Fillable Printable Collection Information Statement for Businesses Form

Fillable Printable Collection Information Statement for Businesses Form

Collection Information Statement for Businesses Form

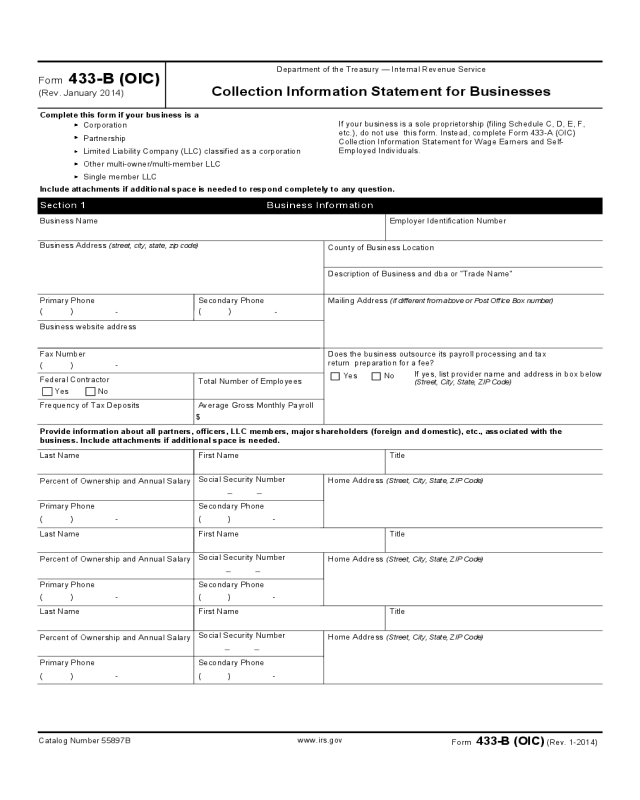

Form 433-B (OIC)

(Rev. January 2014)

Department of the Treasury — Internal Revenue Service

Collection Information Statement for Businesses

Complete this form if your business is a

Corporation

Partnership

Limited Liability Company (LLC) classified as a corporation

Other multi-owner/multi-member LLC

Single member LLC

If your business is a sole proprietorship (filing Schedule C, D, E, F,

etc.), do not use this form. Instead, complete Form 433-A (OIC)

Collection Information Statement for Wage Earners and Self-

Employed Individuals.

Include attachments if additional space is needed to respond completely to any question.

