Fillable Printable Claim for Age Pension and Pension Bonus

Fillable Printable Claim for Age Pension and Pension Bonus

Claim for Age Pension and Pension Bonus

SA002.1503

Claim for Age Pension

and Pension Bonus

1 of 25

• Please use black or blue pen.

• Print in BLOCK LETTERS.

• Mark boxes like this

with a or .

• Where you see a box like this

Go to 5

skip to the question number shown.

You do not need to answer the questions in between.

When to use this form

Use this form to claim the following:

Age Pension

The Age Pension provides income support and access to a range of concessions for

eligible older Australians. The Age Pension is paid at different rates depending on a person’s

circumstances and includes incentives for people to maximise their overall income.

Pension Bonus

The Pension Bonus is a tax free lump sum payment for registered members of the

Pension Bonus Scheme who have deferred claiming Age Pension and stayed in paid work.

The scheme is closed to new registrations. If you are registered in the scheme you must

claim the bonus at the same time you claim Age Pension. Conditions apply.

Filling in this form

Returning your form

Check that all required questions are answered and that the form is signed and dated.

Return this form and any supporting documents to us within 14 days so we can process

your application or claim. If you cannot do this within 14 days, contact us for extra time.

If extra time is required, you must contact us at the earliest possible date to make an

arrangement.

You can return this form and any supporting documents:

• online – submit your documents online. For more information about how to access an

Online Account or how to lodge documents online, go to

www.

humanservices.gov.au/submitdocumentsonline

• by post – return your documents by sending them to:

Department of Human Services

Seniors Services

Reply Paid 7808,

Canberra BC ACT 2610

• in person – if you are unable to submit this form and any supporting documents online

or by post, you can provide them in person to one of our service centres.

What else you may

need to provide

You may need to provide identity documents. For a list of acceptable documents refer to

Confirming your identity in the

Information you need to know about your claim for Age

Pension and Pension Bonus

(Ci006) (Information Booklet).

In your claim pack, you should have the following:

•

Claim for Age Pension and Pension Bonus

form (SA002)

•

Income and Assets

form (SA369).

Forms in your claim

pack

You can access your Centrelink, Medicare and Child Support Online Services through myGov.

myGov is a fast, simple way to access a range of government services online with one

username, one password, all from one secure location. To create a myGov account, go to www.

my.gov.au

Online Services

SA002.1503

2 of 25

If you have a partner and you are both claiming Age Pension, you may choose to complete

one claim pack together or complete a separate claim pack for each person.

If your partner is not claiming Age Pension they still need to provide their details. They can

do so on this form or a separate

Partner Details

form (Mod P). If you do not have this form,

go to www.humanservices.gov.au/forms

Complete the claim form(s) and any additional forms required. You may choose to use an

accountant or financial adviser to complete your

Income and Assets

form (SA369) but you

must sign it. If you need other people to assist with completing your forms, make sure you

give them the forms as soon as possible.

To make sure you are paid from the earliest possible date, you should lodge your claim as

soon as possible. You may lodge your claim form without the other forms and documentation,

however, they will need to be provided before the claim can be processed. Age Pension

claims can be lodged up to 13 weeks before you reach age pension age.

How to claim

Make an appointment with the ophthalmologist/optometrist who usually treats you

(and/or your partner). You should have been given a

Request for Ophthalmologist/

Optometrist Report

form (SA013). If you do not have this form, go to

www.humanservices.gov.au/agepension

When you (and/or your partner) make the appointment, tell the receptionist that you (and/or

your partner) need the optician to complete a form for us, as they may need to allow more

time. The optician may complete the report and give it back to you (or your partner) or they

may send it directly to us. Make sure the report has your (or your partner’s) name and

address on it.

Age Pension for

people who are

permanently blind

Department of

Veterans’ Affairs

Disability Pension

payment option

If you (and/or your partner) currently get a Disability Pension from the Department of

Veterans’ Affairs (DVA), you can both choose to have your Age Pension paid by DVA

instead of us. You will need to complete the claim forms but lodge them with DVA

(contact your local DVA office for lodgement details).

