Fillable Printable Employee Loan Application Form Sample

Fillable Printable Employee Loan Application Form Sample

Employee Loan Application Form Sample

Page 1 of 2

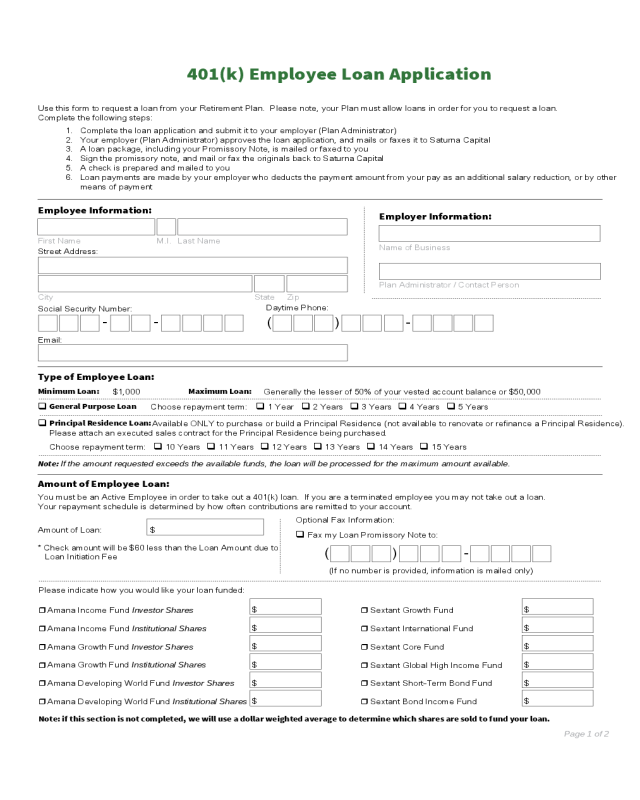

401(k) Employee Loan Application

Type of Employee Loan:

Minimum Loan:

$1,000

Maximum Loan:

Generally the lesser of 50% of your vested account balance or $50,000

General Purpose Loan

Choose repayment term: 1 Year 2 Years 3 Years 4 Years 5 Years

Principal Residence Loan:

Available ONLY to purchase or build a Principal Residence (not available to renovate or refinance a Principal Residence).

Please attach an executed sales contract for the Principal Residence being purchased.

Choose repayment term:

10 Years

11 Years

12 Years

13 Years

14 Years

15 Years

Note: If the amount requested exceeds the available funds, the loan will be processed for the maximum amount available.

Employer Information:

Name of Business

Plan Administrator / Contact Person

Employee Information:

Email:

Street Address:

City State Zip

Last NameFirst Name M.I.

Use this form to request a loan from your Retirement Plan. Please note, your Plan must allow loans in order for you to request a loan.

Complete the following steps:

1. Complete the loan application and submit it to your employer (Plan Administrator)

2. Your employer (Plan Administrator) approves the loan application, and mails or faxes it to Saturna Capital

3. A loan package, including your Promissory Note, is mailed or faxed to you

4. Sign the promissory note, and mail or fax the originals back to Saturna Capital

5. A check is prepared and mailed to you

6. Loan payments are made by your employer who deducts the payment amount from your pay as an additional salary reduction, or by other

means of payment

Amount of Employee Loan:

You must be an Active Employee in order to take out a 401(k) loan. If you are a terminated employee you may not take out a loan.

Your repayment schedule is determined by how often contributions are remitted to your account.

Amount of Loan:

$

* Check amount will be $60 less than the Loan Amount due to

Loan Initiation Fee

- -

Social Security Number:

Daytime Phone:

( ) -

Optional Fax Information:

Fax my Loan Promissory Note to:

(If no number is provided, information is mailed only)

( ) -

Please indicate how you would like your loan funded:

Note: if this section is not completed, we will use a dollar weighted average to determine which shares are sold to fund your loan.

