Fillable Printable Financial Affidavit Form 4-17

Fillable Printable Financial Affidavit Form 4-17

Financial Affidavit Form 4-17

F.C.A. §§413-1, 424-a; Art. 5-B Form 4-17

D.R.L. §§236-B, 240 (Financial Disclosure Affidavit)

10/2012

FAMILY COURT OF THE STATE OF NEW YORK

COUNTY OF

.............................................................................................

In the Matter of a Proceeding for Support Docket No.

(Commissioner of Social Services, Assignor,

on behalf of , Assignee)

FINANCIAL

Petitioner DISCLOSURE

AFFIDAVIT

-against-

Respondent.

.............................................................................................

Notice: Your signature on this form must be notarized. You are required to

attach to this form the following documents:

• Current and representative paycheck stub(s);

• Copies of your most recently filed state and federal income tax returns,

including all forms;

• A copy of the W-2 wage and tax statement(s) submitted with the returns

OR, if you did not file tax returns, a copy of your W-2 form for the most

recent year for which you filed tax returns;

• Information relating to health insurance plans available to you for the

provision of insurance, health care, dental care, optical care, prescription

drug and other pharmaceutical and health-related benefits for the

child(ren) for whom support is sought, including the costs for adding the

child(ren) to such plans; and

• Information relating to accident and life insurance plans.

STATE OF NEW YORK )

):ss.:

COUNTY OF )

I, _________________________________, the (Petitioner) (Respondent) herein, residing at ______________

__________________________________,

1

being duly sworn, depose and say that the following is an accurate

1

Unless ordered confidential, pursuant to Family Court Act §154-b, because of a risk that disclosure would

place the health, safety or liberty of the party at risk. See Form GF-21 and GF-21a, available at www.nycourts.gov.

Form 4-17 Page 2

statement of my income from all sources, my liabilities, my assets and my net worth, from whatever sources,

and whatever kind and nature, and wherever situated:

