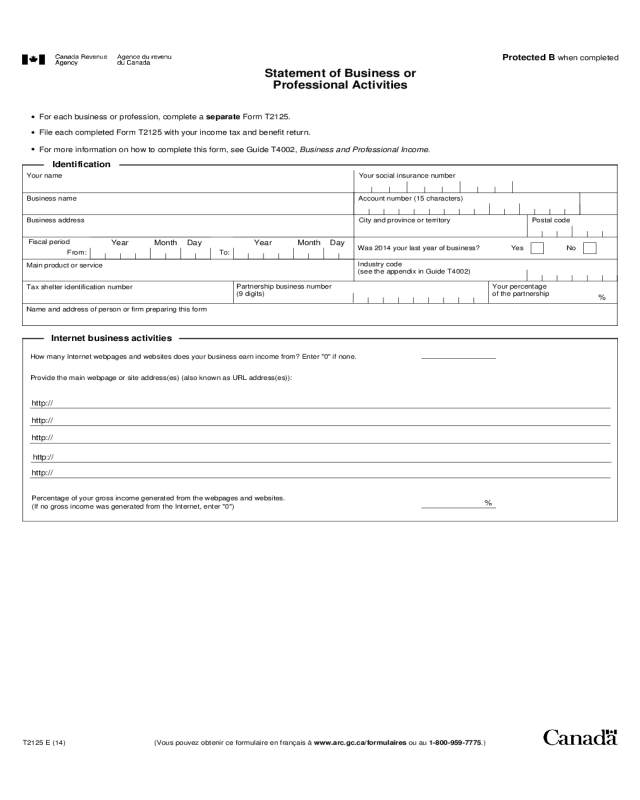

Fillable Printable Business or Professional Activities Statement

Fillable Printable Business or Professional Activities Statement

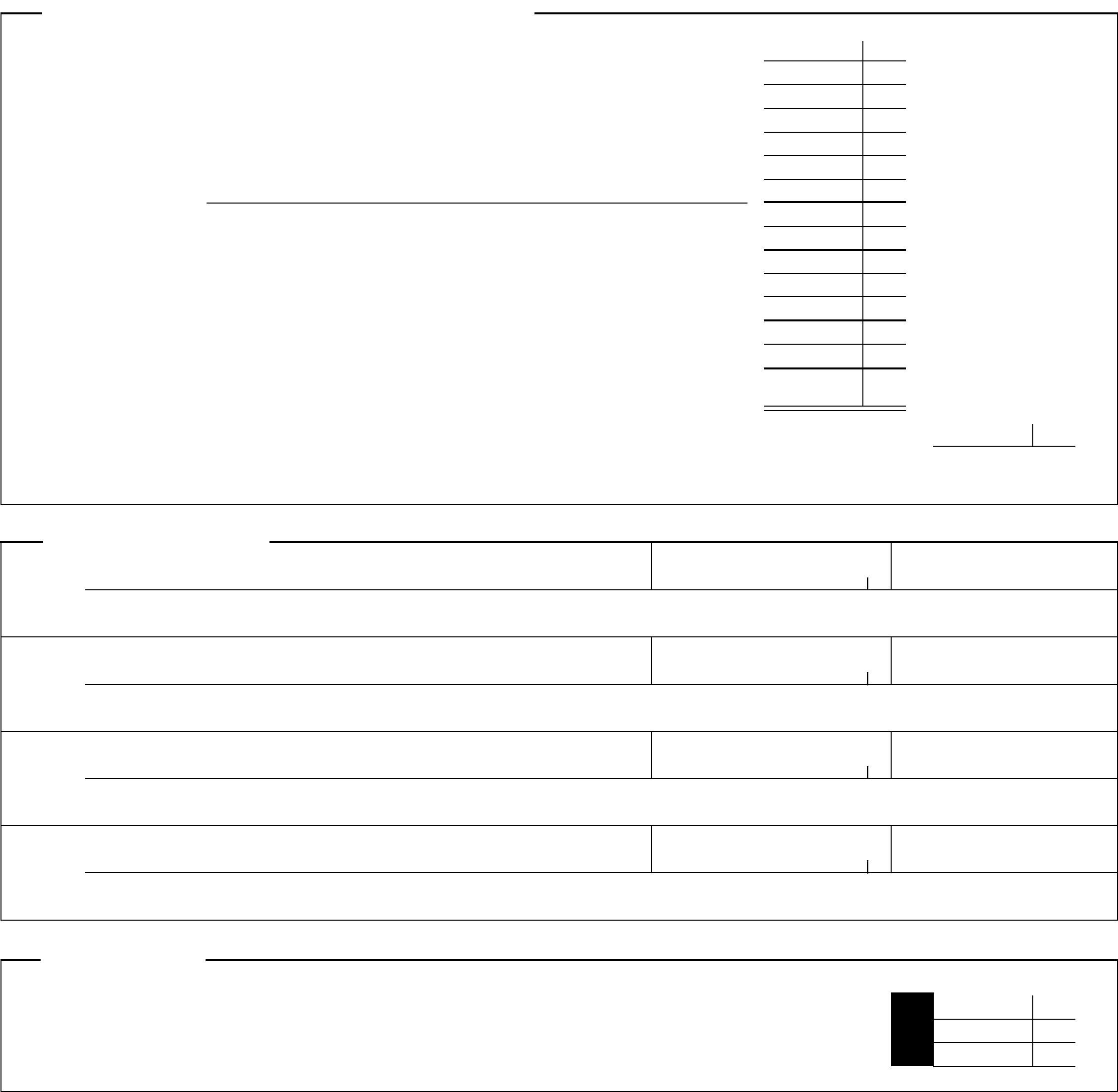

Business or Professional Activities Statement

Protected B when completed

Statement of Business or

Professional Activities

•

For each business or profession, complete a separate Form T2125.

•

File each completed Form T2125 with your income tax and benefit return.

•

For more information on how to complete this form, see Guide T4002, Business and Professional Income.

Your name

Your social insurance number

Business name

Account number (15 characters)

Business address

City and province or territory Postal code

Fiscal period

From:

Year Month Day

To:

Year Month Day

Was 2014 your last year of business?

Yes No

Main product or service

Industry code

(see the appendix in Guide T4002)

Tax shelter identification number

Partnership business number

(9 digits)

Your percentage

of the partnership

%

Name and address of person or firm preparing this form

Identification

How many Internet webpages and websites does your business earn income from? Enter "0" if none.

Provide the main webpage or site address(es) (also known as URL address(es)):

http://

http://

http://

http://

http://

Percentage of your gross income generated from the webpages and websites.

(If no gross income was generated from the Internet, enter "0")

%

Internet business activities

T2125 E (14) (Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca/formulaires ou au 1-800-959-7775.)

