Fillable Printable Employees Pension Scheme 1995 Form Sample

Fillable Printable Employees Pension Scheme 1995 Form Sample

Employees Pension Scheme 1995 Form Sample

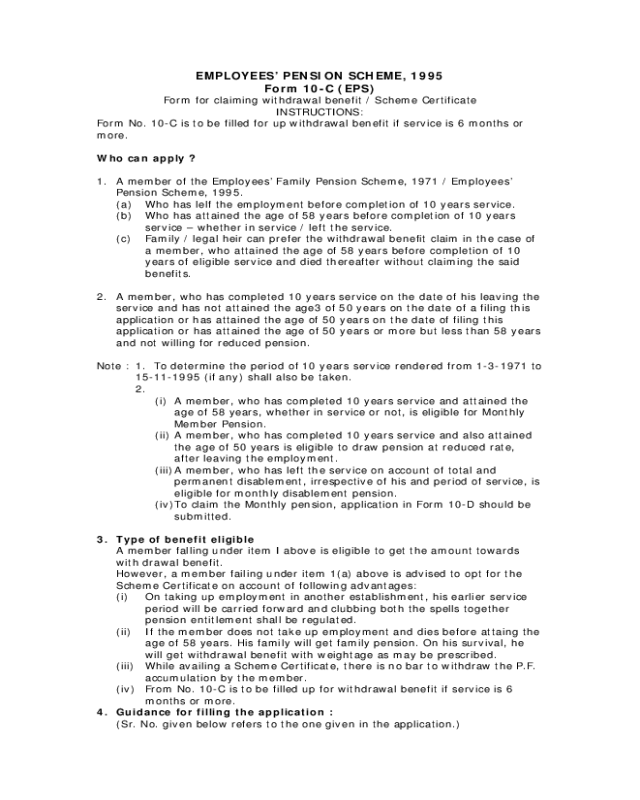

EMPLOYEES’ PENSION SCHEME, 1995

Form 10-C (EPS)

Form for claiming withdrawal benefit / Scheme Certificate

INSTRUCTIONS:

Form No. 10-C is to be filled for up withdrawal benefit if service is 6 months or

more.

Who can apply ?

1. A member of the Employees’ Family Pension Scheme, 1971 / Employees’

Pension Scheme, 1995.

(a) Who has lelf the employment before completion of 10 years service.

(b) Who has attained the age of 58 years before completion of 10 years

service – whether in service / left the service.

(c) Family / legal heir can prefer t he withdrawal benefit claim in the case of

a member, who attained the age of 58 years before completion of 10

years of eligible service and died thereafter without claiming the said

benefits.

2. A member, who has completed 10 years service on the date of his leaving the

service and has not attained the age3 of 50 years on the date of a filing this

application or has attained the age of 50 years on the date of filing this

application or has attained the age of 50 years or more but less than 58 years

and not willing for reduced pension.

Note : 1. To determine the period of 10 years service rendered from 1-3-1971 to

15-11-1995 (if any) shall also be taken.

2.

(i) A member, who has completed 10 years service and attained the

age of 58 years, whether in service or not, is eligible for Monthly

Member Pension.

(ii) A member, who has completed 10 years service and also attained

the age of 50 years is eligible to draw pension at redu ced rate,

after leaving the employment.

(iii) A member, who has left the service on account of total and

permanent disablement, irrespective of his and period of service, is

eligible for monthly disablement pension.

(iv) To claim the Monthly pen s ion, application in Form 10-D should be

submitted.

3. Type of benefit eligible

A member falling under item I above is eligible to get the amount towards

with drawal benefit.

However, a member failing under item 1(a) above is advised to opt for the

Scheme Certificate on account of following advantages:

(i) On taking up employment in another establishment, his earlier service

period will be carried forward and clubbing both the spells together

pension entitlement shall be regulated.

(ii) If the member does not take up employment and dies before attaing the

age of 58 years. His family will get family pension. On his survival, he

will get withdrawal benefit with weightage as may be prescribed.

