Fillable Printable Farm Registration Certification - Connecticut

Fillable Printable Farm Registration Certification - Connecticut

Farm Registration Certification - Connecticut

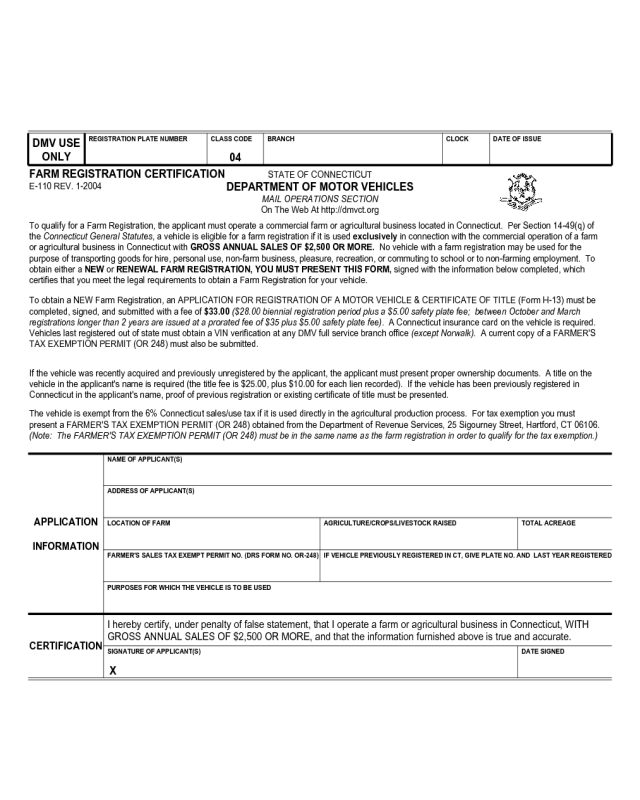

CERTIFICATION

APPLICATION

INFORMATION

FARM REGISTRATION CERTIFICATION

E-110 REV. 1-2004

STATE OF CONNECTICUT

DEPARTMENT OF MOTOR VEHICLES

MAIL OPERATIONS SECTION

On The Web At http://dmvct.org

To qualify for a Farm Registration, the applicant must operate a commercial farm or agricultural business located in Connecticut. Per Section 14-49(q) of

the Connecticut General Statutes, a vehicle is eligible for a farm registration if it is used exclusively in connection with the commercial operation of a farm

or agricultural business in Connecticut with GROSS ANNUAL SALES OF $2,500 OR MORE. No vehicle with a farm registration may be used for the

purpose of transporting goods for hire, personal use, non-farm business, pleasure, recreation, or commuting to school or to non-farming employment. To

obtain either a NEW or RENEWAL FARM REGISTRATION, YOU MUST PRESENT THIS FORM, signed with the information below completed, which

certifies that you meet the legal requirements to obtain a Farm Registration for your vehicle.

I hereby certify, under penalty of false statement, that I operate a farm or agricultural business in Connecticut, WITH

GROSS ANNUAL SALES OF $2,500 OR MORE, and that the information furnished above is true and accurate.

To obtain a NEW Farm Registration, an APPLICATION FOR REGISTRATION OF A MOTOR VEHICLE & CERTIFICATE OF TITLE (Form H-13) must be

completed, signed, and submitted with a fee of $33.00 ($28.00 biennial registration period plus a $5.00 safety plate fee; between October and March

registrations longer than 2 years are issued at a prorated fee of $35 plus $5.00 safety plate fee). A Connecticut insurance card on the vehicle is required.

Vehicles last registered out of state must obtain a VIN verification at any DMV full service branch office (except Norwalk). A current copy of a FARMER'S

TAX EXEMPTION PERMIT (OR 248) must also be submitted.

If the vehicle was recently acquired and previously unregistered by the applicant, the applicant must present proper ownership documents. A title on the

vehicle in the applicant's name is required (the title fee is $25.00, plus $10.00 for each lien recorded). If the vehicle has been previously registered in

Connecticut in the applicant's name, proof of previous registration or existing certificate of title must be presented.

The vehicle is exempt from the 6% Connecticut sales/use tax if it is used directly in the agricultural production process. For tax exemption you must

present a FARMER'S TAX EXEMPTION PERMIT (OR 248) obtained from the Department of Revenue Services, 25 Sigourney Street, Hartford, CT 06106.

(Note: The FARMER'S TAX EXEMPTION PERMIT (OR 248) must be in the same name as the farm registration in order to qualify for the tax exemption.)

DMV USE

ONLY

REGISTRATION PLATE NUMBER CLASS CODE

04

BRANCH CLOCK DATE OF ISSUE

NAME OF APPLICANT(S)

ADDRESS OF APPLICANT(S)

LOCATION OF FARM AGRICULTURE/CROPS/LIVESTOCK RAISED TOTAL ACREAGE

FARMER'S SALES TAX EXEMPT PERMIT NO. (DRS FORM NO. OR-248) IF VEHICLE PREVIOUSLY REGISTERED IN CT, GIVE PLATE NO. AND LAST YEAR REGISTERED

PURPOSES FOR WHICH THE VEHICLE IS TO BE USED

DATE SIGNEDSIGNATURE OF APPLICANT(S)

X