Fillable Printable Sample Mortgage Form

Fillable Printable Sample Mortgage Form

Sample Mortgage Form

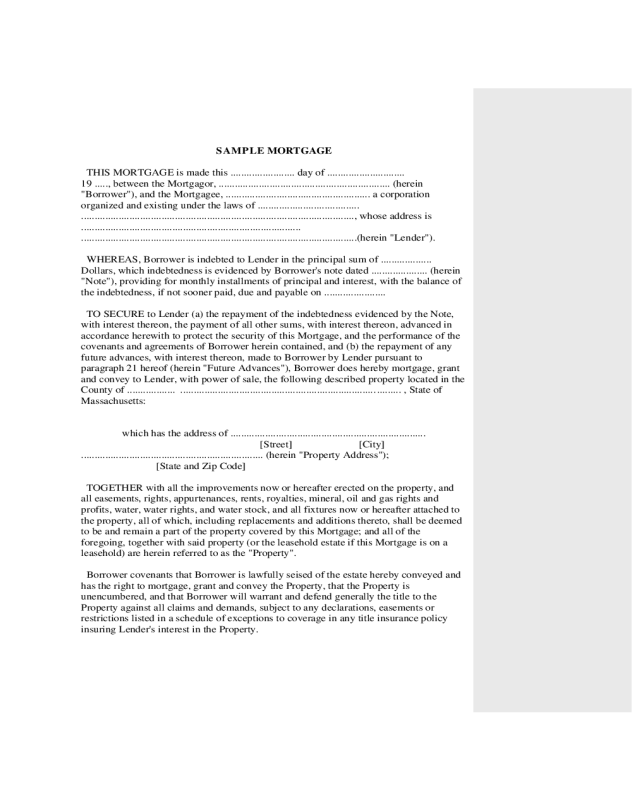

SAMPLE MORTGAGE

THIS MORTGAGE is made this ........................ day of .............................

19 ....., between the Mortgagor, ................................................................ (herein

"Borrower"), and the Mortga gee, ...................................................... a corporation

organize d and existing under the la ws of ...... .................... .... ........

......................................................................................................, whose address is

..................................................................................

........................... .... ... .......... .... ... .......... .... ... ..................... ... .... .......(here i n "Lender").

WH EREAS, Borrower is indebted to Lender in the principal sum of ................. ..

Dollars, which indebtedness is evidenced by Borrower's note dated ......... ... .... ..... (herein

"Note"), providi ng f o r mo nthly insta llment s of princi pal and interest, w ith the balance of

the indebtedness, if not sooner paid, due and pa yable on .......... .... ... ......

TO SECURE to Lender (a ) the repayment of the indebtedn ess evid enced by the Note,

with interest thereon, the payment of all other sums, with interest thereon, advanced in

accordance herewi t h t o protect the s ecuri ty of this Mort ga ge, and the performance of the

covena nts and agreements of Borrower here i n c ont ai ned, and (b ) the repayment of any

future advances, with interest thereon, made to Borrower by Lender pursuant to

paragra p h 21 hereof (he rei n "F ut ure A d vances"), Borrowe r does here by mortgage, gr ant

and convey to Lender, wi th p owe r of sale, the follow i ng des c r ib e d pr operty located in the

County of ....... .... ....... .................. ... ... ........... ... .... .......... ... .................. ......... , State of

Massachusetts:

which has the address of .........................................................................

[Street] [City]

.................................................................... (herein "Property Address");

[State and Zip Code]

TOGETHER wi th all t he impro vement s now or hereaf te r ere cted on the property, and

all easemen t s, r i ghts, appurtenances, rents, royalties, mine ral, oil and gas rights and

profits, water, water rights, and water stock, and all fixtures now or hereafter attached to

the property, all of which, including replacements and additions thereto, shall be deemed

to be and re main a part of the prope rty covered by this M o rt gage; and all of the

foregoing, together with said property (or the leasehold estate if this Mortgage is on a

leasehold) are herein referre d to as the "Property".

Borrower covenants that Borrower is lawfully seised of the estate hereby conveyed and

has the right to mortgage, grant and convey the Property, that the Property is

unencumbere d, an d tha t Borrower wil l warrant and defe n d generally the title to the

Property agai nst all cla i ms and de mands, subject to any declarations, easements or

restrictio ns listed in a sch edule of exceptions to coverage in any title insu rance policy

insuring Lender's interest in the Property.