Protected B when completed

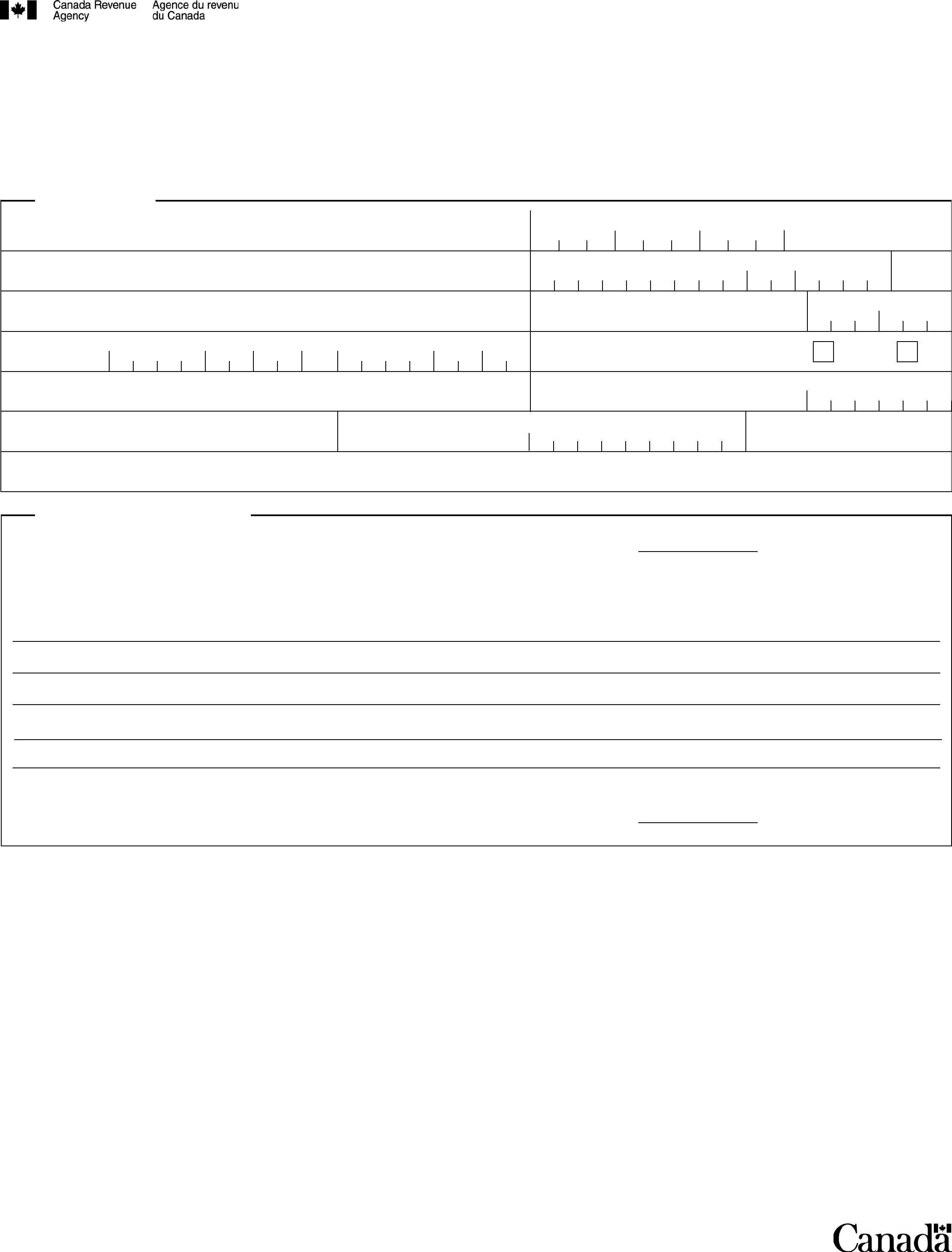

If you have business income, tick this box and complete this part. Do not complete parts 1 and 2 on the same form.

A

Gross sales, commissions, or fees (including GST/HST collected or collectible) ....................................

(i)

Minus

any

GST/HST, provincial sales tax, returns, allowances, discounts, and GST/HST adjustments (included on line A above)

B

Subtotal (amount A minus amount (i))

(ii)

For those using the quick method – Government assistance calculated as follows:

GST/HST collected or collectible on sales, commissions and fees eligible for the quick method ......

(iii)

GST/HST remitted, calculated on (sales, commissions, and fees eligible for the quick method

plus GST/HST collected or collectible) multiplied by the applicable quick method remittance rate ....

(iv)

Subtotal (amount (ii) minus amount (iii))

C

Adjusted gross sales (amount B plus amount (iv)) – Enter this amount on line 8000 in Part 3 below ....................

Part 1 – Business income

If you have professional income, tick this box and complete this part. Do not complete parts 1 and 2 on the same form.

D

Gross professional fees including work-in-progress (WIP) (including GST/HST collected or collectible) ....................

(i)

Minus any GST/HST, provincial sales tax, returns, allowances, discounts, and GST/HST adjustments (included on line D above)

and any WIP at the end of the year you elected to exclude (see Chapter 2 of Guide T4002) ...........................

E

Subtotal (amount D minus amount (i))

(ii)

For those using the quick method – Government assistance calculated as follows:

GST/HST collected or collectible on professional fees eligible for the quick method ..............

(iii)

GST/HST remitted, calculated on (professional fees eligible for the quick method plus

GST/HST collected or collectible) multiplied by the applicable quick method remittance rate ........

(iv)

Subtotal (amount (ii) minus amount (iii))

(v)

Work-in-progress (WIP), start of the year, per election to exclude WIP (see Chapter 2 of Guide T4002) ................

F

Adjusted professional fees (Amount E plus amounts (iv) and (v)) – Enter this amount on line 8000 in Part 3 below .........

Part 2 – Professional income

8000

G

Adjusted gross sales (from amount C in Part 1) or adjusted professional fees (from amount F in Part 2) ...............

Plus

8290

Reserves deducted last year ..............................................

8230

Other income .........................................................

H

Total of the above two lines

Ż

8299

Gross business or professional income (amount G plus amount H) .....................................

Enter this amount on the appropriate line of your income tax and benefit return: business on line 162, professional on line 164, or commission on line 166.

