Fillable Printable Cash Flow Analysis Worksheet

Fillable Printable Cash Flow Analysis Worksheet

Cash Flow Analysis Worksheet

Cash Flow Analysis Worksheets — 1 —

This article describes the cash budget and analysis worksheets available for downloading at the

Department of Agricultural and Resource Economics web site

worksheets are part of the cashcost file in either the Excel or Quattro Pro format. These spreadsheet

templates can be used to generate budget information customized to your operation on an operating

or cash cost basis only (fixed costs are not included).

A cash flow analysis is an important step in taking control of any agricultural business. The allocation

of income to cover expected costs throughout the year will help ensure that all credit obligations will

be met. It is equally important not only to track current cash flows, but also to project at the start of

the production year all expected income and expenditures. Once expected income and expenditures

are recorded, comparisons can be made between projected and actual cash flows to help point out

any discrepancies.

Two of the main worksheets found in the cashcost file are the cash budget worksheet and the analysis

worksheet. Both of the worksheets and how to use them are described in the following paragraphs.

The cash budget worksheet allows the user to summarize all cash inflows (receipts) and outflows

(expenditures) for up to four individual crops grown on the farm during the yearly business cycle. The

year end summary receipts and expenditures are organized into categories and entered on the cash

budget worksheet for each crop. The actual cash flow values can then be used to evaluate historical

cash performance of the business, as well as serve as a guide for future cash flow needs throughout

the current business year.

The analysis worksheet is linked to the cash budget worksheet and allows for percentage adjust-

ments to be made for each crop and each income and expenditure category. A year-end comparison

between the newly adjusted cash budget and the actual cash budget is presented at the end of the

analysis worksheet.

Cash Flow Analysis WorksheetsCash Flow Analysis Worksheets

Cash Flow Analysis WorksheetsCash Flow Analysis Worksheets

Cash Flow Analysis Worksheets

Trent Teegerstrom

||

Introduction

||

||

Components of the Cash Budget & Analysis Worksheets

||

Both the cash budget worksheet and the analysis worksheet are broken up into several main areas

denoted by type of receipts and expenditures. Under some of the main expenditure areas are sub

categories further defining each of the expenditures. Each of the main areas are presented below

with descriptions of what is contained within the areas and where appropriate, examples of data

entries are presented. Data should only be entered in the areas shaded in green on the actual

worksheets. All other areas are calculated fields and will automatically fill in when the information is

provided in the green shaded areas.

http://ag.arizona.edu/arec/ext/budgets/counties.html under the financial template section. The