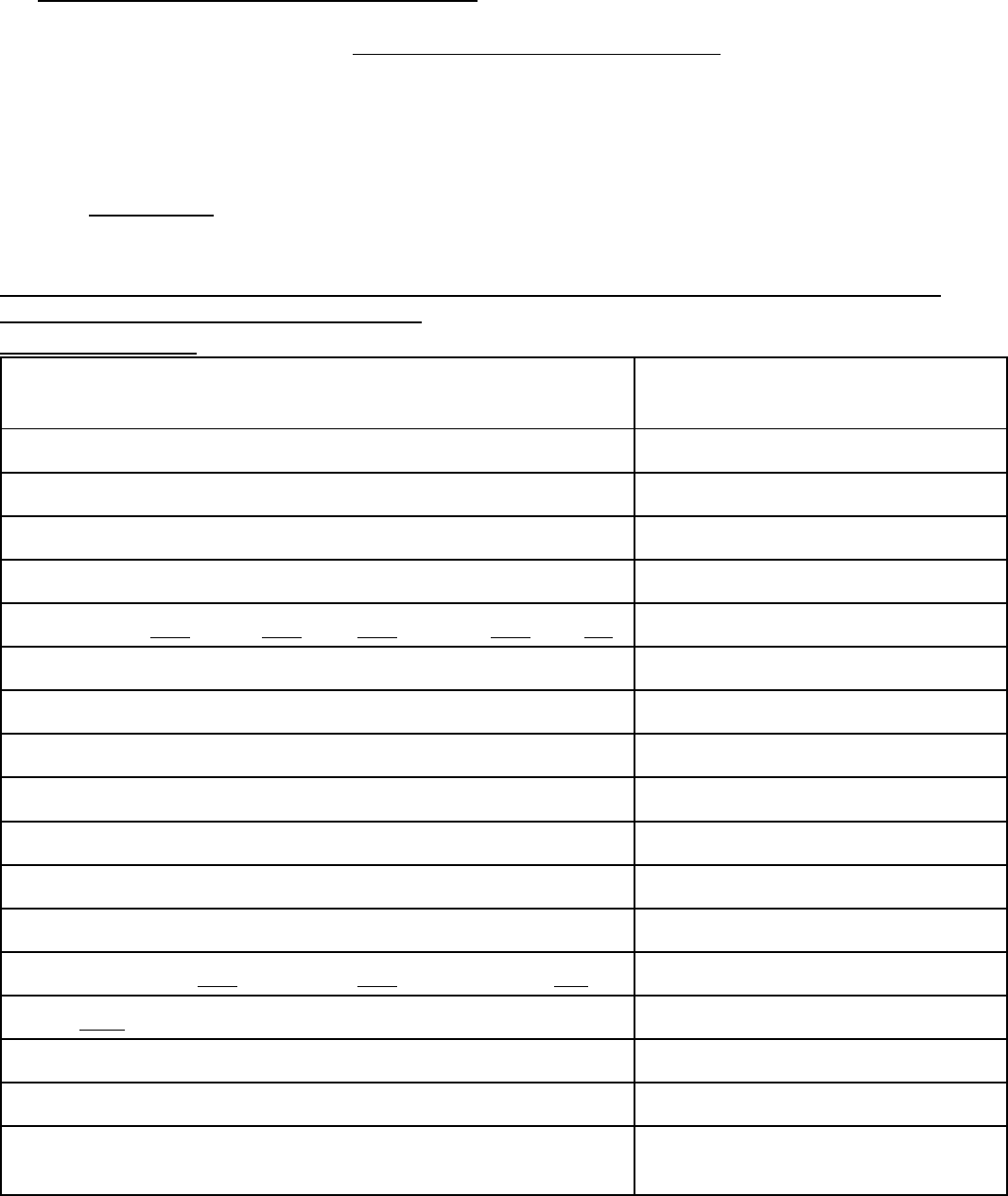

I. INCOME FROM ALL SOURCES: The correct amount of the child support obligation is presumed to be

a percentage of income as defined by law. The percentages are set forth in Addendum A. Other pertinent

information is set forth in Addenda B and C. List your income from all sources as follows:

a. Wages and Salaries (as reportable on Federal and State income tax returns):

1 Employer and address ______________________________________________________________

2. Hours worked per week ______

3. Gross salary/wages

(G

GG

G

Weekly

G

GG

G

Bi-weekly

G

GG

G

Monthly

G

GG

G

Semi–monthly

G

GG

G

Annual)

$________

4. Deductions: a. Social Security/Medicare Tax a. $________

b. Federal Income Tax b. $________

c. New York State Tax c. $________

d. NYC/Yonkers Tax d. $________

e. Other payroll deductions

________________________ e. $________

________________________ $________

________________________ $________

5 . Number of members in household _______

6. Number of dependents _______

7. Income of other members of household $________ per __________

$________ per __________

NOTE: ATTACH INFORMATION FOR ADDITIONAL EMPLOYERS ON SEPARATE PAGES.

b. Self-Employment Income (Describe and list self- employment income; attach to this form the most

recently filed Federal and State income tax returns, including all schedules): ________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

c. Interest/Dividend Income: ________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

d. Other Income/ Benefits:

1. Workers Compensation 1. $________ per __________

2. Disability Benefits 2. $________ per __________

3. Unemployment Insurance Benefits 3. $________ per __________

4. Social Security Benefits 4. $________ per __________

5. Veterans Benefits 5. $________ per __________

6. Pensions and Retirement Benefits 6. $________ per __________

7. Fellowships/Stipends/Annuities 7. $________ per __________

8. Supplemental Security Income (SSI) 8. $________ per __________

Form 4-17 Page 3

9. Public Assistance 9. $________ per __________

10. Food Stamps 10. $________ per __________

e. Income from other sources: (List here and explain any other income including but not limited to: non-

income producing assets; employment “perks” and reimbursed expenses to the extent that they reduce

personal expenses; fringe benefits as a result of employment; periodic income, personal injury settlements;

non-reported income; and money, goods and services provided by relatives and friends):

____________________________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

II. ASSETS: The Court can consider the assets of the custodial parent and/or the non-custodial parent in its

award of child support. List your assets as follows:

a. Savings account balance (Name of bank: _________________________ ) a. $_______________

b. Checking account balance (Name of bank: ________________________) b. $_______________

c. Automobile(s) (Year and make: ________________________________ ) c. $_______________

Loan information ____________________________________________

d. Residence owned (Address: ____________________________________) d. $_______________

e. Other real estate owned _______________________________________ e. $_______________

f. Other assets (For example: stocks, bonds, trailers, boat, etc.) __________ f. $_______________

___________________________________________________________

g. Driver's, professional, recreational, sporting and other licenses and permits held (provide name of issuing

agency, license number and attach a copy if possible) __________________________________________

_____________________________________________________________________________________

NOTE: ATTACH TO THIS FORM ANY INFORMATION AS TO ANY ADDITIONAL ASSETS.

