Fillable Printable Car Insurance Application Form - Ontario

Fillable Printable Car Insurance Application Form - Ontario

Car Insurance Application Form - Ontario

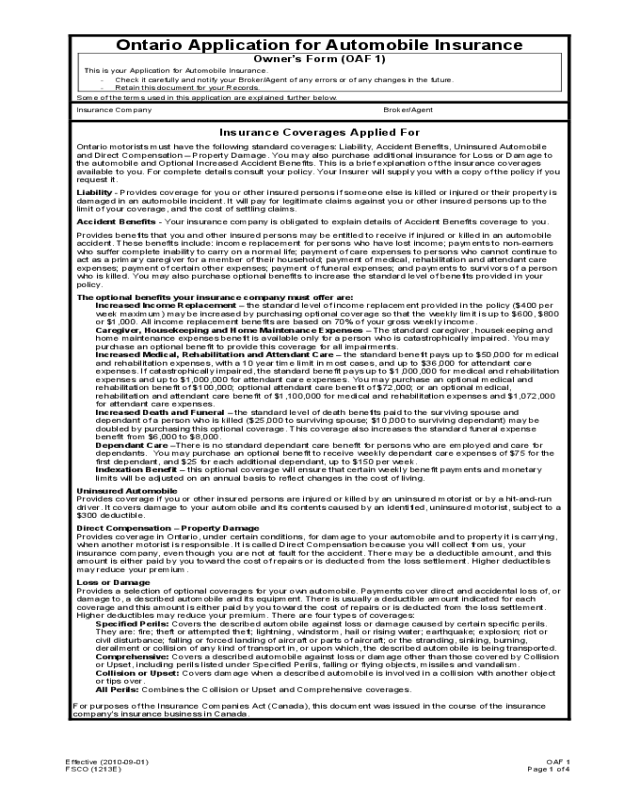

Ontario Application for Automobile Insurance

Owner’s Form (OAF 1)

This is your Application for Automobile Insurance.

- Check it carefully and notify your Broker/Agent of any errors or of any changes in the future.

- Retain this document for your Records.

Some of the terms used in this application are explained further below.

Insurance Company Broker/Agent

Insurance Coverages Applied For

Ontario motorists must have the following standard coverages: Liability, Accident Benefits, Uninsured Automobile

and Direct Compensation – Property Damage. You may also purchase additional insurance for Loss or Damage to

the automobile and Optional Increased Accident Benefits. This is a brief explanation of the insurance coverages

available to you. For complete details consult your policy. Your Insurer will supply you with a copy of the policy if you

request it.

Liability - Provides coverage for you or other insured persons if someone else is killed or injured or their property is

damaged in an automobile incident. It will pay for legitimate claims against you or other insured persons up to the

limit of your coverage, and the cost of settling claims.

Accident Benefits - Your insurance company is obligated to explain details of Accident Benefits coverage to you.

Provides benefits that you and other insured persons may be entitled to receive if injured or killed in an automobile

accident. These benefits include: income replacement for persons who have lost income; payments to non-earners

who suffer complete inability to carry on a normal life; payment of care expenses to persons who cannot continue to

act as a primary caregiver for a member of their household; payment of medical, rehabilitation and attendant care

expenses; payment of certain other expenses; payment of funeral expenses; and payments to survivors of a person

who is killed. You may also purchase optional benefits to increase the standard level of benefits provided in your

policy.

The optional benefits your insurance company must offer are:

Increased Income Replacement – the standard level of income replacement provided in the policy ($400 per

week maximum) may be increased by purchasing optional coverage so that the weekly limit is up to $600, $800

or $1,000. All income replacement benefits are based on 70% of your gross weekly income.

Caregiver, Housekeeping and Home Maintenance Expenses – The standard caregiver, housekeeping and

home maintenance expenses benefit is available only for a person who is catastrophically impaired. You may

purchase an optional benefit to provide this coverage for all impairments.

