Fillable Printable Certification of Residency or Domicile - Oregon

Fillable Printable Certification of Residency or Domicile - Oregon

Certification of Residency or Domicile - Oregon

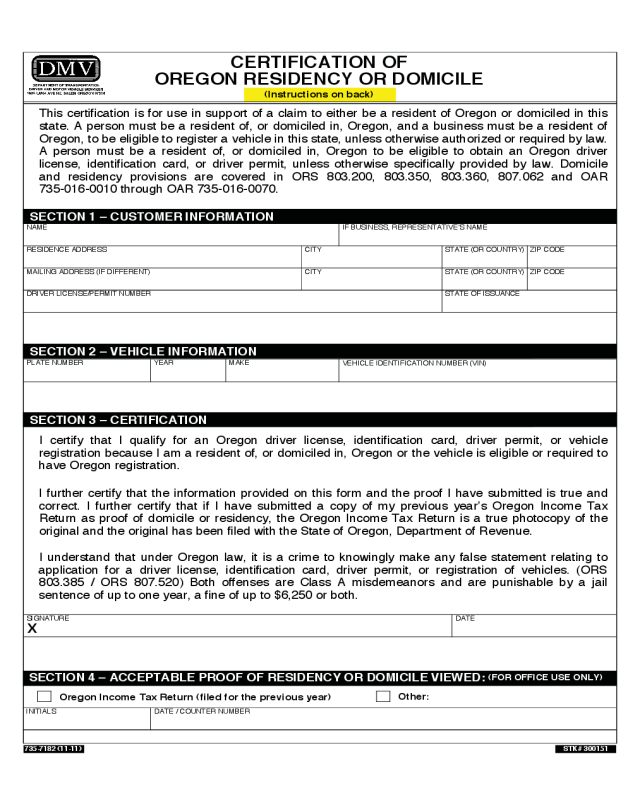

CERTIFICATION OF

OREGON RESIDENCY OR DOMICILE

735-7182 (11-11)

SECTION 1 – CUSTOMER INFORMATION

NAME

RESIDENCE ADDRESS

MAILING ADDRESS (IF DIFFERENT)

CITY

ZIP CODE

This certification is for use in support of a claim to either be a resident of Oregon or domiciled in this

state. A person must be a resident of, or domiciled in, Oregon, and a business must be a resident of

Oregon, to be eligible to register a vehicle in this state, unless otherwise authorized or required by law.

A person must be a resident of, or domiciled in, Oregon to be eligible to obtain an Oregon driver

license, identification card, or driver permit, unless otherwise specifically provided by law. Domicile

and residency provisions are covered in ORS 803.200, 803.350, 803.360, 807.062 and OAR

735-016-0010 through OAR 735-016-0070.

(Instructions on back)

IF BUSINESS, REPRESENTATIVE’S NAME

DRIVER LICENSE/PERMIT NUMBER

STATE OF ISSUANCE

CITY

STATE (OR COUNTRY)

ZIP CODE

I certify that I qualify for an Oregon driver license, identification card, driver permit, or vehicle

registration because I am a resident of, or domiciled in, Oregon or the vehicle is eligible or required to

have Oregon registration.

I further certify that the information provided on this form and the proof I have submitted is true and

correct. I further certify that if I have submitted a copy of my previous year’s Oregon Income Tax

Return as proof of domicile or residency, the Oregon Income Tax Return is a true photocopy of the

original and the original has been filed with the State of Oregon, Department of Revenue.

I understand that under Oregon law, it is a crime to knowingly make any false statement relating to

application for a driver license, identification card, driver permit, or registration of vehicles. (ORS

803.385 / ORS 807.520) Both offenses are Class A misdemeanors and are punishable by a jail

sentence of up to one year, a fine of up to $6,250 or both.