III. DEDUCTIONS FROM INCOME: The Court allows certain deductions from income prior to applying

the child support percentages. List the deductions that apply to you as follows:

a. Unreimbursed employee business expenses a. $_______________

b. Maintenance actually paid to spouse not a party to this action* b. $_______________

c. Maintenance actually paid to spouse who is a party to this action c. $_______________

d. Child support actually paid on behalf of non- subject child(ren)* d. $_______________

e. Public Assistance and Food Stamps e. $_______________

f. Supplemental Security Income f. $_______________

g. NYC/Yonkers Income Tax g. $_______________

h. Social Security/Medicare Taxes h. $_______________

*Attach to this form a copy of the appropriate Court Order

IV. HEALTH INSURANCE, UNREIMBURSED HEALTH-RELATED EXPENSES, CHILD CARE

EXPENSES, EDUCATIONAL EXPENSES AND LIFE AND ACCIDENT INSURANCE POLICIES:

As part of the child support obligation, parents must be directed to provide health insurance coverage, pay a

pro-rated share of the cost or premiums to obtain or maintain the health insurance coverage, a pro-rated share

of unreimbursed health-related expenses, pro-rated share of child care expenses and, in the Court's discretion,

educational expenses. The Court may direct you to purchase and maintain life and/or accident insurance

benefits or assign benefits on existing policies for the benefit of your children. List your information as follows

Form 4-17 Page 4

and cross out or delete inapplicable provisions:

a. [Check applicable box]:

G

GG

G

I do NOT have health insurance coverage [If this box is checked, SKIP to section IV(b), below]

G

GG

G

I HAVE health insurance coverage through [specify]:

G

GG

G

Employer or organization

G

GG

G

Private purchase

G

GG

G

Medicaid

G

GG

G

"Child Health Plus" program; my monthly premium is $ ____________

1. My coverage includes

G

GG

G

medical

G

GG

G

dental

G

GG

G

prescription drugs

G

GG

G

optical

G

GG

G

other health care services or benefits [specify]: _______________________________________

2. The cost of the insurance paid by me is $______________per _______________

3. The person(s) covered by my insurance is/are: ___________________________________________

________________________________________________________________________________

4. My policy number is .

5. Coverage

G

GG

G

does

G

GG

G

does not presently include my child(ren). The additional cost to me to include

my child(ren) would be [specify cost for each type of benefit; if benefit unavailable, so indicate]:

Medical: $____________ per _______ Optical: $____________ per _______

Dental: $____________ per _______ Prescription drugs: $____________ per _______

Other Health Services or Benefits [specify]:___________________ $____________ per _______

6. The name and address of my primary (and secondary) health insurer is/are: ___________________

_______________________________________________________________________________

7. My primary (and secondary) health plan administrator is/are: (indicate name, address and telephone

number of contact person for employer or organization): __________________________________

_______________________________________________________________________________

8. There are

G

GG

G

medical

G

GG

G

dental

G

GG

G

prescription drugs

G

GG

G

optical

G

GG

G

other health care benefits [specify]: ______________________________ benefits available to the

child(ren) through an individual who is not a party to this action. This individual is [indicate name

and relationship]: _________________________________________________________________.

The cost is: $____________ per _______.

b. My child care provider is: _______________________________________________________________

The average number of hours of child care incurred per week are: _______________________________

c. My child's educational needs and expenses are: ______________________________________________

____________________________________________________________________________________

d. I have the following life and accident insurance policies:

1. Life insurance: (Name of insurer):____________________________ $______________

(Beneficiary/Beneficiaries):_____________________________________

(Name of insurer):____________________________ $______________

(Beneficiary/Beneficiaries):_____________________________________

2. Accident insurance: (Name of insurer):____________________________ $______________

(Name of insurer):____________________________ $______________

Form 4-17 Page 5

This information is current as of (specify date) __________________________.