Increased Medical, Rehabilitation and Attendant Care – the standard benefit pays up to $50,000 for medical

and rehabilitation expenses, with a 10 year time limit in most cases, and up to $36,000 for attendant care

expenses. If catastrophically impaired, the standard benefit pays up to $1,000,000 for medical and rehabilitation

expenses and up to $1,000,000 for attendant care expenses. You may purchase an optional medical and

rehabilitation benefit of $100,000; optional attendant care benefit of $72,000; or an optional medical,

rehabilitation and attendant care benefit of $1,100,000 for medical and rehabilitation expenses and $1,072,000

for attendant care expenses.

Increased Death and Funeral – the standard level of death benefits paid to the surviving spouse and

dependant of a person who is killed ($25,000 to surviving spouse; $10,000 to surviving dependant) may be

doubled by purchasing this optional coverage. This coverage also increases the standard funeral expense

benefit from $6,000 to $8,000.

Dependant Care –There is no standard dependant care benefit for persons who are employed and care for

dependants. You may purchase an optional benefit to receive weekly dependant care expenses of $75 for the

first dependant, and $25 for each additional dependant, up to $150 per week.

Indexation Benefit – this optional coverage will ensure that certain weekly benefit payments and monetary

limits will be adjusted on an annual basis to reflect changes in the cost of living.

Uninsured Automobile

Provides coverage if you or other insured persons are injured or killed by an uninsured motorist or by a hit-and-run

driver. It covers damage to your automobile and its contents caused by an identified, uninsured motorist, subject to a

$300 deductible.

Direct Compensation – Property Damage

Provides coverage in Ontario, under certain conditions, for damage to your automobile and to property it is carrying,

when another motorist is responsible. It is called Direct Compensation because you will collect from us, your

insurance company, even though you are not at fault for the accident. There may be a deductible amount, and this

amount is either paid by you toward the cost of repairs or is deducted from the loss settlement. Higher deductibles

may reduce your premium.

Loss or Damage

Provides a selection of optional coverages for your own automobile. Payments cover direct and accidental loss of, or

damage to, a described automobile and its equipment. There is usually a deductible amount indicated for each

coverage and this amount is either paid by you toward the cost of repairs or is deducted from the loss settlement.

Higher deductibles may reduce your premium. There are four types of coverages:

Specified Perils: Covers the described automobile against loss or damage caused by certain specific perils.

They are: fire; theft or attempted theft; lightning, windstorm, hail or rising water; earthquake; explosion; riot or

civil disturbance; falling or forced landing of aircraft or parts of aircraft; or the stranding, sinking, burning,

derailment or collision of any kind of transport in, or upon which, the described automobile is being transported.

Comprehensive: Covers a described automobile against loss or damage other than those covered by Collision

or Upset, including perils listed under Specified Perils, falling or flying objects, missiles and vandalism.

Collision or Upset: Covers damage when a described automobile is involved in a collision with another object

or tips over.

All Perils: Combines the Collision or Upset and Comprehensive coverages.

For purposes of the Insurance Companies Act (Canada), this document was issued in the course of the insurance

ompany’s insurance business in Canada. c

Effective (2010-09-01) OAF 1

FSCO (1213E) Page 1 of 4

Save

Effective (2010-09-01)

FSCO (1213E)