For more information

Refer to the Information Booklet at www.humanservices.gov.au/agepension

If you need a translation of any documents for our business, we can arrange this for you

free of charge.

To speak to us in languages other than English, call 131 202.

Note: Call charges apply – calls from mobile phones may be charged at a higher rate.

If you have a hearing or speech impairment, you can contact the TTY service on

Freecall™ 1800 810 586. A TTY phone is required to use this service.

SA002.1503

3 of 25

Age Pension

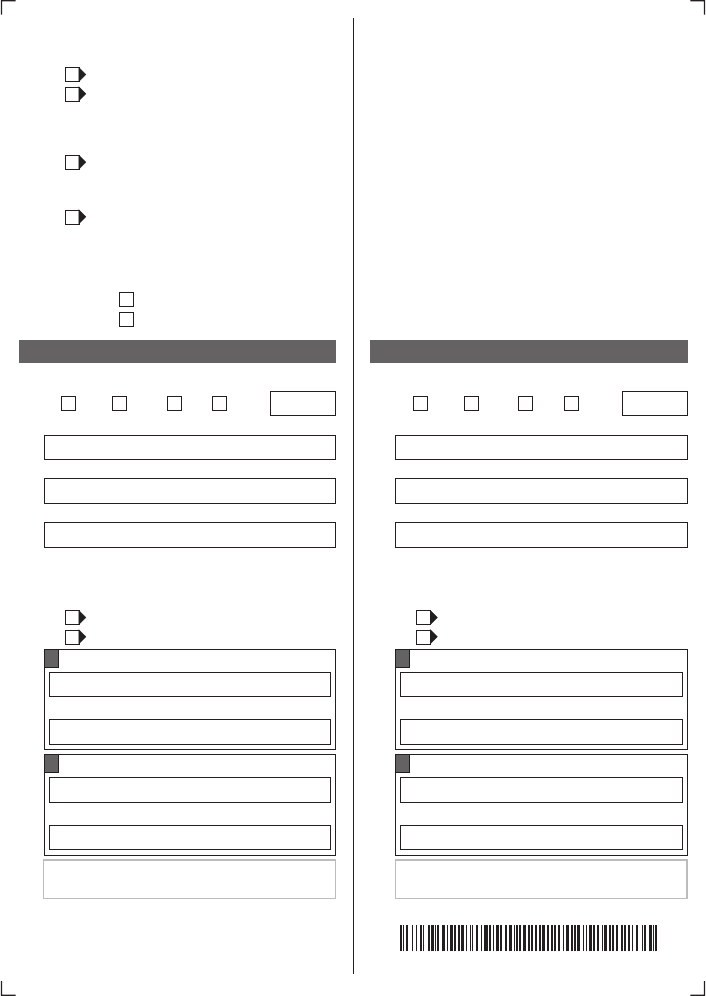

Do you have a partner?

1

Go to 4

We require your partner’s details to assess your

claim.

Go to next question

No

Yes

Is your partner also claiming Age Pension?

2

Your partner can provide their details on this form

or a separate

Partner Details

form (Mod P).

Go to next question

Your partner can claim on this form or on a

separate claim form.

Go to next question

No

Yes

Indicate if your partner is using this form or a separate form

for a claim or to provide their details.

