Fillable Printable Building Loan Mortgage

Fillable Printable Building Loan Mortgage

Building Loan Mortgage

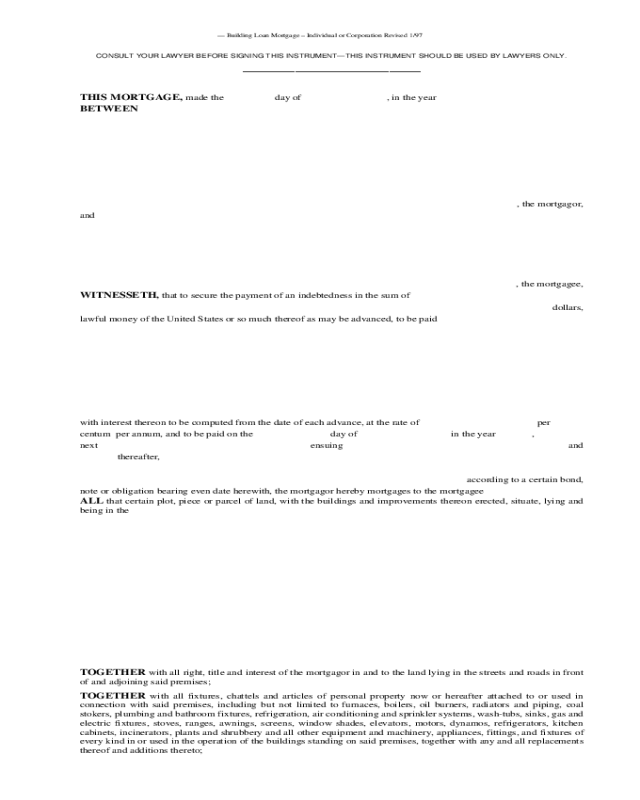

— Building Loan Mortgage – Individual or Corporation Revised 1/97

CONSULT YOUR LAWYER BEFORE SIGNING THIS INSTRUMENT—THIS INSTRUMENT SH OULD BE USED BY LAWYERS ONLY.

—————————————————

THIS MORTGAGE, made the day of , in the year

BETWEEN

, the mortgagor,

and

, the mortgagee,

WITNESSETH, that to secure the payment of an indebtedness in the sum of

dollars,

lawful money of the United States or so much thereof as may be advanced, to be paid

with interest thereon to be computed from the date of each advance, at the rate of per

centum per annum, and to be paid on the day of in the year ,

next ensuing and

thereafter,

according to a certain bond,

note or obligation bearing even date herewith, the mortgagor hereby mortgages to the mortgagee

ALL that certain plot, piece or parcel of land, with the buildings and improvements thereon erected, situate, lying and

being in the

TOGETHER

with all right, title and interest of th e mortgagor in and to th e land lying in the streets and ro ads in front

of and adjoining said premises;

TOGETHER with all fixtures, chattels and articles of personal property now or hereafter attached to or used in

connection with said premises, including but not limited to furnaces, boilers, oil burners, radiators and piping, coal

stokers, plumbing and bathroom fixtures, refrigeration, air conditioning and sprinkler systems, wash-tubs, sinks, gas and

electric fixtures, stoves, ranges, awnings, screens, window shades, elevators, motors, dynamos, refrigerators, kitchen

cabinets, incinerators, plants an d shrubbery and all o ther equipment and machinery, appliances, fittings, and fixtures of

every kind in or used in the operation of the buildings standing on said premises, together with any and all replacements

thereof and additions thereto;

TOGETHER with all awards heretofore and hereafter made to the mortgagor for taking by eminent domain the whole

or any part of said premises or any easement therein, including any awards for changes of grade of streets, which said

awards are hereby assigned to the mortgagee, who is hereby authorized to collect and receive the proceeds of such

awards and to give proper receipts and acquittances therefor, and to apply the same toward the payment of the mortgage

debt, notwithstanding the fact that the amount owing thereon may not then be due and payable; and the said mortgagor

hereby agrees, upon request, to make, execute and deliver any and all assignments and other instruments sufficient for

the purpose of assigning said awards to the mortgagee, free, clear and discharged of any encumbrances of any kind or

nature whatsoever.

AND the mortgagor covenants with the mortgagee as follows:

1. That the mortgagor will pay the indebtedness as hereinbefore provided.

2. That the mortgagor will keep the buildings on the premises insured (i) against loss by fire for the benefit of the

mortgagee, (ii) against loss by flood if the premises are located in an area identified by the Secretary of Housing and

Urban Development as an area having special flood hazards and in which flood insurance has been made available

under the National Flood Insurance Act of nineteen hundred sixty-eight; that he will assign and deliver the policies to

the mortgagee; and that he will reimburse the mortgagee for any premiums paid for insurance made by the mortgagee

on the mortgagor’s default in so insuring the buildings or in so assigning and delivering the policies.

