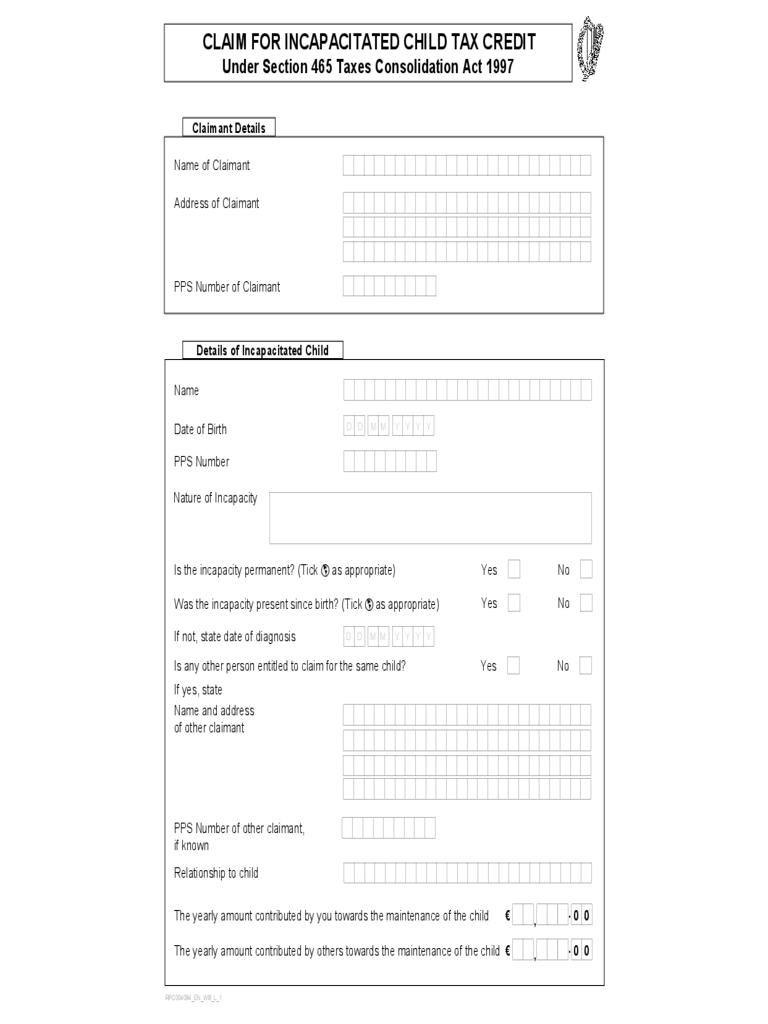

Fillable Printable Child Tax Sample Form

Fillable Printable Child Tax Sample Form

Child Tax Sample Form

Name of Claimant

Address of Claimant

PPS Number of Claimant

Name

Nature of Incapacity

Is the incapacity permanent? (Tick

as appropriate)

PPS Number

RPC004084_EN_WB_L_1

Date of Birth

D D

M M Y Y Y Y

Yes No

Claimant Details

Was the incapacity present since birth? (Tick

as appropriate)

Yes No

If not, state date of diagnosis

D D

M M Y Y Y Y

Is any other person entitled to claim for the same child? Yes No

If yes, state

Name and address

of other claimant

PPS Number of other claimant,

if known

Relationship to child

The yearly amount contributed by others towards the maintenance of the child

The yearly amount contributed by you towards the maintenance of the child

€ 0 0

.

,

€ 0 0

.

