

We can also arrange interpreters if you phone or visit us.

Phone 0345 605 6055.

If you have speech or hearing difficulties, you can contact the

Attendance Allowance Service Centre by textphone on 0345 604 5312.

Our textphone service does not receive messages from mobile phones.

Or you can contact an organisation like Citizens Advice.

This pack is available in

large print or braille.

Please phone 0345 605 6055.

Contents Page

Things to get together before you fill in the claim form 3

How to fill in the claim form 3

What is Attendance Allowance and can I get it? 4

What do ‘help with personal care’ and ‘supervise’ mean? 5

When can I claim Attendance Allowance? 5

How is Attendance Allowance worked out?

Lower rate of Attendance Allowance 6

Higher rate of Attendance Allowance 6

About how your disabilities affect you 6

About medical examinations 6

Do you normally live in Great Britain? 7

Special rules

Getting Attendance Allowance under the special rules means: 8

Claiming under the special rules for someone else 8

How to claim under the special rules 8

How to get a DS1500 report 8

About your illnesses or disabilities and the treatment or help you receive

Consent 9

About the aids and adaptations you use 9

About being in hospital, a care home or a similar place 10

How we pay you

If we pay you too much money 10

How the Department for Work and Pensions collects and uses information 10

Help and advice about other benefits 11

What happens next 12

2

3

Before you fill in the claim form, it will be useful to have ready some

of the things listed below. Do not worry if you do not have all of

them.

• Your National Insurance number. You can find this on your National

Insurance number card, letters from the Department for Work and

Pensions, or payslips.

• The name of your GP and the address of your GP’s surgery.

• Details of your medication or an up-to-date printed prescription list if

you have one.

• Details of anyone you have seen about your illnesses or disabilities in

the last 12 months, apart from your GP.

• Your hospital record number (if you know it). You can find this on

your appointment card or letter.

• If you have been in a hospital, a care home or similar place - the

dates you went in and came out, and the name and address of the

place you stayed.

Things to get together before you fill in the

claim form

Please use black ink to fill in the form. Do not worry if you are not sure

how to spell something or you make a mistake. If you want to correct

a mistake, please cross it out with a pen – do not use correction fluid.

Please tick the box to show

your answer. For example:

Yes

P

You do not have to fill in the form in one go. Take your time so that

you can describe all the help you need.

How to fill in the claim form

No

You may also find it helpful to keep a record – write down a list of things

you have needed help with or found difficult over one or two days. If

you have good days and bad days, or your disability varies over time,

you may want to keep a record of your needs over a good day and over

a bad day. Start from the time you get up in the morning, through 24

hours, to the time you get up the following morning. You can send in

the record with your form if you want to.

4

You may get Attendance Allowance if:

• you are 65 or over when you make your claim

• you are not entitled to Disability Living Allowance

• you are not entitled to Personal Independence Payment

• your disability means that you need help with your personal care

(see page 5) or you need someone to supervise you for your own or

someone else’s safety (see page 5), and

• you have needed that help for at least six months.

Even if you are not actually getting the help you need, you can still

get Attendance Allowance.

If you are under 65, you may be able to get Personal Independence

Payment instead. Contact the Personal Independence Payment Helpline

if you want to ask us about a Personal Independence Payment (see

Help and advice about other benefits on page 11).

Attendance Allowance is to help with extra costs if you have a disability

severe enough that you need someone to help look after you and you

are aged 65 or older when you claim.

You may not think of yourself as disabled, but if you have a health

condition or illness that means you need the sort of help we tell you

about in these notes, you may be able to get Attendance Allowance.

Your disability may be physical, or you may have mental-health

problems, learning difficulties, sight, hearing or speech difficulties.

• Attendance Allowance is not usually affected by your income or

savings (but, if you get Constant Attendance Allowance with

another benefit, this will be paid instead, or reduce the amount of

your Attendance Allowance).

• Attendance Allowance is not taken off other benefits and tax

credits you may receive.

• You don’t usually need to have paid any National Insurance

contributions to claim Attendance Allowance.

• You do not have to pay tax on the Attendance Allowance

you receive.

• If you get Attendance Allowance, you may get extra money with

other benefits (see page 11).