NOTE

US $ .............................. ............................., Massachusetts

City

..................................., 19 ......

FOR VALUE RECEIVED, the undersigne d ("Borrower") pr omise(s) to pay ...........

................. ... ..................... ... ........... ... ... ........... ... ..................... ... ..., or order, the princ i pal

sum of ........ .... .............. ........................ . Dollars, with interest on the unpaid principal

balance from the date of this Note, until paid, at the rate of..... ... .... .. perc ent per annum.

Principal and interest shall be payable at ..............

................. ... ..................... ... ........... ... .... .......... ... ..................... ... ..., or such other place as

the Note hol der may designate, in c onsecut i ve mont hly instal lments of

........................... .... ... . Dolla rs (US $ ....... .... ... .......... .... . ), on the ......... ..... da y of each

month beginning .................. ............. ..., 19 ...... Such monthl y installments shall c ontinue

until the entire indebtedness evidenced by this Note is fully paid, except that any

remai ni ng i n debted ness, if not s oo ner paid, sha ll b e due and payable

on................................................................................

If any monthly installment under this Note is not paid when due and remains unpaid

after a date specified by a notice to Borrower, the en tire pri ncipal amoun t o uts tanding and

accrued interest thereon shall at once become due and payable at the option of the Note

holder. The date s pecified shall not be less than thirty da ys from the date s uch

notice is mailed. The Note holder may exerc ise this option to accelerate during any

defaul t b y Borr ow er re gardless of any pri or forbeara nce. If suit is bro u ght to collect thi s

Note, the Note holder shall be entitled to collect all reasonable costs and expenses of suit,

including, but not limited to, reasonable attorney's fees.

Borrower shall pay to the Note holder a late charg e of ..........percent of any monthly

installment not received by the Note holder within ..........days after the installment is due.

Borrower ma y prepay the principa l am ou nt o ut s tanding in wh ole or i n part. T he N o te

holder may require t hat a ny partial prepayments (i) be made on the date monthly

installments are due an d (ii ) be in t he am o unt of that part of one or more monthly

insta llments which would be a pp li c able to principal. An y pa rtial prepaymen t sha ll be

applied against the principal amount outstanding and shall not postpone the due date of

any subse qu e n t mon t hly insta llm ents or cha nge t he amount of s uch i nst al l ments, unless

the Note hol der shall otherwise a gree in writi n g.

Presentment, notice of dishonor, and protest are hereby waived by all makers, sureties,

guarant o rs a n d end orser s hereof. Th is Note shall b e the joi nt and several obl i gation of all

makers, sureties, g uara ntors and e n do rs ers, and shall be bindi ng u p on them and their

successors and assigns.

Any notice to Borrower p ro vided for in th is Note shall be given by mail ing such notice

by certified mail addressed to Borrower at the Property Address stated below, or to such

other address as Borrower may designate by notice to the Note holder. Any notice to the

Note holder shall be given by mailing such notice by certified mail, return receipt

requested, to the Note holder at the address stated in the fir st paragra ph of this Note, or at

such other address as may have been des i g nated by notice to Borrower.

The inde btedness evidenced b y this N ote is secured by a Mortgage, dated

.......... ................................, and reference is made to the Mortgage for rights as to

acceleration of the indebtedness evidenced by this Note.

..................................................

.................................................. .................................................

.................................................. .................................................

Property Address (Execute Original Only)

UNIFORM COVE NANTS. Borrower and Lender covenant and agree as follows:

1. Payment of Principals and Interest. Borrower shall promptly pay when due the

prin cipa l of and interest on the indebtedness evidenced by the Note, prepayment and late

charges as pro vi de d i n the N ote, a nd the p rincipal of a nd interest on any Fu tu re Advances

secure d by this Mortgage.

2. Funds for Taxes and Insurance. Subject to applicable law or to a written waiver by

Lender, Borrower shal l pay to Lend e r o n the da y m o nt hly instal lments of princ i pa l an d

interest are payable under the Note, until the Note is paid in full, a sum (herein "Funds")

equal to one-twelf t h of the yearly taxes a nd asse ssments whi ch m a y attain priority over

this Mo rt gage, and ground rents on the Prop erty, if any, pl us one-twe lft h of yearly

premium installments for hazard insurance, plus one-twe lf th of yearly prem ium

installments for mortgage insurance, if any, all as reasonably estimated initially and from

time to time by Lender on the basis of assessments and bills and reasonable estimates

thereof.