OAF 1

Page 2 of 4

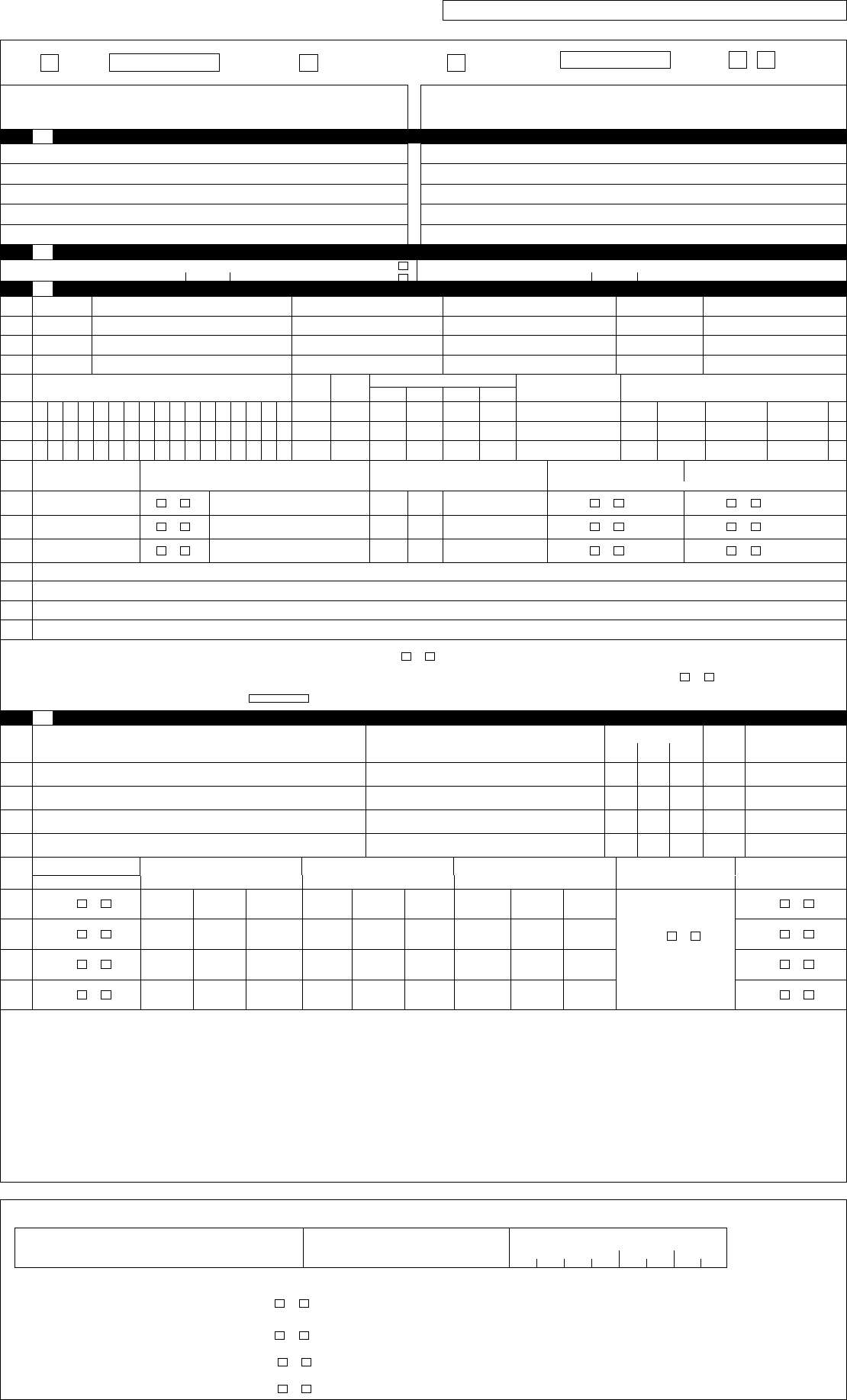

Ontario Application for Automobile Insurance

Owner's Form (OAF 1)

Policy No. Assigned

New policy Replacing Policy No. Company bill Broker/Agent bill

Other (specify) Language

English

Preferred

French

Insurance Company (Insurer) Broker/Agent

Broker Code:

1 Applicant's Name & Postal Address Lessor (if applicable)

Name and Address Name and Address

Postal Code Postal Code

Phone No. Home ( ) Work ( ) Phone No. ( ) Fax ( )

2 Policy Period (all times are local times at the applicant's address shown above)

Effective Date: Year Month Day Time:

a.m.

