- Affidavit of Financial Support for Undergraduate Applicants - Kansas

- International Student Financial Affidavit - Lake Land College

- Affidavit of Support Form - Pennsylvania

- International Student Financial Affidavit - University at Albany

- McNeese Affidavit of Support Form - Louisiana

- Affidavit of Financial Support Form - New Jersey

Fillable Printable Financial Affidavit - New Hampshire Judicial Branch

Fillable Printable Financial Affidavit - New Hampshire Judicial Branch

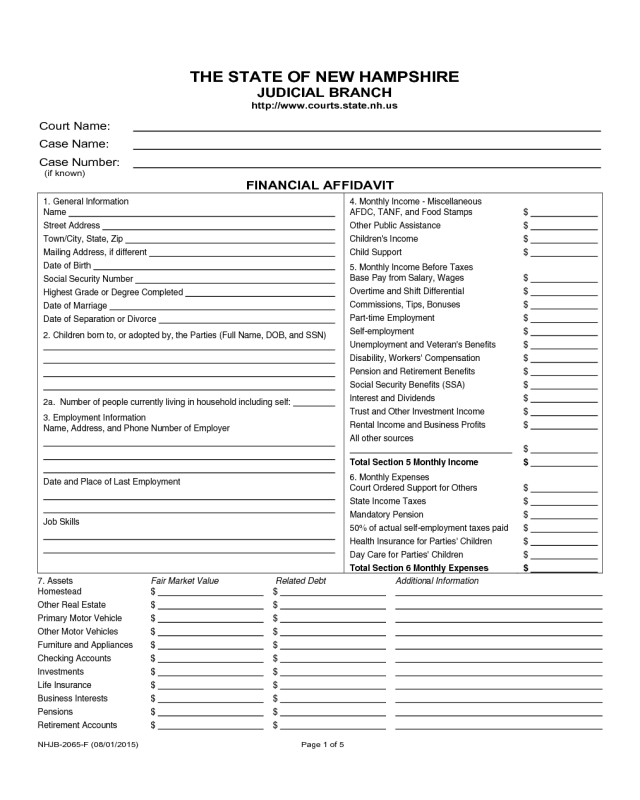

Financial Affidavit - New Hampshire Judicial Branch

NHJB-2065-F (08/01/2015) Page 1 of 5

THE STATE OF NEW HAMPSHIRE

JUDICIAL BRANCH

http://www.courts.state.nh.us

Court Name:

Case Name:

Case Number:

(if known)

FINANCIAL AFFIDAVIT

1. General Information

Name

Street Address

Town/City, State, Zip

Mailing Address, if different

Date of Birth

Social Security Number

Highest Grade or Degree Completed

Date of Marriage

Date of Separation or Divorce

2. Children born to, or adopted by, the Parties (Full Name, DOB, and SSN)

2a. Number of people currently living in household including self:

3. Employment Information

Name, Address, and Phone Number of Employer

Date and Place of Last Employment

Job Skills

4. Monthly Income - Miscellaneous

AFDC, TANF, a nd Food Stamps

Other Public Assistance

Children's Income

Child Support

5. Monthly Income Before Taxes

Base Pay from Salary, Wages

Overtime and Shift Differential

Commissions, Tips, Bonuses

Part-time Employment

Self-employment

Unemployment and Veteran's Benefits

Disability, Workers' Compensation

Pension and Retirement Benefits

Social Security Benefits (SSA)