The Fu nds shal l be held in an insti t u tion the dep os its o r accou nt s of which are ins ure d or

guarant eed by a Federa l or sta te agenc y (including Lender if Len der is such an

institution). Lender shall apply the Funds to pay said taxes, assessments, insurance

premi ums and gro und rents . Le nder may not charge for so holdi ng a n d applying th e

Funds, analyzing said account, or verifying and comp il i n g sai d asses sments and bills,

unless Lender pays Borrower interest on the Fu n ds and applicab le law permits Lender to

make such a charge. Borrower and Lender may agree in writing at the time of execution

of this Mortgage that interest on the Funds shall be paid to Borrower, and unless such

agreement is made or applicable law requires such interest to be paid, Lender shall not be

required to pay Borrower any interest or earnings on the Funds. Lender shall give to

Borrower, wit h o ut charge, an annual accounti n g of t he F unds show ing credi ts an d debits

to the F un ds and t he purp ose for which ea ch debit to t he Fun ds was made. The Fu nds a re

pledged as additional sec urity for the sums secured by this Mortgage.

If the amount of the Funds held by Lender, together with the future monthly

installments of Funds p a yabl e prior to the due dates of taxes, assessm e nts, ins ura nce

premiums and ground rents, shall exceed the amount required to pay said taxes,

assessments, insurance premiums and ground rents as they fall due, such excess shall be,

at Borrower's option, either promptly repaid to Borrower or credited to Borrower on

monthl y instal lments of Funds . If the amount of the Funds hel d by Lender shall no t be

sufficie n t to pay taxes, ass essments, ins urance prem iums and ground re nts as they fall

due, Borr ow er s hal l pay to Lender any amount necess ary to make up t he d eficienc y

within 30 day s from the date notice is mailed by Lender to Borrower requesting payment

thereof.

Upon payment in full of all sums secured by this Mortgage, Lender shall promptly

refund to Borrower any Funds held by Lender. If under paragraph 18 hereof the Property

is sold or the Property is otherwise acquired by Lender, Lender shall apply, no later than

immediately prior to the sale of the Property or its acquisition by Lender, any Funds held

by Lend er at the time of application as a credit against the sums secured by this

Mortgage.

3. Applica ti on of P a yments. Unles s ap pli c able law provi des ot herw ise, all payments

recei ve d b y Len de r u nder the Note a nd paragr aphs I and 2 here of shall be applied by

Lender firs t in payment of amount s payable to Len der b y Borrower un der pa ra graph 2

hereof, then to interest payable on the Note, then to the principal of the Note, and then to

interest and principal on an y Future Advances.

4. Charges; Liens. Borrower shall pay all taxes assessments and other charges. fines

and impositions attributable to the Property which may attain a pr iority over this

Mortgage, and leasehold payments or ground rents, if any, in the manner provided under

paragraph 2 hereof or, if not paid in such manner, by Borrower making payment, when

due, directl y to the payee thereof. Bor rower s hall promptly furnish to Lender all notices

of amounts due under this paragraph, and in the event Borrower shall make payment

directly, Borrower shall prom ptly furnish to Lender receipts evidencing such payments.

Borrower shall promptly discharg e any lien which has priority over this Mortgage;

provided, that Borrower shall not be required to discharge any such lien so long as

Borrower shall agree in writing to the payment of the obligation secured by such lien in a

manner acceptable to Le nde r, or shall in good faith co ntes t s uch lien by, or defend

enforcement of s uch lien in, legal proceedings w hic h operate to prevent the enforcement

of the lien or forfeiture of the Property or any part thereof.

5. Hazard Insurance. Borrower shall kee p the improvem ents now existing or hereafter

erected on the Property insured against loss by fire, hazards included within the term

"extended coverage", and such other hazards as Lender may require and in such amounts

and for such pe ri ods as L ender may require; p rovided, that Len der s hall not require th at

the amount of suc h coverage exceed that amount of coverage require d to pa y the sums

secure d by this Mortgage.