Cash Flow Analysis Worksheets — 2 —

Part 1: The Cash Budget Worksheet

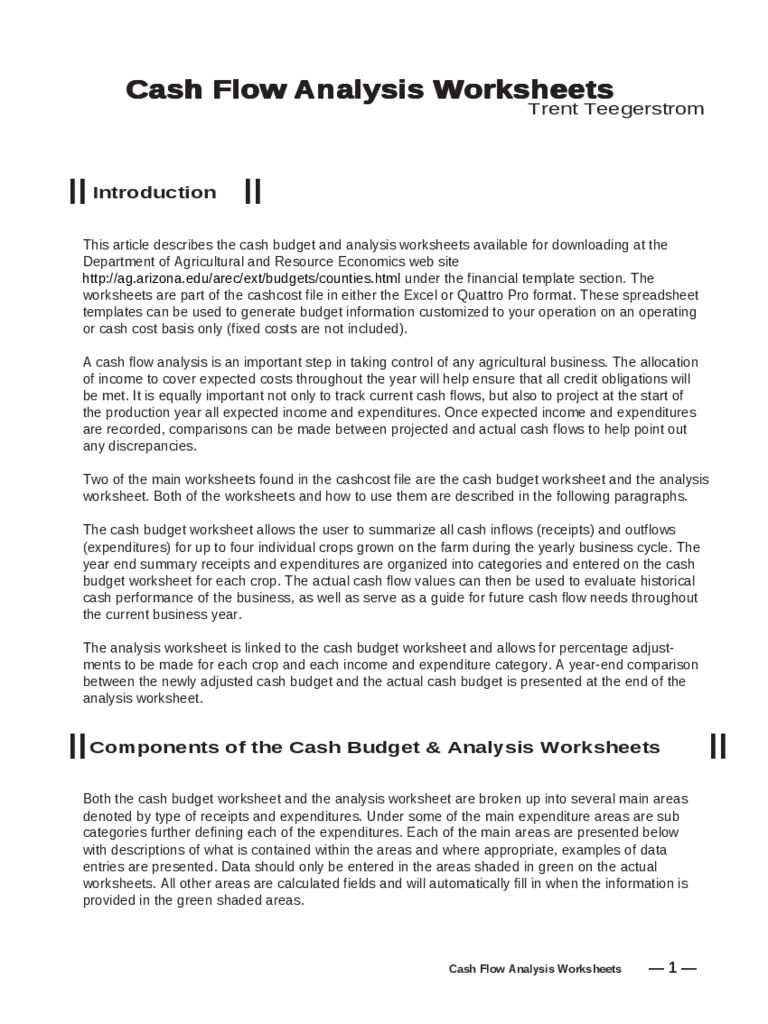

Acreage and Revenues

1 – Total Acres

This area is for recording the total number of acres planted for each crop. For example, 400

acres of Alfalfa Hay, 80 acres of Spring Cantaloupe, 120 acres of Durum Wheat, and 100 acres

of Upland Cotton.

2 – Yield (per acre)

Input the yield per acre for each crop listed (Figure 1, part 1).

3 – Price Received (per acre)

List the average prices received for each of the crops listed.

4 – Total Receipts (per acre)

Receipts for each of the crops are calculated based on the information provided in the yield and

price areas above. Additional revenues such as government payments and custom work can also

be accounted for in the section (Figure 1, part 2).

Figure 1

Cash Flow Analysis Worksheets — 3 —

Cash Expenses

Cash expenses are those costs that vary with output for the production period under

consideration.There are three main categories each with supporting sub categories.

1 – Land Preparation & Growing

All costs incurred before harvest.

Labor:

Includes labor for tractor, irrigation, hand, and other.

Chemicals & Custom Application:

Includes all chemicals used throughout the

growing process including fertilizer, insecticide, herbicide, etc.

Irrigation:

Cost of the water only. Does not include labor or water assessment charge.

Farm Machinery & Vehicles:

Includes all fuels used (diesel, gas, etc.), as well as

repair and maintenance on equipment used in the land preparation and growing of the crop.

Other Purchased Inputs:

Includes expenditures such as seeds, rentals, and

technology fees

2 – Harvest & Post Harvest

All costs incurred during and after the harvesting of the crop.

Labor:

Includes labor for tractor, hand, and other.

Chemicals & Custom Application:

Includes chemicals such as defoliants.

Farm Machinery & Vehicles:

Includes all fuels used (diesel, gas, etc.), as well as

repair and maintenance on equipment used in the harvesting and shipping of the crop.

Other Purchased Inputs:

Includes expenditures such as ginning, crop assessment, and

custom harvesting.

3 – Other Costs

Includes costs such as overhead, insurance, operating interest, and leasing.