Part 3 – Gross business or professional income

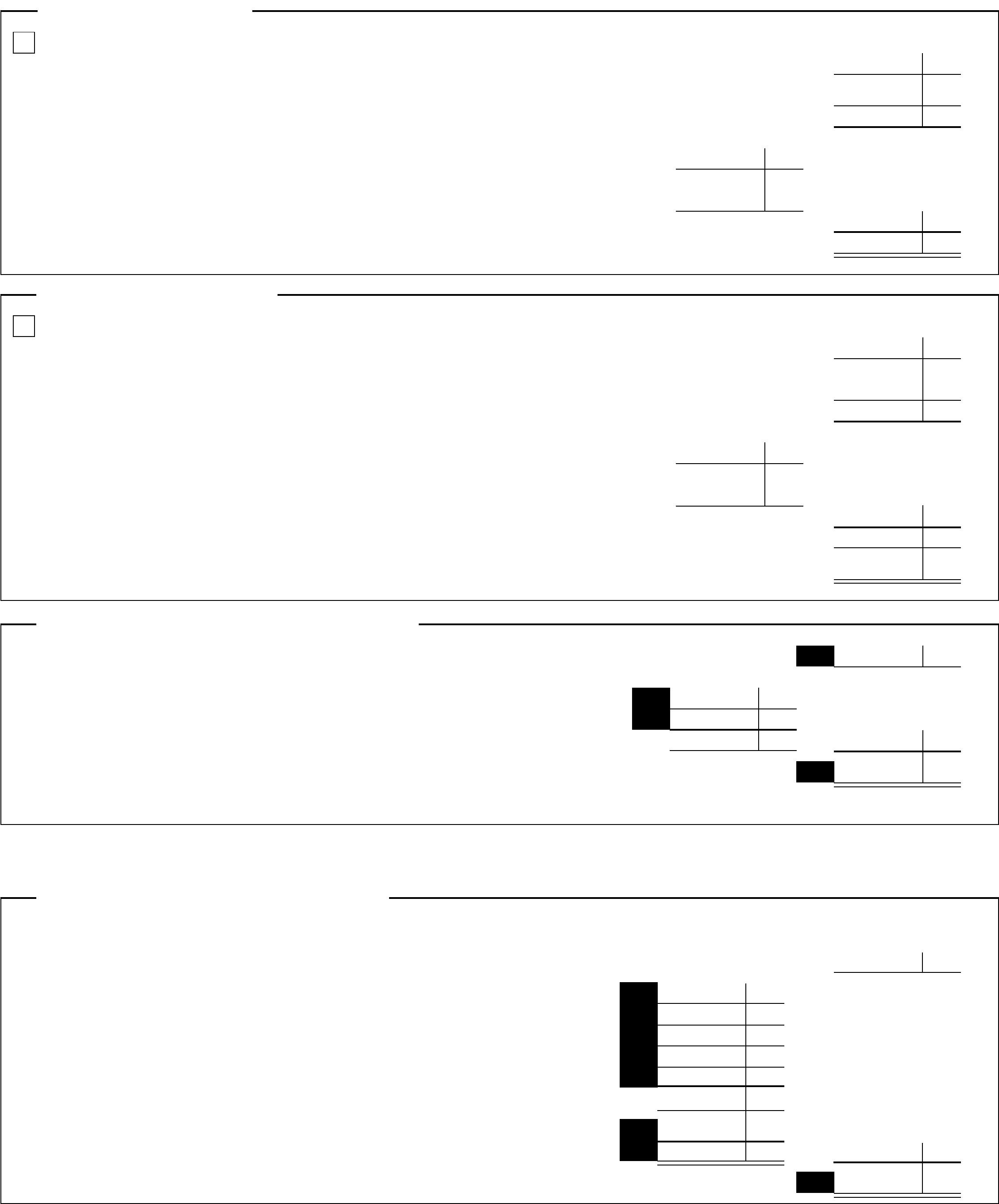

If GST/HST has been remitted or an input tax credit has been claimed, do not include GST/HST when you calculate the cost of goods sold, expenses, or net

income (loss) in parts 4 to 6.

If you have business income, complete this part. Enter only the business part of the costs.

I

Gross business income from line 8299 in Part 3 above .....................................................

Opening inventory (include raw materials, goods in process, and finished goods) ...........

8300

8320

Purchases during the year (net of returns, allowances, and discounts)...................

8340

Direct wage costs .......................................................

8360

Subcontracts ..........................................................

8450

Other costs ...........................................................

Total of the above five lines

Minus

8500

Closing inventory (include raw materials, goods in process, and finished goods) ...........

8518

Cost of goods sold

Ż

J

Gross profit (amount I minus amount J) ..........................................................

8519

Part 4 – Cost of goods sold and gross profit

Page 2 of 6

Protected B when completed

K

Gross profit from line 8519 in Part 4 on page 2, or gross income from line 8299 in Part 3 on page 2 ......................

Expenses (enter only the business part)

8521

Advertising ...........................................................

8523

Meals and entertainment (allowable part only) ...................................

8590

Bad debts ............................................................

8690

Insurance.............................................................

8710

Interest ..............................................................

8760

Business tax, fees, licences, dues, memberships, and subscriptions ....................

8810

Office expenses ........................................................

8811

Supplies..............................................................

8860

Legal, accounting, and other professional fees ...................................

8871

Management and administration fees .........................................

8910

Rent ................................................................

8960

Maintenance and repairs ..................................................

9060

Salaries, wages, and benefits (including employer's contributions) .....................

9180

Property taxes .........................................................

9200

Travel (including transportation fees, accommodations, and allowable part of meals) ........

9220

Telephone and utilities....................................................

9224

Fuel costs (except for motor vehicles) .........................................

9275

Delivery, freight, and express ...............................................

9281

Motor vehicle expenses (not including CCA) (see Chart A on page 6) ...................

9935

Allowance on eligible capital property .........................................

9936

Capital cost allowance (CCA) (from Area A on page 5) .............................

9270

Other expenses (specify):

9368

L

Total business expenses (total of lines 8521 to 9270)

Ż

9369

Net income (loss) before adjustments (amount K minus amount L) ......................................