You can find out more about Attendance Allowance by visiting

www.gov.uk or by phoning the AA Helpline - see page 1.

What is Attendance Allowance and can I get it?

5

‘Help with personal care’ means day-to-day help with things like:

• washing (or getting into or out of a bath or shower)

• dressing

• eating

• going to or using the toilet, or

• telling people what you need or making yourself understood (if you

have a problem, such as learning difficulties, that makes this hard).

You can normally only get Attendance Allowance when you have

needed help for six months (unless you claim under the special rules –

see page 8). If you claim straight away, we will deal with your claim as

soon as possible.

What do ‘help with personal care’ and ‘supervise’ mean?

When can I claim Attendance Allowance?

‘Supervise’ means that you need someone to watch over you to help

you avoid substantial danger to yourself or other people.

This could mean:

• when you take medicines or have treatment

• keeping you away from danger that you may not know is there

• avoiding danger you could face because you cannot control the

way you behave, and

• stopping you from hurting yourself or other people.

You may need help with personal care or supervision because you:

• find it hard to move your arms or legs or have no control

over them

• get breathless easily or are in pain, or

• have behaviour difficulties, mental-health problems, or you

get confused.

6

Higher rate of Attendance Allowance

You may get the higher rate if you need:

• help with personal care or someone to supervise you throughout

the day and also during the night.

You may also be able to get this rate if you claim under the special rules

(see page 8).

There are fixed amounts of money for Attendance Allowance. You can

find the current rates in the leaflet called Benefit and Pension Rates.

You can get this leaflet from any Jobcentre Plus.

The rates are also on our website at www.gov.uk

How is Attendance Allowance worked out?

There are two rates of Attendance Allowance:

• lower rate, and

• higher rate.

The rate you get is based on how much help you need.

Lower rate of Attendance Allowance

You may get the lower rate of Attendance Allowance if you need:

• help with personal care frequently throughout the day

• help with personal care during the night

• someone to supervise you continually throughout the day to help

you avoid substantial danger

• someone to watch over you at night to help you avoid substantial

danger, or

• someone with you when you are on dialysis.

You may not think of yourself as disabled, but if you have a health

condition or illness that means you need the sort of help we tell you

about in these notes, you may be able to get Attendance Allowance.

We know that disabilities can affect people more on one day than

another – they have good days and bad days. We know that your

disability may vary over a period of time. Please try to tell us as much

as you can about how your disability varies.

We also know that help needed during the day and help needed during

the night can be different. There are separate questions for you to tell

us about the different sort of help you might need.

About how your disabilities affect you

These notes give you more help and advice with some of

the questions in the claim form

About medical examinations

If we cannot get a clear picture of how your illnesses or disabilities

affect you, we may ask a health care professional to examine you.

Medical Services, who arrange medical examinations for us will contact

you if an examination is required.