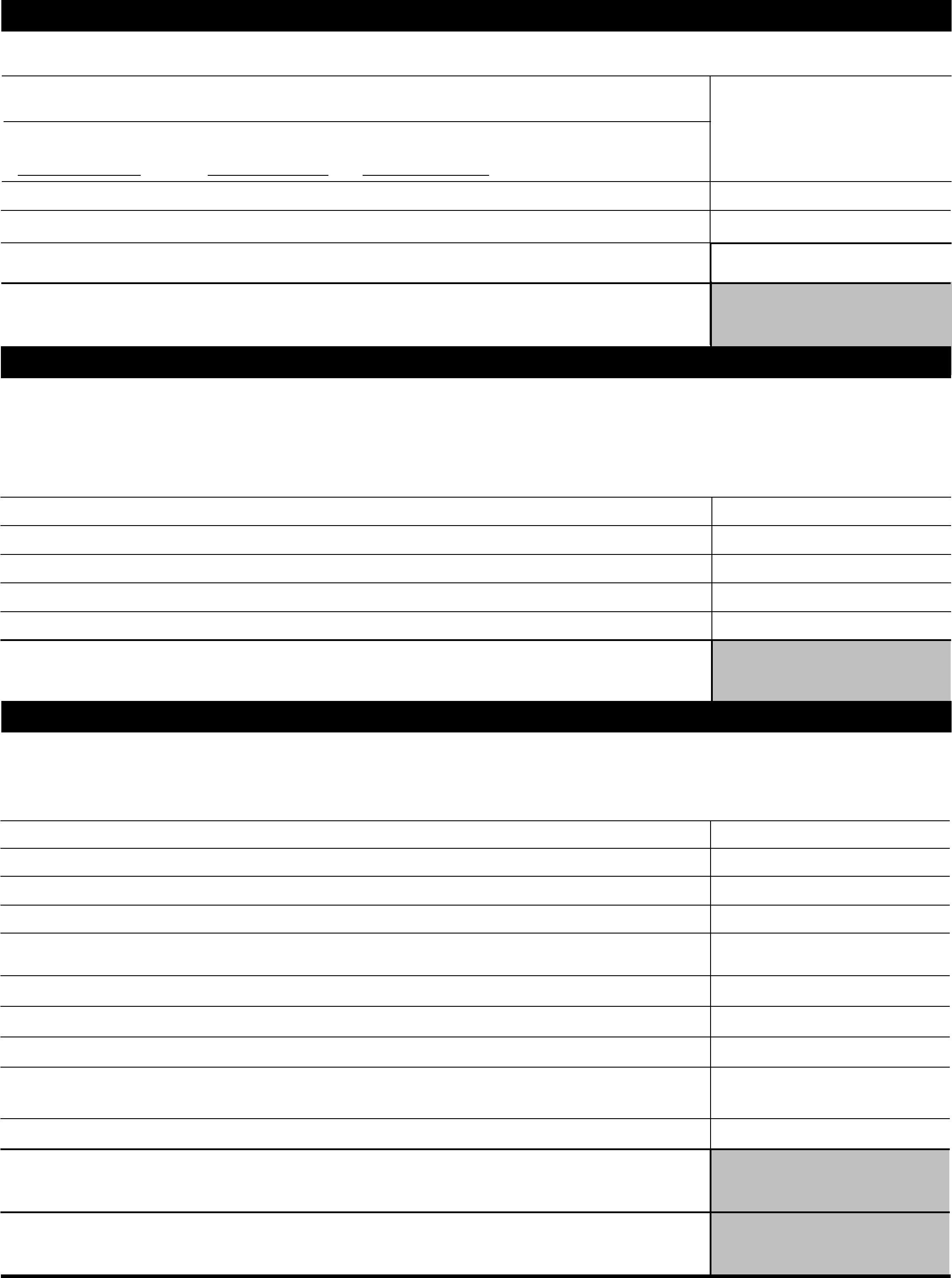

Business InformationSection 1

Business Name Employer Identification Number

Business Address (street, city, state, zip code)

County of Business Location

Description of Business and dba or "Trade Name"

Primary Phone

( )

-

Secondary Phone

( )

-

Business website address

Mailing Address

(if different from above or Post Office Box number)

Fax Number

( ) -

Federal Contractor

Yes No

Total Number of Employees

Frequency of Tax Deposits Average Gross Monthly Payroll

$

Does the business outsource its payroll processing and tax

return preparation for a fee?

Yes No

If yes, list provider name and address in box below

(Street, City, State, ZIP Code)

Provide information about all partners, officers, LLC members, major shareholders (foreign and domestic), etc., associated with the

business. Include attachments if additional space is needed.

Last Name First Name

Title

Percent of Ownership and Annual Salary

Social Security Number

Primary Phone

( ) -

Secondary Phone

( ) -

Home Address

(Street, City, State, ZIP Code)

Last Name First Name

Title

Percent of Ownership and Annual Salary

Social Security Number

Primary Phone

( ) -

Secondary Phone

( ) -

Home Address

(Street, City, State, ZIP Code)

Last Name First Name

Title

Percent of Ownership and Annual Salary

Social Security Number

Primary Phone

( ) -

Secondary Phone

( ) -

Home Address

(Street, City, State, ZIP Code)

Catalog Number 55897B

www.irs.gov

Form

433-B (OIC) (Rev. 1-2014)

