Fillable Printable Bereavement Benefits Claim Form

Fillable Printable Bereavement Benefits Claim Form

Bereavement Benefits Claim Form

l Bereavement Payment

l Widowed Parent’s Allowance

l Bereavement Allowance

Help for widows, widowers and

surviving civil partners

Bereavement

benefits

BB1 Notes 01/15

This pack contains

– more information about bereavement benefits

– a bereavement benefits claim form.

2

What are bereavement benefits?

We use bereavement benefits to mean any of these

l Bereavement Payment

l Widowed Parent’s Allowance

l Bereavement Allowance.

They are all based on your spouse or civil partner’s National Insurance

(NI) contributions.

By your spouse or civil partner we mean the person you were legally

married to, or were in a civil partnership with, at the time of their death.

For people who live or have lived in Scotland

Please get in touch with us if you live or have lived in Scotland and you

are not sure if you were legally married.

Can I get bereavement benefits?

You may be able to get bereavement benefits if your spouse or civil

partner had paid enough NI contributions.

You cannot get bereavement benefits if at the time of death

l you were divorced from your spouse, or

l your civil partnership had been dissolved, or

l you were living together as if you were married, but you were not

legally married, or

l you had remarried or formed a civil partnership, or

l you were living with another person as if you were married.

The information in these notes will help you see if you are able to get

any of the bereavement benefits.

You can find out more about bereavement benefits at

www.gov.uk/browse/benefits/bereavement

But if you are still not sure if you can get bereavement benefit, claim

anyway.

3

Bereavement Payment

Answer these 3 questions to find out if you may be able to get a

Bereavement Payment.

1 Were you under state pension age when your spouse or

civil partner died?

2 Was your spouse or civil partner under state pension age

when they died?

3 Was your spouse or civil partner over state pension age

when they died and not entitled to a basic pension based

on their own contributions?

We call this a category A pension.

You may be able to get a Bereavement Payment

l if you have answered Yes to at least one of these questions, and

l if your spouse or civil partner had paid enough NI contributions.

If you are entitled to a Bereavement Payment, it will be paid as a lump

sum.

You may be able to get Widowed Parent’s Allowance or Bereavement

Allowance as well as a Bereavement Payment.

No

Yes

No

Yes

No

Yes

4

Widowed Parent’s Allowance

Please answer these questions to find out if you may be able to get

Widowed Parent’s Allowance.

1 Are you entitled to Child Benefit for one of your children or

one of your spouse or civil partner’s children?

3 Was your spouse or civil partner getting Child Benefit?

4 If you are a woman, are you pregnant?

2 Are you entitled to Child Benefit but not getting it because

you or your late spouse or civil partner fell into the High

Income Child Benefit charge group?

No

Yes

No

Yes

No

Yes

No

Yes

You may be able to get Widowed Parent’s Allowance

l if you have answered Yes to at least one of these questions, and

l if your spouse or civil partner had paid enough NI contributions.

But if you have answered No to all these questions, you may still be

able to get Bereavement Allowance.

If you are entitled to Widowed Parent’s Allowance, the amount that

you can get is based on the NI contributions of your spouse or civil

partner. It may include an Additional Pension based on their earnings

since 1978. It may also include an Additional Pension based on caring

responsibilities contribution-based Employment and Support

Allowance, or Incapacity Benefit since April 2002.

You can usually get Widowed Parent’s Allowance as long as you are

entitled to Child Benefit.

If you fall into the High Income Child Benefit charge group and you

have not claimed Child Benefit, you must do so for your claim for a

Widowed Parent's Allowance to be considered.

If you fall into this group please contact HM Revenue & Customs

(HMRC) to make your claim.

5

Widowed Parent’s Allowance continued

If you stop being entitled to Child Benefit within 52 weeks of the

death of your spouse or civil partner, you may be able to receive

Bereavement Allowance for the remainder of the 52 weeks. This does

not apply to you if you are a man whose wife died before

9 April 2001.

If your late spouse or civil partner was claiming Child Benefit and you

have not yet made a claim to transfer the Child Benefit to your

name, you must do so for your claim for a Widowed Parent's

Allowance to be considered.