3

This form

Separate form

Your name

Other

Family name

4

First given name

Second given name

MsMissMrsMr

Your name

Other

Family name

First given name

Second given name

MsMissMrsMr

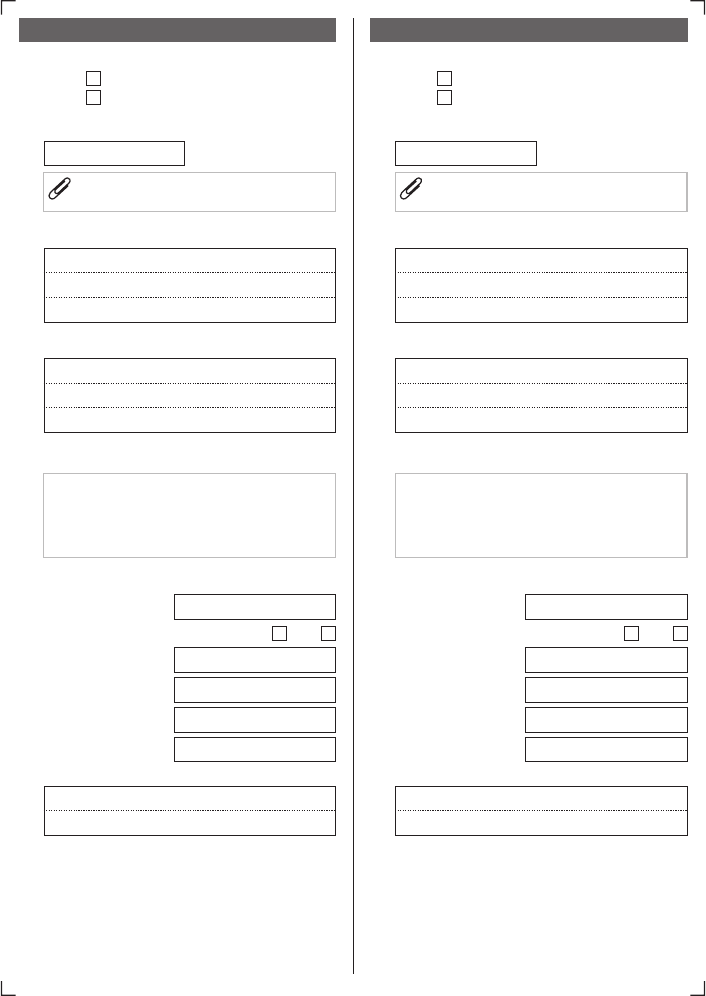

Have you ever used or been known by any other name

(e.g. name at birth, maiden name, previous married name,

Aboriginal or tribal name, alias, adoptive name, foster name)?

5

Other name

Type of name (e.g. name at birth)

1

Other name

Type of name (e.g. maiden name)

2

If you have more than 2 other names, attach a separate

sheet with details.

If you have more than 2 other names, attach a separate

sheet with details.

Have you ever used or been known by any other name

(e.g. name at birth, maiden name, previous married name,

Aboriginal or tribal name, alias, adoptive name, foster name)?

Other name

Type of name (e.g. name at birth)

1

Other name

Type of name (e.g. maiden name)

2

You Your partner

Go to next question

Give details below

No

Yes

Go to next question

Give details below

No

Yes

4

5

CLK0SA002 1503

SA002.1503

4 of 25

Your date of birth

/ /

7

Your permanent address

Postcode

8

Your sex

6

Male

Female

Your postal address (if different to above)

9

Postcode

Attach an original document as proof of your date

of birth.

If you are claiming Age Pension, attach an original

document as proof of your date of birth.

Your sex

Male

Female

/ /

Your date of birth

You Your partner

Your permanent address

Postcode

Your postal address (if different to above)

Postcode

7

8

6

9

10

Your contact details Your contact details

Home phone number

Is this a silent number?

Email

@

Fax number

Work phone number

Alternative phone number

( )

( )

( )

( )

No Yes

Mobile phone number

Home phone number

Is this a silent number?

Email

@

Fax number

Work phone number

Alternative phone number

( )

( )

( )

( )

No Yes

Mobile phone number

10

If you provide an email address or mobile phone number,

you may receive electronic messages (SMS or email)

from us. To read the Terms and Conditions, go to

www.humanservices.gov.au/em or visit one of our service

centres.

Please read this before answering the following question.

If you provide an email address or mobile phone number,

you may receive electronic messages (SMS or email)

from us. To read the Terms and Conditions, go to

www.humanservices.gov.au/em or visit one of our service

centres.

Please read this before answering the following question.

SA002.1503

Are you of Aboriginal or Torres Strait Islander Australian

origin?

If you are of both Aboriginal and Torres Strait Islander

Australian origin, please tick both ‘Yes’ boxes.