Expiry Date: Year Month Day Time::

p

.m.

at 12:01 a.m.

3 Described Automobile Each automobile will be used primarily in the vicinity of the applicant s address, unless otherwise stated in Remarks.

Auto

No.

Model

Year

Make or Trade Name Model Body Type

No. of Cylinders

or Engine Size

Gross Vehicle Weight Rating

[ ] Lbs [ ] Kg

1.

2.

3.

Auto

No

Vehicle Identification No. (Serial No.) Owned? Leased?

Purchased/Leased

Purchase Price

(including options & taxes)

Automobile Use (*Give details in Remarks section)

Year Month New? Used?

Pleasure

Commute

One - Way Business* Farm

Comm

ercial*

1.

km

2.

km

3.

km

Auto

No.

Estimated Annual

Driving Distance

Is any automobile used for car pooling?

If Yes, give no. of Passengers and Details

Type of Fuel Used

Unrepaired Damage?

Modified/Customized

(See Note 1)

Gas Diesel

If other, give details:

(If Yes, give details in Remarks section)

1.

km Yes No

Yes No Yes No

2.

km Yes No

Yes No Yes No

3.

km Yes No

Yes No Yes No

Auto

No.

Lienholder Name & Postal Address

1.

2.

3.

■ Is the applicant both the Registered Owner and the Actual Owner of the described automobile(s)? Yes No If No, give details in Remarks section.

■ Will any of the described automobiles be rented or leased to others, or used to carry passengers for compensation or hire, or haul a trailer, or carry explosives or radioactive material? Yes No

■ Total number of automobiles in the household or business.

4 Driver Information – List all drivers of the described automobile(s) in the household or business.

Driver

No.

Name as shown on Driver's Licence Driver's Licence Number

Date of Birth

Sex Marital Status

Year Month Day

1.

2.

3.

4.

Driver

No.

Driver Training Certificate

Attached?

Date First Licensed in Canada or U.S.

(Class G or equivalent)

Other class of licence, if any Percentage Use by Each Driver

Are any other persons in the

household or business

licensed to drive?

Do any drivers qualify for

Retiree Discount?

(See Note 2)

Class Year Month Class Year Month Auto. 1 Auto. 2 Auto. 3

1.

Yes No

Yes No

If yes, provide complete

details in the Remarks

section.

Yes No

2.

Yes No

Yes No

3.

Yes No

Yes No

4.

Yes No

Yes No

Special Notes:

Note 1: Modified/customized includes changes, other than repairs or restorations that affect the original manufacturer’s design specifications or increase

the value of the automobile. These may include, but are not limited to: engine modifications; paint changes; non-factory installed wheels, tires

and electronic accessories and equipment, etc. If you are insured for "Loss or Damage Coverage", there is a $1500 limit on non-factory installed

electronic accessories and equipment.

Note 2: Retiree Discount – You may be entitled to a discount if you are the principal operator of a described automobile, are retired, have not been

employed for 26 weeks or more in the last 52 weeks, do not earn or receive income from any office or employment, are not engaged in any

professional occupation and are not operating a business. To qualify, you must be at least age 65, or receiving a pension under the Canada

Pension Plan, the Quebec Pension Plan, or a pension registered under the Income Tax Act. If you qualify, your broker or agent will ask you to

sign a declaration to confirm this.

If a driver is licensed less than 6 years in Canada, driving experience in other countries may be recognized. Attach proof of other licensing and insurance.

What are the details of the applicant's most recent automobile insurance?

Insurance Company Policy No. Expiry Date

Year Month Da

y

To the applicant's knowledge...

■ Has any driver's licence, vehicle permit etc, issued to the applicant or to any person in the household or business been suspended or cancelled in the last 6 years?

Yes No If Yes, give details in Remarks section.

■ Has any insurance company cancelled automobile insurance for the applicant or any listed driver in the last 3 years?