(iii) While availing a Scheme Certificate, there is no bar to withdraw the P.F.

accumulation by the member.

(iv) From No. 10-C is to be filled up for withdrawal benefit if service is 6

months or more.

4. Guidance for filling the application :

(Sr. No. given below refers to the one given in the application.)

Sr. No. 1(a) : Writ e your name in CAPITAL letters as given in the service

record of your establishment.

1(b) : To be furnished only when the application preferred by a

person other than the member himself (i.e. Nominee/family

member)

2 : The exact date of birth of the member should be given.

3 to 7 : Particulars should be written clearly without any overwriting of

cutting, Correction if any, be attested.

8 : The option is to be given by the member only if he not

rendered 10 years service and eligible for withdrawal benefit.

9 : Complete particulars if nominee an d family (spouse and all

children) should be given without fall.

10 : To be furnished when the claim is preferred by nominee of the

family member(s).

11 : To be completed only when a member is eligible for

withdrawal benefit and opted for it in lieu of Scheme

Certificate (not applicable to those who are entitled for

Scheme Certificate or opted for Scheme Certificate in lieu of

withdrawal benefit.)

12 : In case, the member is drawing Family Pension / Pension

under the Employees’ Pension Scheme 1995, the details

should be furnished.

Advance Report :

To be given where the withdrawal benefit is admissible and opted for payment

by cheque.(The Advance Receipt need not be signed by member, if the

payment is opted through Money order).

Attestation of claim form :

The claim should preferable be attested by the employer under whom the

member was last employed. If for any reason, the claimant is unable to get

the application attested by his exemployer, he may forward the claim to the

Provident Fund Office duly clarifying the position, after getting it attested by

any one of the following authorized officials :

(i) Manager of the Bank where the member is holding an account.

(ii) Head of Education Institution

(iii) A Gazetted Officer

(iv) Sub-Post Master

(v) The Magistrate

(vi) Member of Central Board of Trustees, Employees’ Provident Fund or

Regional Committee.

(vii) Chairman / Secretary / Panchayat / Member of the Muncipal / District /

Local Board.

(viii) President of the village Union / Panchayat / Member of parliament /

Member of Legislative Assembly.

(ix) Any other officer approved by the Regional P. F. Commissioner.

5. Four further guidance / clarification required, if any, the Public Relation Officer

in the nearest Provident Fund Office (including Provident Fund Inspectorates)

may be contacted.

6. The status of the claim can be verified from the website www.epfindia.com

Form available fee of cost.

A. C. Gr. No. ___________

Serial No. _____________

Employer’s Tel. No. : ______________

Member’s or Contect Tel. No : _______

Inquiry Tel. No. : 27542251

Website : www.epfindia.com

For Office use only

Inward No.

Form No. 10-C (E.P.S.)

EMPLOYEES’ PENSION SCHEME, 1995

Form to be used by a member of the Employees’ Pension Scheme, 1995 for

Claming Withdrawal benefit / Scheme Certificate

(Read INSTRUCTIONS before filling in this form)

Form No. 10-C is to be filled for up withdrawal benefit if service is 6 months or

more.

1 Name of the Member :

(In Block Letter)

Name of the claimant(s) :

2 Date of Birth :

3 Marital Status :

4 Father’s Name :

Husband’s Name :

(if applicable)

:

5 Name & address of the

Establishment in which, t he member

was last employed

:

Region/SRO

Code

Esstt. Code No. A/c. No.

6 Code No. & Account No.

7 Reason for leaving service & Date of

leaving

:

8 Full Postal Address

(In Block Letters)

Shri/Smt./Kum./S/o / W/o / D/o

:

PIN

9 Are you willing to accept Scheme Certif icate in

lieu of withdrawal benefits?