If you fall into this group please contact HMRC to make your claim.

More information

For more information

l go to www.gov.uk/child-benefit/how-to-claim

l telephone the HMRC Helpline on 0300 200 3100. Lines are open

Monday to Friday 8am to 8pm, Saturday 8am to 4pm. If you have

speech or hearing difficulties and use a textphone, the number to

use is 0300 200 3103.

Bereavement Allowance

Answer this question to find out if you may be able to get

Bereavement Allowance.

1 Were you aged 45 or over when your spouse or civil

partner died?

No

Yes

You may be able to get Bereavement Allowance

l if you have answered Yes to this question, and

l if your spouse or civil partner had paid enough NI contributions.

If you are entitled to Bereavement Allowance, the amount that you

can get depends on your age when your spouse or civil partner died

and your spouse or civil partner’s NI contributions.

If you were aged 55 or over, you may get the full rate of Bereavement

Allowance. But if you were aged under 55, you will get less than the

full amount.

6

Bereavement Allowance continued

Bereavement Allowance cannot include any Additional Pension and is

paid at the basic rate only.

You can usually get Bereavement Allowance for 52 weeks. It will stop if

you become entitled to State Pension before the end of the 52 weeks.

To find out when you can get State Pension visit

www.gov.uk/calculate-state-pension

If you were getting Widowed Parent’s Allowance for less than 52 weeks

and it stops because you are no longer entitled to Child Benefit, you

may be able to get Bereavement Allowance which is paid at the basic

rate only

l for the remainder of the 52 weeks, or

l until you are entitled to State Pension whichever comes first.

How to claim

Just fill in claim form BB1.

We are sorry that we have to ask you some questions about your spouse

or civil partner. This is because bereavement benefits are based on your

spouse or civil partner’s NI contributions.

If you have any difficulty filling in this claim form, someone else can do it

for you. You can ask a friend, a relative or an advice centre. Or ask at your

Jobcentre Plus office.

Please make sure that you sign the Declaration in Part 7 of the claim

form, if you can.

When to claim

You should send us the claim form BB1 as soon as possible.

l You must send us your claim form within 3 months of the death of

your spouse or civil partner. Failure to do so may affect your

entitlement to benefit.

l If your spouse died on or after 1 April 2003 your claim for a

Bereavement Payment can be accepted for up to 12 months.

l If your civil partner died on or after 5 December 2005 your claim for

a Bereavement Payment can be accepted for up to 12 months.

7

More about benefits for widows, widowers

and surviving civil partners

Are benefits for widows, widowers and surviving civil partners

affected by earnings?

No – if you work, your bereavement benefit will not go down because

of the money that you earn.

Are benefits for widows, widowers and surviving civil partners

taxable?

Bereavement Payment

This benefit is paid as a lump sum and is tax-free.

Widowed Parent’s Allowance or Bereavement Allowance

These benefits are taxable. If you have to pay tax, they are counted

as part of your income when tax is worked out.

What happens if you are also entitled to contribution-based

Employment and Support Allowance or Incapacity Benefit?

If you are getting contribution-based Employment and Support

Allowance or Incapacity Benefit and

l the amount that you get is less than your bereavement benefit, or

l your contribution-based Employment and Support Allowance

stops because you have received it for 365 days

you will not lose money. We will pay you an amount of benefit to

make up your full entitlement.

You will pay tax on contribution-based Employment and Support

Allowance from the first day you get it.

8

Help and advice

If you want more information about bereavement benefits, or

any other benefit, or if you would like advice about

employment and training opportunities, please get in touch

with your Jobcentre Plus office.

You can find the phone number and address on the advert in

the business numbers section of the phone book. Look under

Jobcentre Plus.

