Fillable Printable Contingency Fee Agreement - Datnow's

Fillable Printable Contingency Fee Agreement - Datnow's

Contingency Fee Agreement - Datnow's

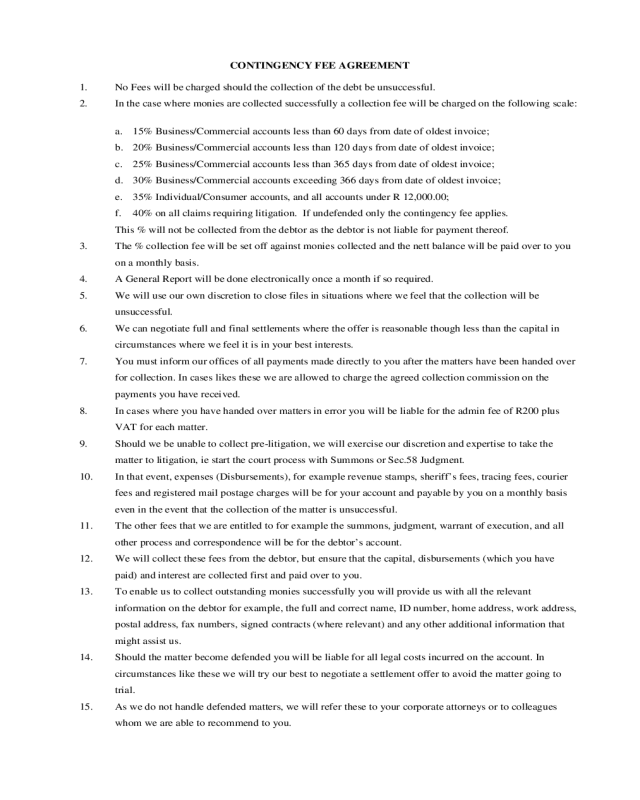

CONTINGENCY FEE AGREEMENT

1. No Fees will be charged should the collection of the debt be unsuccessful.

2. In the case where monies are collected successfully a collection fee will be charged on the following scale:

a. 15% Business/Commercial accounts less than 60 days from date of oldest invoice;

b. 20% Business/Commercial accounts less than 120 days from date of oldest invoice;

c. 25% Business/Commercial accounts less than 365 days from date of oldest invoice;

d. 30% Business/Commercial accounts exceeding 366 days from date of oldest invoice;

e. 35% Individual/Consumer accounts, and all accounts under R 12,000.00;

f. 40% on all claims requiring litigation. If undefended only the contingency fee applies.

This % will not be collected from the debtor as the debtor is not liable for payment thereof.

3. The % collection fee will be set off against monies collected and the nett balance will be paid over to you

on a monthly basis.

4. A General Report will be done electronically once a month if so required.

5. We will use our own discretion to close files in situations where we feel that the collection will be

unsuccessful.

6. We can negotiate full and final settlements where the offer is reasonable though less than the capital in

circumstances where we feel it is in your best interests.

7. You must inform our offices of all payments made directly to you after the matters have been handed over

for collection. In cases likes these we are allowed to charge the agreed collection commission on the

payments you have received.

8. In cases where you have handed over matters in error you will be liable for the admin fee of R200 plus

VAT for each matter.

9. Should we be unable to collect pre-litigation, we will exercise our discretion and expertise to take the

matter to litigation, ie start the court process with Summons or Sec.58 Judgment.

10. In that event, expenses (Disbursements), for example revenue stamps, sheriff’s fees, tracing fees, courier

fees and registered mail postage charges will be for your account and payable by you on a monthly basis

even in the event that the collection of the matter is unsuccessful.

11. The other fees that we are entitled to for example the summons, judgment, warrant of execution, and all

other process and correspondence will be for the debtor’s account.

12. We will collect these fees from the debtor, but ensure that the capital, disbursements (which you have

paid) and interest are collected first and paid over to you.

13. To enable us to collect outstanding monies successfully you will provide us with all the relevant

information on the debtor for example, the full and correct name, ID number, home address, work address,

postal address, fax numbers, signed contracts (where relevant) and any other additional information that

might assist us.

14. Should the matter become defended you will be liable for all legal costs incurred on the account. In

circumstances like these we will try our best to negotiate a settlement offer to avoid the matter going to

trial.

15. As we do not handle defended matters, we will refer these to your corporate attorneys or to colleagues

whom we are able to recommend to you.