$

$

$

$

$

$

$

$

$

$

$

$

❒

Amana Income Fund Investor Shares

❒

Amana Income Fund Institutional Shares

❒

Amana Growth Fund Investor Shares

❒

Amana Growth Fund Institutional Shares

❒ Amana Developing World Fund Investor Shares

❒ Amana Developing World Fund Institutional Shares

❒

Sextant Growth Fund

❒ Sextant International Fund

❒

Sextant Core Fund

❒ Sextant Global High Income Fund

❒ Sextant Short-Term Bond Fund

❒ Sextant Bond Income Fund

Page 2 of 2

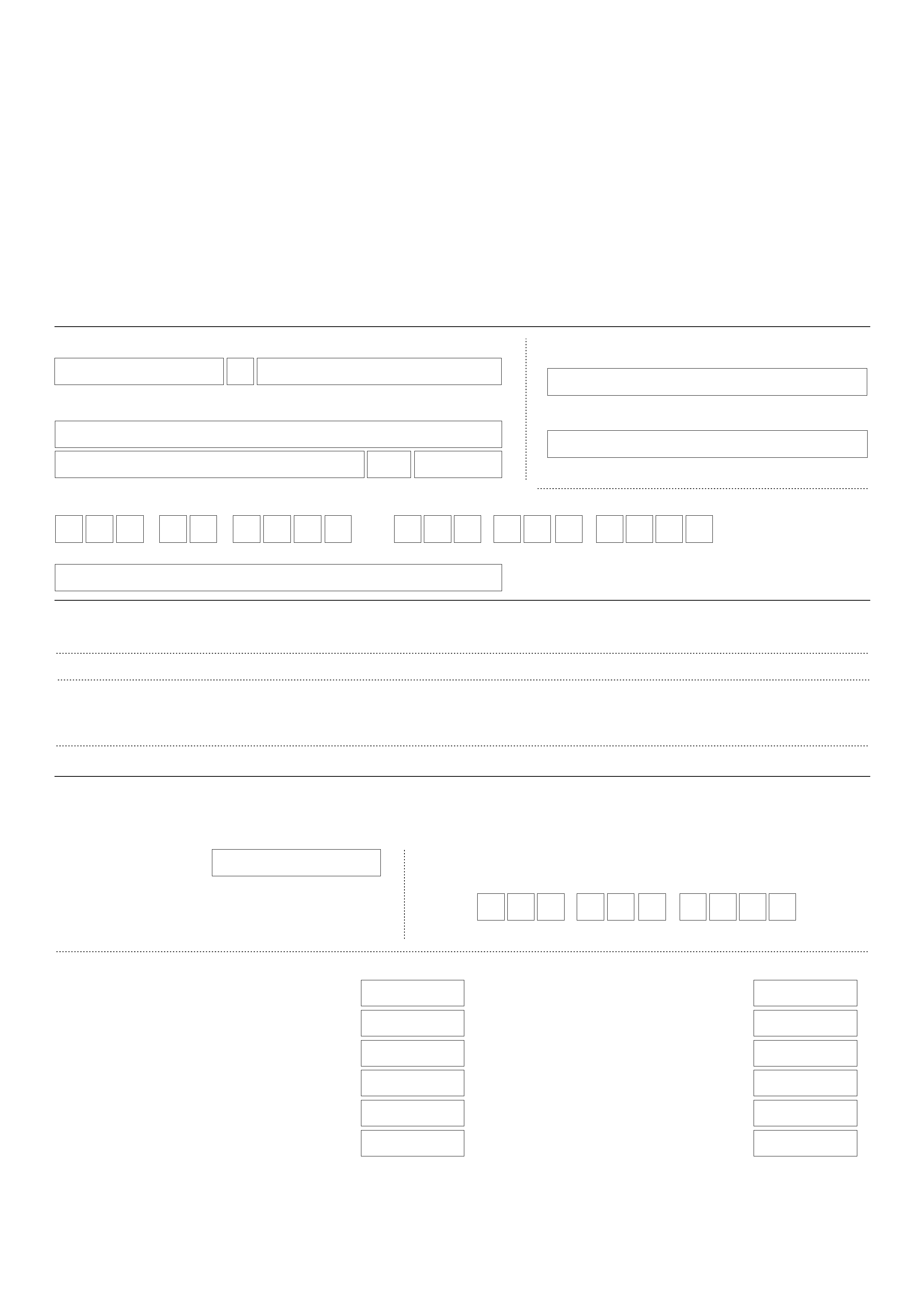

401(k) Employee Loan Application

Cost

– A loan fee in the amount of $60 shall be deducted from the loan

amount approved.

