Fillable Printable Child Care Expenses Tax Credit - Colorado

Fillable Printable Child Care Expenses Tax Credit - Colorado

Child Care Expenses Tax Credit - Colorado

DR 0347 (10/07/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

www.TaxColorado.com

Use this form to determine if you can claim the Colorado

Child Care Expenses tax credit. You may be able to claim

the credit if you pay someone to care for your dependent

who is under age 13. For information about any federal

form or publication listed below, please visit www.IRS.gov

Eligibility

To be able to claim the Colorado credit for child care

expenses, you must le federal form 1040 or 1040A. You

cannot claim this credit if you led federal form 1040EZ,

1040NR or 1040NR-EZ. If you did not le a federal income

tax return, you may still be eligible for the Low Income

Child Care Expenses credit. To claim the low income credit,

you must complete and submit with your Colorado return,

federal form 1040 and 2441. You must also meet all of the

following tests:

1. The care must be for one or more qualifying persons

who are identied on federal form 2441.

2. You (and your spouse if ling jointly) must have earned

income during the year.

3. You must pay child care expenses so you (and your

spouse if ling jointly) can work or look for work.

Qualifying expenses are dened under Section 21 of

the Internal Revenue Code.

4. You must make payments for child care expenses to

someone you (and your spouse) cannot claim as a

dependent. If you make payments to your child, he

or she cannot be your dependent and must be age

19 or older by the end of the year. You cannot make

payments to:

a. Your spouse, or

b. The parent of your qualifying person if your qualifying

person is your child and under the age of 13.

5. You cannot claim this credit if your federal ling status

is Married Filing Separate.

6. You must identify the care provider on this form.

It is recommended that you fully review IRS Publication 503

for eligibility tests and the denition of qualifying income

and children. All of the information in this form is required

and your credit may be denied if it is incomplete.

Part I - Person or Organization Who Provided the Care

Use this section to list the name, address and Social

Security or Federal Employer ID number of the child care

provider(s) you used. If you are unable to provide the

Social Security or Federal Employer ID number of the child

care provider, you must show that you attempted to obtain

the required information by attaching such proof to this

form.

List the total amount paid for the full year of child care, paid

to each provider.

Part II- Qualifying Child Information

For lines 2a – 2d, list each qualifying child, their year of

birth and their Social Security number. You must also list

the amount of child care expenses for each specic child.

Complete lines 2e through 4 as instructed on the form.

If the amount on line 4 is greater than $60,000 do not

continue because you do not qualify for this credit.

If line 4 is $60,000 or less, enter the amount from line 9 of

the IRS form 2441, Child and Dependent Care Expenses,

on line 5 of this form DR 0347.

For line 6 enter your tax from your federal income tax

return. See IRS form 1040 line 47 or 1040A line 28. If

the amount of line 6 is greater than $0, continue to Part

III. Otherwise, if line 6 is $0 or if you did not le a federal

income tax return and your adjusted gross income is

$25,000 or less, skip to Part IV.

Part III- Child Care Expenses Credit

If you had federal tax on line 6 above, use line 4 to

determine the decimal amount from Table A. Enter the

appropriate amount on line 7.

For line 8 enter the amount from line 11 of IRS form 2441,

Child and Dependent Care Expenses.

For line 9 multiply line 8 by the decimal on line 7.

Full–year residents should enter amount from this form on

line 9 to form 104CR line 1. If you completed Part III and

you were a part-year resident, continue to Part V.

Part IV- Low-Income Child Care Expenses

If you have no federal tax on line 6 and the amount of line

4 is $25,000 or less, use Table B to calculate the credit.

Otherwise, go back to Part III to calculate your credit.

For line 11 multiply line 3 by the decimal on line 10.

For line 12 enter the smaller amount of line 11 or the

appropriate amount from Table B.

Full–year residents should enter amount from this form on

line 12 to form 104CR line 1. If you completed Part III and

you were a part-year resident, continue to Part V.