7

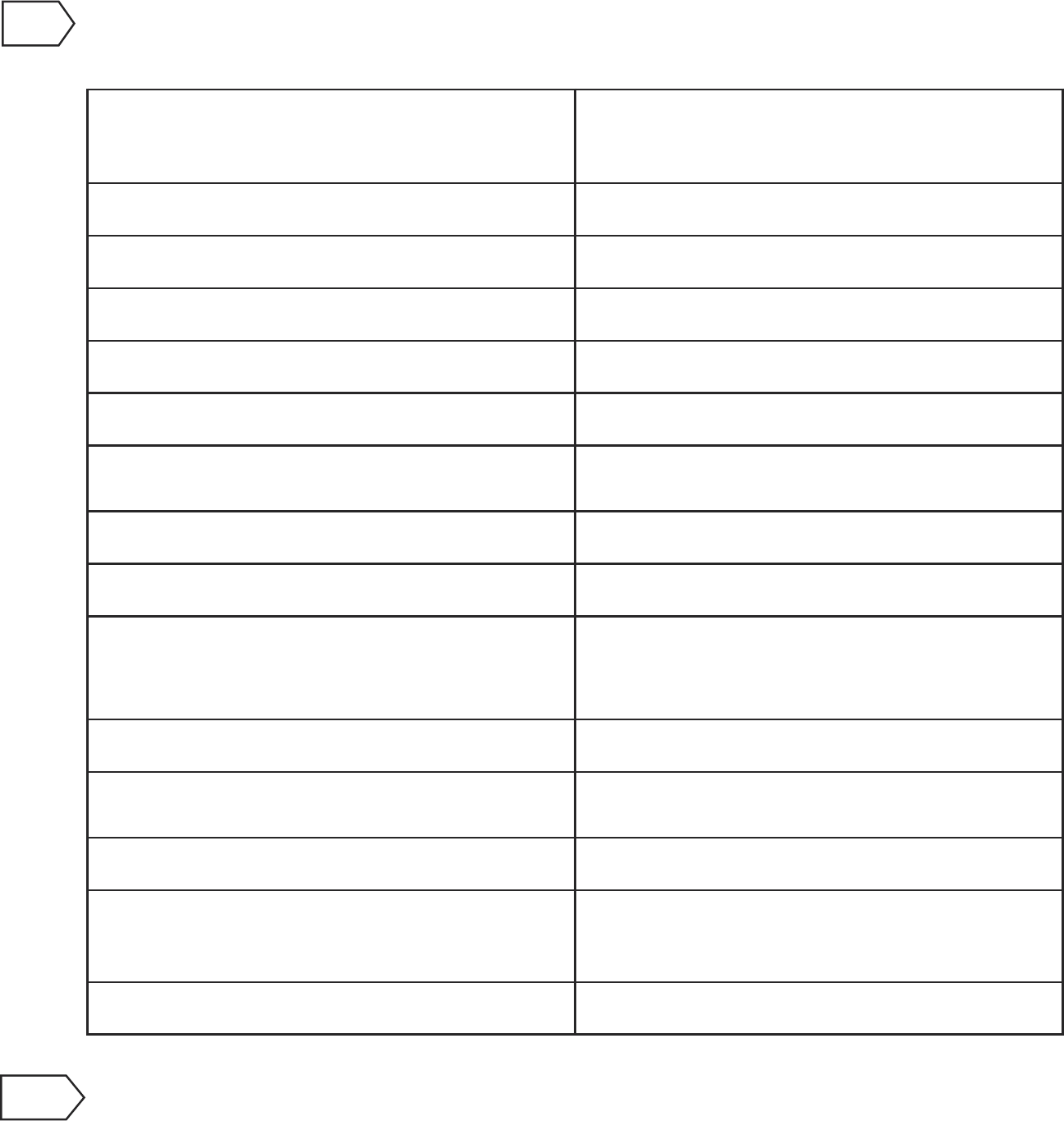

Austria

Italy (including Sicily, Sardinia and

Elba but not Vatican City and San

Marino)

Belgium Latvia

Bulgaria Liechtenstein

Croatia Lithuania

Cyprus Luxemburg

Czech Republic Malta

Denmark (but not the Faroe Islands

and not Greenland)

Netherlands

Estonia Norway

Finland (but not the Aland Islands) Poland

France (including Corsica,

Guadeloupe, Martinique, Reunion and

French Guiana but not Monaco)

Portugal

Germany Romania

Greece (Including Crete and the

Greek Islands)

Slovakia

Hungary Slovenia

Iceland

Spain (including the Balearic Islands,

the Canary Islands and the Spanish

enclaves of Ceuta and Melilla)

Republic of Ireland Sweden

If you’re not British, Swiss or a national of the following countries, send us your passport,

travel documents and any letters you have from the Home Office with the form.

7

To be entitled to AA you normally have to have lived in the UK for two years out of

the last three and not be subject to Immigration Control. You may be able to meet

this condition if you are, or have been, living in another EEA state or Switzerland.

These rules do not apply if you are terminally ill and qualify under special rules.

Also, if you have come to Great Britain from a country that is part of the European

Economic Area (EEA), or Switzerland, then depending on your circumstances you

may not have to wait for this period of time before you can get AA.

If you or a member of your family live in another country that is part of the EEA, or

in Switzerland, then you may be able to get AA if the UK is responsible for paying

you sickness benefits.

You can find more information about claiming AA when you live in another country

that is part of the EEA, or in Switzerland on our website www.gov.uk

8

Do you normally live in Great Britain?

