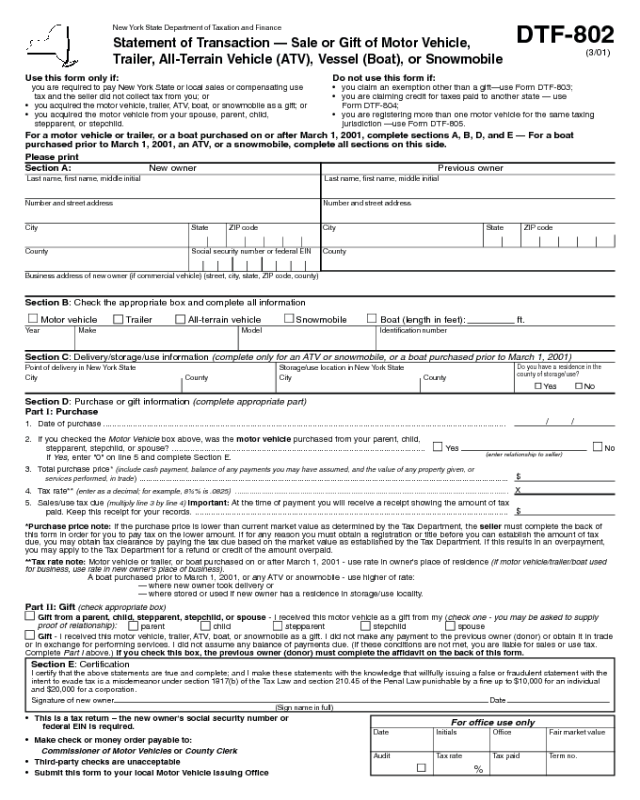

Fillable Printable ATV Bill of Sale Form - New York

Fillable Printable ATV Bill of Sale Form - New York

ATV Bill of Sale Form - New York

DTF-802

(3/01)

Use this form only if:

€ you are required to pay New York State or local sales or compensating use

tax and the seller did not collect tax from you; or

•

you acquired the motor vehicle, trailer, ATV, boat, or snowmobile as a gift; or

• you acquired the motor vehicle from your spouse, parent, child,

stepparent, or stepchild.

Do not use this form if:

• you claim an exemption other than a gift—use Form DTF-803;

• you are claiming credit for taxes paid to another state — use

Form DTF-804;

• you are registering more than one motor vehicle for the same taxing

jurisdiction —use Form DTF-805.

For a motor vehicle or trailer, or a boat purchased on or after March 1, 2001, complete sections A, B, D, and E — For a boat

purchased prior to March 1, 2001, an ATV, or a snowmobile, complete all sections on this side.

Please print

Last name, first name, middle initial Last name, first name, middle initial

Number and street address Number and street address

City State ZIP code City State ZIP code

County Social security number or federal EIN County

Business address of new owner (if commercial vehicle) (street, city, state, ZIP code, county)

Section B: Check the appropriate box and complete all information

Motor vehicle Trailer All-terrain vehicle Snowmobile Boat (length in feet): ft.

Year Make Model Identification number

Section C: Delivery/storage/use information

(complete only for an ATV or snowmobile, or a boat purchased prior to March 1, 2001)

Point of delivery in New York State Storage/use location in New York State

City County City County

Section D: Purchase or gift information

(complete appropriate part)

Part I: Purchase

1. Date of purchase ...............................................................................................................................................................................

//

2. If you checked the

Motor Vehicle

box above, was the motor vehicle purchased from your parent, child,

stepparent, stepchild, or spouse? .............................................................................................................. Yes No

If

Yes,

enter "0" on line 5 and complete Section E.

3. Total purchase price*

(include cash payment, balance of any payments you may have assumed, and the value of any property given, or

services performed, in trade

) ........................................................................................................................................................................

$

4. Tax rate**

(enter as a decimal; for example, 8¼% is .0825)

......................................................................................................................................

X

5. Sales/use tax due

(multiply line 3 by line 4)

Important: At the time of payment you will receive a receipt showing the amount of tax

paid. Keep this receipt for your records. ........................................................................................................................................

$

*Purchase price note: If the purchase price is lower than current market value as determined by the Tax Department, the seller must complete the back of

this form in order for you to pay tax on the lower amount. If for any reason you must obtain a registration or title before you can establish the amount of tax

due, you may obtain tax clearance by paying the tax due based on the market value as established by the Tax Department. If this results in an overpayment,

you may apply to the Tax Department for a refund or credit of the amount overpaid.