You can get a bereavement benefits claim pack (form BB1) by

phoning 0845 606 0265. If you have speech or hearing

difficulties and use a textphone, call on 0845 606 0285.

You can download a claim pack at

www.gov.uk/browse/benefits/bereavement

Please complete the form and send to the Jobcentre Plus

address on the claim form or to your nearest Jobcentre Plus

office as soon as possible.

Voluntary organisations that may be able

to advise you

l For emotional support, contact

CRUSE Bereavement Care

Helpline

Email

Website

0844 477 9400

www.cruse.org.uk

l Your local Citizens Advice Bureau.

Bereavement

benefits

BB1 01/15

Your claim for bereavement benefits

l Your benefit payments may be delayed if you do not

– answer all the questions on this form that apply to you and

your spouse or civil partner

– send us all the documents we ask for.

If you cannot do this, get in touch with us straight away.

l Please tell us about any other personal details you think we

should know about in Part 6. For instance, other names or recent

previous addresses.

l For emotional support, contact

CRUSE Bereavement Care

Helpline 0844 4779 400

Email [email protected]

Website www.cruse.org.uk

l Your local Citizens Advice Bureau

The information we collect about you and how we use it depends

mainly on the reason for your business with us. But we may use it

for any of the Department’s purposes, which include

l social security benefits and allowances

l child support

l employment and training

l private pensions policy, and

l retirement planning.

We may get information from others to check the information you

give to us and to improve our services. We may give information to

other organisations as the law allows, for example to protect

against crime.

To find out more about how we use information, visit

www.gov.uk/dwp/personal-information-charter or contact

any of our offices.