8

12

Special rules

We have special rules for people who are terminally ill (this means

people who have a progressive disease and are not expected to live

longer than another six months).

So that we can deal with your claim as quickly as possible, it is

important that you send a DS1500 report with your claim. The notes

below tell you how to get a DS1500 report.

If you don’t have the DS1500 report by the time you have filled in the

claim form, send us the claim form straight away. Please send the

DS1500 when you can.

Getting Attendance Allowance under the special rules means:

• getting the higher rate of Attendance Allowance

• getting paid straight away (this means you do not have to wait

until you have needed help for six months − but changes like those

on page 10, question 44 of these notes may still affect how much

money you get), and

• we deal with your claim more quickly.

Claiming under the special rules for someone else

You can claim under the special rules for someone else. You do not

have to tell them you are claiming for them. Tell us about them on the

claim form. We will normally write to them about whether they can get

Attendance Allowance, but we will not tell them anything about the

special rules.

If you are filling in this form as part of your job, you do not need to tell

us your National Insurance number or date of birth at question 13.

How to get a DS1500 report

Ask your doctor or specialist for a DS1500 report.

This is a report about your medical condition. You won’t have to pay for

it. You can ask the doctor’s receptionist, a nurse or a social worker to

arrange this for you. You do not have to see the doctor. Most doctors’

practices provide DS1500 reports very quickly. Ask for the report in a

sealed envelope if you do not want anyone to see it.

How to claim under the special rules

Please fill in the claim form. Tick the box at question 19 of the claim

form to show you are claiming under the special rules.

If you do not tick this box, we cannot normally pay you under the

special rules.

9

Consent

We may need to contact your GP, or the people or organisations

involved with you, for information about your condition(s) or treatment.

This may include medical information.

This is so that a clear understanding is gained by the department of

your current needs. You do not have to agree to us contacting these

people or organisations but if you do not agree, we may be unable to

make sure you are entitled to the benefit you are claiming.

18

About your illnesses or disabilities and the

treatment or help you receive

We want to know if you use any aids or adaptations to help you do

things. For example:

• a hoist, monkey pole or bed-raiser may help you get out of bed

• a commode, raised toilet seat or rails may help you with your

toilet needs

• bath rails, a shower seat or a hoist may help you bath

or shower

• a long-handled shoehorn, button hook, zip pull or sock aid may

help you dress

• a stairlift, raised chair, wheelchair or rails may help you move

about indoors

• a walking stick, walking frame, crutches or artificial limbs may

help you get around

• special cutlery or a feeding cup may help you eat and drink, or

• a hearing aid, textphone, magnifier or braille terminal may help

you communicate.

We also want you to tell us if you need help to use the aids or

adaptations, and if you do, what help you get from another person.

25

About the aids and adaptations you use

45

By care home, we mean a home such as a residential care home,

nursing home, hospice or similar place.

We need to know if:

• you are in a hospital, a care home or similar place when you

make your claim, and

• the local authority or NHS pay anything towards the cost of

your stay.

If you are awarded Attendance Allowance when you are in hospital, a

care home or a similar place, we cannot pay you until you come out.

But if you are a private patient or resident, paying for your stay without

help from public funds, we will be able to pay you.

We may still be able to pay you if you are claiming under the special

rules and you are in a hospice.

About being in hospital, a care home or a similar place

10

If we pay you too much money

We have the right to take back any money we pay that you are not

entitled to. This may be because of the way the system works for

payments into an account.

For example, you may give us some information, which means you are

entitled to less money. Sometimes we may not be able to change the

amount we have already paid you. This means we will have paid you

money that you are not entitled to. We will contact you before we take

back any money.

When we collect information about you we may use it for any of our

purposes. These include dealing with:

l social security benefits and allowances

l child support

l employment and training

l financial planning for retirement

l occupational and personal pension schemes.

We may get information about you from others for any of our purposes

if the law allows us to do so. We may also share information with

certain other organisations if the law allows us to.

To find out more about how we use information, visit our website at

www.dwp.gov.uk/privacy-policy or contact any of our offices.

48

How we pay you

How the Department for Work and Pensions

collects and uses information