Part 5 – Net income (loss) before adjustments

M

Your share of the amount on line 9369 in Part 5 or the amount from your T5013 slip ........

9974

N

Plus: GST/HST rebate for partners received in the year (see Chapter 3 of Guide T4002) .....

O

Total (amount M plus amount N)

Ż

9943

P

Minus: Other amounts deductible from your share of the net partnership income (loss) (from the chart in Part 7 below) . . .

Q

Net income (loss) after adjustments (amount O minus amount P)........................................

9945

R

Minus: Business-use-of-home expenses (your share of amount 3 in part 8)...................................

9946

Your net income (loss) (amount Q minus amount R) .................................................

Enter this amount on the appropriate line of your income tax and benefit return: business on line 135, professional on line 137, or commission on line 139.

Part 6 – Your net income (loss)

Claim expenses you incurred that were not included in the partnership statement of income and expenses, and for which the

partnership did not reimburse you.

Other amounts deductible from your share of the partnership (total of the above amounts)

Enter this amount on line 9943, in Part 6 above

Part 7 – Other amounts deductible from your share of the net partnership income (loss)

Page 3 of 6

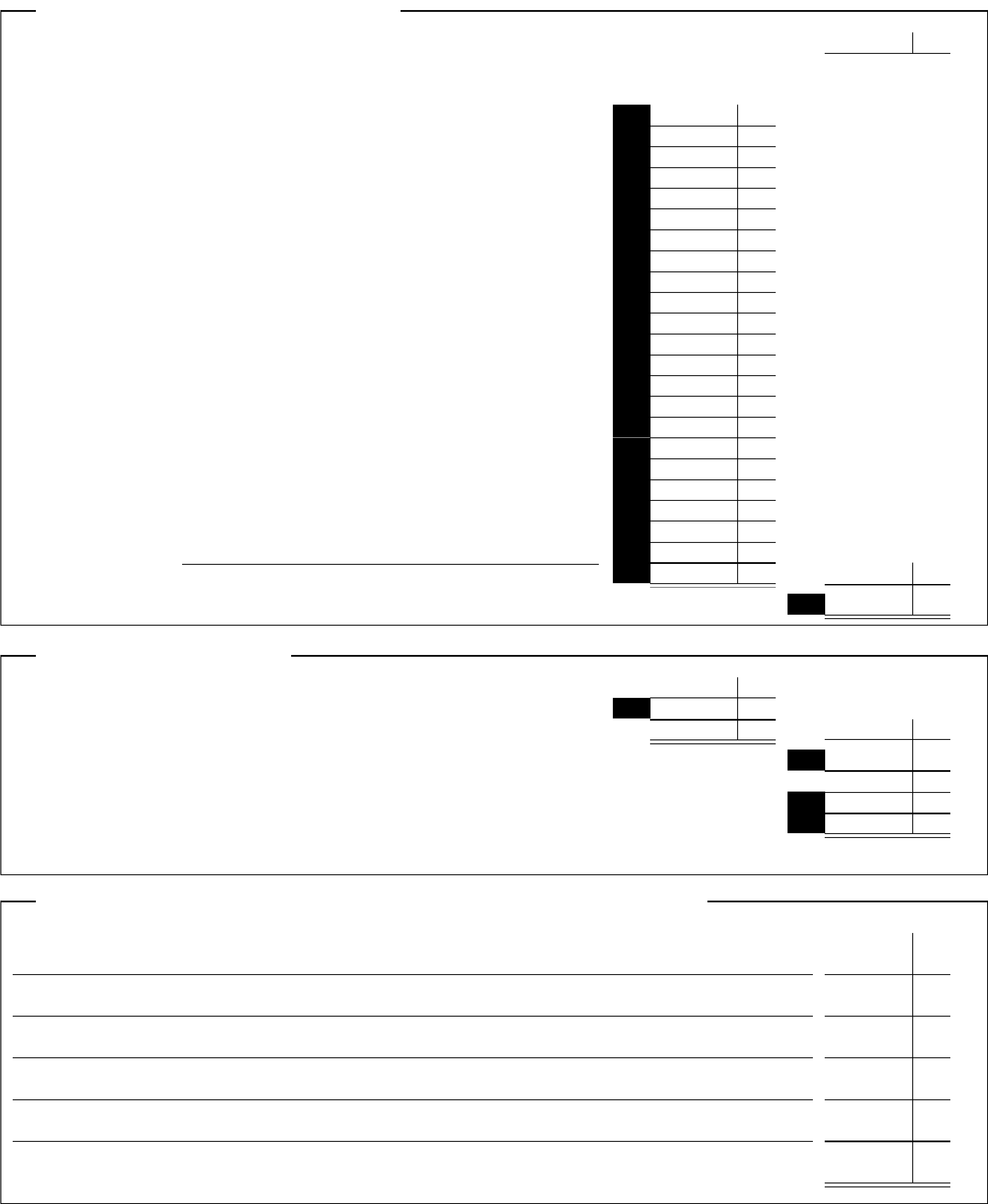

Protected B when completed

Heat .......................................................................