Yes No If Yes, give details in Remarks section.

■ During the last 3 years, has any automobile insurance policy issued to the applicant or any listed driver been cancelled or has any claim been denied for material misrepresentation?

Yes No If Yes, give details in Remarks section.

■ Has the applicant or any listed driver been found by a court to have committed a fraud connected with automobile insurance?

Yes No If Yes, give details in Remarks section.

Save

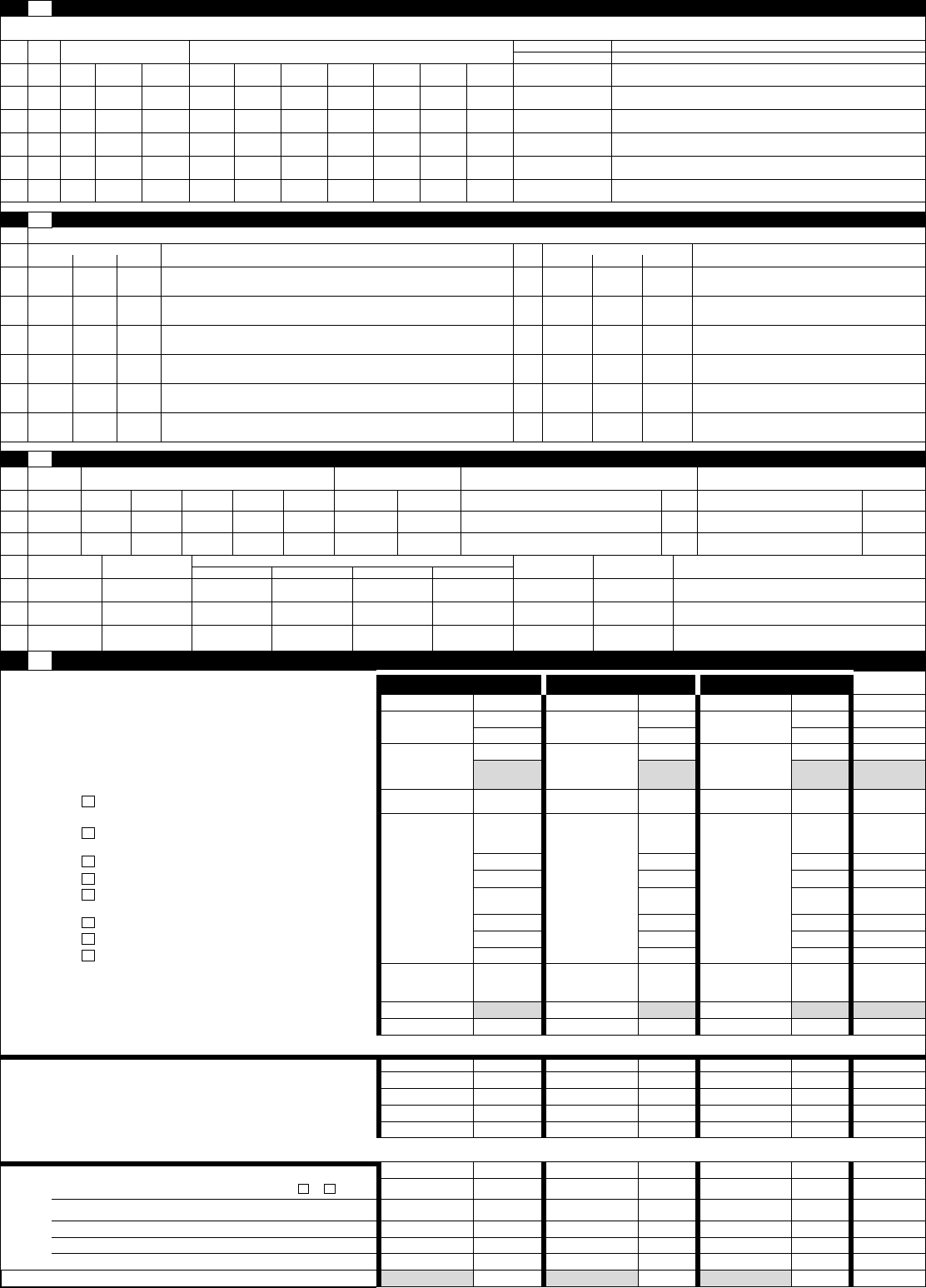

5 Previous Accidents and Insurance Claims

Give details of all accidents or claims arising from the ownership, use or operation of any automobile by the applicant or any listed driver during the last 6 years. The coverages are: BI - Bodily Injury, PD -

Property Damage, AB - Accident Benefits, DCPD - Direct Compensation - Property Damage, UA - Uninsured Automobile, Coll- Collision, AP - All Perils, Comp - Comprehensive, SP - Specified Perils

Driver

No.

Auto

No

Date

Coverage Claim Paid Under

Amount Paid or Estimate Details (Use Remarks section if necessary)

Year Month Day BI PD AB DCPD UA Coll/AP Comp/SP

6 History of Convictions

Give details of all convictions of the applicant and any listed driver arising from the operation of any automobile in the last 3 years.

Driver

No.

Date Convicted

Details (Use Remarks section if necessary)

Driver

No

Date Convicted

Details (Use Remarks section if necessary)

Year Month Day Year Month Day

7 Rating Information – AGENT/BROKER AND COMPANY USE ONLY

Auto

No.

Class

Driving Record

Driver No. At-Fault Claim Surcharges Conviction Surcharges

BI PD AB DCPD

Coll/AP

Princ. Sec. Description % Description %