V. VARIANCE FROM THE PERCENTAGES: The Family Court Act allows the Court to order support

different from the percentages if the Court finds that the support based upon the percentages would be unjust

or inappropriate due to certain factors. The factors are set forth in Addendum D. The following is/are the

factor(s) that the Court should consider in this case: _____________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

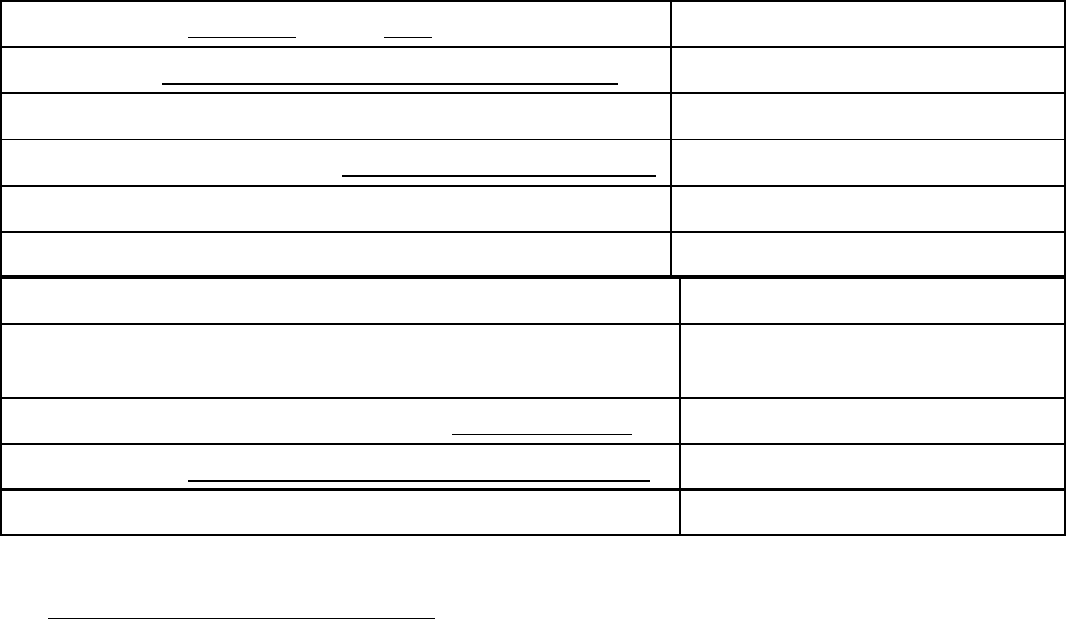

VI. EXPENSES: In ordering support by the percentages the Court is not obligated to consider your

expenses. However, if the Court varies from the percentages, your expenses may be considered. List your

expenses as follows: List all expenses on a weekly or monthly basis; however, you must be consistent.

If any items are paid monthly, divide by 4.3 to obtain the weekly payment. If any items are paid weekly,

multiply by 4.3 to obtain the monthly payment.

Check applicable box: I am listing my expenses on a

G

GG

G

weekly

G

GG

G

monthly basis:

EXPENSE ITEM COST [check box]:

G

GG

G weekly G

GG

G monthly

a) Rent or mortgage payment a. $

b) Mortgage interest and amortization b. $

c) Realty taxes(if not included in mortgage payment) c. $

d) Insurance on realty d. $

e) Utilities: gas electric water telephone cable e. $

f) Garbage collection f. $

g) Household repairs (specify) g. $

h) Food h. $

i) Charge accounts, loans, etc. (from Section VII below)

i. $

1)

2)

3)

j) Auto expense: gas maintenance insurance & fees j. $

loan

k) Public transportation k. $

l) Life insurance l. $

m) Health insurance m. $

Form 4-17 Page 6

n) Clothing: self $ others $ n. $

(Explain: )

o) Laundry and dry cleaning o. $

p) Education and tuition (explain: ) p. $

q) Child care q. $

r) Contributions r. $

s) Union dues (Are dues mandatory? 9 yes 9No) s. $

t) Entertainment t. $

u) Miscellaneous personal expenses (specify: ) u. $

v) Other (specify: ) v. $

w) TOTAL: 9

99

9 weekly 9

99

9Monthly Expenses w. $

VII. LIABILITIES, LOANS AND DEBTS: In ordering support by the percentages the Court is not obligated

to consider liabilities, loans, and debts. However, if the Court varies from the percentages, they may be

considered. List your liabilities, loans and debts as follows:

Creditor ____________________ Creditor ____________________ Creditor ____________________

Purpose _________________ Purpose _________________ Purpose _________________

Date incurred _____________ Date incurred _____________ Date incurred _____________

Total balance due $_________ Total balance due $_________ Total balance due $_________

Monthly payment $ _________ Monthly payment $ _________ Monthly payment $ ________

NOTE: ATTACH TO THIS FORM INFORMATION REGARDING ANY ADDITIONAL DEBTS.

Form 4-17 Page 7

I have carefully read the foregoing statement and attest to its truth and accuracy.

[Notarization of your signature is REQUIRED].

_________________________________________

(Petitioner)(Respondent)

_________________________________________

Print or Type Name

_________________________________________

Signature of Attorney, if any

_________________________________________

Attorney's Name (Print or Type)

_________________________________________

_________________________________________

_________________________________________

Attorney's Address and Telephone Number

Sworn to before me this __________

day of ______________, _________.

______________________________

Notary Public

(Deputy)Clerk of the Court

Form 4-17 Page 8

ADDENDUM A

CHILD SUPPORT PERCENTAGES

The child support percentages that shall be applied by the Court unless the Court makes a finding that the non-custodial

parent’s share is unjust or inappropriate are as follows: 17% for one child; 25% for two children; 29% for three children; 31%

for four children; and no less than 35% for five or more children.

ADDENDUM B

COMBINED PARENTAL INCOME “CAP”

Where combined parental income exceeds the amount published by the New York State OTDA pursuant to Social

Services Law 111-i(2)a, the Court shall determine the amount of child support for the amount of the combined parental income

in excess of such dollar amount through consideration of the factors set forth in Addendum D and/or the support percentage set

forth in Addendum A. The combined parental income amount will be revised every two years, beginning on January 31, 2012,

and the revised amount will be posted on-line at www.newyorkchildsupport.com.

ADDENDUM C

SELF-SUPPORT RESERVE

Where the annual amount of the basic child support obligation would reduce the non-custodial parent’s income below

the poverty income guidelines amount for a single person as reported by the federal Department of Health and Human

Services, the basic child support obligation shall be twenty-five dollars ($25) per month unless the interests of justice dictate

otherwise. Where the annual amount of the basic child support obligation would reduce the non-custodial parent's income

below the self-support reserve but not below the poverty income guidelines amount of a single person as reported by the

federal Department of Health and Human Services, the basic child support obligation shall be fifty dollars ($50) per month or

the difference between the non-custodial parent's income and the self-support reserve, whichever is greater.

ADDENDUM D

VARIANCE FROM THE PERCENTAGES

The Court has the discretion to vary from the percentages if it finds that the non-custodial parent's pro-rata share of the

basic child support obligation is unjust or inappropriate. This finding shall be based upon consideration of the following

factors:

1. The financial resources of the custodial and non-custodial parent, and those of the child.

2. The physical and emotional health of the child and his/her special needs and aptitudes.

3. The standard of living the child would have enjoyed had the marriage or household not been dissolved.

4. The tax consequences to the parties.

5. The non-monetary contributions that the parents will make toward the care and well-being of the child.

6. The educational needs of either parent.

7. A determination that the gross income of one parent is substantially less than the other parent's gross income.

8. The needs of the children of the non-custodial parent for whom the non-custodial parent is providing support who are not

subject to the instant action and whose support has not been deducted from income, and the financial resources of any

person obligated to support such children, provided, however, that this factor may apply only if the resources available to

support such children are less than the resources available to support the children who are subject to the instant action.

9. Provided that the child is not on public assistance (i) extraordinary expenses incurred by the non-custodial parent in

exercising visitation, or (ii) expenses incurred by the non-custodial parent in extended visitation provided that the

custodial parent's expenses are substantially reduced as a result thereof.

10. Any other factors the Court determines are relevant in each case.

NOTE: The language in the above Addenda is paraphrased from the statute for the purposes of simplification. For statutory

language, see Family Court Act Sections 413(1), 416 and 424-a and Domestic Relations Law Sections 236-B and 240.