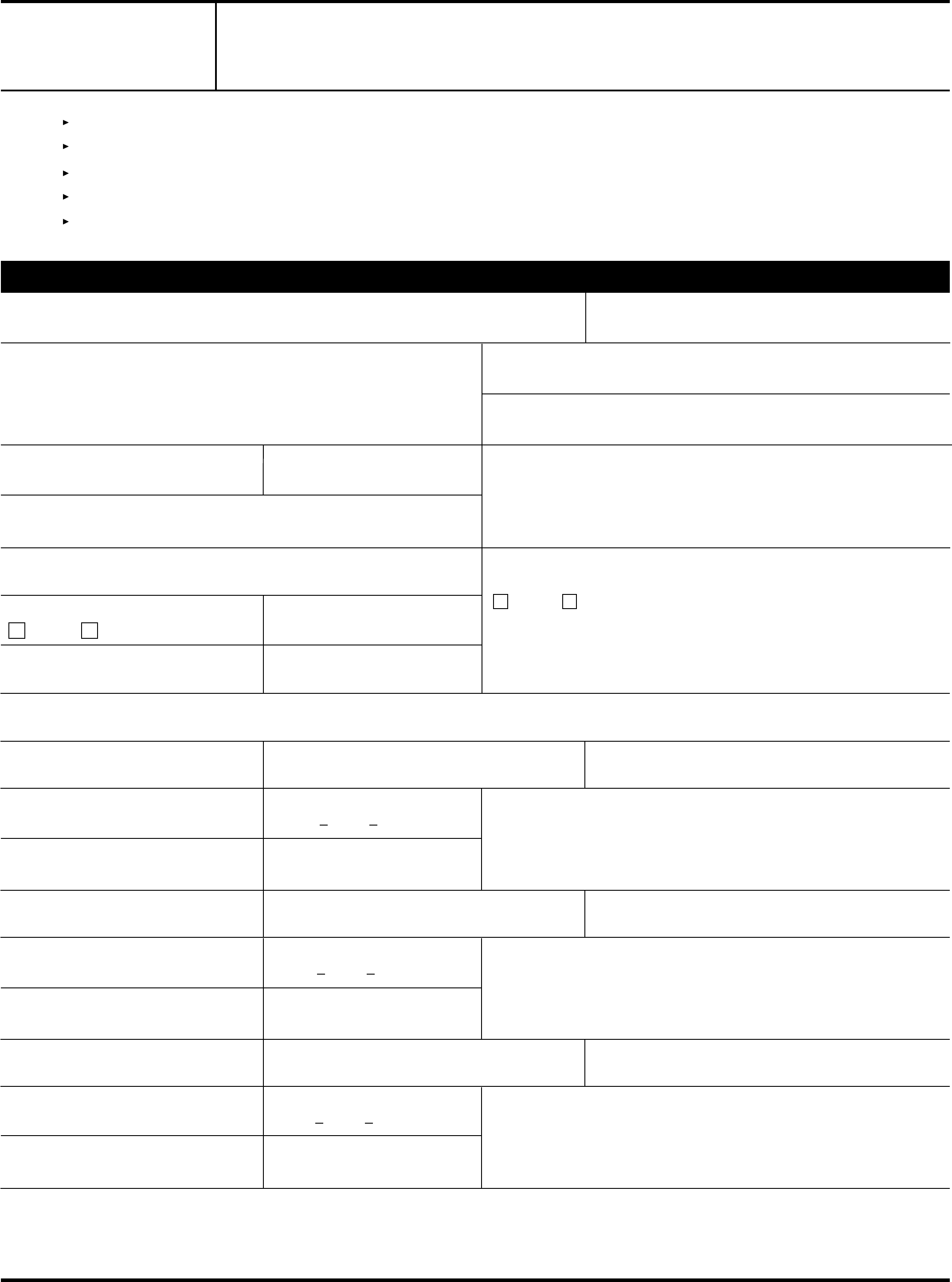

Page 2 of 6

Section 2

Business Asset Information

Gather the most current statement from banks, lenders on loans, mortgages (including second mortgages), monthly payments, loan balances, and

accountant's depreciation schedules, if applicable. Also, include make/model/year/mileage of vehicles and current value of business assets. To

estimate the current value, you may consult resources like Kelley Blue Book (www.kbb.com), NADA (www.nada.com), local real estate postings of

properties similar to yours, and any other websites or publications that show what the business assets would be worth if you were to sell them. Asset

value is subject to adjustment by IRS. Enter the total amount available for each of the following (if additional space is needed, please include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash Checking Savings Money Market Online Account Stored Value Card

Bank Name Account Number

(1a) $

Checking Savings Money Market Online Account Stored Value Card

Bank Name Account Number

(1b) $

Checking Savings Money Market Online Account Stored Value Card

Bank Name Account Number

(1c) $

Total value of bank accounts from attachment

(1d) $

Add lines (1a) through (1d) =

(1) $

Investment Account:

Stocks Bonds Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Less Loan Balance

– $ =

(2a) $

Investment Account:

Stocks Bonds Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Less Loan Balance

– $ =

(2b) $

Total of investment accounts from attachment. [current market value X.8 less loan balance(s)]

(2c) $

Add lines (2a) through (2c) =

(2) $

Notes Receivable

Do you have notes receivable?

Yes No

If yes, attach current listing which includes name, age, and amount of note(s) receivable.

Accounts Receivable

Do you have accounts receivable, including e-payment, factoring

companies, and any bartering or online auction accounts?

Yes No

If yes, you may be asked to provide a list of name, age, and amount of the account(s) receivable.

Catalog Number 55897B

www.irs.gov

Form

433-B (OIC) (Rev. 1-2014)

