Fillable Printable Building Loan Contract - New York

Fillable Printable Building Loan Contract - New York

Building Loan Contract - New York

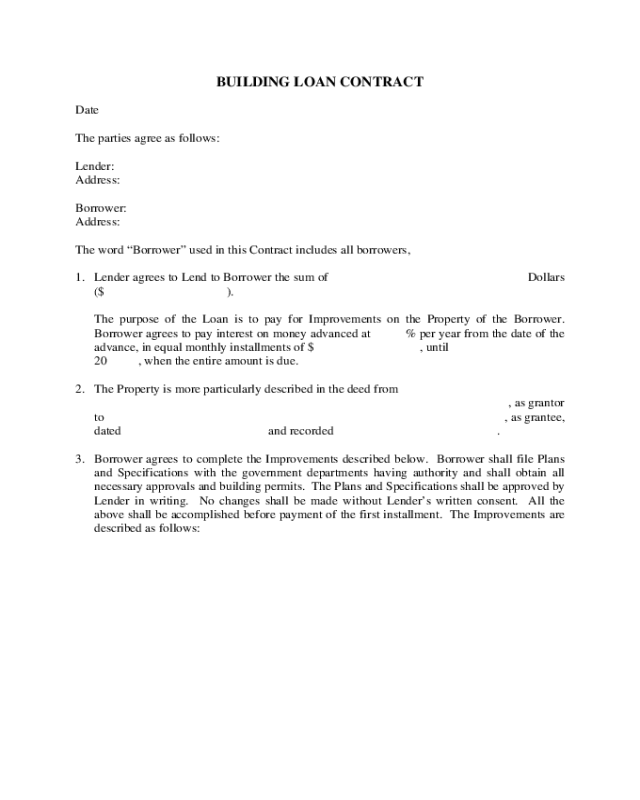

BUILDING LOAN CONTRACT

Date

The parties agree as follows:

Lender:

Address:

Borrower:

Address:

The word “Borrower” used in this Contract includes all borrowers,

1. Lender agrees to Lend to Borrower the sum of Dollars

($ ).

The purpose of the Loan is to pay for Improvements on the Property of the Borrower.

Borrower agrees to pay interest on money advanced at % per year from the date of the

advance, in equal monthly installments of $ , until

20 , when the entire amount is due.

2. The Property is more particularly described in the deed from

, as grantor

to , as grantee,

dated and recorded .

3. Borrower agrees to complete the Improvements described below. Borrower shall file Plans

and Specifications with the government departments having authority and shall obtain all

necessary approvals and building permits. The Plans and Specifications shall be approved by

Lender in writing. No changes shall be made without Lender’s written consent. All the

above shall be accomplished before payment of the first installment. The Improvements are

described as follows:

4. The Loan will be advanced according to Lender, determination at this time it is contemplated

that, installments shall be paid as follows:

Lender may advance all or any part of any installment before the due date. Lender shall be

given 5 days notice before any installment is due.

5. Borrower agrees to complete the Improvements according to the Plans and Specifications.

Work will begin within days after the date of this Contract. Borrower shall carry on

the work with reasonable diligence.

6. Simultaneously to the execution of this agreement, Borrower has signed a Bond or note for

the Loan. The payment of the Bond or Note is secured by a Mortgage on the Property

described made by the Borrower on this date. The Mortgage is to be recorded on the date

this Contract is filed. This Contract is subject to the terms of the Bond or Note and Mortgage.

7. No installment shall be due unless (a) work usually done at that stage of construction is done

in a good and workmanlike manner, and (b) all materials and fixtures usually installed and

furnished by that stage of construction are installed and furnished. Lender shall inspect the

work prior to making any installment. Work is to be done to Lender’s satisfaction. No

installment is to be paid unless construction is approved by an engineer, architect or other

satisfactory to Lender.

8. No installment is due and payable while there is any lien or other encumbrance on the

Property (except the Mortgage securing this Contract). The Borrower shall deliver to Lender

a certificate of the County Clerk or a title insurance company that no liens, orders or

assignment of contract have been filed against the Property after recording of the Mortgage.

9. If the work stops or does not proceed at reasonable speed, Lender may employ workmen and

purchase materials and do whatever necessary to complete or protect the work. If mechanics

liens or orders or assignments of contract are filed against the Property, Lender may pay and

satisfy them. If taxes, assessments, sewer rents or water rates charged against the Property

are not paid when due, Lender may pay them. Payments made by Lender under this

Paragraph are secured by the Bond or Note and Mortgage as if they were installments paid to

Borrower.