3. That no building on the premises shall be altered, removed or demolished without the consent of the mortgagee.

4. That the whole of said prin cipal sum and interest shall become due at the option of the mortgagee: after default in

the payment of any instalment of principal or of interest for fifteen days; or after default in the payment of any tax,

water rate, sewer rent or assessment for thirty days after notice and demand; or after default after notice and demand

either in assigning and d eliverin g the po licies insuring the build ings again st loss b y fire or in reimbursing the mortgagee

for premiums paid on such insurance, as hereinbefore provided; or after default upon request in furnishing a statement

of the amount due on the mortgage and whether any offsets or defenses exist against the mortgage debt, as hereinafter

provided. An assessment which has been made payable in instalments at the application of the mortgagor or lessee of

the premises shall nevertheless, for the purpose of this paragraph, be deemed due and payable in its entirety on the day

the first instalment becomes due or payable or a lien.

5. That the holder of this mortgage, in an y action to foreclose it, shall be entitled to the appointment of a receiver.

6. That the mortgagor will pay all taxes, assessmen ts, sewer rents or water rates, and in default thereof, the mortgagee

may pay the same.

7. That the mortgagor within five days upo n request in person or within ten days u pon request by mail will furnish a

written statement duly acknowledged of the amount due on this mortgage and whether any offsets or defenses exist

against the mortgage debt.

8. That notice and demand or request may be in writing and may be served in person or by mail.

9. That the mortgagor warrants the title to the premises.

10. That the fire insurance policies required by paragraph No. 2 above shall contain the usual extended coverage

endorsement; that in addition th ereto the mortgagor, within thirty days after notice and demand, will keep th e premises

insured against war risk and any other hazard that may reasonably be required by the mortgagee. All of the provisions

of paragraphs No. 2 and No. 4 above relating to fire insurance and the provisions of Section 254 of the Real Property

Law construing the same shall apply to the additional insurance required by this paragraph.

11. That in case of a foreclosure sale, said premises, or so much thereof as may be affected by this mortgage, may be

sold in one parcel,

12. That if any action or proceeding be commenced (except an action to foreclose this mortgage or to collect the debt

secured thereby), to which action or proceeding the mortgagee is made a party, or in which it becomes necessary to

defend or uphold th e lien of this mortgage , all sums paid by the mortgagee for the exp ense of any litigatio n to prosecute

or defend the rights and lien created by this mortgage (including reasonable counsel fees), shall be paid by the

mortgagor, together with interest thereon at the rate of six per cent. per annum, and any such sum and the interest

thereon shall be a lien on said premises, prior to any right, or title to in terest in or clai m upon said pr emises attaching or

accruing subsequent to the lien of this mortgage, and shall be deemed to be secured by this mortgage. In any action or

proceeding to foreclose this mortgage, or to recover or collect the debt secured thereby, the provisions of law respecting

the recovering of costs, disbursements and allowances shall prevail unaffected by this covenant.

13. That the mortgagor hereby assigns to the mortgagee the rents, issues and profits of the premises as further security

for the payment of said indebtedness, and the mortgagor grants to the mortgagee the right to enter upon and to take

possession of the premises for the purpose of collecting the same and to let the premises or any part thereof, and to

apply the rents, issues and profits, after payment of all necessary charges and expenses, on account of said indebtedness.

This assignment and grant shall con tinue in effect until this mortgage is paid. The mortgagee hereby waives the righ t to

enter upon and to take possession of said premises for the purpose of collecting said rents, issues and profits, and the

mortgagor shall be entitled to collect and receive said rents, issues and profits until default under any of the covenants,

conditions or agreements contained in this mortgage, and agrees to use such rents, issues and profits in payment of

principal and interest becoming due on this mortgage and in payment of taxes, assessments, sewer rents, water rates and

carrying charges becoming due against said premises, but such right of the mortgagor may be revoked by the mortgagee

upon any default, on five days’ written notice. The mortgagor will not, without the written consent of the mortgagee,

receive or collect rent from any tenant of said premises or any part thereof for a period of more than one month in

advance, and in the event of any default under this mortgage will pay monthly in advance to the mortgagee, or to any

receiver appointed to collect said rents, issues and profits, the fair and reasonable rental value for the use and

occupation of said premises or of such part thereof as may be in the possession of the mortgagor, and upon default in

any such payment will vacate and surrender the possession of said premises to the mortgagee or to such receiver, and in

default thereof may be evicted by summary proceedings.

