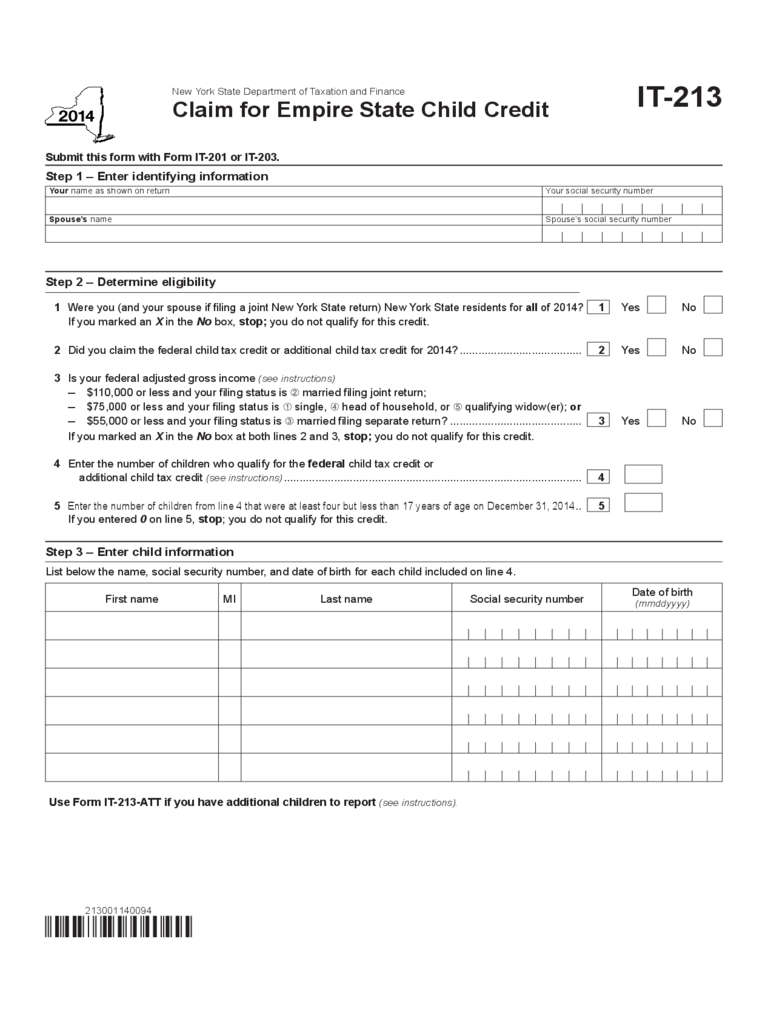

Fillable Printable Child Tax Credits Form - New York

Fillable Printable Child Tax Credits Form - New York

Child Tax Credits Form - New York

213001140094

1

Were you (and your spouse if ling a joint New York State return) New York State residents for all of 2014?

1 Yes No

If you marked an X in the No box, stop; you do not qualify for this credit.

2 Did you claim the federal child tax credit or additional child tax credit for 2014? ....................................... 2 Yes No

3 Is your federal adjusted gross income

(see instructions)

– $110,000 or less and your ling status is married ling joint return;

–

$75,000 or less and your ling status is single, head of household, or qualifying widow(er); or

– $55,000 or less and your ling status is married ling separate return? .......................................... 3 Yes No

If you marked an X in the No box at both lines 2 and 3, stop; you do not qualify for this credit.

4 Enter the number of children who qualify for the federal child tax credit or

additional child tax credit

(see instructions) ............................................................................................... 4

5

Enter the number of children from line 4 that were at least four but less than 17 years of age on December 31, 2014

.. 5

If you entered 0 on line 5, stop; you do not qualify for this credit.

New York State Department of Taxation and Finance

Claim for Empire State Child Credit

IT-213

First name MI

Social security number

Date of birth

(mmddyyyy)

Step 3 – Enter child information

List below the name, social security number, and date of birth for each child included on line 4.

Last name

Submit this form with Form IT-201 or IT-203.

Step 1 – Enter identifying information

Your name as shown on return Your social security number

Spouse’s name Spouse’s social security number

Use Form IT-213-ATT if you have additional children to report (see instructions).