Part V- Part Year Resident Limitation

Complete this part only if you were a part-year resident of

Colorado in 2014. Enter the percentage from form 104PN

line 34 on line 13 of this DR 0347.

For line 14 multiple the amount from line 9 or line 12 by the

percentage from line 13. Enter this amount on line 1 of form

104CR.

Child Care Expenses Tax Credit

Instructions

DR 0347 (10/07/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

www.TaxColorado.com

Child Care Expenses Tax Credit

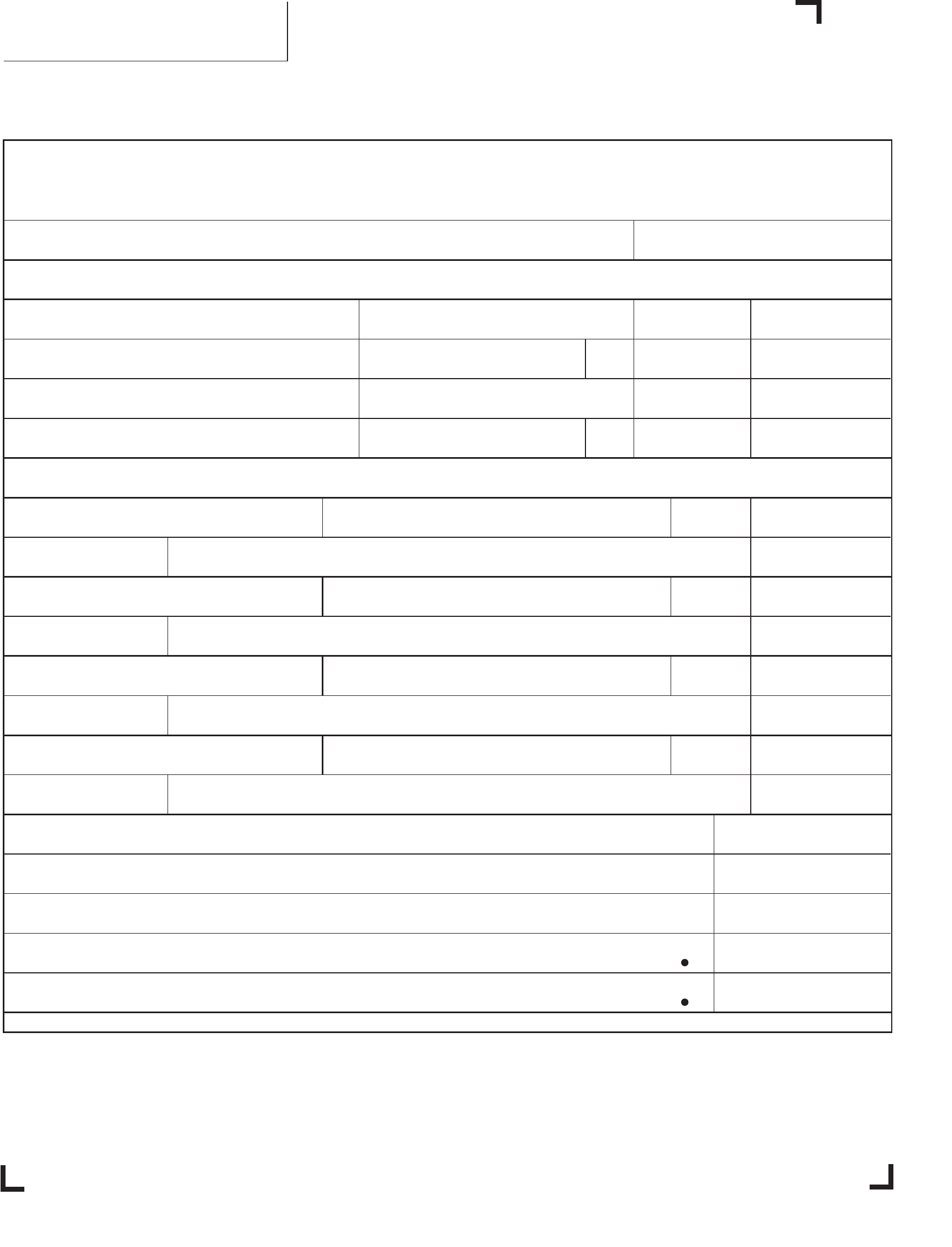

Submit this form with your complete Colorado Individual Income Tax Return, including forms 104 and 104CR.

