- Employee's Withholding Exemption Certificate - Arkansas

- Income Certification - Texas

- Employee's Withholding Exemption Certificate - Virginia

- Employee's Withholding Allowance Certificate - New Jersey

- Employee Withholding Exemption Certificate - Michigan

- Employee's Withholding Certificate - Connecticut

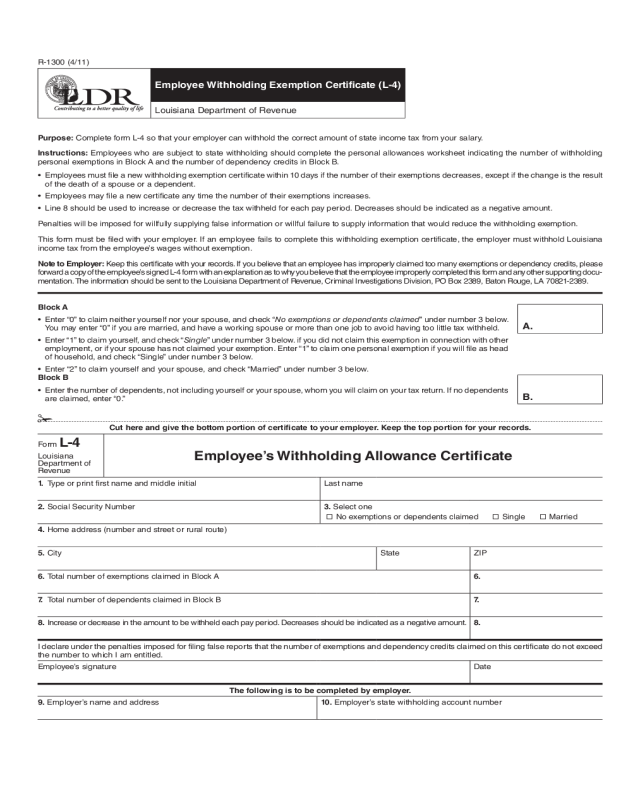

Fillable Printable Employee Withholding Exemption Certificate (L-4) -Louisiana

Fillable Printable Employee Withholding Exemption Certificate (L-4) -Louisiana

Employee Withholding Exemption Certificate (L-4) -Louisiana

Employee Withholding Exemption Certicate (L-4)

Louisiana Department of Revenue

Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary.

Instructions: Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding

personal exemptions in Block A and the number of dependency credits in Block B.

• Employeesmustleanewwithholdingexemptioncerticatewithin10daysifthenumberoftheirexemptionsdecreases,exceptifthechangeistheresult

of the death of a spouse or a dependent.

• Employeesmayleanewcerticateanytimethenumberoftheirexemptionsincreases.

• Line8shouldbeusedtoincreaseordecreasethetaxwithheldforeachpayperiod.Decreasesshouldbeindicatedasanegativeamount.

Penalties will be imposed for willfully supplying false information or willful failure to supply information that would reduce the withholding exemption.

Thisformmustbeledwithyouremployer.Ifanemployeefailstocompletethiswithholdingexemptioncerticate,theemployermustwithholdLouisiana

income tax from the employee’s wages without exemption.

Note to Employer:Keepthiscerticatewithyourrecords.Ifyoubelievethatanemployeehasimproperlyclaimedtoomanyexemptionsordependencycredits,please

forward a copy of the employee’s signed L-4 form with an explanation as to why you believe that the employee improperly completed this form and any other supporting docu-

mentation.TheinformationshouldbesenttotheLouisianaDepartmentofRevenue,CriminalInvestigationsDivision,POBox2389,BatonRouge,LA70821-2389.

Block A

• Enter“0”toclaimneitheryourselfnoryourspouse,andcheck“No exemptions or dependents claimed”undernumber3below.

Youmayenter“0”ifyouaremarried,andhaveaworkingspouseormorethanonejobtoavoidhavingtoolittletaxwithheld.

• Enter“1”toclaimyourself,andcheck“Single”undernumber3below.ifyoudidnotclaimthisexemptioninconnectionwithother

employment,orifyourspousehasnotclaimedyourexemption.Enter“1”toclaimonepersonalexemptionifyouwillleashead

ofhousehold,andcheck“Single”undernumber3below.

• Enter“2”toclaimyourselfandyourspouse,andcheck“Married”undernumber3below.

A.

Block B

• Enterthenumberofdependents,notincludingyourselforyourspouse,whomyouwillclaimonyourtaxreturn.Ifnodependents

areclaimed,enter“0.”

B.

Cut here and give the bottom portion of certicate to your employer. Keep the top portion for your records.

Form L-4

Louisiana

Department of

Revenue

Employee’s Withholding Allowance Certicate

1. Typeorprintrstnameandmiddleinitial Last name

2. SocialSecurityNumber 3. Selectone

NoexemptionsordependentsclaimedSingleMarried

4. Home address (number and street or rural route)

5. City State ZIP

6. Total number of exemptions claimed in Block A 6.

7. Total number of dependents claimed in Block B 7.

8.Increaseordecreaseintheamounttobewithheldeachpayperiod.Decreasesshouldbeindicatedasanegativeamount. 8.

Ideclareunderthepenaltiesimposedforlingfalsereportsthatthenumberofexemptionsanddependencycreditsclaimedonthiscerticatedonotexceed

thenumbertowhichIamentitled.

Employee’s signature Date

The following is to be completed by employer.

9. Employer’s name and address 10. Employer’s state withholding account number

R-1300(4/11)