,

CLAIM FOR INCAPACITATED CHILD TAX CREDIT

Under Section 465 Taxes Consolidation Act 1997

Details of Incapacitated Child

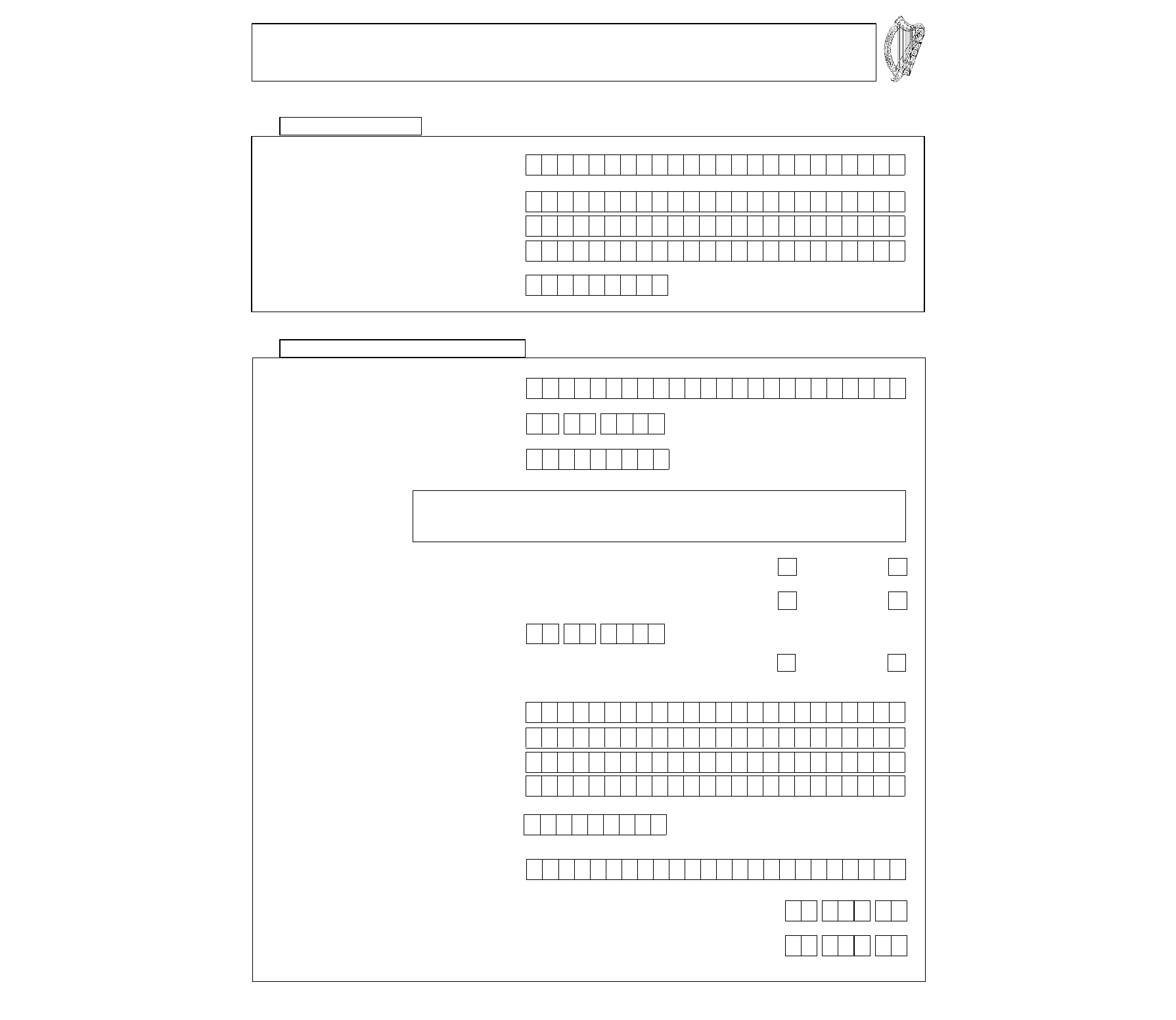

Refunds

If you wish to have any refund paid directly to your bank account, please supply your bank account

details.

Single Euro Payments Area (SEPA)

Bank account numbers and sort codes have been replaced by International Bank Account Numbers

(IBAN) and Bank Identifier Codes (BIC). These numbers are generally available on your bank

account statements. It is not possible to make a refund directly to a foreign bank account that is not a

member of SEPA.

Note: Any subsequent Revenue refunds will be made to this bank account unless otherwise notified.

Bank Details

Declaration to be signed by a medical practitioner

I declare that all the particulars given on this form are correct to the best of my knowledge and belief.