Other organisations who might be able to help you

How we collect and use information

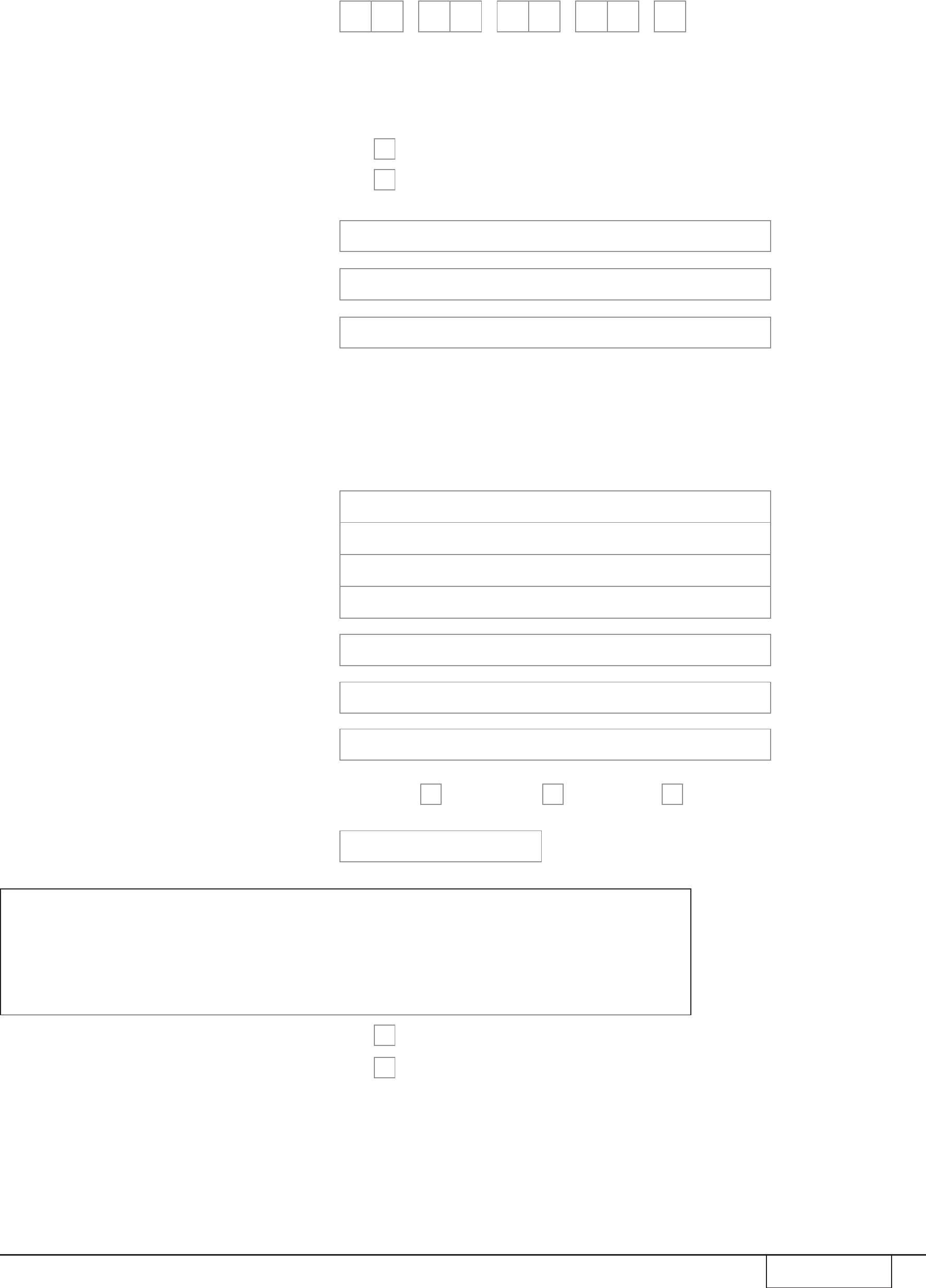

Part 1: About you

2

Mr/Mrs/Miss/Ms

Surname or family name

All other names, in full

All other surnames or family names

you have been known by or are

using now.

Please include maiden name, all

former married or civil partnership

names and all changes of family

name where appropriate.

National Insurance (NI) number

You can find this on your National

Insurance (NI) numbercard, letters

from the Department for Work and

Pensions or payslips.

Letters Numbers Letter

Address

Code Number

Mobile phone number

Home phone number

private

personal

If you do not know your NI number,

have you ever had one or used one

at any time?

Yes

No

Email address

where we can contact you

Please confirm if this email address is

secure

Postcode

BB1 01/15

Date of birth

/ /

Please send us your original birth certificate, if you have it. Do not send us a

photocopy. But if you do not have your birth certificate, do not delay sending

in this claim form. If you prefer, you can take your birth certificate to your

Jobcentre Plus office. Take this form as well. They will sign this form to show that

they have seen your certificate.

Are you sending your birth

certificate with this form?

Yes

No

We will send your birth certificate back

to you as soon as we can.

Please fill in this form with BLACK INK and in CAPITALS.