Interest and Dividends

Trust and Other Investment Income

Rental Income and Business Profits

All other sources

Total Section 5 Monthly Income

6. Monthly Expenses

Court Orde red Support for Others

State Income Taxes

Mandatory Pension

50% of actual self-employment taxes paid

Health Insurance for Parties' Children

Day Care for Parties' Children

Total Section 6 Monthly Expenses

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

7. Assets Fair Market Value Related Debt Additional Information

Homestead $ $

Other Real Estate $ $

Primary Motor Vehicle $ $

Other Motor Vehicles $ $

Furniture and Appliances $ $

Checking Accounts $ $

Investments $ $

Life Insurance $ $

Business Interests $ $

Pensions $ $

Retirement Accounts $ $

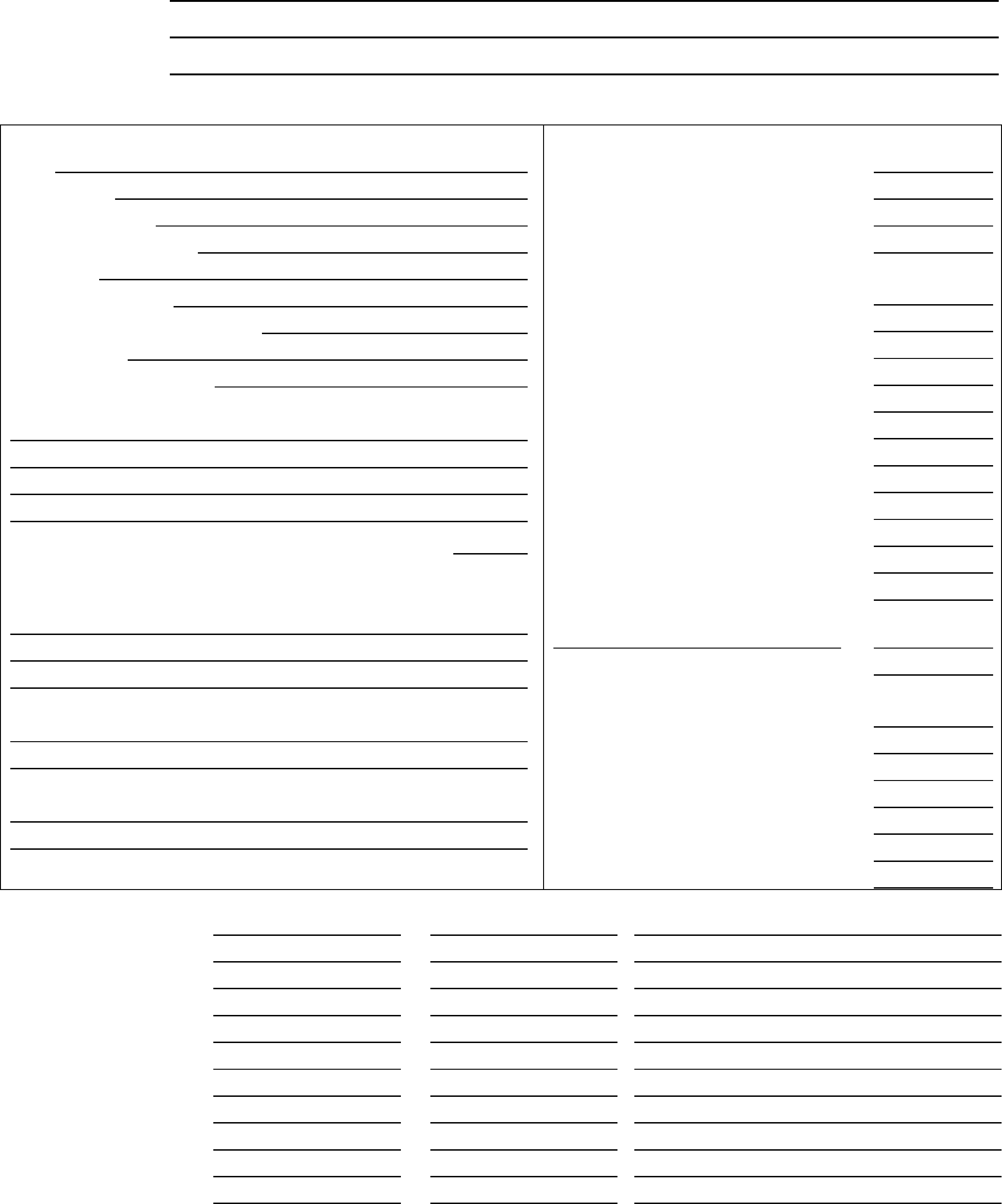

Case Name:

Case Number:

FINANCI AL AFFIDAVIT

NHJB-2065-F (08/01/2015) Page 2 of 5

8. Additional Assets - If you have an interest in any property which is held solely by or jointly with any other person or entity, and which has not

already been disclosed, or if you are owed money from any source, please explain

9. Tax Return Information

Year of last return filed

Single or joint return

My Total W-2s and 1099s = $

If Self-employed, check here and attach copy of most recent

IRS Schedule C.

10. Insurance

Life

Company

Type and Face Amount

Beneficiaries

Health

Company

Type

Description of Coverage

Dental

Company

Description of Coverage

11. Debts

Who is debt owed to? Who owes debt? Balance

$

$

$

$

$

12. Retirement Plans

Plan or Account Name

Type

Most Recent Value $

Value at Filing $

If Defined Benefit, status of vesting and description of Benefit

13. Attachments:

Pay Stub Monthly Expenses

Schedule C Other (describe)

Check here if parties agree to waive Monthly Expenses form.