1.

2.

3.

Auto

No.

List Price New Vehicle Code

Rate Group

Location Territory

Discounts

Description and Percentage

AB

DCPD

Coll/AP Comp/SP

1.

2.

3.

8 Insurance Coverages Applied For – Read Page 1 of this form before completing this section.

Automobile 1 Automobile 2 Automobile 3

Occasional

Driver Premium

Liability Limit (000s) Premium Limit (000s) Premium Limit (000s) Premium

Bodily Injury

Property Damage

Accident Benefits (Standard Benefits)

Optional Increased Accident Benefits

( √ ) Coverage Required

Income Replacement ($600/$800/$1,000)

(up to $

per week)

(up to $

per week)

(up to $

per week)

Caregiver, Housekeeping & Home Maintenance

As stated in Section

4 of Policy

As stated in

Section 4 of Policy

As stated in

Section 4 of Policy

Medical and Rehabilitation ($100,000)

Attendant Care ($72,000)

Medical, Rehabilitation ($1,100,000) &

Attendant Care ($1,072,000)

Death & Funeral

Dependant Care

Indexation Benefit (Consumer Price Index)

Uninsured Automobile

As stated in

Section 5 of Policy

As stated in

Section 5 of Policy

As stated in

Section 5 of Policy

Direct Compensation-Property Damage

This policy contains a partial payment of recovery clause for property damage

if a deductible is specified for Direct Compensation-Property Damage.

Deductible Deductible Deductible

Loss or Damage* Deductible Premium Deductible Premium Deductible Premium Premium

Specified Perils (excluding Collision or Upset)

Comprehensive (excluding Collision or Upset)

Collision or Upset

All Perils

* This policy contains a partial payment of loss clause. A deductible applies for each claim except as stated in your policy.