Questions 11 and 12 are optional and will not affect your

payment. If you do answer, the information will help us

to continue to improve services to Aboriginal and Torres

Strait Islander Australians and Australian South Sea

Islanders.

Australian South Sea Islanders are the descendants of

Pacific Islander labourers brought from the Western

Pacific in the 19th Century.

11

Are you of Australian South Sea Islander origin?

12

No

Yes – Aboriginal Australian

Yes – Torres Strait Islander Australian

No

Yes

Do you need an interpreter when dealing with us?

This includes an interpreter for people who have a hearing

or speech impairment.

13

Go to 15

No

Yes

Do you want to authorise another person or organisation to

make enquiries, get Centrelink payments and/or act on

your behalf?

16

Go to next question

No

Yes

You will need to complete and attach an

Authorising a person or organisation

to enquire or act on your behalf

form

(SS313). If you do not have this form or

want more information about nominee

arrangements, go to

www.humanservices.gov.au/nominees

Do you give permission for your partner to make enquiries

with us on your behalf?

You can change this authority at any time.

17

No

Yes

Are you of Aboriginal or Torres Strait Islander Australian

origin?

If you are of both Aboriginal and Torres Strait Islander

Australian origin, please tick both ‘Yes’ boxes.

Questions 11 and 12 are optional and will not affect your

payment. If you do answer, the information will help us

to continue to improve services to Aboriginal and Torres

Strait Islander Australians and Australian South Sea

Islanders.

Australian South Sea Islanders are the descendants of

Pacific Islander labourers brought from the Western

Pacific in the 19th Century.

Are you of Australian South Sea Islander origin?

No

Yes – Aboriginal Australian

Yes – Torres Strait Islander Australian

No

Yes

Do you need an interpreter when dealing with us?

This includes an interpreter for people who have a hearing

or speech impairment.

Go to 15

No

Yes

Do you want to authorise another person or organisation to

make enquiries, get Centrelink payments and/or act on

your behalf?

Go to next question

No

Yes

You will need to complete and attach an

Authorising a person or organisation

to enquire or act on your behalf

form

(SS313). If you do not have this form or

want more information about nominee

arrangements, go to

www.humanservices.gov.au/nominees

Do you give permission for your partner to make enquiries

with us on your behalf?

You can change this authority at any time.

No

Yes

Go to next question Go to next question

What is your preferred spoken language?

14

What is your preferred spoken language?

What is your preferred written language?

15

What is your preferred written language?

11

12

13

16

17

14

15

5 of 25

You Your partner

SA002.1503

6 of 25

You Your partner

‘Permanently’ means you normally live in Australia on

a long-term basis. Holidays or short trips outside

Australia would not affect this.

Please read this before answering the following question.

18

Are you living in Australia permanently?

No

Yes

Go to 29

Are you an Australian citizen who was born in Australia?

20

What is your country of birth?

21

You will need to provide proof of your

Australian residence status

(e.g. citizenship papers, passport or

other documentation).

Go to next question

No

Yes

Go to next question

Give details below

Have you EVER lived or travelled outside Australia,

including short trips and holidays?

19

No

Yes

Passport number

Country of issue

Go to next question

Give details below

Did you start living in Australia before 1965?

23

No

Yes

Name of the ship or airline on which you arrived

Name of the place where you first arrived/disembarked

What was your name when you first arrived in Australia?

When did you start living in Australia?

22

/ /

‘Permanently’ means you normally live in Australia on

a long-term basis. Holidays or short trips outside

Australia would not affect this.

Please read this before answering the following question.

Are you living in Australia permanently?

No

Yes

Go to 29

Are you an Australian citizen who was born in Australia?

What is your country of birth?

You will need to provide proof of your

Australian residence status

(e.g. citizenship papers, passport or

other documentation).

Go to next question

No

Yes

Go to next question

Give details below

Have you EVER lived or travelled outside Australia,

including short trips and holidays?

No

Yes

Passport number

Country of issue

Go to next question

Give details below

Did you start living in Australia before 1965?

No

Yes

Name of the ship or airline on which you arrived

Name of the place where you first arrived/disembarked

What was your name when you first arrived in Australia?

