- Withholding Allowance Certificate - Washington D.C.

- Employees Withholding Allowance Certificate - Kansas

- Employee Withholding Allowance/Exemption Certificate - Minnesota

- Employee's Withholding Exemption Certificate - Mississippi

- Employee's Withholding Exemption Certificate - Massachusetts

- Employee's Withholding Exemption and County Status Certificate - Indiana

Fillable Printable Employee Withholding Allowance/Exemption Certificate - Minnesota

Fillable Printable Employee Withholding Allowance/Exemption Certificate - Minnesota

Employee Withholding Allowance/Exemption Certificate - Minnesota

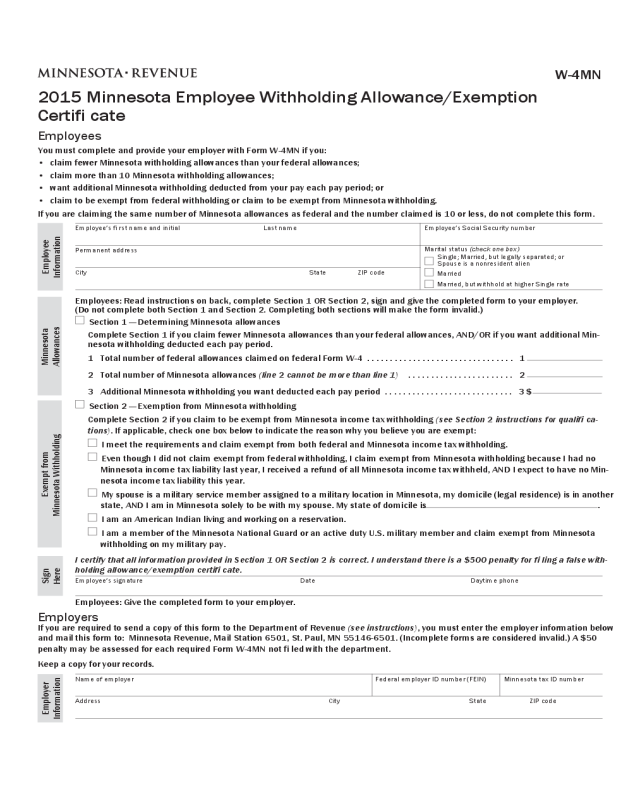

Exempt from

Minnesota Withholding

Section 2 — Exemption from Minnesota withholding

Complete Section 2 if you claim to be exempt from Minnesota income tax withholding (see Section 2 instructions for qualifi ca-

tions). If applicable, check one box below to indicate the reason why you believe you are exempt:

I meet the requirements and claim exempt from both federal and Minnesota income tax withholding.

Even though I did not claim exempt from federal withholding, I claim exempt from Minnesota withholding because I had no

Minnesota income tax liability last year, I received a refund of all Minnesota income tax withheld, AND I expect to have no Min-

nesota income tax liability this year.

My spouse is a military service member assigned to a military location in Minnesota, my domicile (legal residence) is in another

state, AND I am in Minnesota solely to be with my spouse. My state of domicile is .

I am an American Indian living and working on a reservation.

I am a member of the Minnesota National Guard or an active duty U.S. military member and claim exempt from Minnesota

withholding on my military pay.

W-4MN

2015 Minnesota Employee Withholding Allowance/Exemption

Certifi cate

Employees: Give the completed form to your employer.

Employers

If you are required to send a copy of this form to the Department of Revenue (see instructions), you must enter the employer information below

and mail this form to: Minnesota Revenue, Mail Station 6501, St. Paul, MN 55146-6501. (Incomplete forms are considered invalid.) A $50

penalty may be assessed for each required Form W-4MN not fi led with the department.

Keep a copy for your records.

Employee’s signature Date Daytime phone

I certify that all information provided in Section 1 OR Section 2 is correct. I understand there is a $500 penalty for fi ling a false with-

holding allowance/exemption certifi cate.