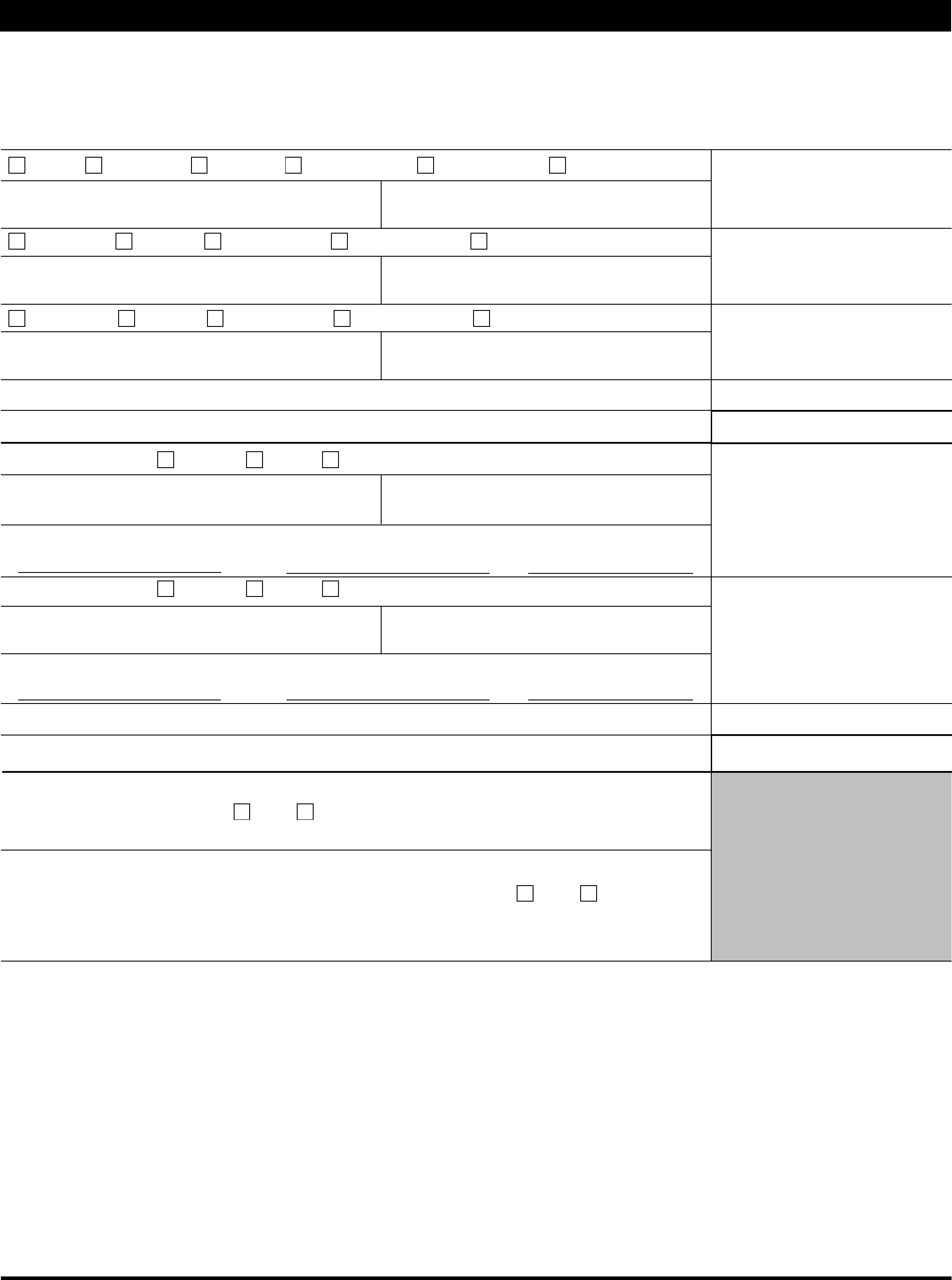

Page 3 of 6

Section 2 (Continued)

Business Asset Information

If the business owns more properties, vehicles, or equipment than shown in this form, please list on an attachment.

Real Estate

(Buildings, Lots, Commercial Property, etc.)

Property Address (Street Address, City, State, ZIP

Code)

Property Description

Date Purchased

Name of Creditor

Date of Final Payment

County and Country

Current Market Value

$

X .8 = $

Less Loan Balance (Mortgages, etc.)

– $

Total Value of Real Estate = (3a) $

Property Address

(Street Address, City, State, ZIP

Code)

Property Description Date Purchased

Name of Creditor Date of Final Payment

County and Country

Current Market Value

$

X .8 = $

Less Loan Balance (Mortgages, etc.)

– $

Total Value of Real Estate = (3b) $

Total value of property(s) listed from attachment [current market value X .8 less any loan balance(s)]

(3c) $

Add lines (3a) through (3c) =

(3) $

Business Vehicles (cars, boats, motorcycles, trailers, etc.). If additional space is needed, list on an attachment.