The insurance carrier providing the insurance shall be c h ose n b y Borrow er su bject to

appr oval by Lender; pr ovi d ed, that such app ro val shal l not be unreason ably wit hhe ld. All

premiums on insurance policies shall be paid in the manner provided under paragraph 2

hereof or, if n ot p ai d i n such manner, b y Borr ow er making payment, when due, direct ly

to the insurance carrier.

All insurance policies and renewals thereof shall be in form acc eptable to Lender and

shall include a standard mortgage clause in favor of and in form acceptable to Lender.

Lender shall have the right to hold the policies and renewals thereof, and Borrower shall

promptly furnish to Lender all renewal notices and all receipts of paid premiums. In the

event of loss, Borrower shall give prompt notice to the insurance carrier and Lender.

Le nder ma y make pr oof o f l oss if no t m ade p rom pt ly by Borr ower.

Unless Lender and Borrower otherwise agree in writing, insurance proceeds shall be

applied to restorati on or repair of the Property damaged, pro vi ded such rest orati o n or

repai r is economically fe asible an d the securit y of this Mort gage is not thereb y im paired.

If such resto r at i on or re p air is not economically feasible or if the sec uri ty of this

Mortgage would be impaired, the insurance proceeds shall be applied to the sums secured

by this Mortgage, with the excess , if any, paid to Borrower. If the Property is abandoned

by Borrower, or if Borrower fails to respond to Lender within 30 days fro m the date

noti ce is mail ed by Len der to Borrower that the insurance carrier of fers to settle a clai m

for insura nce benefits , L e nde r is authorized t o col lect and apply the ins ura nce procee ds at

Lender's o pt ion ei t her t o res t orat i on or repair of the Property or to the sums secure d b y

this Mortgage.

Unless Lender and Borrower otherwise agree in writing, any such application of

proceeds to princi pal shall not extend or postpone the due date of the monthl y

installments referred t o in para graphs 1 and 2 hereof or change the am ount of such

installments. If under paragraph 18 hereof the Property is acquired by Lender, all right,

title and i nterest of Borrower in and to any ins ura nce po licies and in a nd t o the pr oceeds

thereof resulting from damage to the Property prior to the sale or acquisition shall pass to

Lender to the extent of the sums secured by this Mortgage immediately prior to such sale

or ac quis it ion.

6. Preservation and Maintenance of Property: Leaseholds; Condominiums; Planned

Unit Developments. Borrower shall keep the Property in good repair and shall not

commit waste or permit impairment or deterioration of the Property and shall comply

with the provisions of any lease if this Mortgage is on a leasehold. If this Mortgage is on

a unit in a condominium or a pla nn e d uni t de vel opment, B orrower shall perf orm all of

Borrower's o bl igations u nder the declar ation or coven ants creati n g or go verning t he

condom i ni u m or plan ned u nit deve lopme nt, t he b y-law s an d regulations of the

condom i ni um or planned u nit developm ent, and cons ti tuent doc uments. If a

condominium or planned unit development rider is executed by Borrower and recorded

to gether with this Mortgage, the coven ants and agreements of such rider shall be

incorporated into and shall amend and supplement the covenants and agreements of this

Mortgage as if the rider were a part hereof.

7. Protection of Lender's Security. If Borrow er fails to perform the covenants and

agreements contained in this Mortgage, or if any actio n or pro ceeding is c omm e nced

which materially affect s Lender's interest in the Property, including, but not limited to,

eminent d omain, insol vency, code enf orcem ent, or arra ngements or proceedings

involving a bankrupt or decedent, then Lender at Lender's option, upon notice to

Borrower, m a y make suc h appearances, disburse such sum s and ta ke such action as is

necessa ry to protect L en der's interest, including, b ut no t li m it ed t o, disbursement of

reasonable attorney's fees and entry upon the Property to make repairs. If Lender required

mortgage insurance as a condition of making the loan secured by this Mortgage,

Borrower shal l pay the premiums required to main tain such insurance in effect until such

time as the requireme nt for suc h insurance terminates in accordance with Borrower's and

Lender's written agreement or applicable law. Borrower shall pay the amount of all

mortgage in su rance p r em iums in the manne r pro vided under paragraph 2 hereof.