When did you start living in Australia?

/ /

This question assists us to verify your Australian residence. This question assists us to verify your Australian residence.

18

20

21

19

23

22

Year you last entered Australia Year you last entered Australia

SA002.1503

7 of 25

You Your partner

Date granted

/ /

Country of citizenship

What is your country of citizenship?

24

Australia

Other

Are you a refugee or former refugee?

28

No

Yes

Date granted

/ /

Are you a refugee or former refugee?

No

Yes

What type of visa did you arrive on?

25

Permanent

Temporary

Unknown (e.g. arrived

on parent’s passport)

Your visa details on arrival

26

Date visa grantedVisa sub class

Most recent visa details

Has your visa changed since you arrived in Australia?

27

Date visa grantedVisa sub class

Go to next question

Go to next question

Go to 27

Go to next question

No

Yes

/ /

/ /

What type of visa did you arrive on?

Permanent

Temporary

Unknown (e.g. arrived

on parent’s passport)

Your visa details on arrival

Date visa grantedVisa sub class

Most recent visa details

Has your visa changed since you arrived in Australia?

Date visa grantedVisa sub class

Go to next question

Go to next question

Go to 27

Go to next question

No

Yes

/ /

/ /

What is your country of citizenship?

Australia

Country of citizenshipOther

New Zealand passport

(special category visa)

Go to 27

New Zealand passport

(special category visa)

Go to 27

Go to 25 Go to 25

24

28

25

26

27

SA002.1503

8 of 25

From

29

Country of residence

1

To

/ // /

Go to next question

No

Yes

From

Country of residence

2

To

/ // /

From

Country of residence

3

To

/ // /

From

Country of residence

4

To

/ // /

If you require more space, attach a separate sheet with

details.

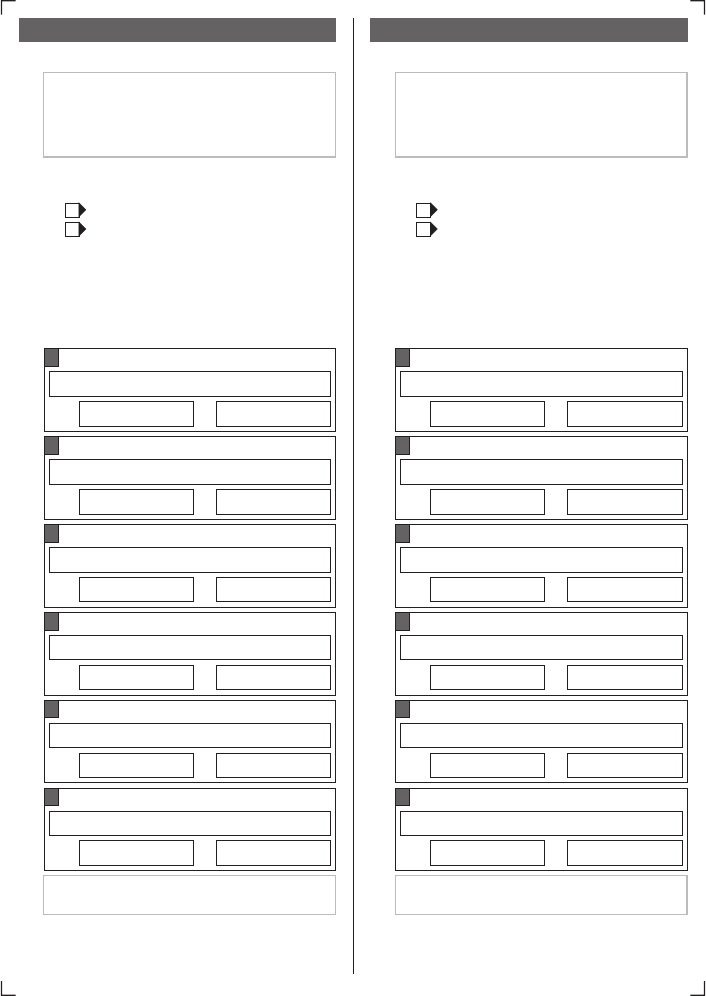

Except for short trips or holidays, have you EVER lived

outside Australia?