Vehicle Make & Model

Year

Date Purchased Mileage or Use Hours

Lease

Loan

Monthly Lease/Loan Amount

$

Name of Creditor Date of Final Payment

Current Market Value

$

X .8 = $

Less Loan Balance

– $

Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) =

(4a) $

Vehicle Make & Model

Year Date Purchased Mileage or Use Hours

Lease

Loan

Monthly Lease/Loan Amount

$

Name of Creditor Date of Final Payment

Current Market Value

$

X .8 = $

Less Loan Balance

– $

Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) =

(4b) $

Vehicle Make & Model Year Date Purchased Mileage or Use Hours

Loan

Lease

Monthly Lease/Loan Amount

$

Name of Creditor Date of Final Payment

Current Market Value

$

X .8 = $

Less Loan Balance

– $

Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) =

(4c) $

Total value of vehicles listed from attachment [current market value X .8 less any loan balance(s)]

(4d) $

Add lines (4a) through (4d) =

(4) $

Catalog Number 55897B

www.irs.gov

Form

433-B (OIC) (Rev. 1-2014)

Page 4 of 6

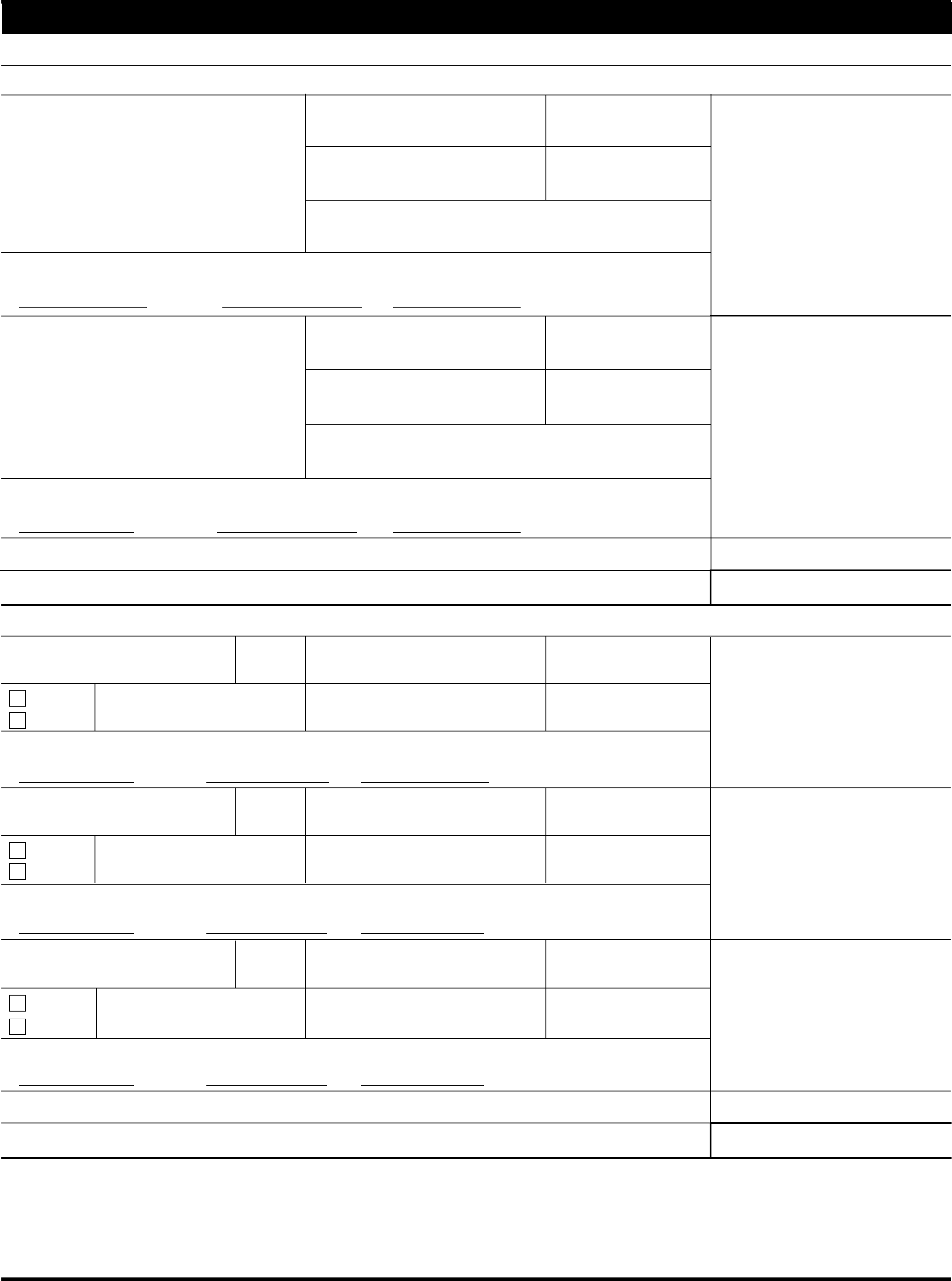

Section 2 (Continued)

Business Asset Information

Other Business Equipment

[If you have more than one piece of equipment, please list on a separate attachment and put the total of all equipment in box (5b)]

Type of equipment

Current Market Value

$ X .8 = $

Less Loan Balance

– $

Total value of equipment

(if leased or used in the production of

income enter 0 as the total value)

=

(5a) $

Total value of equipment listed from attachment [current market value X .8 less any loan balance(s)]

(5b) $

IRS allowed exemption for professional books and tools of trade -

(5c) $ [4,470]

Total value of all business equipment =

Add lines (5a) and (5b) minus line (5c), if number is less than zero, enter zero =

(5) $

Do not include amount on the lines with a letter beside the number. Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0".