Any amounts disbursed by Lender pursuant to this paragraph 7, with interest thereon.

shall b ecome additi o nal in debtedness of Borr ower secured by this M ort g age. U nl e ss

Borrower and Lender agree to other terms of payment, such amounts shall be payable

upon notice from Lender to Borrower requesting payment thereof. and shall bear interest

from the date of dis bursem ent a t the r ate payable from tim e to ti me o n outs t an di ng

principal under the Note unless payment of interest at such rate would be contrary to

applicable law , in which event such a m oun ts shall bear interest at the high e st rate

permissible under a p plicab le law . Nothin g con tai ned in this para gra ph 7 shall requi re

Lender to incur any expense or take any a ction hereunde r.

8. Inspection. Lender may mak e or ca use t o be m ade reas onable entrie s up on and

inspecti o ns of the Property, provi de d th at Le nder shall give Borrow e r no tice p r i or to an y

such inspection specifying reasonable cause therefor relat ed to Lender's interest in the

Property.

9. Condemnation. The proceeds of an y award or claim for damages, direc t or

conse q uent ial. in con nec tion with a ny c o ndemnati o n or o t her taking of the P rop e rty, or

part thereof. or for conveyance in lieu of condemnation. are hereby assigned and shall be

paid to Lender.

In the event of a total taking of the Property. the proceeds shall be applied to the sums

secu red by this Mortgage. With the excess. if any, paid to Borrower. In the event of a

partial taking of the Property, unless Borrower and Lende r otherwise agree in writin g.

there shall be app li e d to the s ums secure d by this Mortga ge s u ch p roportio n of the

proceeds as is equal to that proportion which the amount of the sums sec ured by this

Mortgage immediately pri or t o t he date of taking bea rs to t h e fair mar ket val ue of the

Property immediately prio r t o t he dat e of taking. with the bala nce of the pro ceeds paid to

Borrower.

If the Prope rty is aban doned by Bo rrower . or if. after notice by Lender to Borrower that

the condemnor offers to make an award or settle a claim for damages. Borrower fails to

respond to Lender within 30 days after the date such notice is mailed . Lender is

authorized to collect and apply the proceeds. at Lender's option. either to restoration or

repair of the Property or to the sums secured by this Mortgage.

Unless Lender and Borrower otherwise agree in writing. any such application of

proceeds to princi pal shall not extend or postpone the due date of the monthl y

installments referred t o in para graphs 1 and 2 hereof or change the am ount of such

installments.

10. Borrower Not Released. Extensio n of the time for pa yment o r mo di ficat i o n of

amortization of the sums secured by this Mortgage granted by Lender to any successor in

interest of Borrower shall not operate to release. in any manner, the liability of the

original Borrower and Borrower's successors in interest. Lender shall not be required to

commence proceedings aga i nst such successor or refuse to extend time for payment or

otherwise modify amortization of t he sum s se cured by t his Mort ga ge by r easo n of a ny

demand ma de b y the ori gin al B or r o w er and Borrower's successors in interest.

11. Forbearance by Lender Not a Waiver. Any forbearance by Lender in exercising

any right or remedy hereunder, or otherwise affo rded by applicable law. shall not be a

waiver of or preclude the exercise of any such right or remedy. The procurement of

insurance or the pa yme n t of taxes or other liens or charges by Len der s ha l l no t be a

waiver of Lender's right to accelerate the matu rity of th e indeb tedness s ecured by t h is

Mortgage.

12. Remedies Cumulative. All rem edies pro v ided in this Mort gage are distinct a n d

cumula ti ve t o an y ot her r ig ht or

remed y un der this Mortgage o r affo rded by law or equi t y. and m ay he exercised

concurrently, independently or successively.

13. Successors and Assigns Bound; Joint and Several Liability; Captions. The

covena nts and ag reements herei n c o ntai ned shall bind, and the righ ts her eunder shal l

inure to, the respective successors and assigns of Lender and Borrower. subject to the

provis i on s of parag r ap h l7 hereof. All covenants an d a greements of Borrower shall be

joint and several. The captions and headings of the paragraphs of this Mortgage are for

convenie nce only and are not to be used to interpret or define the provisi o ns hereof.

