Fillable Printable Bank Charges Refund Form Sample

Fillable Printable Bank Charges Refund Form Sample

Bank Charges Refund Form Sample

Catalog Number 63488O www.irs.gov

Form 8546 (Rev. 2-2013)

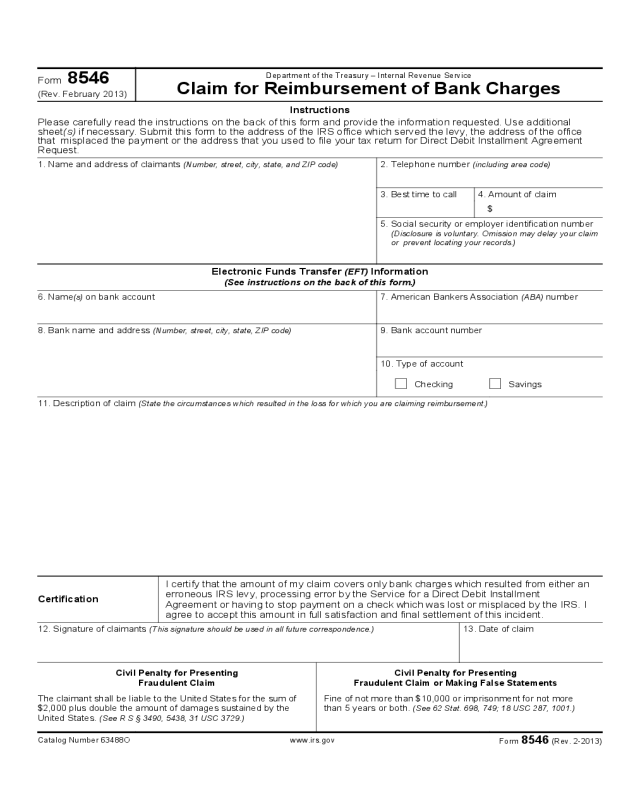

Form 8546

(Rev. February 2013)

Department of the Treasury – Internal Revenue Service

Claim for Reimbursement of Bank Charges

Instructions

Please carefully read the instructions on the back of this form and provide the information requested. Use additional

sheet(s) if necessary. Submit this form to the address of the IRS office which served the levy, the address of the office

that misplaced the payment or the address that you used to file your tax return for Direct Debit Installment Agreement

Request.

1. Name and address of claimants (Number, street, city, state, and ZIP code) 2. Telephone number (including area code)

3. Best time to call 4. Amount of claim

$

5. Social security or employer identification number

(Disclosure is voluntary. Omission may delay your claim

or prevent locating your records.)

Electronic Funds Transfer (EFT) Information

(See instructions on the back of this form.)

6. Name(s) on bank account 7. American Bankers Association (ABA) number

8. Bank name and address (Number, street, city, state, ZIP code) 9. Bank account number

10. Type of account

Checking Savings

11. Description of claim (State the circumstances which resulted in the loss for which you are claiming reimbursement.)

Certification

I certify that the amount of my claim covers only bank charges which resulted from either an

erroneous IRS levy, processing error by the Service for a Direct Debit Installment

Agreement or having to stop payment on a check which was lost or misplaced by the IRS. I

agree to accept this amount in full satisfaction and final settlement of this incident.

12. Signature of claimants (This signature should be used in all future correspondence.) 13. Date of claim

Civil Penalty for Presenting

Fraudulent Claim

The claimant shall be liable to the United States for the sum of

$2,000 plus double the amount of damages sustained by the

United States.

(See R S § 3490, 5438, 31 USC 3729.)

Civil Penalty for Presenting

Fraudulent Claim or Making False Statements

Fine of not more than $10,000 or imprisonment for not more

than 5 years or both.

(See 62 Stat. 698, 749; 18 USC 287, 1001.)

Catalog Number 63488O www.irs.gov

Form 8546 (Rev. 2-2013)

Instructions

Please complete all blocks. Write "NONE" if the block does not apply.

Use this form only for reimbursement of bank charges for:

1. an erroneous levy, or

2. stopping payment on a check that the IRS lost or misplaced.

3. Direct Debit Installment Agreement (DDIA) processing error

on the part of the Service.