Cash Flow Analysis Worksheets — 4 —

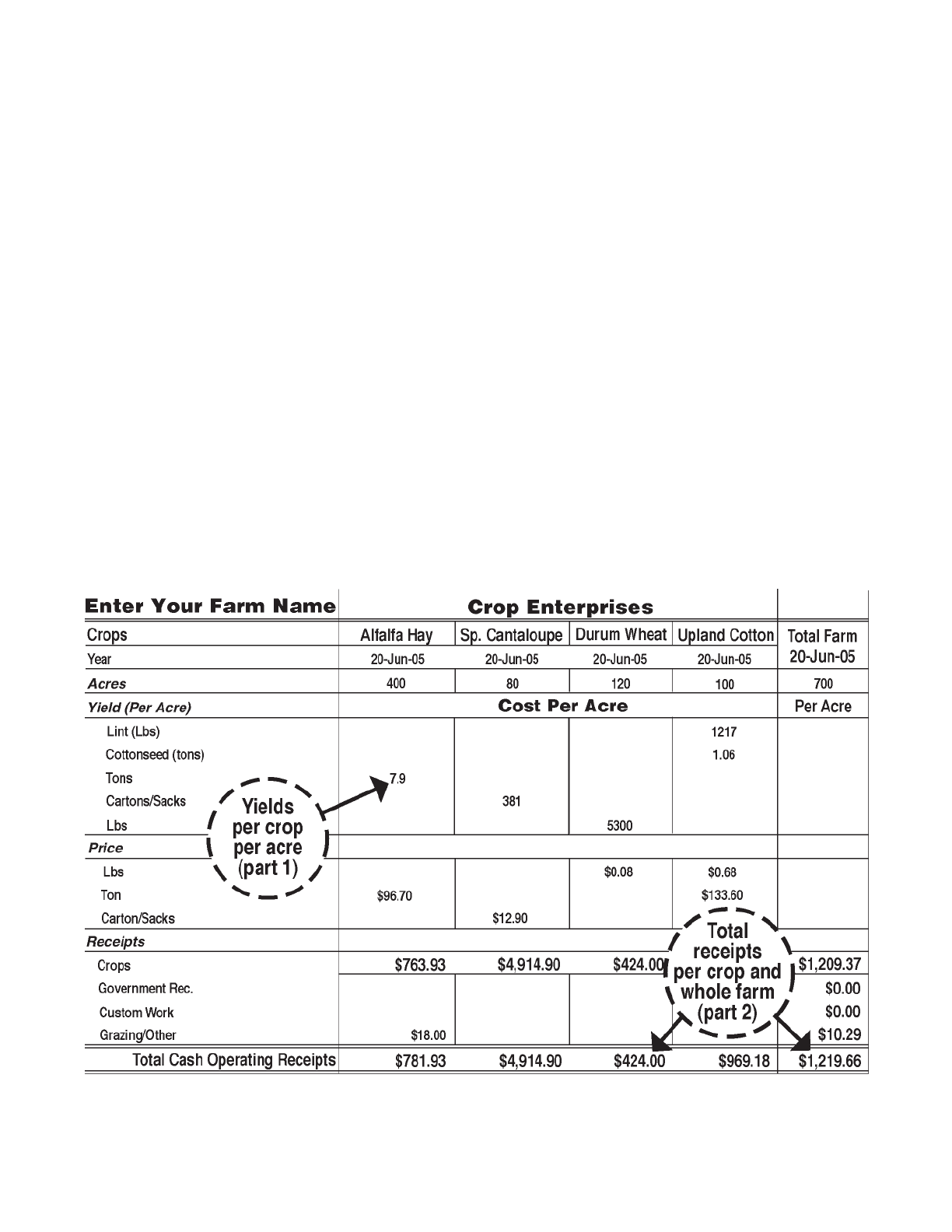

Cash Flow Analysis

This area calculates the total cash returns over total cash expenditures for each crop and the

whole farm on a per acre basis (Figure 2).