14. Notice. Except for an y notice required unde r appl icable law t o be given in an ot her

manner, (a) any notice t o B orr ower prov i ded for in this Mort gage shall be given b y

mailing such notice by certified mail addressed to Borrower at the Property Address or at

such other address as Bo rrow e r may designa te b y notice t o Le nder as provided herein,

and (b) any notice to Lender shall be given by certifie d mail, return receipt requested, to

Lender's address stated herein or to such other address as Lender may designate by notice

to Borrow er as pr ovided herein. A n y not ice p ro vide d for in th is Mortgage shall be

deemed to have b een gi v en t o Borr ow er or Le nder when given i n the man ner desi g nated

herein.

15. Uniform Mortgage; Governing Law; Severability. This form of mortgage

combine s un iform cove n a nts f or nat i onal use and non-uniform covenants with limited

variations by jurisdiction to constitute a uniform security instrument covering real

property. This Mortgage shall be governed by the law of the jurisdiction in which the

Property is located. In the event that any provision or clause of this Mortgage or the Note

conflicts with applicable law. such conflict shall not aff ect ot her provisions of this

Mortgage or the Note whic h can be give n ef f ect w ithout the co nfl ict i ng provisi on. and to

this end the provisions of the Mortgage and the Note are declared to be severable.

16. Borrower's Copy. Borr ow er shall be furnished a co nfo rmed c o p y of the N ote and

of this Mortgage at the time of execution or after recordation hereof.

17. Transfer of the Property; Assumption. If all or any part of the Property or an

interest therein is sold or transferred by Borrowe r witho ut Lender's pr ior w ritt en cons ent,

excluding (a) the creation of a lien or encumbrance subordinate to this Mortgage, (b) the

creation of a purchase mone y security interest for household appliances, (c) a transfer by

devise, descent or by operation of law upo n the deat h of a jo int t enant or (d ) the g ra n t of

any leasehold interest of three years or less not containing an option to purchase, Lender

may, at Lende r's o pt i on, declare all t he sums se cured by this Mort gage to be imm ediat ely

due and payable. Lender sha ll h a ve w aived suc h opt i on to ac celerate if, prior t o the sa le

or transf er. Lende r and the person to whom the Property is to be sold or transferre d reach

agreement in writing that the credit of such person is satisfactory to Lender and that the

interest payable on the s u ms secured by this M ort gage shall be at suc h rat e as Lender

shall request. If Lender has waived the option to accelerate provided in this paragraph 17,

and if Borrower's successo r in interest has ex ecuted a written assumption agreemen t

accepted in writing by Lender, Lender shall release Borrower from all obligations under

this Mortgage and the Note.

If Lender exercises such option to accelerate, Lender shall mail Borrower notice of

acceleration in accordance with paragra ph 14 here of. Suc h notice shall provide a period

of not less than 30 days from the date the notice is mailed within which Borrower may

pay the sums declared due. If Borrower fails to pay such sums prior to the expiration of

such period, Lender ma y, wi tho ut further notice o r dema nd o n Borrow e r, in vo ke a n y

remed ies pe rmitted by paragraph 18 hereof.

NON-UNIFORM COVENANTS. Borrower and Lender furth er covenant and agree as

follows:

18. Acceleration; Remedies. Except as provided in paragraph 17 hereof, upon

Borrower's br each of any co vena nt or agreement of Borrower in this Mortgage, inc l uding

the cove nan t s t o pa y when due an y su ms secured by this M ortgage, L ender prior to

acceleration shall mail notice to Borrower as provided in paragraph 14 here of specif ying:

(1) the breach; ( 2) the action required to cure suc h breach; (3) a date, not less than 30

days from the date t he noti ce is mail ed to Borrower, b y which such breach must be cured;

and (4) that failure to cure such breach on or before the date specified in the notice may

result in acc eleration of the sums secured b y this Mortgage and sale of the Propert y. The

notice shall further inform Borrower of the right to reinstate after acceleration and the

right t o bri n g a court action to ass ert the non-exi s tence of a default or an y other defe ns e

of Borrower to acceleration and sale. If the breac h is not cured on or bef ore the date

specifi ed i n th e notice, Lender at Lende r's op tion m ay declare all of the sums secured by

this Mo rt gage to be immediately due and payable wit ho u t f urther demand and Lend er

may invoke the STATUTORY PO WER OF SALE and any other remedies permitted by

applicable law. Lender shall be entitled to collect all reasonable costs and expenses

incurre d in p urs ui ng the remedies provide d in t his pa ra gr a ph 1 8, in cludin g, but n ot

limited to, reasonable attorney's fees.