You must also submit a copy of IRS form 2441 with your Colorado return.

Thoroughly read the instructions to be certain you are eligible for this credit.

Be sure to complete all required information. Failure to do so may result in a denied credit or delayed refund.

Taxpayer name SSN

Part I – Persons or Organizations Who Provided the Care - You must complete this part

If you have more than two care providers or if the provider is non-prot, see the instructions.

1.

(a) Care Provider’s First Name

Last Name Middle Initial (b) SSN or FEIN

(c) Address City State Zip (d) Amount Paid

$

(a) Care Provider’s First Name Last Name Middle Initial (b) SSN or FEIN

(c) Address City State Zip (d) Amount Paid

$

Part II – Qualifying Child Information - You must complete this part

If you have more than four qualifying children, see the instructions.

2(a). Child’s First Name

Last Name Middle Initial Year of Birth

SSN

Qualied expenses you incurred and paid in 2014 for the person listed in 2(a)

$

2(b).

Child’s First Name

Last Name Middle Initial Year of Birth

SSN

Qualied expenses you incurred and paid in 2014 for the person listed in 2(b)

$

2(c).

Child’s First Name

Last Name Middle Initial Year of Birth

SSN

Qualied expenses you incurred and paid in 2014 for the person listed in 2(c)

$

2(d).

Child’s First Name

Last Name Middle Initial Year of Birth

SSN

Qualied expenses you incurred and paid in 2014 for the person listed in 2(d)

$

2(e). Enter the sum of all qualied child care expenses

$

2(f). Enter your earned income

$

2(g). If ling a joint return, enter the earned income of the other person

$

3. Enter the smallest of line 2(e), 2(f) or 2(g) 3

$

4. Enter your adjusted gross income from your federal income tax return.

See IRS form 1040 line 37 or 1040A line 21 4

$

If the amount of line 4 is greater than $60,000 STOP - you do not qualify for this credit.

*140347==19999*

5. Enter the amount from line 9 of IRS form 2441, child and dependent care expenses 5

$

6. Enter your tax from your federal income tax return.

See IRS form 1040 line 47 or 1040A line 30 6

$

Complete Part III if line 6 is greater than $0. Otherwise, skip to Part IV.