Policy Change Forms (Name & No.) Deductible/Limit Premium Deductible/Limit Premium Deductible/Limit Premium Premium

Family Protection Coverage -OPCF 44R Yes No

LIMIT SAME AS LIABILITY UNLESS

OTHERWISE NOTED

LIMIT SAME AS LIABILITY UNLESS

OTHERWISE NOTED

LIMIT SAME AS LIABILITY UNLESS

OTHERWISE NOTED

Total Premium Per Automobile

Effective (2010-09-01) OAF 1

FSCO (1213E) Page 3 of 4

Save

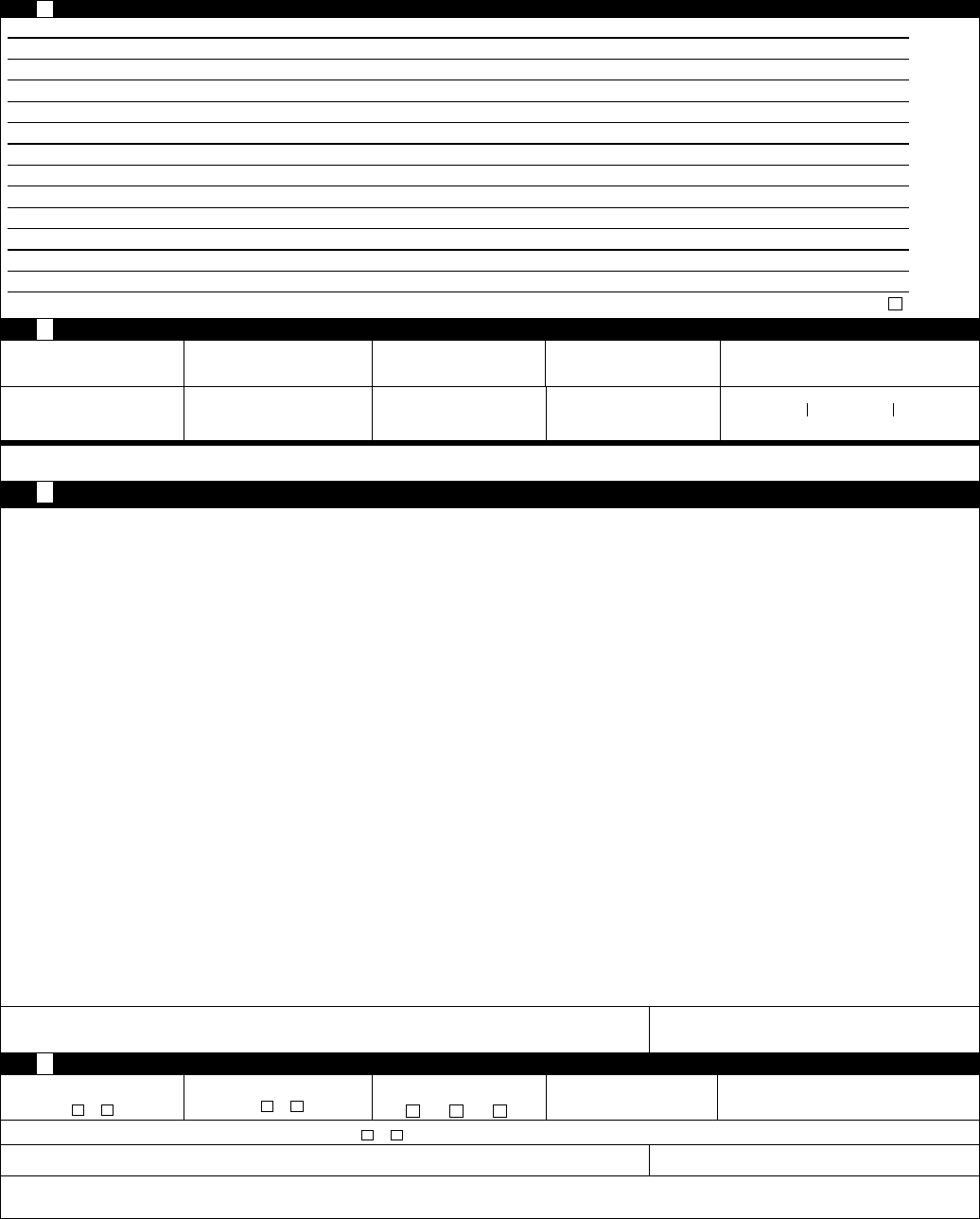

9 Remarks - Use this space if you have further details

Extra sheets attached.