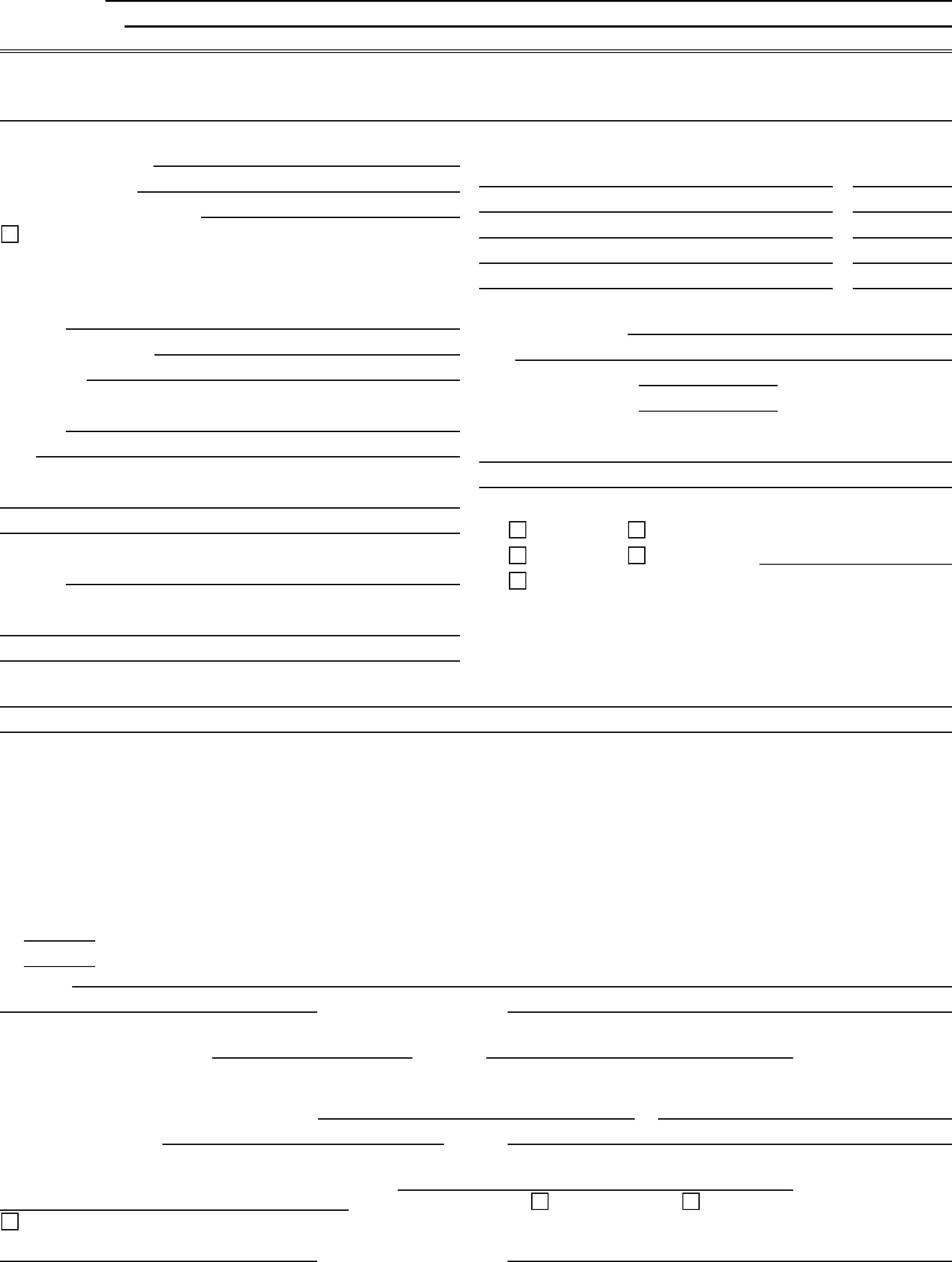

14. Additional Information

I swear (affirm) that:

A. To the best of my knowledge and belief, I have fully disclosed all income and all assets having any substantial value; and

B. I have reasonably estimated the fair market value of each asset; and

C. I understand that I have a duty to update the information provided in this financial affidavit for each court hearing; and

D. I understand that if a support order is issued in this case obligating me to pay support, it shall be my responsibility to immediately provide the

Court with any change of address in writing. If I fail to do so, I may be held in default, found in contempt of court and a warrant may be issued for

my arrest. (See USO Standing Order SO-4C.)

E. Rule 1.25-A Compliance -- Family Division Only: (Initial one)

I have complied with Rule 1.25-A regarding mandatory disclosure; OR

I understand my obligation to comply with Rule 1.25-A regarding mandatory disclosure. I have not fully complied with Rule 1.25-A

due to:

Date Signature

State of , County of

The person signing this financial affidavit appeared and signed this before me and took oath that the statements set forth in this Financial Affidavit,

together with any attachments listed in section 13 above, are true to the best of his or her knowledge and belief.