Sign

Here

Employees

You must complete and provide your employer with Form W-4MN if you:

• claim fewer Minnesota withholding allowances than your federal allowances;

• claim more than 10 Minnesota withholding allowances;

• want additional Minnesota withholding deducted from your pay each pay period; or

• claim to be exempt from federal withholding or claim to be exempt from Minnesota withholding.

If you are claiming the same number of Minnesota allowances as federal and the number claimed is 10 or less, do not complete this form.

Employee’s fi rst name and initial Last name Employee’s Social Security number

Permanent address

Marital status (check one box)

City State ZIP code

Married

Married, but withhold at higher Single rate

Employee

Information

Single; Married, but legally separated; or

Spouse is a nonresident alien

Employees: Read instructions on back, complete Section 1 OR Section 2, sign and give the completed form to your employer.

(Do not complete both Section 1 and Section 2. Completing both sections will make the form invalid.)

Section 1 — Determining Minnesota allowances

Complete Section 1 if you claim fewer Minnesota allowances than your federal allowances, AND/OR if you want additional Min-

nesota withholding deducted each pay period.

1 Total number of federal allowances claimed on federal Form W-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total number of Minnesota allowances (line 2 cannot be more than line 1) . . . . . . . . . . . . . . . . . . . . . . . 2

3 Additional Minnesota withholding you want deducted each pay period . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $

Minnesota

Allowances

Name of employer Federal employer ID number (FEIN) Minnesota tax ID number

Address City State ZIP code

Employer

Information

Form W-4MN Instructions

When to Complete

Aft er you determine the number of federal

withholding allowances to claim on federal

Form W-4, you must determine the number

of Minnesota withholding allowances to

claim.

If you claim the same number of Minne-

sota allowances as federal and the number

claimed is 10 or less, you do not need to

complete Form W-4MN. Your employer

will use the same number as on your federal

Form W-4 to determine the amount of Min-

nesota income tax to withhold.

You must complete Form W-4MN and

provide it to your employer, if you:

• choose to claim fewer Minnesota allow-

ances than for federal purposes (Min-

nesota allowances cannot exceed the

number of federal allowances);

• claim more than 10 Minnesota allow-

ances (

Note:

Your employer is required to

provide copies of your completed Form

W-4MN to the department);

• request additional Minnesota withhold-

ing be deducted each pay period; or

• claim to be exempt from Minnesota in-

come tax withholding and you reasonably

expect your wages to exceed $200 per

week

(see Section 2 instructions)

.

Consider completing a new Form W-4MN

whenever your personal or fi nancial situa-

tion changes. If you have not had suffi cient

income tax withheld from your wages, inter-

est and/or penalty charges may be assessed

when you fi le your individual income tax

return.

Note:

An employee who submits a false Form

W-4MN may be subject to a $500 penalty.

Section 1 — Minnesota Allowances

Do not claim more than the correct number

of allowances. If you claim every allow-

ance to which you are entitled and you still

expect to owe more income tax for the year

than will be withheld, you may:

• increase your withholding by claiming

fewer allowances; or

• enter into an agreement with your em-

ployer to have additional amounts with-

held

(see line 3 instructions)

.

Line 3. If you claim no Minnesota allow-

ances on line 2, and you still expect to have

a balance due on your tax return for the

year, you may ask your employer to with-

hold an additional amount of tax each pay

period. If your employer agrees, enter the

additional amount you want withheld from

each paycheck on line 3.

Section 2 — Minnesota Exemption

If you are exempt from Minnesota with-

holding, your employer will not withhold

Minnesota income tax from your pay. To

claim exemption, you must meet one of the

following requirements:

• You meet the federal requirements; you

claim exempt from federal withholding

on Form W-4 and you also want to claim

exempt from Minnesota withholding; you

had no Minnesota income tax liability in

the prior year; you received a full refund

of Minnesota tax withheld; and you

expect to have no Minnesota income tax

liability for the current year. OR

• You qualify as exempt from Minnesota

withholding under the Soldiers and

Sailors Civil Relief Act. To qualify, you

must be the spouse of a military mem-

ber assigned to duty in Minnesota, be

domiciled in another state and be present

in Minnesota solely to be with your active

duty military member spouse. OR

If you are claiming the same number of Minnesota allowances as federal and the number claimed is 10 or less,

there is no need for you to complete this form.