Add lines (1) through (5) and enter the amount in Box A =

$

Box A

Available Equity in Assets

Section 3

Business Income Information

Enter the average gross monthly income of your business. To determine your gross monthly income use the most recent 6-12 months documentation

of commissions, invoices, gross receipts from sales/services, etc.; most recent 6-12 months earnings statements, etc., from every other source of

income (such as rental income, interest and dividends, or subsidies); or you may use the most recent 6-12 months Profit and Loss (P&L) to provide the

information of income and expenses.

Note: If you provide a current profit and loss statement for the information below, enter the total gross monthly income in Box B below. Do

not complete lines (6) - (10).

Gross receipts (6) $

Gross rental income (7) $

Interest income (8) $

Dividends (9) $

Other income (Specify on attachment)

(10) $

Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0".

Add lines (6) through (10) and enter the amount in Box B =

$

Box B

Total Business Income

Section 4

Business Expense Information

Enter the average gross monthly expenses for your business using your most recent 6-12 months statements, bills, receipts, or other documents

showing monthly recurring expenses.

Note: If you provide a current profit and loss statement for the information below, enter the total monthly expenses in Box C below. Do not

complete lines (11) - (20).

Materials purchased (e.g., items directly related to the production of a product or service)

(11) $

Inventory purchased (e.g., goods bought for resale)

(12) $

Gross wages and salaries (13) $

Rent (14) $

Supplies (items used to conduct business and used up within one year, e.g., books, office supplies, professional

equipment, etc.)

(15) $

Utilities/telephones (16) $

Vehicle costs (gas, oil, repairs, maintenance)

(17) $

Insurance (other than life)

(18) $

Current taxes (e.g., real estate, state, and local income tax, excise franchise, occupational, personal property,

sales and employer's portion of employment taxes, etc.)

(19) $

Other expenses (e.g., secured debt payments. Specify on attachment. Do not include credit card payments)

(20) $

Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0".

Add lines (11) through (20) and enter the amount in Box C =

$

Box C

Total Business Expenses

Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0".

Subtract Box C from Box B and enter the amount in Box D =

$

Box D

Remaining Monthly Income

Catalog Number 55897B

www.irs.gov

Form

433-B (OIC) (Rev. 1-2014)