14. That the whole of said principal sum and the interest shall become due at the option of the mortgagee: (a) after

failure to exhibit to the mortgagee, within ten days after demand, receipts showing payment of all taxes, water rates,

sewer rents and assessments; or (b) after the actual or threatened alteration, demolition or removal of any building on

the premises without the written consent of the mortgagee; or (c) after the assignment of the rents of the premises or any

part thereof without the written consen t of the mortgagee; or (d) if the buildings on said premises are not maintained in

reasonably good repair; or (e) after failure to comply with any requirement or order or notice of violation of law or

ordinance issued by any governmental department claiming jurisdiction over the premises within three months from the

issuance thereof; or (f) if on application of the mortgagee two or mor e fire in sur ance companies lawf ully d oing bu siness

in the State of New York refuse to issue policies insuring the buildings on the premises; or (g) in the event of the

removal, demolition or destruction in whole or in part of any of the fixtures, chattels or articles of personal property

covered hereby, unless the same are promptly replaced by similar fixtures, chattels and articles of personal property at

least equal in quality and condition to those replaced, free from chattel mortgages or other encumbrances thereon and

free from any reservation of title thereto; or (h) after thirty days’ notice to the mortgagor, in the even t of the passage of

any law deducting from the value of land for the purposes of taxation any lien thereon, or changing in any way the

taxation of mortgages or debts secured thereby for state or local purposes; or (i) if the mortgagor fails to keep, observe

and perform any of the other covenants, conditions or agreements contained in this mortgage or of those contained in

the building loan contract hereinafter mentioned.

15. That the mortgagor will, in compliance with Section 13 of the Lien Law receive the advances secured hereby and

will hold the right to receive such advances as a trust fund to be applied first for the purpose of paying the cost of the

improvement and will apply the same first to the payment of the cost of the improvement before using any part of the

total of the same for any other purpose.

16. This mortgage is made pursuant to a certain building loan contract between the mortgagor and the mortgagee dated

in the year , and intended to be filed in the office of the Clerk of the County of

on or before the date of the recording of this mortgage, and is subject to all the provisions of said

contract as if they were fully set forth herein and made part of this mortgage.

Strike out this

clause 17 if

inapplicable

17. That the execution of this mortgage has been duly authorized by the board of directors of the mortgagor.

This mortgage may not be changed or terminated orally. The covenants contained in this mortgage shall run with

the land and bind the mortgagor, the heirs, personal representatives, successors and assigns of the mortgagor and all

subsequent owners, encumbrancers, tenants and subtenants of the premises, and shall enure to the benefit of the

mortgagee, the personal representatives, successors and assigns of the mortgagee and all subsequent holders of this

mortgage. The word “mortgagor” shall be construed as if it read “mortgagors” and the word “mortgagee” shall be

construed as if it read “mortgagees” whenever the sense of this mortgage so requires.

IN WITNESS WHEREOF, this mortgage has been duly executed by the mortgagor.

I

N PRESENCE OF:

ACKNOWLEDGEMENT TAKEN IN NEW YORK STATE

State of New York, County of , ss:

On the day of in the year , before

me, the undersigned, personally appeared

, personally known to me or proved to me on the basis of

satisfactory evidence to be the individual(s) whose name(s) is (are)

subscribed to the within instrument and acknowledged to me that

he/she/they executed the same in his/her/their capacity(ies), and that

by his/her/their signature(s) on the instrument, the individual(s), or

the person upon behalf of which the individual(s) acted, executed the

instrument.

ACKNOWLEDGEMENT BY SUBSCRIBING WITNESS

TAKEN IN NEW YORK STATE

State of New York, County of , ss:

On the day of in the year , before

me, the undersigned, a Notary Public in and for said State, personally

appeared , the

subscribing witness to the foregoing instrument, with whom I am

personally acquainted, who, being by me duly sworn, did depose and

say that he/she/they reside(s) in

(if the place of residence is in a city, include the street and street number if any, thereof);

that he/she/they know(s)

to be the individual described in and who executed the foregoing

instrument; that said subscribing witness was present and saw said

execute the same; and that said witness at the same time subscribed

his/her/their name(s) as a witness thereto

ACKNOWLEDGEMENT TAKEN IN NEW YORK STATE

State of New York, County of , ss:

On the day of in the year , before

me, the undersigned, personally appeared

, personally known to me or proved to me on the basis of

satisfactory evidence to be the individual(s) whose name(s) is (are)

subscribed to the within instrument and acknowledged to me that

he/she/they executed the same in his/her/their capacity(ies), and that

by his/her/their signature(s) on the instrument, the individual(s), or

the person upon behalf of which the individual(s) acted, executed the

instrument.

ACKNOWLEDGEMENT TAKEN OUTSIDE NEW YORK

STATE

*State of , County of , ss:

*(Or insert District of Columbia, Territory, Possession or Foreign

County)

On the day of in the year

,before me the undersigned personally appeared

Personally known to me or proved to me on the basis of satisfactory

evidence to be the individual(s) whose name(s) is (are) subscribed to

the within instrument and acknowledged to me that he/she/they

executed the same in his/her/their capacity(ies), that by his/her/their

signature(s) on the instrument, the individual(s) or the person upon

behalf of which the individual(s) acted, executed the instrument, and

that such individual make such appearance before the undersigned in

the

(add the city or political subdivision and the state or country or other

place the acknowledgement was taken).

Title No.

TO

SECTION:

BLOCK:

LOT:

COUNTY OR TOWN:

RETURN BY MAIL TO:

DISTRIBUTED BY

The Judicial Title Insurance Agency LLC

800-281-TITLE

(

8485

)

FAX: 800-FAX-9396

Building Loan Mortgage