Continued

• You are a member of an American Indian

tribe living and working on the reserva-

tion of which you are an enrolled member.

OR

• Your wages are for Minnesota National

Guard (MNG) pay or for active duty U.S.

military pay. MNG and active duty U.S.

military members can claim exempt from

Minnesota withholding on these wages,

even if taxable federally. Visit our website

to view Income Tax Fact Sheet #5 for fur-

ther tax information regarding military

personnel.

Note:

In order to avoid owing tax at the end

of the year, you may not want to claim ex-

empt if you (and/or your spouse when fi ling

a joint return) expect to have other forms of

income subject to Minnesota tax.

If you claim exempt from Minnesota with-

holding, you must provide your employer

with a new Form W-4MN by February 15th

of each year. If your wages are expected to

exceed $200 per week, your employer is re-

quired to furnish a copy to the department.

If another person can claim you as a depen-

dent on his or her federal tax return, you

cannot claim exempt from Minnesota with-

holding if your annual income exceeds $950

and includes more than $300 of unearned

income.

Employee Instructions

Use of Information

All information on Form W-4MN is

private by state law. It cannot be given

to others without your consent, except

to the Internal Revenue Service and to

other states that guarantee the same

privacy. Your name, address and Social

Security number are required for

identifi cation. Information about your

allowances is required to determine

your correct tax. We ask for your phone

number so we can call you if we have a

question.

Form W-4MN Instructions

All new employees must complete federal

Form W-4 when they fi rst begin work for

you. If the employee claims the same num-

ber of Minnesota allowances as federal, does

not request additional Minnesota with-

holding be deducted or claims exempt from

Minnesota withholding, there is no need for

the employee to complete Form W-4MN.

When determining Minnesota withhold-

ing, use the same number of allowances the

employee listed on Form W-4.

If the employee does not give you a com-

pleted Form W-4 or Form W-4MN before

the fi rst wage payment, withhold Min-

nesota tax as if the employee is single with

zero withholding allowances. You are not

required to verify the number of allowances

claimed by each employee.

You should honor each Form W-4MN you

receive unless we notify you otherwise or if

the employee claims more Minnesota than

federal allowances. If the employee claims

more Minnesota than federal allowances,

use the number of federal allowances to

determine the Minnesota withholding

(see

Section 1)

.

For more information, see

When to Com-

plete

under

Employee Instructions

. Keep all

forms in your records.

If your employee claims exempt from Min-

nesota withholding, they must provide you

with a new Form W-4MN by Feb. 15 of each

year. Exempt forms received during the year

must be submitted to the department within

30 days of receipt from the employee.

When to Send Copies

You must send copies of Form W-4MN to

the department if the employee:

• claims more than 10 Minnesota with-

holding allowances; or

• claims to be exempt from Minnesota

withholding and you reasonably expect

the employee’s wages to exceed $200

per week (

Exception:

If the employee is

a resident of a reciprocity state and has

completed Form MWR); or

• you believe the employee is not entitled to

the number of allowances claimed.

If the employee is only asking to have

additional Minnesota withholding to be de-

ducted, there is no need to submit the Form

W-4MN to the department.

A $50 penalty may be assessed for each

required Form W-4MN not fi led with the

department.

Invalid Forms W-4MN

Th e following situations make the Form

W-4MN invalid:

• any unauthorized change or addition to

the form, including any change to the lan-

guage certifying the form is correct;

• if, by the date an employee gives it to

you, he or she indicates in any way the

form is false;

• the form is incomplete or lacks the neces-

sary signatures;

• both Section 1 AND Section 2 were com-

pleted;

• the employer information is incomplete.

If you receive an invalid form, do not use

it to fi gure Minnesota income tax with-

holding. Tell the employee it is invalid and

they must complete and submit a new one.

If the employee does not give you a valid

one, withhold taxes as if the employee was

single and claiming zero withholding al-

lowances. However, if you have an earlier

Form W-4MN for this worker that is valid,

withhold as you did before.

Employer Instructions