**Tax rate note: Motor vehicle or trailer, or boat purchased on or after March 1, 2001 - use rate in owner's place of residence

(if motor vehicle/trailer/boat used

for business, use rate in new owner's place of business)

.

A boat purchased prior to March 1, 2001, or any ATV or snowmobile - use higher of rate:

— where new owner took delivery or

— where stored or used if new owner has a residence in storage/use locality.

Part II: Gift

(check appropriate box)

Gift from a parent, child, stepparent, stepchild, or spouse - I received this motor vehicle as a gift from my (

check one - you may be asked to supply

proof of relationship):

parent child stepparent stepchild spouse

Gift - I received this motor vehicle, trailer, ATV, boat, or snowmobile as a gift. I did not make any payment to the previous owner (donor) or obtain it in trade

or in exchange for performing services. I did not assume any balance of payments due. (If these conditions are not met, you are liable for sales or use tax.

Complete

Part I

above.) If you check this box, the previous owner (donor) must complete the affidavit on the back of this form.

Section E: Certification

I certify that the above statements are true and complete; and I make these statements with the knowledge that willfully issuing a false or fraudulent statement with the

intent to evade tax is a misdemeanor under section 1817(b) of the Tax Law and section 210.45 of the Penal Law punishable by a fine up to $10,000 for an individual

and $20,000 for a corporation.

Signature of new owner Date

(Sign name in full)

New York State Department of Taxation and Finance

Statement of Transaction — Sale or Gift of Motor Vehicle,

Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

Date Initials Office Fair market value

Audit Tax rate Tax paid Term no.

%

Section A: New owner Previous owner

(enter relationship to seller)

For office use only

• This is a tax return – the new owner's social security number or

federal EIN is required.

• Make check or money order payable to:

Commissioner of Motor Vehicles

or

County Clerk

• Third-party checks are unacceptable

• Submit this form to your local Motor Vehicle Issuing Office

Do you have a residence in the

county of storage/use?