Figure 2

Cash Flow Analysis Worksheets — 5 —

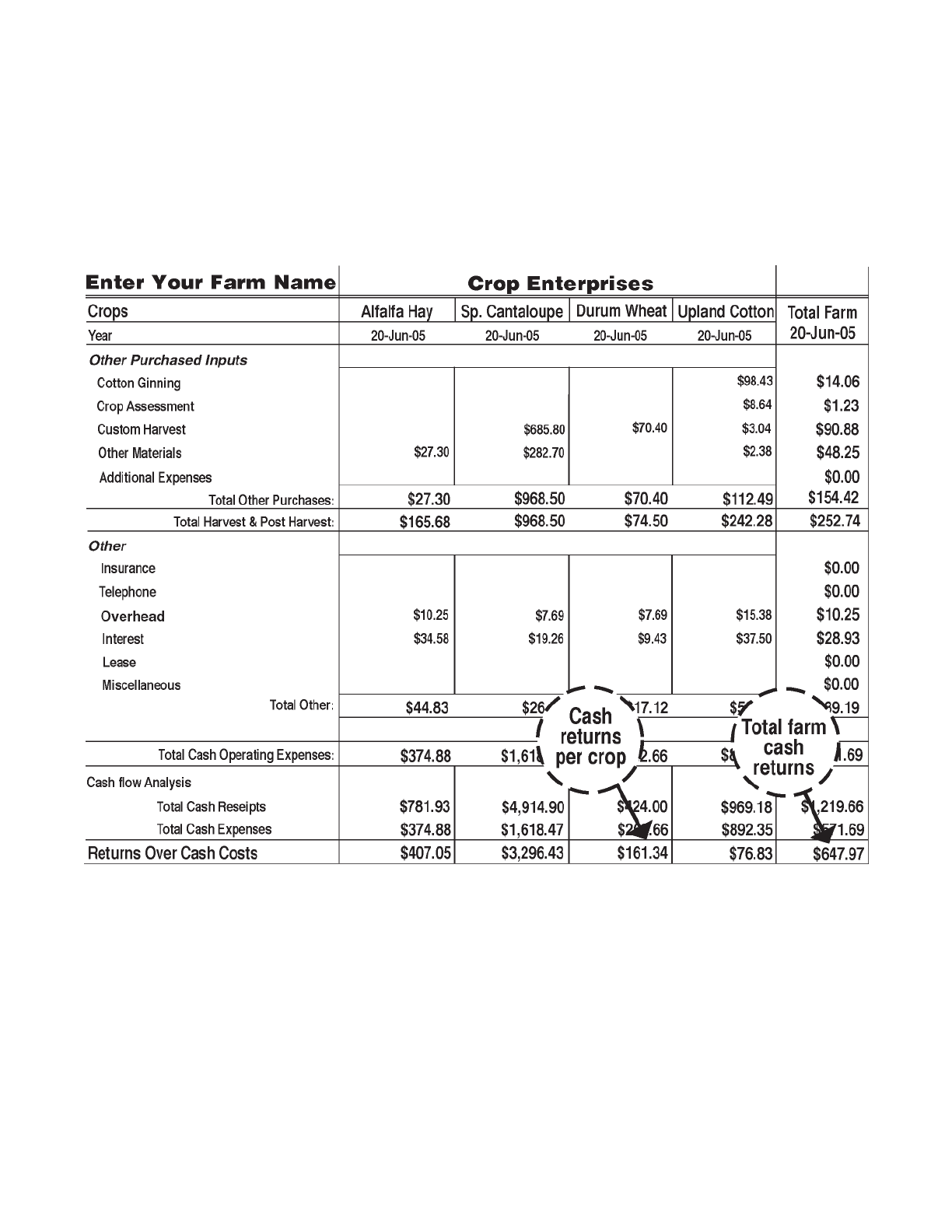

Part 2: The Analysis Worksheet

The structure of the analysis worksheet is the same as that for the cash budget worksheet. All of

the categories and their sub categories are carried over from the cash budget worksheet, so any

changes made to the categories will be carried through. The analysis worksheet depicts all costs

on a total acre per crop basis and on a whole farm. The two columns that make the analysis

worksheet different are the percent of operating expenses column and the adjustment column.

Percent of Operating Expenses Column

This area calculates the percent of the total operating expenses for each category for each crop.

This calculation will help define the areas where the majority of the cash expenses occur

(Figure 3, part 1).

Adjustment Column

This column is used for making adjustments to individual categories for each crop listed. Adjust-

ments can be made on a percentage increase or decrease (Figure 3, part 2). The adjustment

column is the only area where entries are allowed to be made. All other information is either

carried forward from the cash budget worksheet or is automatically calculated.