Step 2 – Determine eligibility

213002140094

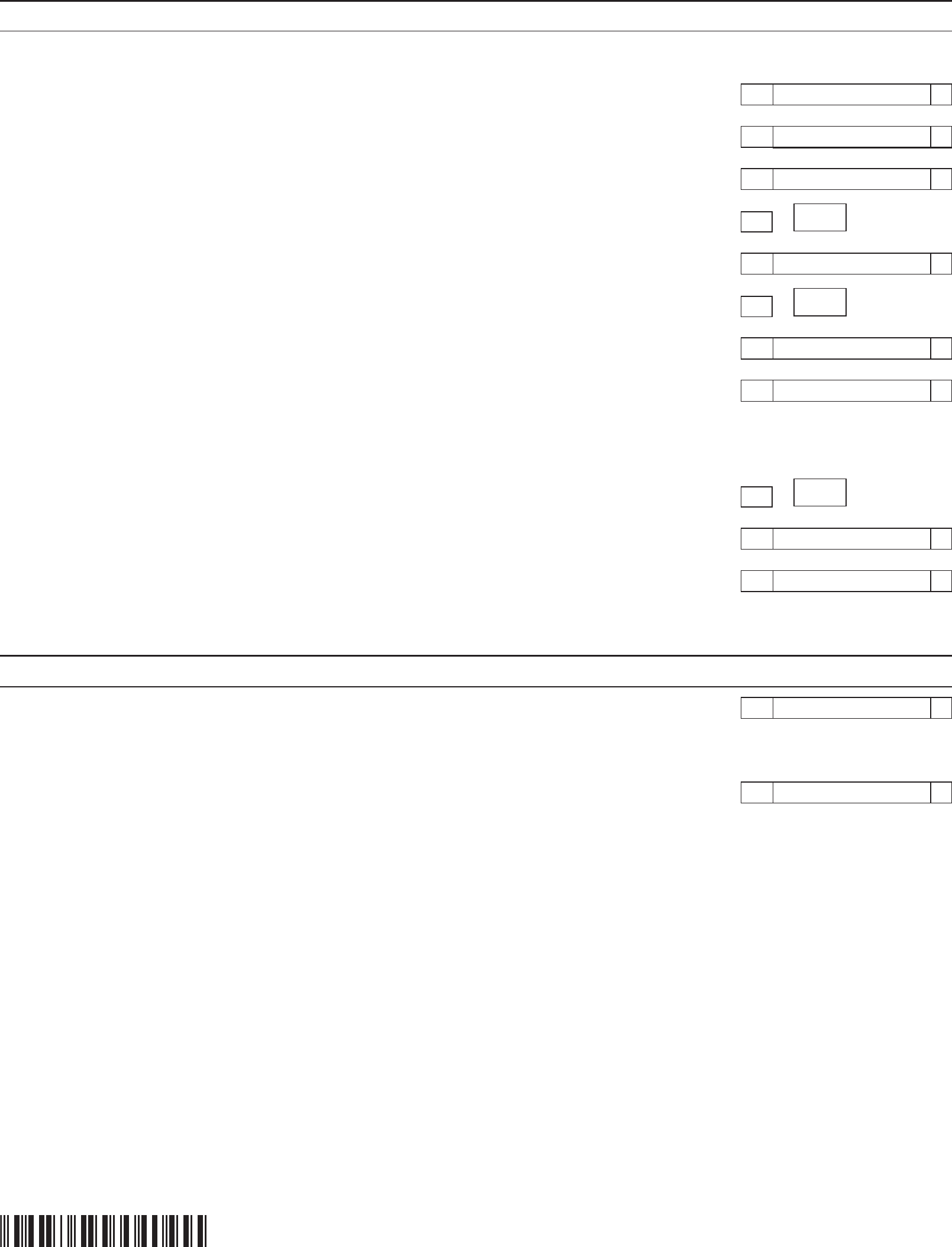

Step 4 – Compute credit

IT-213 (2014) (back)

If you answered No to question 2, skip lines 6 through 12, and enter 0 on line 13; continue with line 14.

6 Enter your federal child tax credit from Form 1040A, line 35, or Form 1040, line 52 ............................ 6

00

7 Enter your federal additional child tax credit from Form 1040A, line 43, or Form 1040, line 67 ............. 7 00

8 Add lines 6 and 7 .................................................................................................................................... 8 00

9 Enter the number of children from line 4 ................................................................................................ 9

10 Divide line 8 by line 9 ............................................................................................................................. 10

00

11 Enter the number of children from line 5 ................................................................................................ 11

12 Multiply line 10 by line 11 ........................................................................................................................ 12

00

13 Multiply line 12 by 33% (.33) .................................................................................................................. 13

00

If you marked the No box on line 3, skip lines 14 and 15, and enter the amount from line 13 on line 16.

All others continue with line 14.

14 Enter the number of children from line 5 ................................................................................................ 14

15 Multiply line 14 by 100 ............................................................................................................................ 15

00

16 Empire State child credit (enter the amount from line 13 or line 15, whichever is greater) ............................... 16 00

If you led a joint federal return but are required to le separate New York State returns, continue with

lines 17 and 18. All others enter the line 16 amount on Form IT-201, line 63.

Whole dollars only

Step 5 – Spouses required to le separate New York State returns (see instructions)

17 Enter the full-year resident spouse’s share of the line 16 amount; do not leave line 17 blank ........... 17

00

Enter here and on Form IT-201, line 63.

18 Enter the part-year resident or nonresident spouse’s share of the line 16 amount;

do not leave line 18 blank ............................................................................................................... 18

00

Enter the line 18 amount and code 213 on Form IT-203-ATT, line 12.