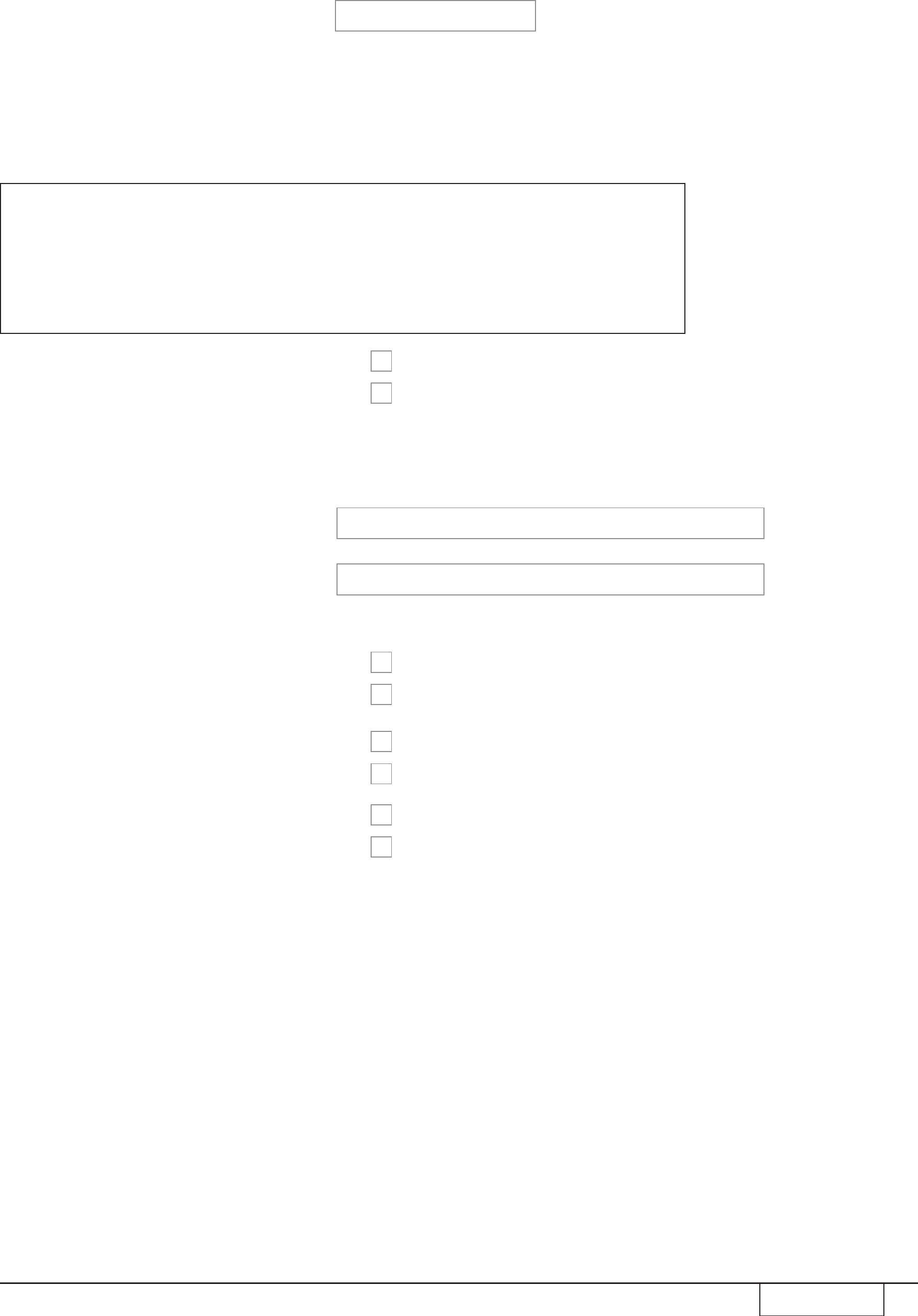

Part 1: About you continued

3

Please send us your original marriage or civil partnership certificate, if you have

it. Do not send us a photocopy. But if you do not have your marriage or civil

partnership certificate, do not delay sending in this claim form. If you prefer,

you can take your marriage or civil partnership certificate to your Jobcentre Plus

office. Take this form as well. They will sign this form to show that they have

seen your certificate.

Are you sending your marriage or

civil partnership certificate with

this form?

Yes

No

We will send your marriage or

civil partnership certificate back

to you as soon as we can.

Please tell us the country where

your marriage or civil partnership

took place.

Did your marriage end in divorce

or has your civil partnership

been dissolved?

Are you legally separated?

Are you, or have you been living

with someone else as if you were

married to them, or as if you are

civil partners?

Yes

No

Yes

No

Yes

No

Please tell us about this at Part 6.

BB1 01/15

What was the date of your

marriage or civil partnership?

If you converted or changed your

civil partnership into a marriage or

married your civil partner, enter

the date your marriage is treated

as starting on.

/ /

Under what law/religion was

the ceremony conducted?