Yes No

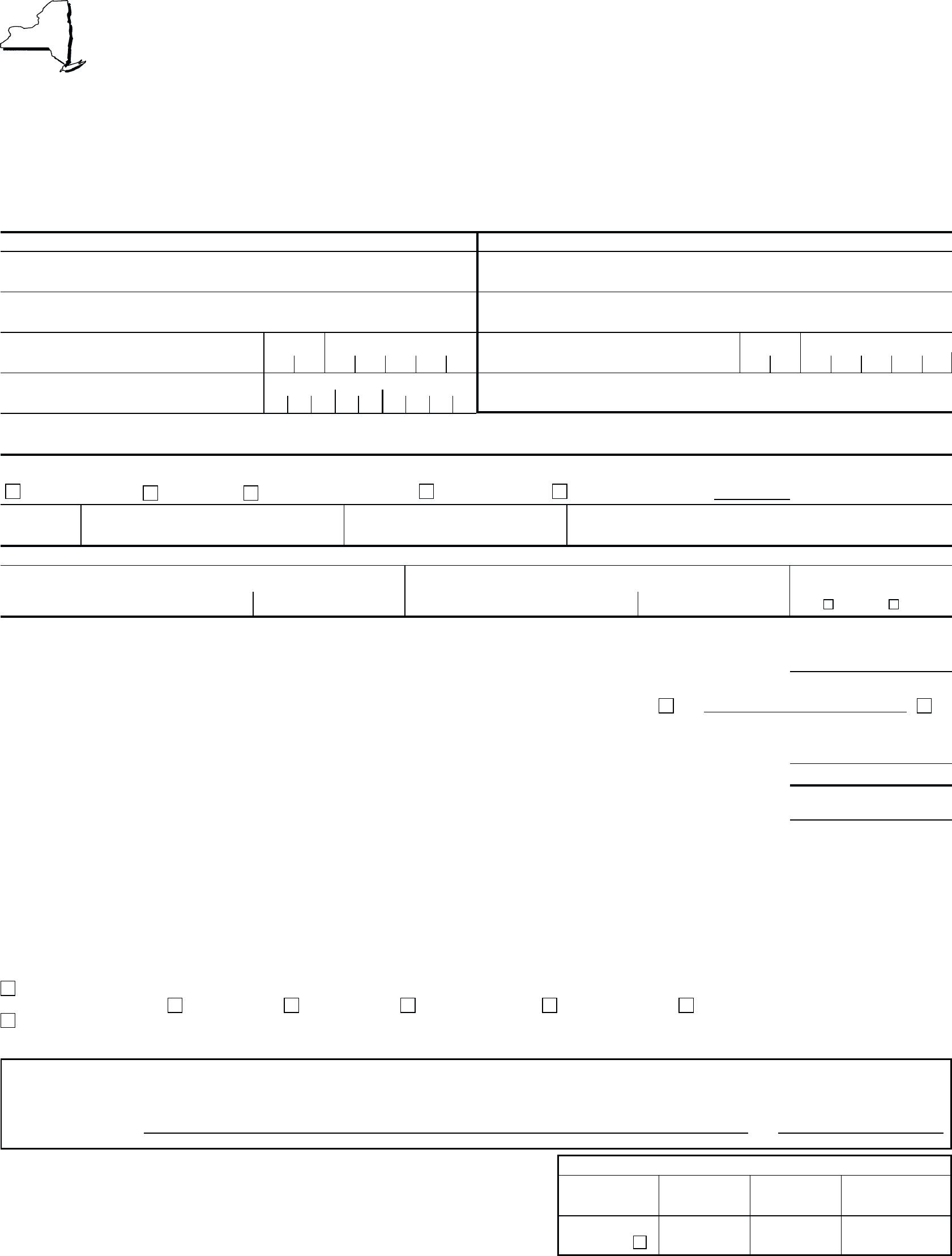

Affidavit of Sale or Gift of a Motor Vehicle, Trailer, ATV, Vessel (Boat), or Snowmobile

Seller/donor

This affidavit must be completed by seller/donor if:

• the selling price of the motor vehicle, trailer, ATV, boat, or snowmobile was below fair market value (excluding sales of a motor vehicle to

your parent, child, stepchild, stepparent, or spouse); or

• the motor vehicle was a gift to a person other than your parent, child, stepchild, stepparent, or spouse; or

• the trailer, ATV, boat, or snowmobile was a gift (regardless of relationship).

(Please print and answer all questions.)

Affidavit of

(check one):

Sale Gift

Seller/gift donor

Last name, first name, middle initial

Number and street address

City State ZIP code

County

Purchaser/recipient

Last name, first name, middle initial

Number and street address

City State ZIP code

County

Vehicle type

(check one):

Motor vehicle Trailer ATV Boat Snowmobile

Year Make Model Identification number

Condition of vehicle/boat

(check one):

Good Fair Poor Mileage (hours if boat or snowmobile):

1. a. Date vehicle/boat was sold/given / /

b. Place of delivery

2. Relationship of purchaser/recipient (if none, enter

none

) .......................................................................................

3. Did purchaser/recipient: Yes No

a. perform any service for you as a condition for the vehicle/boat sold or given? ...................................................

(If

Yes,

enter the value of the service $ and explain below.)

b. assume any debt you owed on this vehicle/boat? ...............................................................................................

(If

Yes,

enter the amount $ and explain below.)

c. trade/swap a vehicle or other property for this vehicle/boat? ..............................................................................

(If

Yes,

enter value of property traded/swapped $ and explain below.)

4. Total selling price. Include cash, plus all amounts entered on lines 3a, 3b, or 3c. .................................................. $

5. Complete only if a corporation or business is the seller/donor. Yes No

a. Was or is the purchaser/recipient an employee, officer, or stockholder of the company/corporation? ...............

(If

Yes,

explain below.)

b. Was the transaction part of any terms of employment, employment contract, or termination agreement? ........

(If

Yes,

explain below.)