Electricity ....................................................................

Insurance ...................................................................

Maintenance .................................................................

Mortgage interest ..............................................................

Property taxes ................................................................

Other expenses (specify):

Subtotal

Minus: Personal-use part ........................................................

Subtotal

Plus: Capital cost allowance (business part only) ........................................

Amount carried forward from previous year ........................................

Subtotal

1

Minus: Net income (loss) after adjustments (from amount Q in Part 6 on page 3 – if negative, enter "0") .

2

Business-use-of-home expenses available to carry forward (amount 1 minus amount 2

– if negative, enter "0") ..........................................................

Allowable claim (the lesser of amounts 1 and 2 – Enter your share of this amount on line 9945 in Part 6) .................

3

Part 8 – Calculation of business-use-of-home expenses

Details of other partners

Name

and

address

Share of net

income or (loss)

$

Percentage of

partnership

%

Name

and

address

Share of net

income or (loss)

$

Percentage of

partnership

%

Name

and

address

Share of net

income or (loss)

$

Percentage of

partnership

%

Name

and

address

Share of net

income or (loss)

$

Percentage of

partnership

%

9931

Total business liabilities ......................................................................

9932

Drawings in 2014 ...........................................................................

9933

Capital contributions in 2014 ...................................................................

Details of equity

Page 4 of 6

Protected B when completed

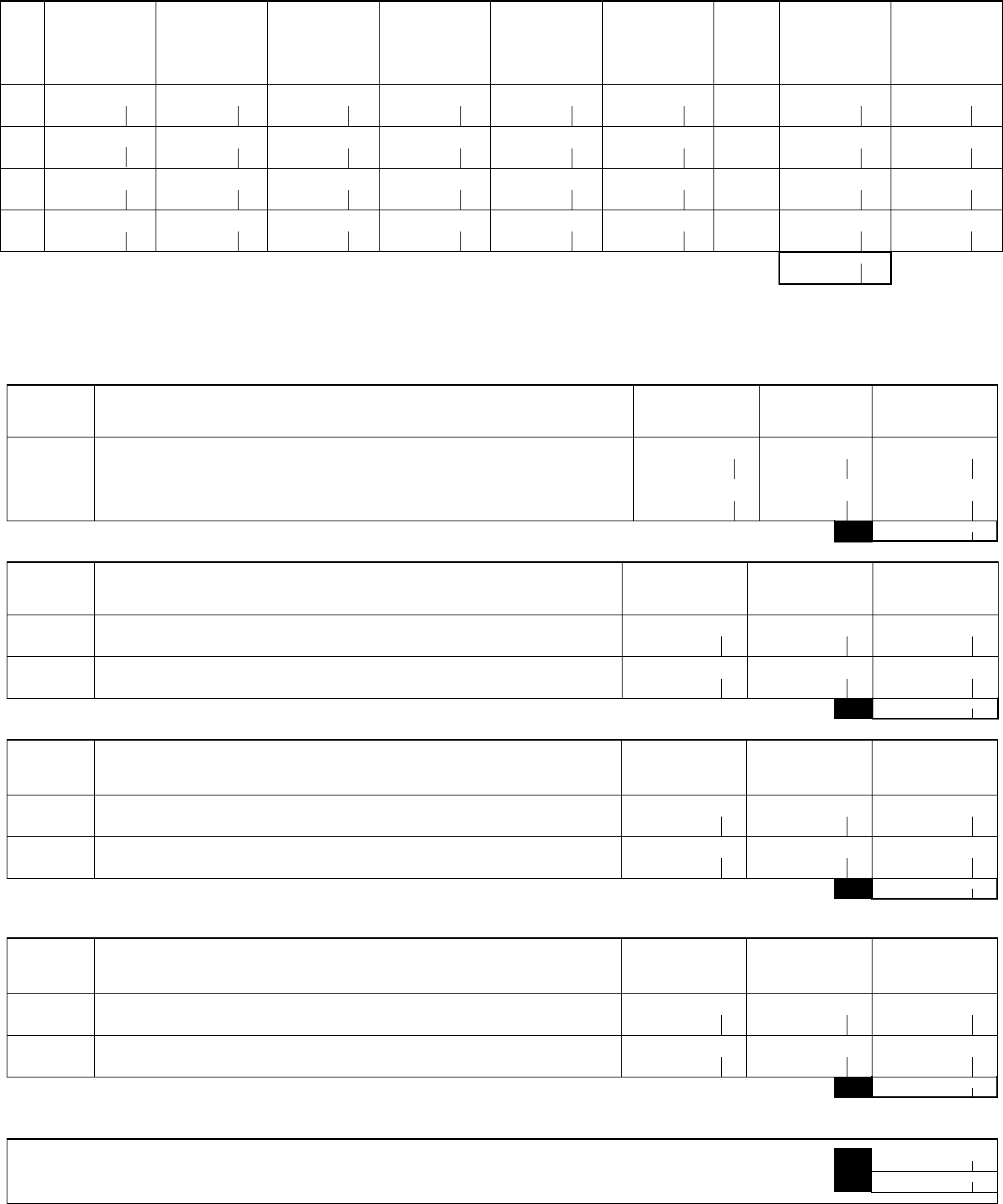

Area A – Calculation of capital cost allowance (CCA) claim

1

Class

number

2

Undepreciated

capital cost (UCC)

at the start of the year

3

Cost of additions

in the year

(see areas B and C

below)

4

Proceeds of

dispositions

in the year (see

areas D and E below)

5*

UCC after additions

and dispositions

(col. 2 plus col. 3

minus col. 4)

6

Adjustment for

current-year additions

1/2 x (col. 3 minus

col. 4). If negative,

enter "0."

7

Base amount

for CCA

(col. 5 minus col. 6)

8

Rate

(%)

9

CCA for the year

(col. 7 x col. 8 or an

