- Employee's Withholding Allowance Certificate - New Jersey

- Employee's Withholding Exemption Certificate - Virginia

- Employee's Withholding Certificate - Connecticut

- Employee's Withholding Exemption Certificate - Arkansas

- Employee Withholding Exemption Certificate - Michigan

- Income Certification - Texas

Fillable Printable Income Certification - Texas

Fillable Printable Income Certification - Texas

Income Certification - Texas

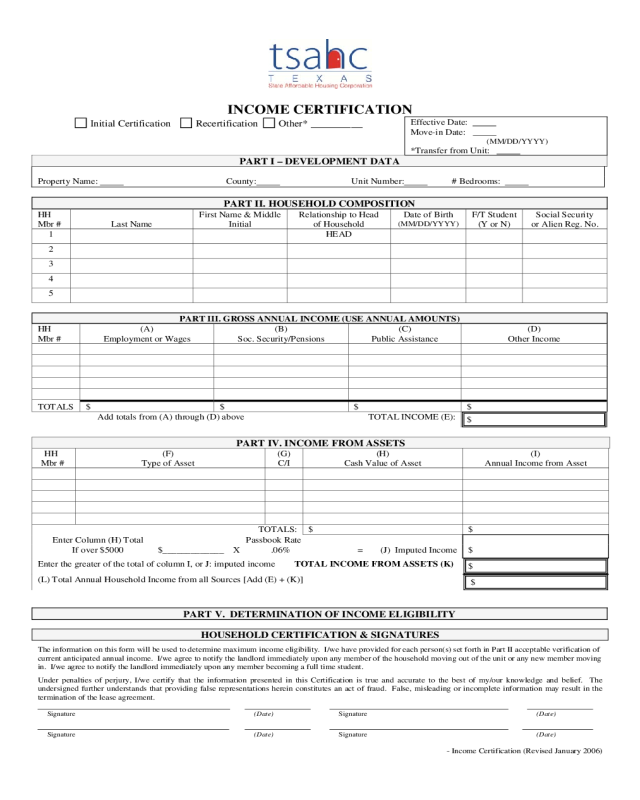

INCOME CERTIFICATION

HOUSEHOLD CERTIFICATION & SIGNATURES

The information on this form will be used to determine ma ximum income eligibility. I/we have provided for each person(s) set forth in Part II acceptable verification of

current anticipated annual income. I/we agree to notify the landlord immediately upon any me mber of the household moving out o f the unit or any new member moving

in. I/we agree to notify the landlord imm e diately upon any member becoming a full time student.

Under penalties of perjury, I/we certify that the information presented in this Certification is true and accurate to the best of my/our knowledge and belief. The

undersigned further understands that providing false representations herein constitutes an act of fraud. False, misleading or incomplete information may result in the

termination of the lease agreement.

Signature (Date) Signature (Date)

Signature (Date) Signature (Date)

- Income Certification (Revised January 2006)

Initial Certification Recertification Other* _________

Effective Date:

Move-in Date:

(MM/DD/YYYY)

*Transfer from Unit:

PART I – DEVELOPMENT DATA

Property Name: County: Unit Number: # Bedrooms:

PART II. HOUSEHOLD COMPOSITION

HH

Mbr #

Last Name

First Name & Middle

Initial

Relationship to Head

of Household

Date of Birth

(MM/DD/YYYY)

F/T Student

(Y or N)

Social Security

or Alien Reg. No.

1 HEAD

2

3

4

5

PART III. GROSS ANNUAL INCOME (USE ANNUAL AMOUNTS)

HH

Mbr #

(A)

Employment or Wages

(B)

Soc. Security/Pensions

(C)

Public Assistance

(D)

Other Income

TOTALS $ $ $ $

Add totals from (A) through (D) above TOTAL INCOME (E):

$

PART IV. INCOME FROM ASSETS

HH

Mbr #

(F)

Type of Asset

(G)

C/I

(H)

Cash Value of Asset

(I)

Annual Income from Asset

TOTALS: $ $

Enter Column (H) Total Passbook Rate

If over $5000 $_____________ X .06% = (J) Imputed Income $

Enter the greater of the total of column I, or J: imputed income TOTAL INCOME FROM ASSETS (K)

$

(L) Total Annual Household Income from all Sources [Add (E) + (K)]