List ALL countries, INCLUDING AUSTRALIA, you

have lived in SINCE BIRTH.

If you were born outside Australia, include the

country where you were born.

Include the periods you have lived in each

country.

Do NOT include short trips or holidays.

From

Country of residence

5

To

/ // /

You Your partner

From

Country of residence

6

To

/ // /

From

Country of residence

1

To

/ // /

Go to next question

No

Yes

From

Country of residence

2

To

/ // /

From

Country of residence

3

To

/ // /

From

Country of residence

4

To

/ // /

Except for short trips or holidays, have you EVER lived

outside Australia?

List ALL countries, INCLUDING AUSTRALIA, you

have lived in SINCE BIRTH.

If you were born outside Australia, include the

country where you were born.

Include the periods you have lived in each

country.

Do NOT include short trips or holidays.

From

Country of residence

5

To

/ // /

From

Country of residence

6

To

/ // /

If you require more space, attach a separate sheet with

details.

29

We need to know if you have lived in any countries other

than Australia from birth through to the present. ‘Lived’

means where you/your family made your home or spent

a long period of time – it does not include places you

visited.

Please read this before answering the following question.

We need to know if you have lived in any countries other

than Australia from birth through to the present. ‘Lived’

means where you/your family made your home or spent

a long period of time – it does not include places you

visited.

Please read this before answering the following question.

SA002.1503

Where do you want your payment made?

The bank, building society or credit union account must be

in your name. A joint account is acceptable.

30

Name of bank, building

society or credit union

Branch where the

account is held

Account number (this may

not be your card number)

Account held in the name(s) of

Where do you want your payment made?

The bank, building society or credit union account must be

in your name. A joint account is acceptable.

Branch number (BSB)

Only give details if you are also claiming Age Pension

on this form.

Note: Payments cannot be made into an account used

exclusively for funding from the National Disability

Insurance Scheme.

9 of 25

You Your partner

Name of bank, building

society or credit union

Branch where the

account is held

Account number (this may

not be your card number)

Account held in the name(s) of

Branch number (BSB)

31

How often do you wish to receive the minimum pension

supplement amount?

Fortnightly

Quarterly

Please read this before answering the following

question.

The pension supplement helps you to meet the costs

of your daily household and living expenses. It is

automatically paid each fortnight with your regular

pension.

You have the option to receive part of the pension

supplement on a quarterly basis. This component/part

is known as the minimum pension supplement amount.

You may find this option useful for budgeting purposes.

If you choose this option, the minimum pension

supplement amount accrues daily during the quarter and

is paid as soon as possible after 20 March, 20 June,

20 September and 20 December with your fortnightly

pension payment.

The option to get the minimum pension supplement as a

fortnightly payment or quarterly payment can be changed

at any time.

Please read this before answering the following

question.

Only give details if you are also claiming Age Pension

on this form.

The pension supplement helps you to meet the costs

of your daily household and living expenses. It is

automatically paid each fortnight with your regular

pension.

You have the option to receive part of the pension

supplement on a quarterly basis. This component/part

is known as the minimum pension supplement amount.

You may find this option useful for budgeting purposes.

If you choose this option, the minimum pension

supplement amount accrues daily during the quarter and

is paid as soon as possible after 20 March, 20 June,

20 September and 20 December with your fortnightly

pension payment.

The option to get the minimum pension supplement as a

fortnightly payment or quarterly payment can be changed

at any time.

How often do you wish to receive the minimum pension

supplement amount?

Fortnightly

Quarterly

30

31

Note: Payments cannot be made into an account used

exclusively for funding from the National Disability

Insurance Scheme.

SA002.1503

10 of 25

Amount

(must be in whole dollars)

$

.00 per fortnight

OR

Percentage (%)

of taxable payment

% per fortnight

Do you want tax taken out of your payment?

If your only income for this financial year is the payment

you are now claiming, you may not have to pay any tax.