Figure 3

Cash Flow Analysis Worksheets — 6 —

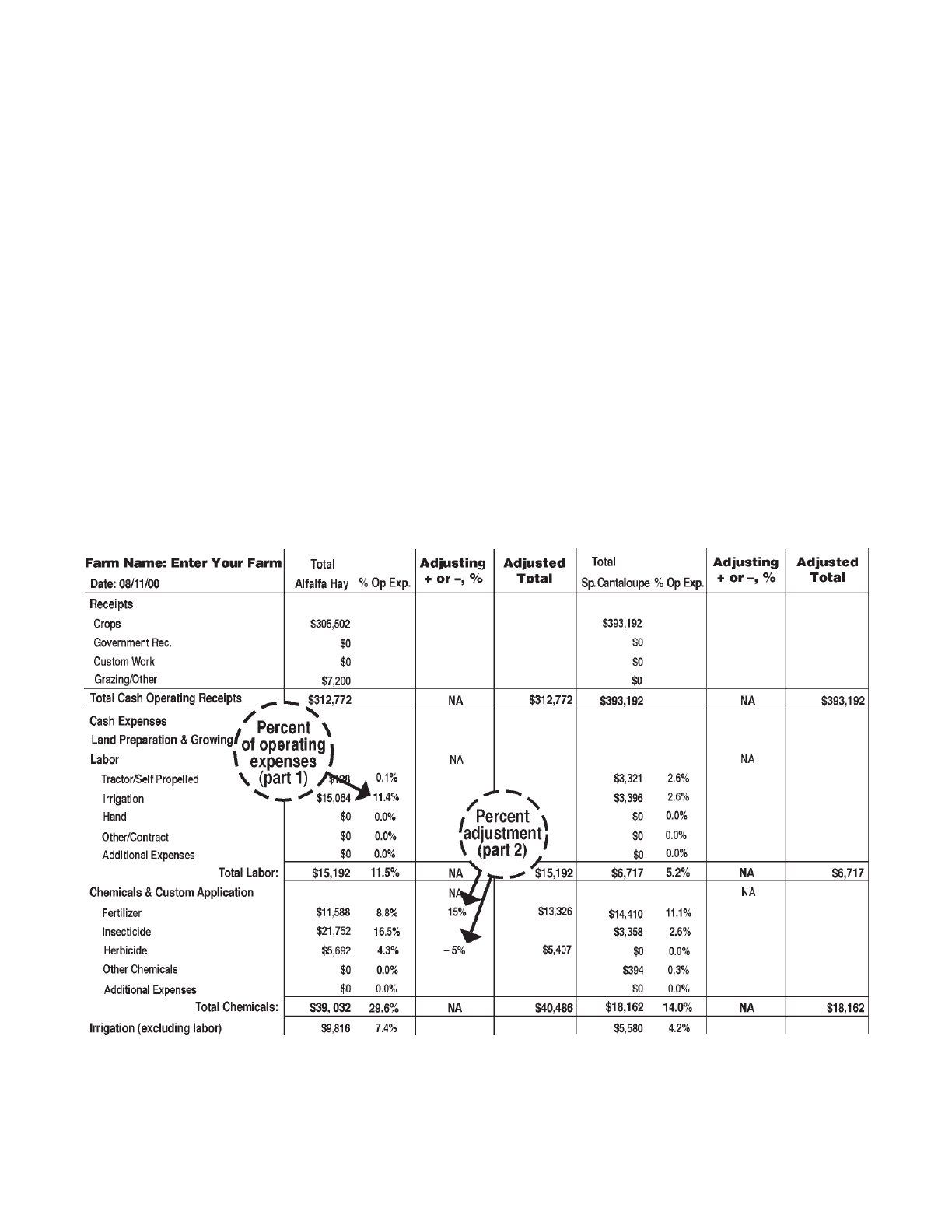

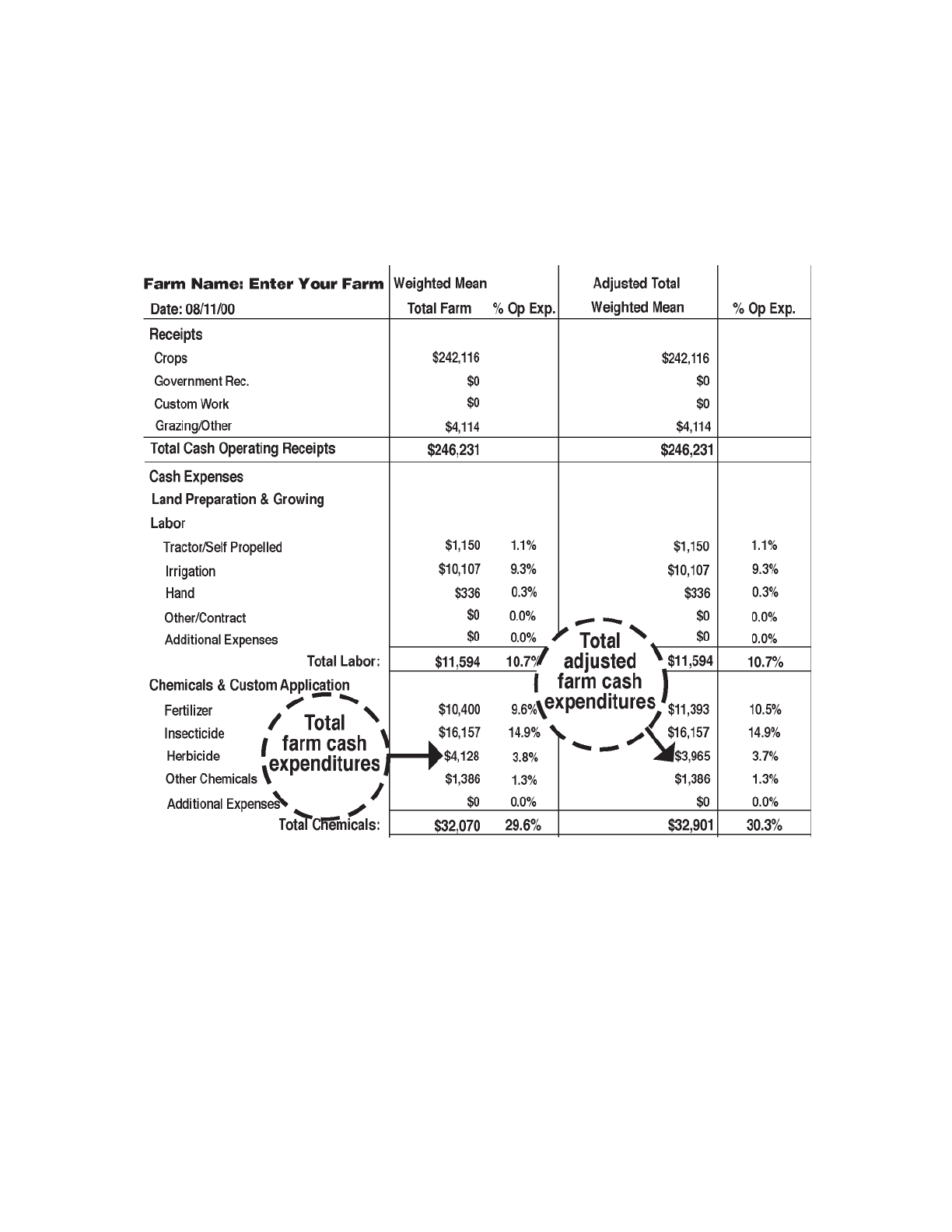

Total Farm & Adjusted Total Farm

At the end of the worksheet, the total expenditure per category is adjacent to the adjusted

totals for comparisons (Figure 4).

||

Final Thoughts on Cash Flow vs Accrual Accounting

||

While cash flow analysis is an important tool in managing today’s ranches, care should be used

when interpreting cash flow analysis. Remember that a cash flow only looks at cash transactions

when they are either paid or received, not when they are actually incurred (accrual accounting).

Therefore, cash flow is only a measure of cash profits. To get at true profits, accrual accounting is

needed to account for not only non-cash items but also changes in inventories, accounts receivable,

and accounts payable. It is a well-known fact that a business can be going broke and still generate a

positive cash flow for several years.

Figure 4