Page 5 of 6

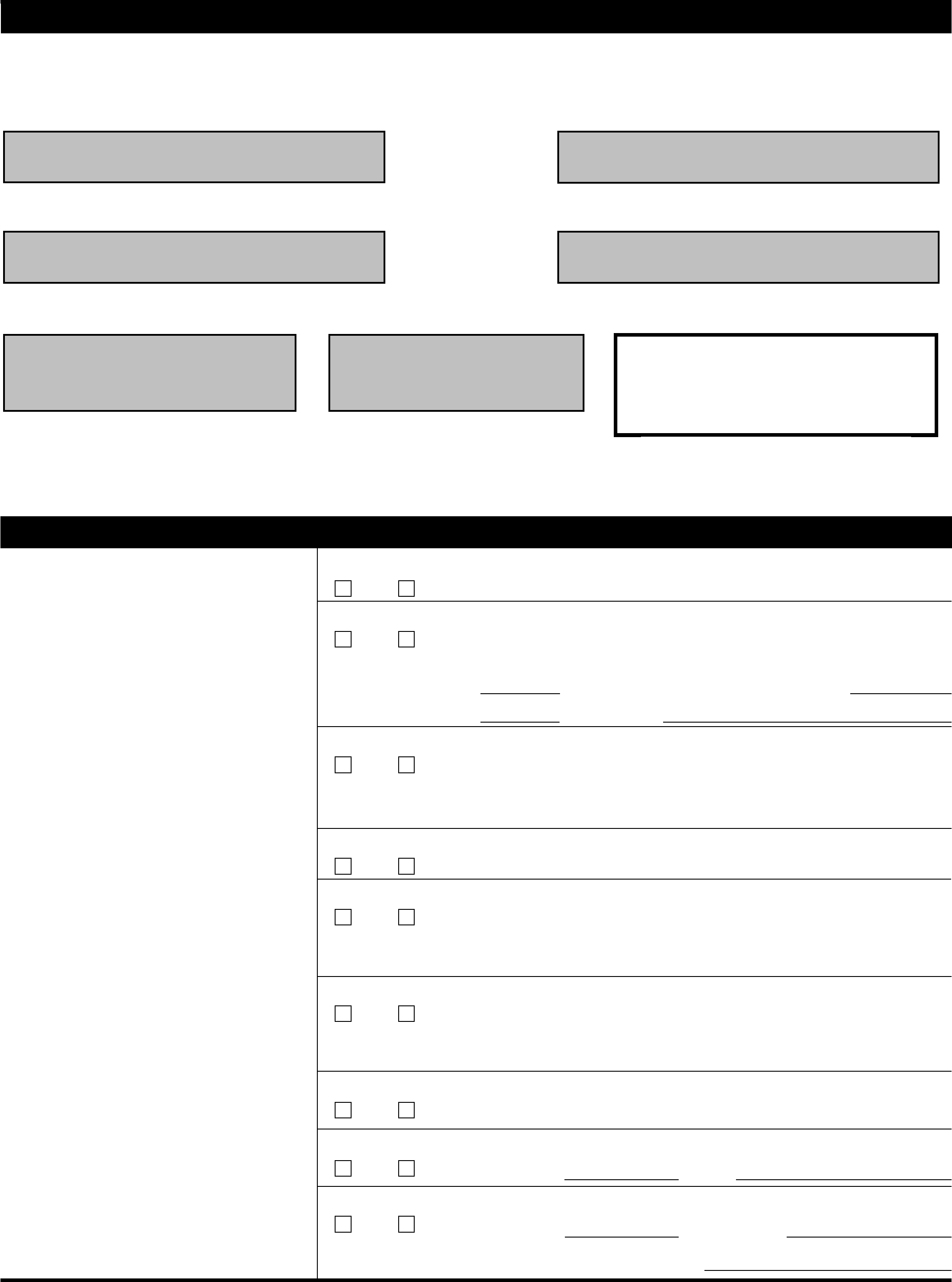

Section 5

Calculate Your Minimum Offer Amount

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount.

Paying over a shorter period of time will result in a smaller minimum offer amount.

If you will pay your offer in 5 months or less, multiply "Remaining Monthly Income" (Box D) by 12 to get "Future Remaining Income." Do not enter a

number less than zero.

$

Round to the nearest whole dollar.

Enter the amount from Box D

X 12 =

$

Box E Future Remaining Income

If you will pay your offer in more than 5 months, multiply "Remaining Monthly Income" (from Box D) by 24 to get "Future Remaining Income." Do not

enter a number less than zero.

$

Enter the amount from Box D

X 24 =

$

Box F Future Remaining Income

Determine your minimum offer amount by adding the total available assets from Box A to amount in either Box E or Box F. Your offer amount must

be more than zero.

$

Enter the amount from Box A*

+

$

Enter the amount from either

Box E or Box F

=

$

Offer Amount

Your offer must be more than zero ($0).

Do not leave blank. Use whole dollars only.

If you cannot pay the offer amount due to special circumstances, explain on the Form 656, Offer in Compromise, Section 3. You must offer

something.

*You may exclude any equity in income producing assets shown in Section 2 of this form.

Section 6 Other Information

Additional information IRS needs to

consider settlement of your tax debt. If this

business is currently in a bankruptcy

proceeding, the business is not eligible to

apply for an offer.

Is the business currently in bankruptcy?

Yes No

Has the business ever filed bankruptcy?

Yes No

If yes, provide:

Date Filed

(mm/dd/yyyy) Date Dismissed or Discharged (mm/dd/yyyy)

Petition No. Location Filed

Does this business have other business affiliations (e.g., subsidiary or parent companies)?

Yes No

If yes, list the Name and Employer Identification Number:

Do any related parties (e.g., partners, officers, employees) owe money to the business?

Yes No

Is the business currently, or in the past, a party to a lawsuit?

Yes No

If yes, date the lawsuit was resolved:

In the past 10 years, has the business transferred any assets for less than their full value?

Yes No

If yes, provide date and type of asset transferred:

Has the business been located outside the U.S. for 6 months or longer in the past 10 years?

Yes No

Does the business have any funds being held in trust by a third party?

Yes No

If yes, how much $ Where:

Yes No

Does the business have any lines of credit?

If yes, credit limit $ Amount owed $

What property secures the line of credit?