adjusted amount)

10

UCC at the end of the

year

(col. 5 minus col. 9)

Total CCA claim for the year (enter this amount, minus any personal part and any

CCA for business-use-of-home expenses, on line 9936 in Part 5 on page 3**)

* If you have a negative amount in this column, add it to income as a recapture on line 8230, "Other income," in Part 3 on page 2. If no property is left in the class and there is a

positive amount in the column, deduct the amount from income as a terminal loss on line 9270, "Other expenses," in Part 5 on page 3. Recapture and terminal loss do not apply to

a class 10.1 property. For more information, see Chapter 4 of Guide T4002.

** For information on CCA for "Calculation of business-use-of-home expenses" on page 4, see "Special situations" in Chapter 4 of Guide T4002.

Area B – Details of equipment additions in the year

1

Class

number

2

Property

details

3

Total cost

4

Personal part

(if applicable)

5

Business part

(column 3 minus

column 4)

9925

Total equipment additions in the year

Area C – Details of building additions in the year

1

Class

number

2

Property

details

3

Total cost

4

Personal part

(if applicable)

5

Business part

(column 3 minus

column 4)

9927

Total building additions in the year

Area D – Details of equipment dispositions in the year

1

Class

number

2

Property

details

3

Proceeds of disposition

(should not be more than

the capital cost)

4

Personal part

(if applicable)

5

Business part

(column 3 minus

column 4)

Note: If you disposed of property from your business in the year, see Chapter 4 of Guide T4002,

for information about your proceeds of disposition.

Total equipment dispositions in the year

9926

Area E – Details of building dispositions in the year

1

Class

number

2

Property

details

3

Proceeds of disposition

(should not be more than

the capital cost)

4

Personal part

(if applicable)

5

Business part

(column 3 minus

column 4)

9928

Total building dispositions in the year

Note: If you disposed of a building from your business in the year, see Chapter 4 of Guide T4002,

for information about your proceeds of disposition.

Area F – Details of land additions and dispositions in the year

9923

Total cost of all land additions in the year ..............................................................

9924

Total proceeds from all land dispositions in the year .......................................................

Note: You cannot claim capital cost allowance on land.