Optional Express Delivery

– Prevailing rates apply to expedited courier

service. Delivery times cannot be guaranteed, and charges are non-

refundable. Express delivery is available for deliveries Monday through

Friday only and is not available to P.O. boxes. Delivery is not guaranteed

to all areas.

Amount of Loan

– The maximum loan amount, when added to the

outstanding balance of all other loans from all qualified plans sponsored

by your employer, is generally the lesser of 50% of your vested account

balance, or $50,000 reduced by the excess, if any, of your highest total

outstanding balance of all such loans for the one-year period ending on

the day before the date the loan is made, over the outstanding balance of

loans from all such qualified employer plans on the date the loan is made.

Source and Application of Funds

– Loan disbursements will be made

on a prorated basis from each of your current investment options as

indicated on your loan application, or Saturna Capital will use a dollar

weighted average to determine which funds to liquidate to fund the loan

proceeds.

Eligibility

– You must be actively employed to take a loan. Note that if

you file bankruptcy, the bankruptcy court may prohibit the plan from

processing your repayments through payroll deduction.

Interest Rate Determination

– For loans originating in any given month,

interest due will be based on the designated rate for your Plan on the first

business day of each month, and such rate is fixed for the life of the loan.

The interest rate is set at the current Prime Rate as published in the Wall

Street Journal.

Repayment

– Payments can be made by payroll deduction or other

means. If you choose payroll deduction, Saturna Capital will notify your

employer’s payroll department at the time a loan is made, indicating

the dollar amount your employer must begin deducting from your pay

each pay period according to the payroll frequency selected on the

first page of this form. You should refer to your promissory note and/or

amortization schedule for information as to the amount and due date of

each payment. It is entirely your responsibility to ensure that timely loan

repayments are being remitted to Saturna Capital by your employer’s

payroll department to avoid the tax consequences associated with a

defaulted plan loan.

Principal repayments and interest payments shall be reinvested in your

account in accordance with your current investment elections.

Default

– If the sum of all loan payments due in a calendar quarter is not

made and payment is not received by the end of the following calendar

quarter, pursuant to Internal Revenue Code rules and regulations, the

loan will be in default and the entire outstanding loan balance, including

accrued but unpaid interest, shall be deemed distributed and will be

tax reported to you. This entire amount must be included in your gross

income in the calendar year of default. An IRS premature withdrawal

penalty may also apply. Borrowers who default on a loan from the Plan

may be prohibited from obtaining future loans from the Plan.

Prepayment

– Prepayment in full of the outstanding loan principal and

the accrued interest may be made no earlier than the next loan payment

due date. Arrangements for a full payment must be made by contacting

Saturna Capital for a prepayment figure no more than two weeks before

the payoff.

Full Distributions

– Before a full distribution can be processed, you must

have experienced a distributable event and elect to treat the loan as a

taxable distribution. All outstanding loan principal and accrued interest

shall be treated as a distribution from the Plan on the date of death. The

loan cannot be transferred to, or assumed by, your beneficiary. In addition,

the amount of the outstanding loan will be tax reported as a distribution

to you or your estate, as applicable.

Indemnification

– Saturna Capital Corporation accepts no responsibility

for any adverse tax consequences to you resulting from your failure to

adhere to the terms of this agreement and all applicable federal and state

loan laws, and you hereby hold Saturna Capital harmless from any claim,

of whatever nature, from yourself, your creditors, your family, your heirs,

successors and assigns in connection with this agreement.

Please forward completed paperwork to Saturna at:

Saturna Capital Corporation

Attn: 401(k) Dept.

1300 North State Street

Bellingham, WA 98225

Phone: 1-800-SATURNA

Fax: 1-360-734-0755

Online: www.saturna.com

Terms and Conditions

Plan Administrator Signature: Date:

Employee Signature: Date:

(Please sign and submit to your Employer/Plan Administrator.)

Employee Authorization:

I hereby acknowledge that I have read, understand and agree to all pages of this 401(k) Employee Loan Application form. I affirm that all information

that I have provided is true and correct. I will refer to the fund’s prospectus and/or disclosure documents for more information. I certify that the amount

requested does not exceed the allowable amount described in the Terms and Conditions below. I understand that payments are to be made by payroll

deduction and are due according to the amortization schedule that I receive.