However, you may have to pay tax if you get any other

income this financial year, such as salary or wages.

If you think you will have to pay tax this year, you can

ask us to deduct tax instalments from your payment.

You can change this at any time.

If you are not sure how much tax to have taken out of

your payment, contact the Australian Taxation Office.

Please read this before answering the following question.

34

Go to next question

No

Yes Enter the amount OR percentage of tax you want

taken out per fortnight.

You Your partner

Amount

(must be in whole dollars)

$

.00 per fortnight

OR

Percentage (%)

of taxable payment

% per fortnight

Do you want tax taken out of your payment?

Only answer this question if you are also claiming

Age Pension on this form.

If your only income for this financial year is the payment

you are now claiming, you may not have to pay any tax.

However, you may have to pay tax if you get any other

income this financial year, such as salary or wages.

If you think you will have to pay tax this year, you can

ask us to deduct tax instalments from your payment.

You can change this at any time.

If you are not sure how much tax to have taken out of

your payment, contact the Australian Taxation Office.

Please read this before answering the following question.

Go to next question

No

Yes Enter the amount OR percentage of tax you want

taken out per fortnight.

Have you given us your tax file number before?

Go to 34

Go to next question

Not sure

Yes

You are not breaking the law if you do not give us your

tax file number, but if you do not provide it to us, or

authorise us to get it from the Australian Taxation Office,

you may not be paid.

In giving us your tax file number in relation to this claim

you authorise us to use your tax file number for other

social security payments and services in future where

necessary.

Please read this before answering the following

questions.

Go to next question

No

32

33

Please call us on 132 300.No

Yes

Do you have a tax file number?

Your tax file number

Have you given us your tax file number before?

Go to 34

Go to next question

Not sure

Yes

You are not breaking the law if you do not give us your

tax file number, but if you do not provide it to us, or

authorise us to get it from the Australian Taxation Office,

you may not be paid.

In giving us your tax file number in relation to this claim

you authorise us to use your tax file number for other

social security payments and services in future where

necessary.

Please read this before answering the following

questions.

Go to next question

No

Please call us on 132 300.No

Yes

Do you have a tax file number?

Your tax file number

34

32

33

Widowed

(previously partnered with an opposite-sex

or same-sex partner, including in a

marriage, registered or de facto relationship)

SA002.1503

What is your CURRENT relationship status?

35

11 of 25

SS293

Do you live in the same home as your former partner?

42

No

Yes

Full name

Date of birth Date relationship ended

Please give the following details about your former partner.

43

Go to next question

/ / / /

Current address (if known)

Postcode

Do you currently live in the same home as your partner?

When did you and your partner start living together as a

member of a couple?

/ /

37

Full name

Partner’s illness

Give details belowOther

Your illness

Partner in prison

Partner’s employment

From

To

Date of birth Date of death

38

Go to 47

Go to next question

No

Yes

Why are you not living with your partner?

39

Period not living with your partner

/ /

40

/ /

OR indefinite

Go to 45

Please give the following details about your deceased

partner.

41

Go to 44

/ / / /

What is your date of marriage or relationship registration?

/ /

36

Please read this before answering the following question.

We recognise both opposite-sex and same-sex

relationships. This includes de facto relationships and

relationships registered under state or territory law.

Select ONE option below that best describes your current

relationship status.

Married

Partnered

(living together in an opposite-sex or

same-sex relationship, including de facto)

Go to 36

Go to 37

Registered relationship

(opposite-sex or same-sex relationship

registered under state or territory law)

Go to 36

Separated

(previously lived with an opposite-sex or

same-sex partner, including in a marriage,

registered or de facto relationship)

Go to 42

Divorced

Go to 42

Go to 41

Never married or lived with a partner

Go to 45

Have you re-married, entered into a new registered

relationship or re-partnered (including de facto)?

44

Go to 47

Go to next question

No

Yes

Do you share your accommodation with anyone other than

an immediate member of your family?

45

Go to 47

Go to next question

No

Yes

Your living arrangements

Go to 38

Go to 44

Go to next question