Page 5 of 6

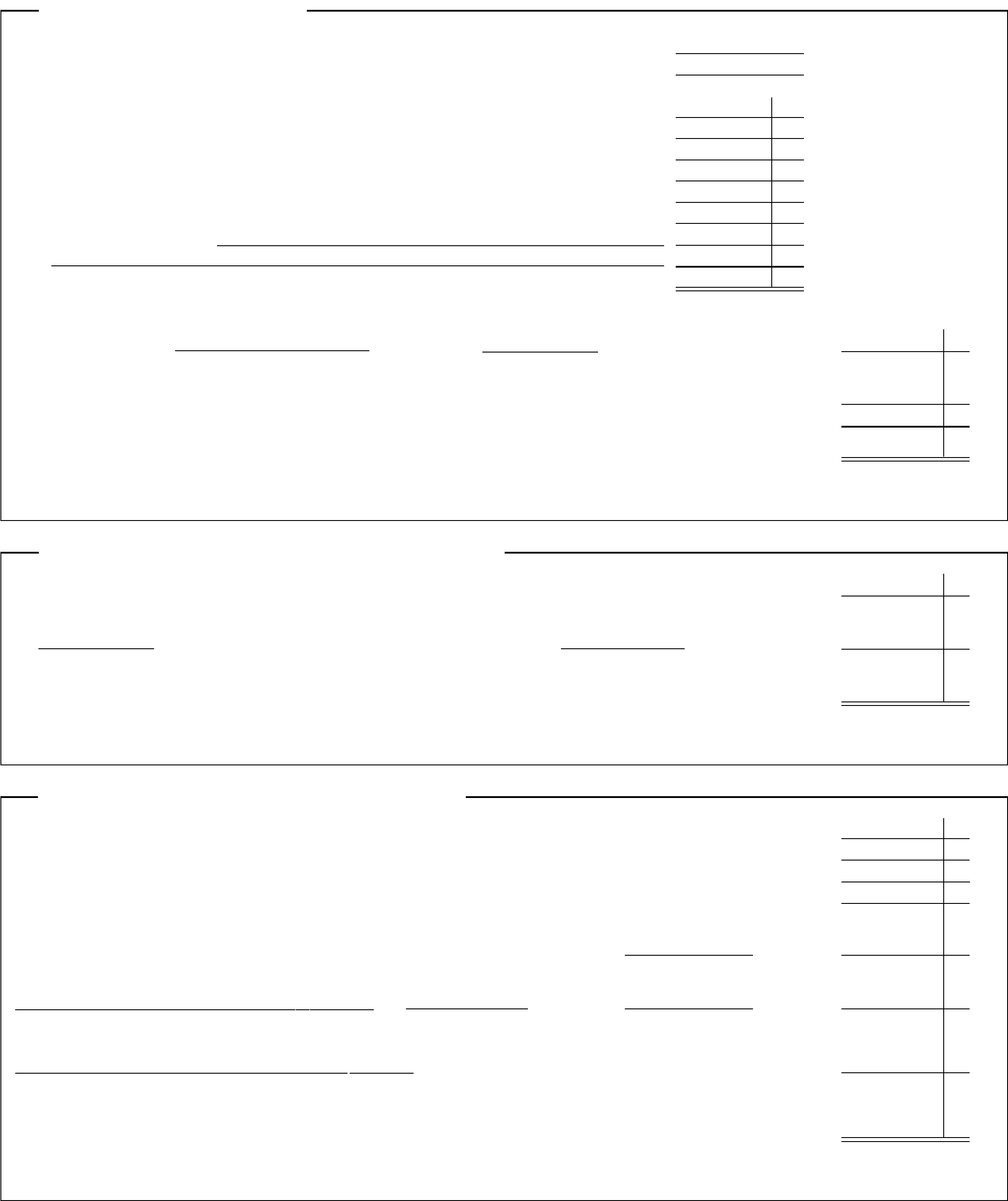

Protected B when completed

1

Kilometres you drove in the fiscal period to earn business income .........................

2

Total kilometres you drove in the fiscal period .......................................

3

Fuel and oil ............................................................

4

Interest (see Chart B below).................................................

5

Insurance .............................................................

6

Licence and registration ...................................................

7

Maintenance and repairs ...................................................

8

Leasing (see Chart C below) ................................................

9

Other expenses (specify):

10

11

Total motor vehicle expenses (total of amounts 3 to 10)

12

Business use part:

(

amount 1:

amount 2:

)

×

amount 11:

........................

=

13

Business parking fees .........................................................................

14

Supplementary business insurance ................................................................

Allowable motor vehicle expenses (add amounts 12, 13, and 14) – Enter this amount on line 9281 in Part 5 on page 3 ......

Note: You can claim CCA on motor vehicles in Area A on page 5.

Chart A – Motor vehicle expenses

A

Total interest payable (accrual method) or paid (cash method) in the fiscal period ..................................

B

$10*

×

the number of days in the fiscal period for which interest

was payable (accrual method) or paid (cash method)

.............

=

Available interest expense (amount A or B, whichever is less) – Enter this amount on amount 4 of Chart A above ..........

* For passenger vehicles bought after 2000.

Chart B – Available interest expense for passenger vehicles

1

Total lease charges incurred in your 2014 fiscal period for the vehicle ..........................................

2

Total lease payments deducted before your 2014 fiscal period for the vehicle .....................................

3

Total number of days the vehicle was leased in your 2014 and previous fiscal periods ...............................

4

Manufacturer's list price ..........................................................................

5

Amount 4 or ($35,294

+

GST** and PST, or HST** on $35,294),

whichever is more

Ż

×

85%

=

6

[($800

+

GST** and PST, or HST** on $800)

×

amount 3]

30

Ż

–

amount 2:

......

=

7

[($30,000

+

GST** and PST, or HST** on $30,000)

×

amount 1]

amount 5

...........................................

=

Eligible leasing cost (amount 6 or amount 7, whichever is less) – Enter this amount on amount 8 of Chart A above ..........

** Use a GST rate of 5% or the HST rate applicable to your province.

Chart C – Eligible leasing costs for passenger vehicles

See the privacy notice on your return

Page 6 of 6