10 Method of Payment

Type of Payment Plan Estimated Policy Premium** Provincial Sales Tax Interest Total Estimated Cost

Amt. Paid with Application Amount Still Due No. of Remaining Instalments Amount of Each Instalment Instalment Due Date

Y M D

** This policy premium is estimated and subject to adjustment or confirmation by the insurer. If we issue a policy and the applicant cancels it, there may be a minimum premium

shown on your Certificate of Automobile Insurance that will not be refunded.

11 Declaration of Applicant – Read this section carefully before you sign.

I understand that to qualify for a driver’s licence, drivers:

• must not suffer from any mental, emotional, nervous or physical disability that significantly interferes with the driver's ability to safely drive an automobile of the class they are licensed for;

• must not be addicted to alcohol or a drug to the extent that it significantly interferes with the driver's ability to safely drive an automobile; and

• must notify the Ministry of Transportation immediately if the driver becomes physically or mentally disabled to the extent that it might interfere with the driver's ability to safely drive an

automobile.

To the best of my knowledge,

• all listed drivers are qualified and hold a driver’s licence, and

• the details in Sections 1 to 6 and 9 are correct.

Inspection:

My Insurer may require my automobile to be inspected. If I do not co-operate with any reasonable arrangements to inspect my automobile, I understand my optional loss or damage

coverages under Section 7 may be cancelled, and any claims under that section may be denied.

Warning - The Insurance Act provides that where:

(a) an Applicant for a contract, (i) gives false particulars of the described automobile to be insured to the prejudice of the Insurer, or (ii) knowingly misrepresents or fails to

disclose in the application any fact required to be stated therein; or (b) the Insured contravenes a term of the contract or commits a fraud; or (c) the Insured wilfully makes a false

statement in respect of a claim under the contract, a claim by the Insured, for other than such statutory accident benefits as are set out in the Statutory Accident Benefits

Schedule, is invalid and the right of the Insured to recover indemnity is forfeited.

Warning – Offences

It is an offence under the Insurance Act to knowingly make a false or misleading statement or representation to an Insurer in connection with the person’s entitlement to a benefit

under contract of insurance, or to wilfully fail to inform the Insurer of a material change in circumstances within 14 days, in connection with such entitlement. The offence is

punishable on conviction by a maximum fine of $100,000 for the first offence and a maximum fine of $200,000 for any subsequent conviction.

It is an offence under the federal Criminal Code for anyone to knowingly make or use a false document with the intent it be acted on as genuine and the offence is punishable, on

conviction, by a maximum of 10 years imprisonment.

It is an offence under the federal Criminal Code for anyone, by deceit, falsehood or other dishonest act, to defraud or to attempt to defraud an insurance company. The offence is

punishable, on conviction, by a maximum of 10 years imprisonment for fraud involving an amount over $5,000 or otherwise a maximum of 2 years imprisonment.

Consent

I am applying for automobile insurance based on the information provided above. With respect to this application or any renewal or change in coverage, I authorize you to collect, use and

disclose my driving record, auto insurance history and auto claims history, and those of the listed drivers from whom I declare I have obtained consent for these purposes, as permitted by law

for the limited purposes necessary to assess the risk, investigate and settle claims, and detect and prevent fraud.

Applicant's Signature Date

12 Report of Broker/Agent

Have you bound this risk?

Yes No

Is this business new to you?

Yes No

Type of Motor Vehicle Liability

Insurance Card issued

Temp Perm None

How long have you known the

Applicant?

How long have you known the Principal Driver?

Has an inspection been completed? Yes No

Broker/Agent Signature Date

The Applicant must receive a copy of the signed application.

A supplementary form for commercial or public use automobiles may be necessary.

Effective (2010-09-01) OAF 1

FSCO (1213E) Page 4 of 4

Save