SECTION 4 – ACCEPTABLE PROOF OF RESIDENCY OR DOMICILE VIEWED:

(FOR OFFICE USE ONLY)

SIGNATURE DATE

X

INITIALS

Oregon Income Tax Return (filed for the previous year)

Other:

SECTION 2 – VEHICLE INFORMATION

SECTION 3 – CERTIFICATION

PLATE NUMBER YEAR

VEHICLE IDENTIFICATION NUMBER (VIN)

MAKE

DATE / COUNTER NUMBER

STATE (OR COUNTRY)

STK# 300151

Use this form to support your claim to being domiciled in, or a resident of, Oregon, or your claim that the vehicle is eligible

or required to have Oregon registration. This form and the proof you submit do not guarantee the issuance of an Oregon

driver license, identification card, driver permit or vehicle registration.

1) The form must be complete, legible and signed.

2) Attach copies of the document(s) that are proof of your claim to either being domiciled in, or a resident of Oregon, or

proof that the vehicle is eligible or required to have Oregon registration. If your transaction is for a driving privilege or

identification card, the proof submitted proving you are domiciled in or a resident of Oregon is in addition to the

required proof of your current residence address as established in OAR 735-062-0030. For a complete list of

acceptable proofs of residence address go to www.oregondmv.com.

If you reside in Oregon, and need to provide proof that you are a resident of or domiciled in Oregon, a true copy

of your Oregon permanent or part-year income tax return filed with the Oregon Department of Revenue for the

previous tax year is acceptable proof with this form. If you filed as a part-year resident the income tax return

must show that you resided in Oregon at the end of that tax year. If you do not have a copy of your income tax

return, you may provide two or more of the following documents with this form:

• A property tax record, utility bills, rent receipts, a lease or rental agreement or other document that shows you reside in

Oregon;

• Enrollment records or other documentation that you are attending an educational institution maintained by public funds

and pay resident tuition fees;

• Motel, hotel, campground or recreational vehicle park receipts showing that you currently reside in Oregon and have

remained in Oregon for six consecutive months or more;

• A statement dated within the last 60 days from a relief agency or shelter that you have no actual residence, but currently

receive assistance in Oregon;

• Fuel receipts, motel receipts, or other documents showing you have lived in Oregon for at least six of the last twelve

months.

• Documents showing you have a current account at a bank or credit union in Oregon and the account has been open for

60 days or more;

• A document showing receipt of public assistance from an agency of the State of Oregon dated within the last twelve

months; or

• An Oregon voter registration card.

If you are domiciled in Oregon, but are temporarily out of state, you may provide one or more of the following

documents with this form:

1. A true copy of your Oregon permanent or part-year income tax return filed with the Oregon Department of Revenue

for the previous tax year. If you filed as a part-year resident, the income tax return must show that you resided in Oregon

at the end of that tax year.

2. Proof that you have continuously maintained an Oregon residence while absent from the state;

3. Proof that you own a residence in Oregon;

4. Proof that you are temporarily residing outside of Oregon for a period of limited duration (paying non-resident tuition at

an out of state school; temporary transfer of employment; temporary care of a family member out of state) and you have

maintained ties to Oregon such as a bank account or voter registration;

5. Proof that you are a member of the United States Armed Forces, or the spouse or domestic partner, or dependent child

residing with a member, and Oregon is listed as your home in military records. A copy of your military LES (Leave and

Earnings Statement) is acceptable proof.

For a business entity, one or more forms of documented proof are required and must be submitted with this

form. Acceptable proof includes, but is not limited to, the following:

1. Property tax records, utility bills, rent receipts, lease agreements or similar documents which show your business is

currently the occupant of an office or warehouse facility in Oregon, along with a copy of service records, fuel receipts,

garage receipts or other documents showing that vehicles are being operated in Oregon;

2. A permit number or other information that shows you or the business hold a permit or other authority issued under ORS

Chapter 825 for intrastate transportation;

3. Storage receipts, repair bills, or similar documents which show the vehicle has been left in Oregon; or

4. Dispatch, delivery, maintenance tax records, or other documentation that shows the vehicle(s) are being housed or

dispatched from a location within Oregon or are otherwise being operated in Oregon.

Instructions