Signature:

Print Name:

Medical Registration Number:

Date:

D D

M M Y Y Y Y

Yes

Yes

I confirm that the child in respect of whom this relief is being claimed, has been

incapacitated since birth or from the date the incapacity arose.

• Child aged over 18

I confirm that this child is permanently incapacitated by reason of physical or

mental infirmity from maintaining himself or herself.

• Child aged under 18

I regard this child as incapacitated by reason of physical or mental infirmity and

the infirmity is such that there is a reasonable expectation that, if he or she were

over the age of 18 years, he or she would be incapacitated from maintaining himself

or herself.

Yes

Tax law provides for penalties for making a false statement or claiming tax credits or reliefs that are

not due.

Penalties

International Bank Account Number (IBAN)

(Maximum 34 characters)

Bank Identifier Code (BIC)

(Maximum 11 characters)

Declaration to be signed by the claimant

I declare that all the particulars given on this form are correct to the best of my knowledge and belief.

Signature

of claimant:

E-mail Address:

Daytime/mobile

phone number:

Date:

D D M M Y Y Y Y

Declarations

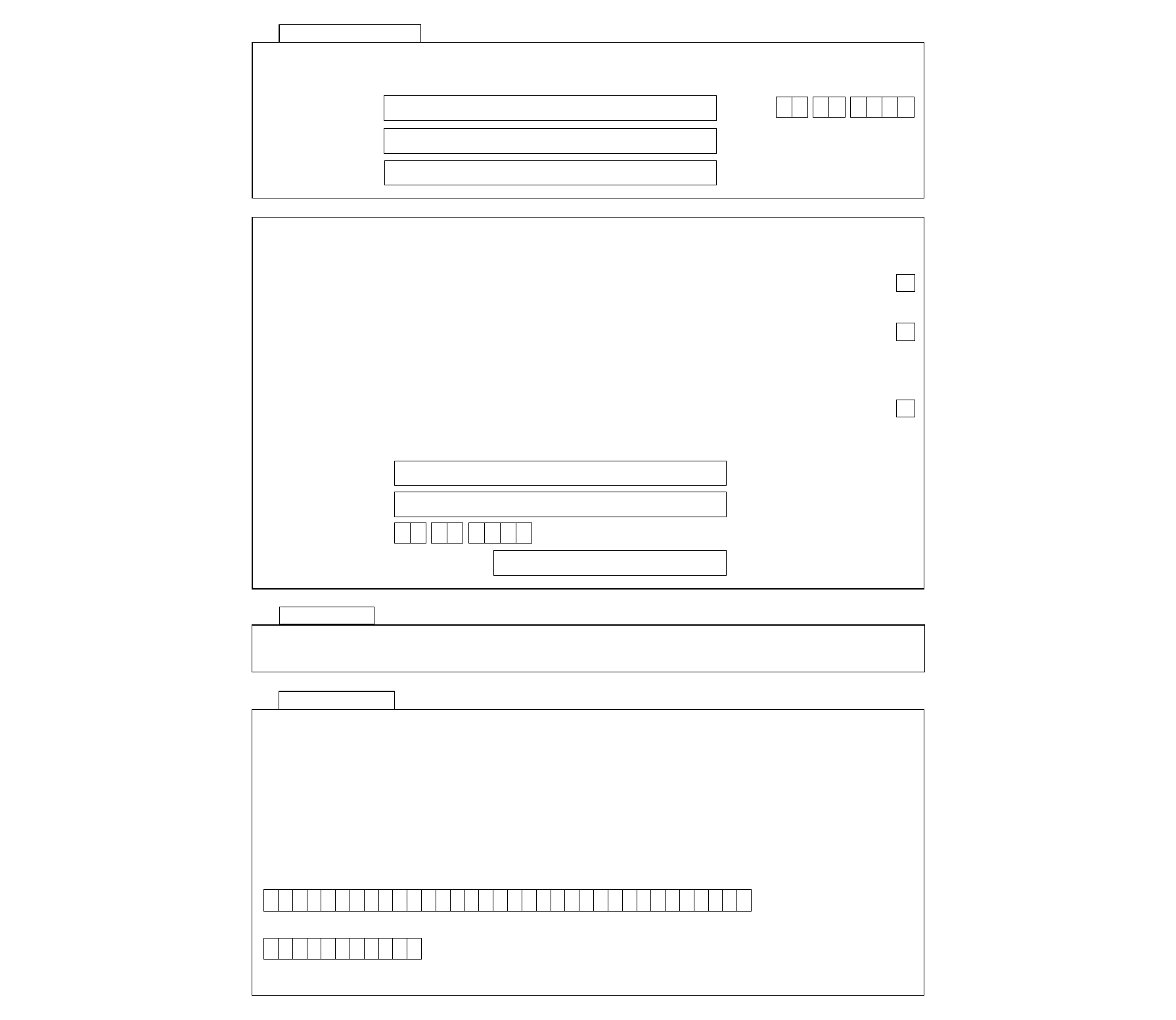

Who can claim the Incapacitated Child Tax Credit?

This tax credit can be claimed where a claimant proves that he or she has living at any time during

the tax year any child who:

• is under 18 years of age and is permanently incapacitated either physically or mentally, or

if over 18 years of age at the commencement of the tax year and is permanently incapacitated

either physically or mentally from maintaining himself or herself and had become so

permanently incapacitated before reaching 21 years, or

• had become so permanently incapacitated after reaching 21 years, but while he or she

has been in receipt of full-time education at any university, college, school or other educational

establishment, or while training full-time for a trade or profession for a minimum of two years.

The tax credit can also be claimed where a claimant proves that he or she has custody of a child and

maintains that child at his or her own expense and that child is permanently incapacitated.

Where more than one child is permanently incapacitated, a tax credit may be claimed for each child.

Tax Credit/Refunds

If your claim is in respect of the current tax year an amended Tax Credit Certificate will be sent to you