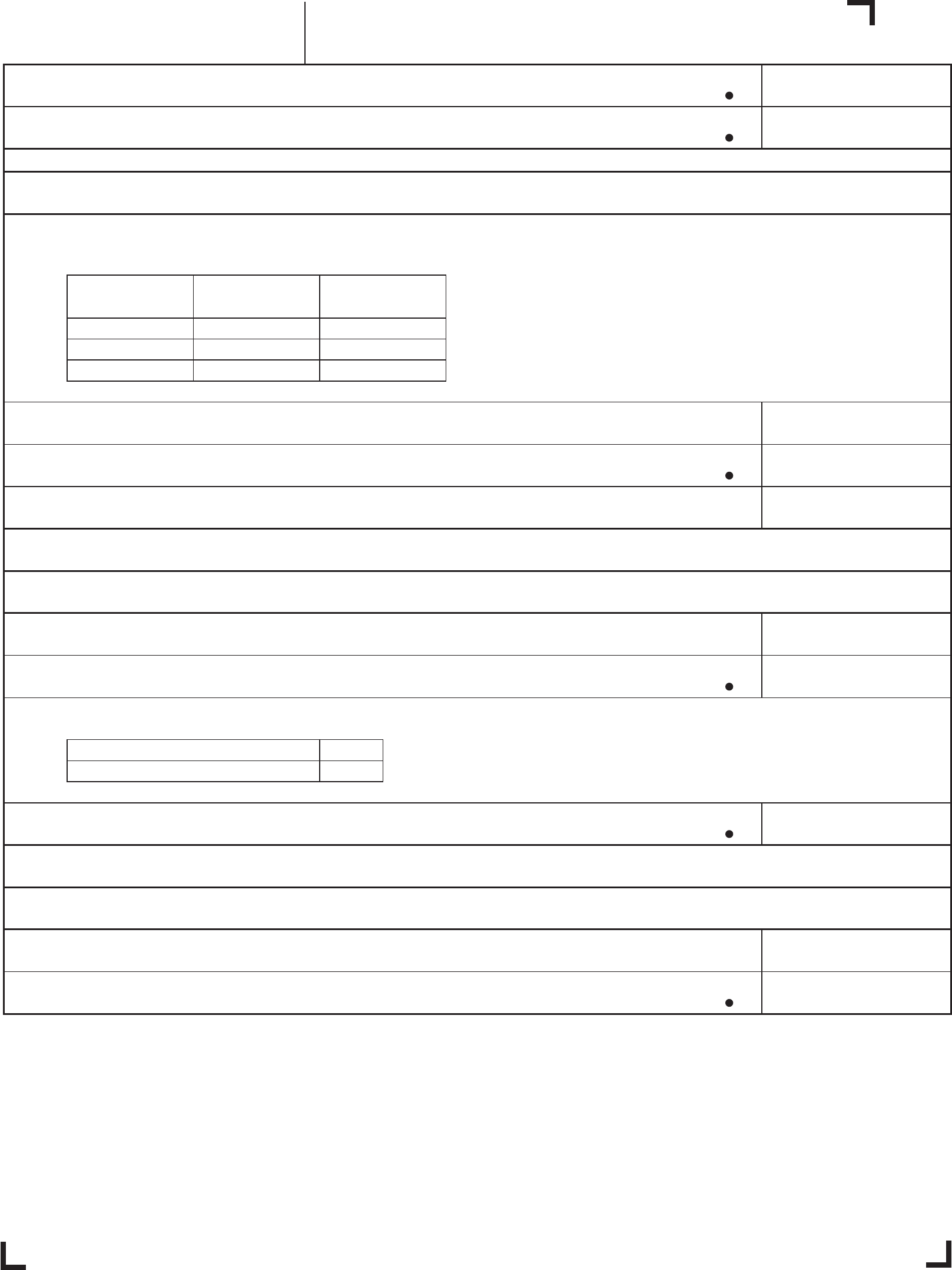

Part III – Child Care Expenses Credit

Determine your Colorado decimal amount from the amount on line 4 above:

Table A

More than:

But not

more than:

Enter this on

line 7 below:

$0 $25,000 .50

$25,000 $35,000 .30

$35,000 $60,000 .10

7. Enter the decimal amount from Table A above 7

X.

8. Enter the amount from line 11 of IRS form 2441, child and dependent care expenses 8

9. Multiply line 8 by the decimal on line 7 9

Full-year residents should enter the amount from line 9 on Form 104CR line 1.

If you completed Part III and you were a part-year resident, proceed to Part V below.

Part IV – Low-Income Child Care Expenses Credit

10. Low-income calculation only. DO NOT complete this Part IV if line 4 is greater than

$25,000 and if line 6 is greater than $0 10

X .25

11. Multiply line 3 by the decimal on line 10 11

Table B

One qualifying child $500

Two or more qualifying children $1,000

12. Enter the smaller of line 11 or the appropriate amount from Table B 12

Full-year residents should enter the appropriate amount from line 12 on Form 104CR line 1

Part-year residents skip to Part V below

Part V – Part-Year Resident Limitation

13. Part-year residents ONLY - enter the percentage from Form 104PN line 34 13

%

14. Multiply the amount from line 9 or line 12 by the percentage from line 13.

Enter the result on line 1 of Form 104CR 14

$

*140347==29999*