Catalog Number 55897B

www.irs.gov

Form

433-B (OIC) (Rev. 1-2014)

Page 6 of 6

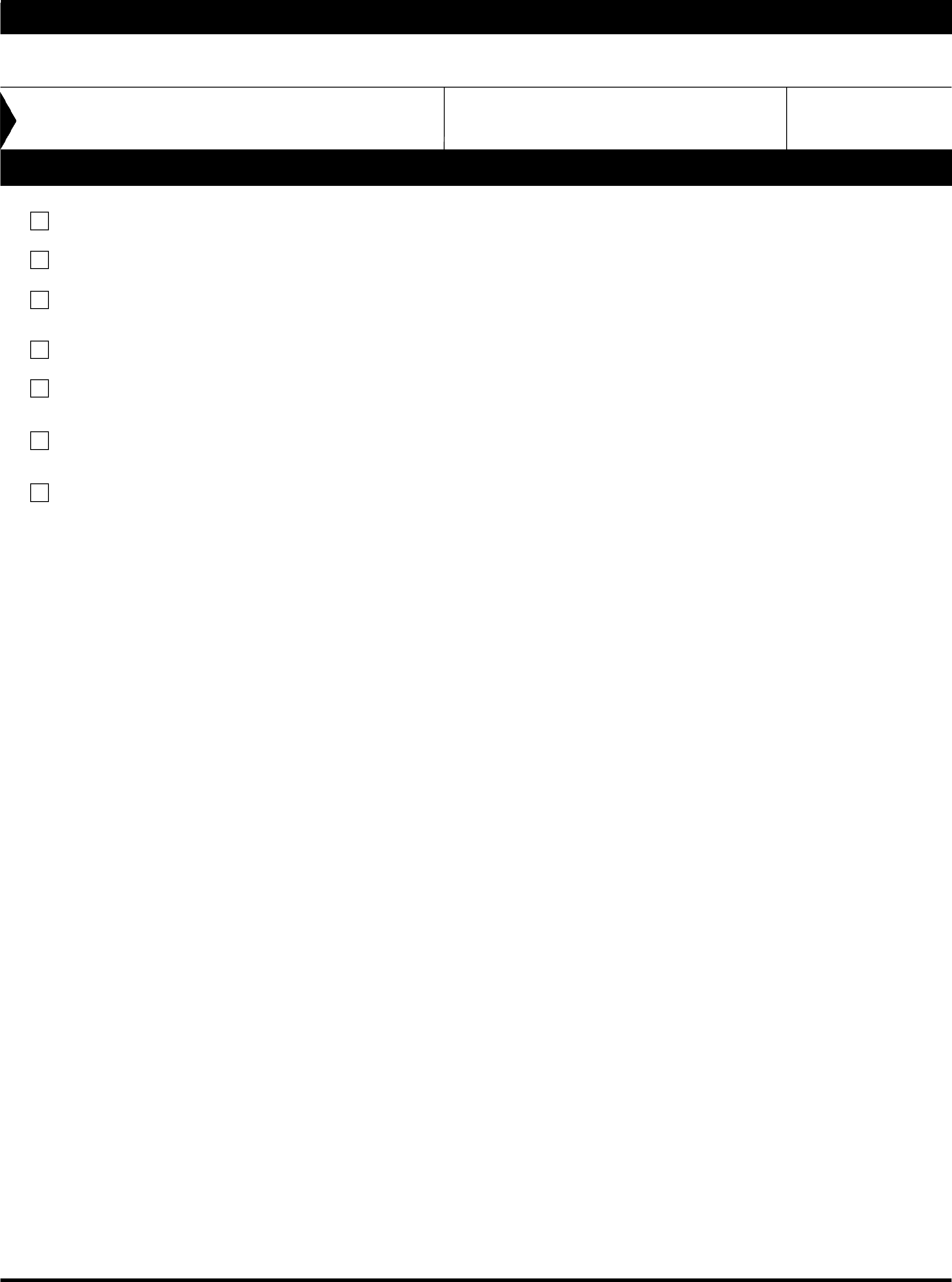

Section 7 Signatures

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best of my knowledge

it is true, correct, and complete.

Signature of Taxpayer

Title

Date

(mm/dd/yyyy)

Remember to include all applicable attachments from list below.

A current Profit and Loss statement covering at least the most recent 6-12 month period, if appropriate.

Copies of the three most recent statements for each bank, investment, and retirement account.

If an asset is used as collateral on a loan, include copies of the most recent statement from lender(s) on loans, monthly

payments, loan payoffs, and balances.

Copies of the most recent statement of outstanding notes receivable.

Copies of the most recent statements from lenders on loans, mortgages (including second mortgages), monthly payments,

loan payoffs, and balances.

Copies of relevant supporting documentation of the special circumstances described in the "Explanation of Circumstances"

on Form 656, if applicable.

Attach a Form 2848, Power of Attorney, if you would like your attorney, CPA, or enrolled agent to represent you and you

do not have a current form on file with the IRS.

Catalog Number 55897B

www.irs.gov

Form

433-B (OIC) (Rev. 1-2014)