If Lender invokes the STATUT ORY POWER OF SALE, Lender shall mail a copy o f a

notice of sa l e to Borr ow er, and to any oth er pers o n req uired by applic able law, in the

manner provided by applica bl e law. Len der shall publ is h th e n oti ce of sal e and t he

Property shall be sold in the manner prescr ibed by applica ble law. Lender or Lend er's

designee ma y purchase the Property at any sale. The proceeds of the sale shall be applie d

in the following order: (a) to all reasonable costs and expenses of the sale, including

reasonable attorney's fees and costs of title evidence; (b) to all sums secured by this

Mortgage; and (c) the excess, if an y, to the pers o n or pers o ns le gal ly entitle d theret o.

19. Borrower's Right to Reinstate. Notwithstanding Lender's acceleration of the sums

secure d by this Mort gage, Borrower sha ll h ave the right to have any pr oceedin gs be gun

by Lender to enforce this Mortgage discontinued at any ti me prior to the earlier to occur

of (i) the fifth day befor e sale of the Propert y purs uan t to the power of sale con tained in

this Mort gage or (ii) entry of a judgm ent e nf orci n g th is Mo rtgage if: (a) Borrow er pays

Lender al l sum s wh ich would be then d ue un d er this Mortgage, t he N ote and notes

securing Future Advances, if any, had no acceleration occurred; (b) Borrower cures all

breaches of an y ot her co venants or agreements of Borrower cont ained in this Mort gag e ;

(c) Borrower pays all reasonable expenses incurred by Lender in enforcing the covenants

and agreem ents of Borrow e r conta i n e d i n this M ort gage and in enforci ng L e nde r's

remed ies as provide d in paragra p h 18 hereof, includin g, but n ot limited to, reasonab le

attorney 's fees; and (d ) Borrower takes such action as Lender may reasonably require to

assure that the lien of this Mortgage, Lender's interest in the Property and Borrower's

obligation to pay the sums secured by this Mortgage shall continue unimpaired. Upon

such payment and cure by Borrower, this Mortgage and the obligations secured hereby

shall remain in full force and effect as if no acceleration had occurred.

20. Assignment of Rents; Lender in Possession. As additional secu rity hereunder,

Borrower hereby assigns to Lender the rents of the Property, provided that Borrower

shall, pr i or to acceleration under paragraph 18 hereof or aba n do nment of the Property,

have the right to co llect and retai n such re nts as the y become due and payab le.

Upon acceleration under paragraph 18 hereof or abandonment of the Property, Lender

shall be ent it led to enter upon, take p oss ession of and manage the Proper ty and to collec t

the rents of the Property including those past due. All rents collected by Lender shall be

applied f i rs t to paymen t of the cos ts of management of the Property and collec ti on of

rents , i ncl ud in g, bu t not limited to, reasonable attor ney's fees, and then to th e sum s

secure d by this Mort gage. Lend er sh all be liable to account o nl y f or t h ose rents actually

received.

21. Future Advances. For the pur pose s permitte d b y applicab le law and upon request

of Borrower, Lender, at Lender's option prio r t o release of this Mortga ge, may make

Future Advances to Borrower. Such Future Advances, with interest thereon, shall be

secure d by this Mort gage when evidence d b y promissor y no tes st at i ng th at said notes are

secure d h e re by. At no tim e sha ll t he princi pal amount of the i ndebtedness secure d b y thi s

Mortgage, not i ncluding sums advanced i n accor dance herewith to protect the securi ty of

this Mortgage, ex ceed the origi nal a mount of the N ote plus US

$.................................................................................................

22. Release. Upon payment of all sums secured by this Mortgage, Lender shall

discharge this Mortga ge w ith out cost to Borrower. Borrowe r sha ll pay all costs of

recordation, if an y.

IN WITNESS WHEREOF, Borrower has executed this Mortgage under seal.

.....................................................

-Borrower

.....................................................

-Borrower

COMMONWEALTH OF MASSACHUSETTS, .................................County ss:

On this ....... ... .... ...... day of ...................., 19......, before me personally appeared

......................................................................................, and

acknowledged the foregoing to be .................... free act and deed.