Explanation (Use this space if you answered

Yes

to any question in 3 or 5 above.):

DTF-802 (3/01) (back)

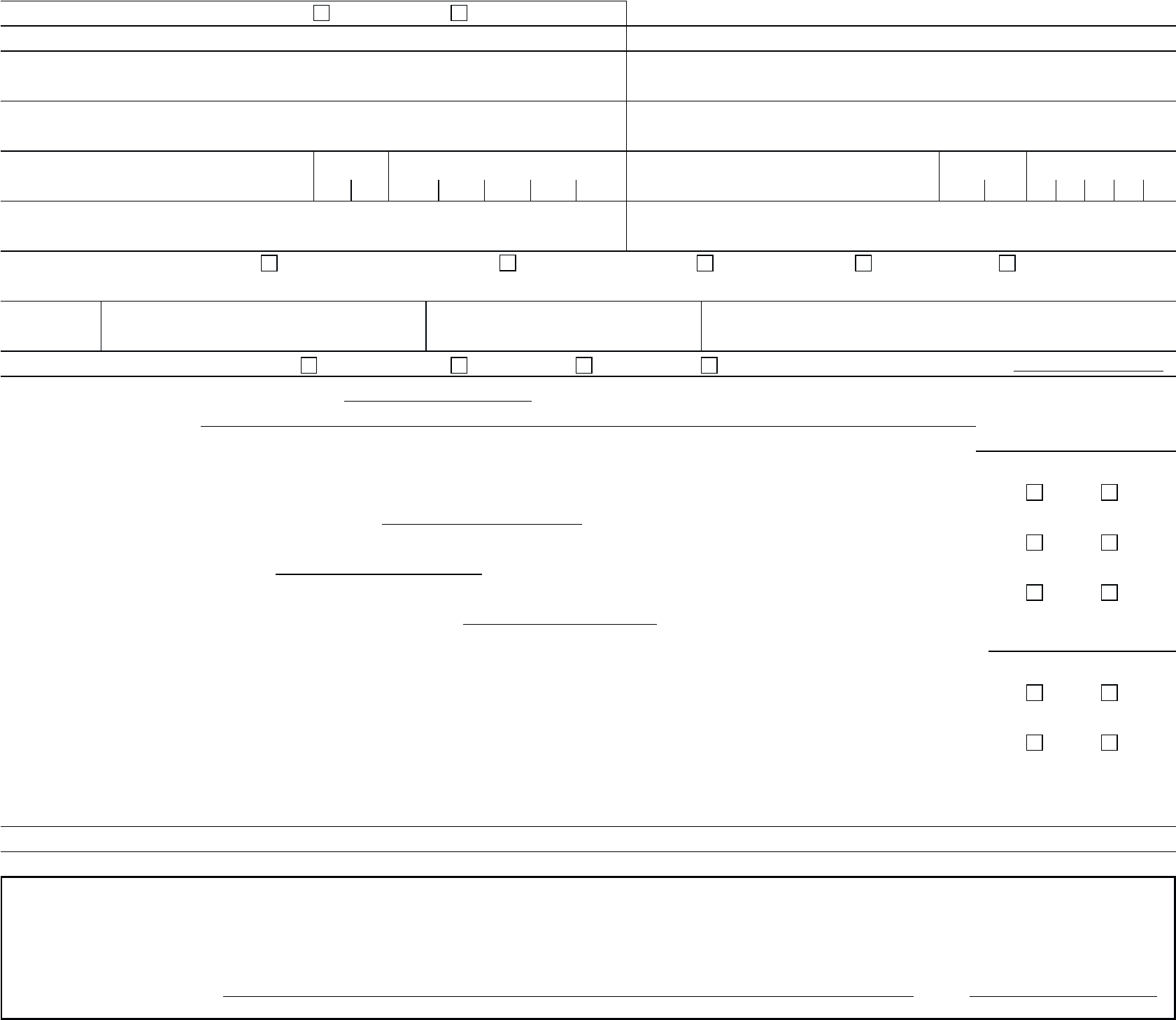

Privacy notification

The right of the Commissioner of Taxation and Finance and the Department of Taxation and Finance to collect and maintain personal

information, including mandatory disclosure of social security numbers in the manner required by tax regulations, instructions, and forms, is

found in Articles 8, 28, and 28-A of the Tax Law; and 42 USC 405(c)(2)(C)(i).

The Tax Department uses this information primarily to determine and administer sales and use taxes or liabilities under the Tax Law, and for

any other purpose authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Director of the Registration and Data Services Bureau, NYS Tax Department, Building 8 Room 338,

W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside Canada, call

(518) 485-6800.

Certification:

I certify that the above statements are true and complete; and I make these statements with the knowledge that willfully issuing a false or

fraudulent statement with the intent to evade tax is a misdemeanor under section 1817(b) of the Tax Law and section 210.45 of the Penal

Law punishable by a fine up to $10,000 for an individual and $20,000 for a corporation.

Signature of seller/donor Date

(Sign name in full)