10. Borrower agrees to pay for and indemnify Lender for all claims or liens for materials, labor

or services furnished for the Improvements on the Property. Borrower shall defend any

action or proceeding brought against Lender on these liens or claims with an attorney of

Lender’s choice.

11. A. The following are defaults:

(1) Assignment of this Contract or any installment by Borrower without, written consent

of Lender.

(2) Death of Borrower before receipt of the last installment.

(3) If the Improvements on the Property are in the Judgment materially injured or

destroyed by fire or other event.

(4) If a petition in bankruptcy is filed by or against the Borrower. If a receiver or trustee

of the Property of the Borrower is appointed. If the Borrower files a petition for

reorganization under any of the provisions of the Bankruptcy Act or of any other law.

If the Borrower makes an assignment for the benefit of creditors or is judged

insolvent by any state or federal court.

(5) If Borrower does not make improvements as called for by the Plans and

Specifications.

(6) If the Plans and Specifications are not approved by the government departments

having authority to approve them.

(7) If the work stops or does not proceed at reasonable speed in the opinion of Lender.

(8) If Borrower gives a security interest in any materials, fixtures or articles used in the

work or placed in the Improvements.

(9) Failure by Borrower to produce on Lender’s demand documents proving Borrower’s

unconditional ownership of the materials, fixtures or articles used in the construction

or placed on the Improvements.

(10) If Borrower fails to make any payment of interest due on any mortgage on the

Property.

(11) If at the time any installment is due, title to the Property is not satisfactory to the

Lender’s attorney even though the same questions existed at the time of any prior

installment payment.

(12) If the Borrower fails to keep any other obligation in this Contract, or in the Bond

or Note and Mortgage.

B. In the event of a Default:

(1) Lender’s obligation to pay installments shall terminate.

(2) At Lender’s option, the Bond or Note and Mortgage shall become immediately due

and payable.

(3) Lender may continue to pay installments without giving up any of Lender’s rights or

waiving them.

12. Borrower will receive the advances secured by the Mortgage and will hold the right to

receive the advances as a trust fund, pursuant to Lien Law Section 13. The advances will be

applied first to pay the cost of the Improvements. Borrower will apply the advances first to

pay the cost of the improvements before using any part of the total of the advances for any

other purpose.

13. Borrower’s statement required by Section 22 of the Lien Law is annexed and made a part

hereof.

14. This Contract cannot be changed or terminated orally.

This Contract is dated as of the date at the top of the first page.

LENDER: BORROWER:

______________________________ ______________________________

Borrowers Statement Under

Section 22 of The Lien Law

STATE OF

COUNTY OF ss.:

being sworn, says:

I live at

I am the of

The Borrower(s) is the Building Loan Contract annexed.

The consideration paid, or to be paid, by Borrower(s) to Lender for the loan is

Dollars ($ ). All

other expenses incurred, or to be incurred, in connection with said loan are as follows:

Examination and insurance of title and recording fees………………….. $

NY State Mortage Tax…………………………………………………... $

Architect’s, engineer’s and surveyor’s fees……………………………... $

Inspections………………………………………………………………. $

Appraisals……………………………………………………………….. $

Conveyancing…………………………………………………………… $

The net sum available to Borrower(s) for the Improvements is

Dollars, ($ ), less

amounts due or payable for insurance premiums, interest on building loan mortgages, ground

rent, taxes, assessments, water rates and sewer rents accruing during the construction of the

Improvements.

This statement is made pursuant to Section 22 of the Lien Law of the State of New York.

The facts herein stated are true to my (our) knowledge.

Sworn to before me on

______________________________

______________________________

______________________________

NOTARY PUBLIC

STATE OF NEW YORK

COUNTY OF , ss:

On the day of , in the year 20 , before me the undersigned,

personally appeared personally known to me or

proved to me on the basis of satisfactory evidence, to be the individual(s) whose name (s) is (are)

subscribed to the within instrument and acknowledged to me that (he) (she) (they) executed the

same in (his) (her) (their) capacity(y)(ies), and that by (his) (her) (their) signature(s) on the

instrument, the individual(s) or the person upon behalf of which the individual(s) acted, executed

the instrument.

____________________________________

Notary Public