The claimants must sign this form. If the bank account involved

is a joint account, each owner on the account must sign the

Form 8546 as a claimant for erroneous levy. DDIA processing

error claims on joint returns also require signature of both

spouses. However, an authorized agent or legal representative

can file and sign the claim if the claimant can't because of

disability, death, or other acceptable reason. Include proof of

authorization if the claim is being filed on behalf of someone.

Claims must be made within one year of the date the claim

accrues and are limited to $1,000. (See 31 USC 3723)

Please attach verification of the amount you are claiming.

Include any documentation you may have explaining or

acknowledging the IRS error. Also, include:

1. a copy of the levy (if the charges were caused by an

erroneous levy),

2. records showing the bank charges caused by the erroneous

levy, the request for replacement of a lost or misplaced

check, or DDIA processing error on the part of the Service,

and

3. records showing that the bank charges have been paid.

Records to support your claim must include bank statements and

correspondence.

If you have any questions about this claim, please contact the

IRS office that issued the levy or requested replacement of your

check. The address is on your copy of the levy or the request for

a new check. If your questions relate to a Direct Debit Installment

Agreement, please contact the IRS at 1-800-829-1040 or mail

your questions to the address that you used to file your tax

return.

If IRS approves your claim, the money can be sent to your bank

by electronic funds transfer (EFT), or we can send you a check.

Payment by EFT will be faster, safer, and more convenient for

you. If you want us to pay your claim by EFT, we need the bank

information in items 6 through 10. The American Bankers

Association (ABA) number (item 7) is the first nine digits in the

number at the bottom of your checks. If you have no checking

account, ask your bank what its ABA number is. If you do not

complete items 6 through 10, a check will be sent to you.

Internal Revenue Policy P-5-39

Reimbursement of Bank Charges Due to Erroneous Levy and Service Loss or Misplacement of Taxpayer

Checks, or Direct Debit Installment Agreement Processing Errors.

The Service recognizes that there are circumstances when an

erroneous use of its unique enforcement powers may cause tax-

payers to incur certain bank charges. Taxpayers who incur bank

charges due to an erroneous levy or a Direct Debit Installment

Agreement (DDIA) processing error on the part of the Service

may file a claim for reimbursement of those expenses. Bank

charges include a financial institution's customary charge for

complying with the levy instructions as well as charges for

overdrafts that are a direct consequence of an erroneous levy or

DDIA processing error on the part of the Service. In addition,

there are times when a taxpayer's check may be lost or

misplaced in processing. When the Service asks for a

replacement check, the taxpayer maybe reimbursed for bank

charges incurred in stopping payment on the original check. The

charges must have been paid by the taxpayer and must not have

been waived or reimbursed by the financial institution. Claims

must be filed with the District Director or Service Center Director

within one year after accrual of the expense.

The following criteria must be present in all erroneous levy

cases:

(1) The Service acknowledges the levy was erroneous;

(2) The taxpayers must not have contributed to the

continuation or compounding of the error; and

(3) Prior to the levy, the taxpayer did not refuse (either orally or

in writing) to timely respond to Service inquiries or provide infor-

mation relevant to the liability for which the levy was made.

The following criteria must be present in all lost check cases:

(1) The Service acknowledges it lost or misplaced the check

during processing;

(2) the Service asks the taxpayer for a replacement of the pay-

ment; and

(3) the Service is satisfied that the replacement payment has

been received.

The following criteria must be present in all DDIA processing

error cases.

(1) The Service failed to act timely, took an incorrect or

improper action, or a systemic failure caused the bank fees;

(2) The taxpayer must not have contributed to the continuation

or compounding of the error that caused the bank fees; and

(3) Prior to the processing error, the taxpayer did not refuse

(either orally or in writing) to timely respond to the Service’s

inquiries or provide sufficient information for the DDIA processing

change to be made.

In compliance with the Privacy Act of 1974, the following is provided.

Solicitation of the information is authorized by Title 31 USC

3723; 31 CFR 3.20 et seq. Disclosure of the information is

voluntary.

The principal purpose of this information will be for our internal

use in processing your claim under 31 USC 3723, or for any

court proceedings which may ensue from the filing of this claim.

We may disclose the information on this form relevant to the

processing of your claim or to any court proceedings resulting

from your claim. We may give the information to the Department

of Justice for the purpose of seeking legal advice or recommend-

ing prosecutions for fraudulent claims or the making of false

statements.