$

PART V. DETERMINATION OF INCOME ELIGIBILITY

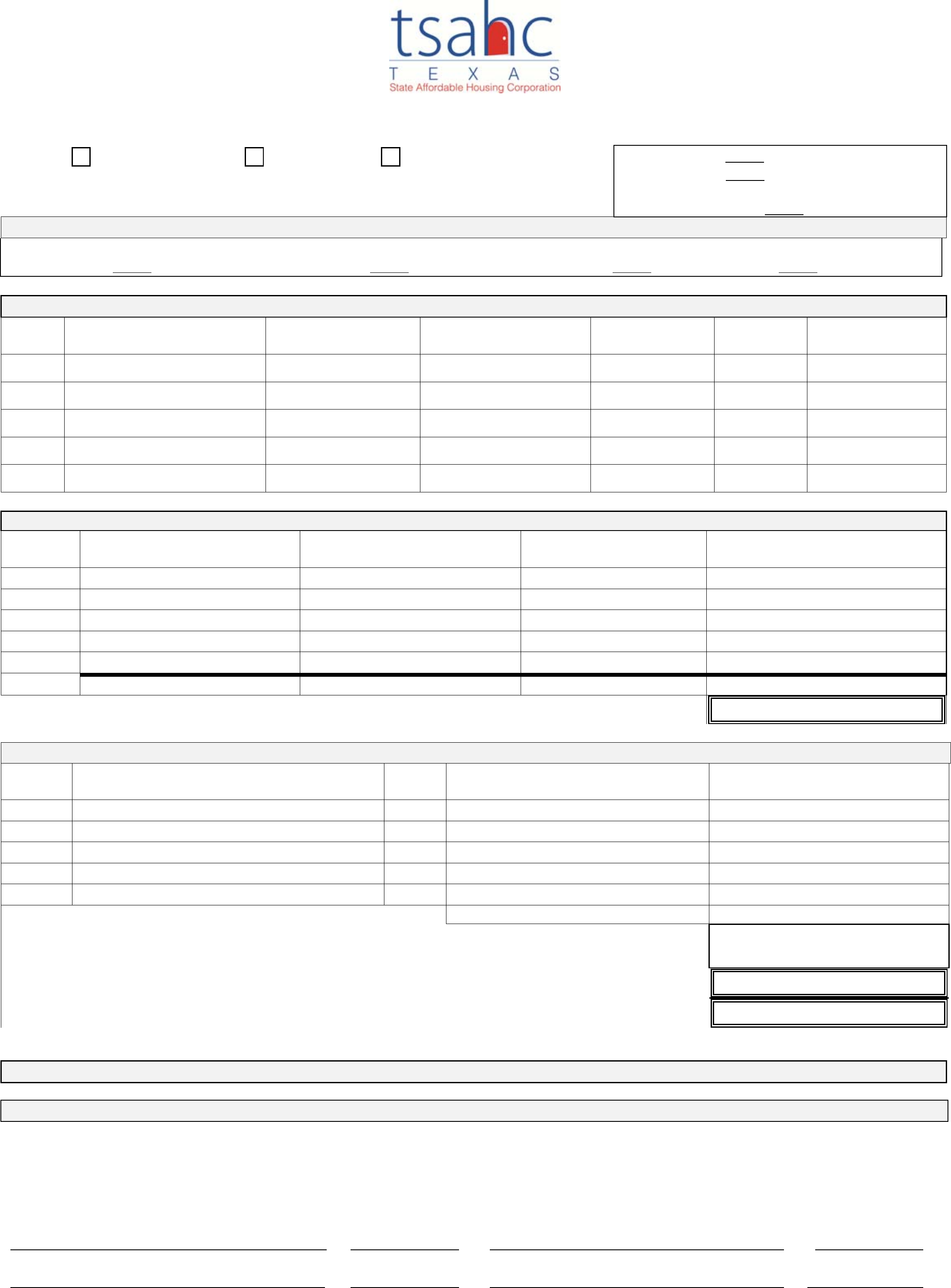

Page 2 - Income Certification (Revised January 2006)

TOTAL ANNUAL HOUSEHOLD INCOME

FROM ALL SOURCES:

From item (L) on page 1

$

Household Meets Income

Restriction at:

50% 60%

80% OI

RECERTIFICATION ONLY

:

Current Income Limit x 140%:

$

(optional) __________________

Household Income exceeds 140% at

recertification:

Yes No

Current Income Limit per Family Size:

$

Household Income at Move-in : $ Household Size at Move-in:

PART VI. RENT

A. Tenant Paid Rent: $

B. Rent Assistance: $

Unit Meets Rent Restriction at:

C. Other non-optional charges $ 50% 60% 80% OI

D. Gross Rent For Unit $

Maximum Rent Limit for this unit:

$ /

ARE ALL OCCUPANTS FULL TIME STUDENTS? If ye s, Stude nts must be Married and filing a joint Income Tax Return

(also attach documentation)

yes no

PART VIII. PROGRAM TYPE

This household’s unit will be counted toward the property’s occupancy requirements. Indicate the household’s income status as established by this

certification/recertification.

50% 60% 80% OI** ** Upon recertification, household was determined over-income (OI) according to

eligibility requirements of the program(s) marked above.

SIGNATURE OF OWNER/REPRESENTATIVE

Based on the representations herein and upon the proofs and documentation required to be submitted, the individual(s) named in Part II of this

Income Certification is/are eligible under the provisions of program’s rules and regulations to live in a unit in this Project.

_____________________________________________ _____________

SIGNATURE OF OWNER/REPRESENTATIVE DATE