(a)

Yes

(b)

No

10 Particulars of Family (Spouse & Children & Nominee)

Name

Date of

Birth

Relationship

with

Member

Name of the

guardian of

minor

(A) Family Member

(B) Nominee

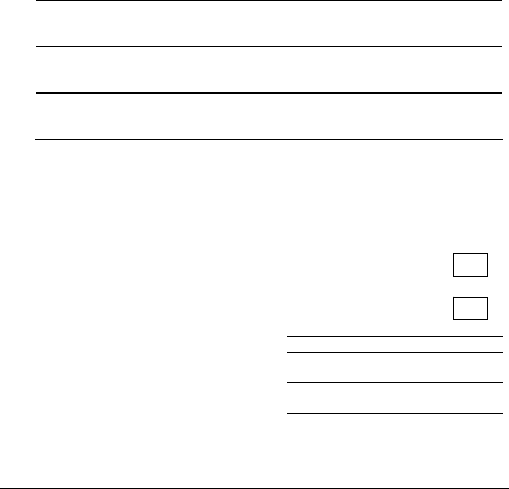

11 In case of death of member after attaining the age of 58 years without

filling the claim :

(A) Date of death of member : _________________

(B) Name of the Claimant(s) / and relationship with the members

_______________

12 MODE OF REMITTANCE (PUT A TICK IN THE BOX AGAINST THE ONE

OPTED)

(a) Bypostal money order at my cost to the address given

against Item No. 7

(b) Account payee cheque sent direct for credit to my SB

A/c. (Scheduled / Co. Operative Bank/Post) Under intimation

to me.

S.B. Account No. :

Name of the Bank :

(In Block Letters)

Branch :

(In Block Letters)

Full Address of the Branch :

(In Block Letters)

13 Are you availing Pension under EPS-95 ? If, so, indicate : PPO No.______

_____________By whom issued ________________________________

CERTIFIED THAT THE PARTICULARS ARE TRUE TO THE BEST OF MY KNOWLEDGE

Date: Signature or left Hand Thumb impression of the Member/Claiment(s)

ADVANCE STAMPED RECEIPT

(To be furnished only in case of 12(b) abov e)

Received a sum of Rs. ____________ (Rupees __________________________ )

only from Regional Provident Fund Commissioner / Officer-in-charge of Sub-

Regional Office _________________ by deposit in my savings Bank A/c towards

the settlement of my Pension Fund Account.

(The Space should be left blank which shall be filled by Regional Provident Fund

Commissioner / Officer- in Charge)

Signature & left hand thumb impression of the member on the stamp

Affix Rs.

1/-

Revenue

Stamp.

Certified that the particulars of the member given are correct and the member

has signed / thumb impressed before me.

The details of wages and period of non-contributory service of the member are as

under :

Form 3A/7 (EPS) enclosed for the period for which it was not sent to Employee’s

Provident Fund Office.)

Wages (Basic + D.A.) as 15-11-95(if applicable) :

Wages as on the date of exit :

Period of non contributory Service :

Year/Month/No. of Days :

Date: Signature of Employer / Authorised Offical

(FOR THE USE OF COMMISSIONER’S OFFICE)

(Under Rs. _________________________ P.I. No. ________________________

___________________________________M.O. / Cheque / Passed for payment

for Rs. _____________________________ (In Words Rupees) ______________

_________________________________________

M.O. Commission (if any) _______________________ / net amount to be paid

by M.O. ____________________________________towards withdrawal benefit.

D.H. S.S. A.A.O.

(FOR USE IN CASE SECTION)

Paid by inclusion in Cheque No. ________________ Dt. _________________

vide cash Book (Bank) Account No. 10 Debit Item No. ___________________

S.S. A.C. (Cash)

For issue of S.S.I.D.S. is enclosed.

D.H. S.S A.A.O. APFC(A/cs)

(FOR USE IN PENSION SECTION)

Scheme Certificate bearing the Control No. ______________ Date ___________

Issued on and end entered in the Scheme Certificate Control Register.

D.H. S.S A.A.O. APFC(A/cs)