in the event of a successful claim and your employer will make any refund due directly to you.

If your claim is for a previous tax year or during a period of unemployment in the current tax year, any

refund due will be sent directly to you by Revenue.

Note: There is no refund due if you have not paid any Income Tax.

What records should I keep?

A Certificate from your Medical Practitioner, outlining the child's incapacity must be retained and

submitted to Revenue if requested.

As your claim may be selected for future examination, you are requested to retain all documentation

relating to this claim for a period of six years from the end of the tax year to which the claim relates.

Can two people claim for the same child?

Yes, but only one tax credit can be claimed for each qualifying child in any tax year. Where the child

is maintained by one person only, that person is entitled to claim the full amount of the tax credit.

If two people are entitled to claim for the same child then the tax credit is split between them in

proportion to the amount paid by each towards the maintenance of the child.

Where do I send this claim form?

The completed form should be returned to your Revenue office. The address can be found on your

Tax Credit Certificate or on any correspondence you have received from Revenue. Alternatively, use

our Contact Locator on www.revenue.ie to obtain the correct address.

Time Limit

A claim for a repayment of tax must be made within four years after the end of the tax year to which

the claim relates.

Accessibility: If you are a person with a disability and require this leaflet in an alternate format the

Revenue Access Officer can be contacted at accessofficer@revenue.ie

NOTES

Further Information

For further information visit www.revenue.ie or contact your Revenue office using the

LoCall number listed below.

Border Midlands West Region 1890 777 425

Cavan, Donegal, Galway, Leitrim, Longford,

Louth, Mayo, Monaghan, Offaly, Roscommon,

Sligo, Westmeath

Dublin Region 1890 333 425

Dublin (City and County)

East & South East Region 1890 444 425

Carlow, Kildare, Kilkenny, Laois, Meath,

Tipperary, Waterford, Wexford, Wicklow

South West Region 1890 222 425

Clare, Cork, Kerry, Limerick

Please note that the rates charged for the use of 1890 (LoCall) numbers may vary

among different service providers. If calling from outside the Republic of Ireland,

phone +353 1 702 3011.

Designed by the Revenue Printing Centre