Fillable Printable Bill of Sale Form for Snowmobile - Iowa

Fillable Printable Bill of Sale Form for Snowmobile - Iowa

Bill of Sale Form for Snowmobile - Iowa

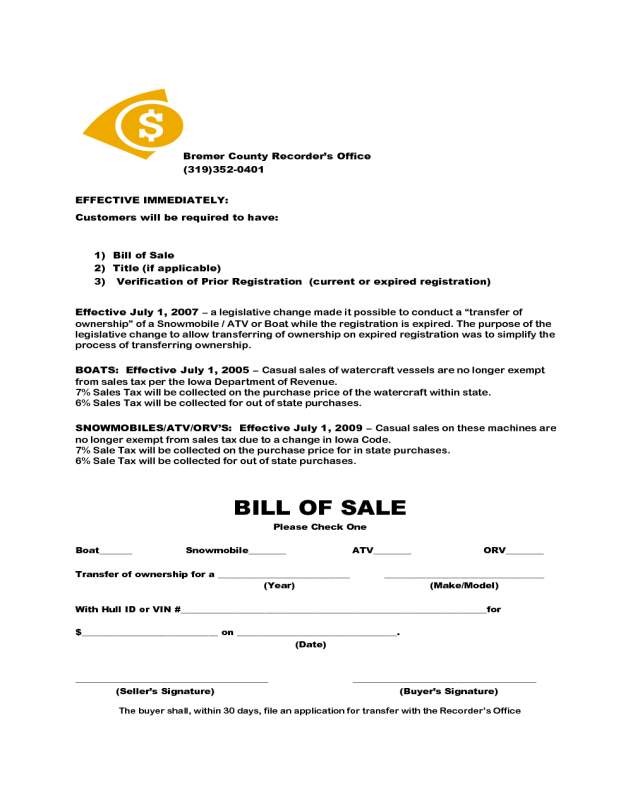

Bremer County Recorder’s Office

(319)352-0401

EFFECTIVE IMMEDIATELY:

Customers will be required to have:

1) Bill of Sale

2) Title (if applicable)

3) Verification of Prior Registration (current or expired registration)

Effective July 1, 2007 – a legislative change made it possible to conduct a “transfer of

ownership” of a Snowmobile / ATV or Boat while the registration is expired. The purpose of the

legislative change to allow transferring of ownership on expired registration was to simplify the

process of transferring ownership.

BOATS: Effective July 1, 2005 – Casual sales of watercraft vessels are no longer exempt

from sales tax per the Iowa Department of Revenue.

7% Sales Tax will be collected on the purchase price of the watercraft within state.

6% Sales Tax will be collected for out of state purchases.

SNOWMOBILES/ATV/ORV’S: Effective July 1, 2009 – Casual sales on these machines are

no longer exempt from sales tax due to a change in Iowa Code.

7% Sale Tax will be collected on the purchase price for in state purchases.

6% Sale Tax will be collected for out of state purchases.

BILL OF SALE

Please Check One

Boat_______ Snowmobile________ ATV________ ORV________

Transfer of ownership for a ____________________________ __________________________________

(Year) (Make/Model)

With Hull ID or VIN #_________________________________________________________________for

$_____________________________ on __________________________________.

(Date)

_________________________________________ _______________________________________

(Seller’s Signature) (Buyer’s Signature)

The buyer shall, within 30 days, file an application for transfer with the Recorder’s Office