This instrument was acknowledged before me on by

My commission expires:

Affix seal, if any Signature of Notarial Officer / Title

I certify that on this date I provided a copy of this document to (other party) or to

(other party’s attorney) by: Hand-delivery OR US Mail OR

E-mail (E-mail only by prior agreement of the parties based on Circuit Court Administrative Order).

Date Signature

Case Name:

Case Number:

FINANCI AL AFFIDAVIT

NHJB-2065-F (08/01/2015) Page 3 of 5

NOTE: Round all numbers to the nearest dollar. To convert weekly expenses to monthly, multiply by 4.33.

1. Housing

Rent

Mortgage Payment

Property Tax

Condo Fee

Home Maintenance

Snow Removal and Lawn Care

2. Utilities

Heating Oil

Wood and Coal

Propane and Natural Gas

Telephone

Electricity

Cable Television

Water and Sewer

Trash Collection

3. Insurance

Homeowner

Renter

Vehicle

Health

Dental

Life

Disability

4. Uninsured Health Care

Medical

Dental

Orthodontics

Eye Care/Glasses/Contacts

Prescription Drugs

Therapy and Counseling

5. Transportation

Primary Vehicle Payment

Other Vehicle Payments

Vehicle Maintenance

Gas and Oil

Registration and Tax

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

6. General and Personal

Groceries

Meals Eaten Out

Tobacco/Alcohol Products

Clothing and Shoes

Hair Care

Toiletries and Cosmetics

Pet Food and Care

Church and Charities

Laundry and Dry Cleaning

Gifts

Newspapers and Magazines

Education (personal)

Dues and Memberships

Vacations

Entertainment and Recreation

Visitation Expenses

7. Children's Expenses and Activities

Children's Clothing and Shoes

Diapers

Day Care

School Supplies

School Lunches

Tuition and Lessons

Sports and Camp

8. Financial

Federal Income Tax

Social Security and Medicare

Loan Payments

Other Debts

Savings

401(k)

IRA

Other Retirement Plans

9. Other Expenses

TOTAL MONTHLY EXPENSES

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$.

$

Case Name:

Case Number:

FINANCI AL AFFIDAVIT

NHJB-2065-F (08/01/2015) Page 4 of 5

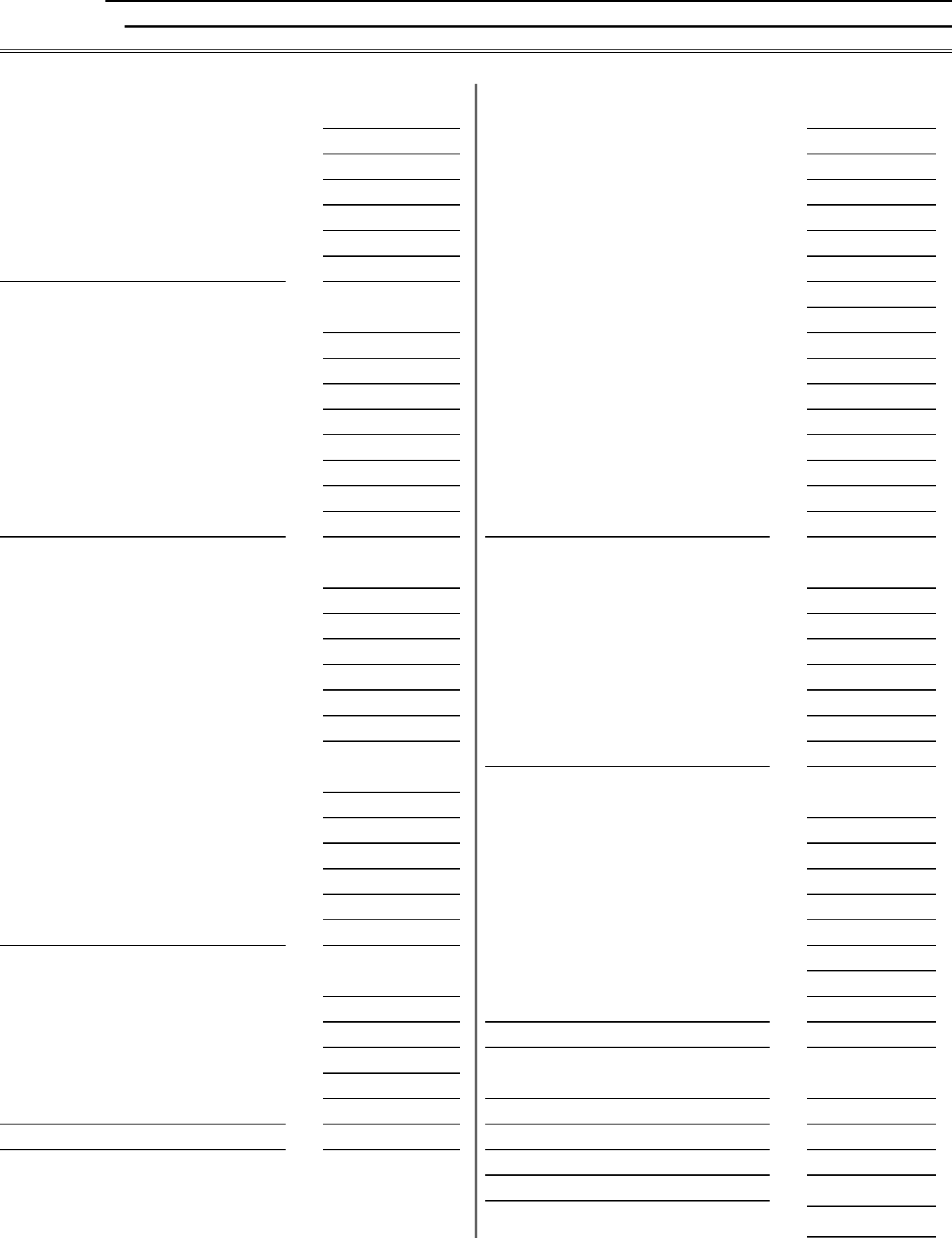

THE STATE OF NEW HAMPSHIRE

General Instructions for Completing the Financial Affidavit Form NHJB-2065-F

A. When this form is needed - You must fill out and file this form with the Court.

If you are the petitioner or respondent in a divorce, legal se paration, or civil union dissolution cas e.

If you are the petitioner or respondent in an after-divorce, custody/par enting, child support, or paternity case.

If either side is requesting chil d support or al imony or a change in an existing support or alimony order.

If a person's ability to pay an obligation is an issue.

Any othe r time that the Court may requir e.

B. If you need more space for any answer, either ad d an attachment and note it at section 13, or us e section 14.

When usin g section 14, put in the number of the answer needing more space, and th en the information.

C. The importance of the oath - This for m must be sworn to under oath and sig ned before a Notary Public or N.H. Justice of the

Peace. All i nfo rmation must be true, accurate, and complete, to the best of your knowledge and belief, under the pains and

penalti es of perjury.

D. Monthly Expenses form - You must always fill out and attach the Monthly Expenses form in the following cases.

If child supp ort is an issue and either side claims that the Child Support Guide lines should not ap ply.

If either side is requesting alimony or payment of college expenses.

If you and t he other side do not agree how to divide your debts.

If either side requests it.

If the Court requires it.

It is not required in other case s, if both sides agree by c hecking the box in section 13, or if the Office of C hild Support Enforcement

(OCSE) does not request it and the Court approves.

E. Duty to Update - You must fill out and file a new Financia l Affidavit for every hearing.

F. Use of Forms - You may use the Financial Affidavit and Monthly Ex penses forms provided by the Court or your ow n forms, as

long as the format and content are identical to the Court versio n. You may design other attachments as you see fit.

G. Child Su pport - If child s up port is an issue, read the U niform Support Order and its Instructions.

Specific Instructions for Numbered Secti ons of the Financial Affidavit Form

1. General Information - Street A ddress means your complete reside nce address. If you hav e filed a Domestic Violence Petition,

or if there are restraining orders, you do not have to give your a ddress. The last two lines in se ction 1 apply only to divorce and

post-div orce cases.

2. Children of th e Parties - Fill in the first and last name, with middle initial, if any, for each child. Give date of birth and Social

Security Number.

3. Employment Information - Fill in name, address and phone number of current employer. List date and place of last employment.

List job sk ills.

4. Monthly Income - Misc ellaneous - List all public assistance i nco me, including AFDC, TANF, food sta mps, SSI, APTD, and

general assistance fr om town or county. If your dependent children receive in come from employment, investments, or other

sources, list it here. This income is excluded when calc ulating child support.

5. Monthly Income - Before Taxes- List all income, except from those sources spec ified in secti on 4. If you are paid weekly,

multiply the weekly amount by 4.33 to get monthl y. If you are paid ev ery 2 weeks, multiply the bi-weekly amou nt by 2.17 to get

monthly. If income is occas ional or irregular, fill in the average amount.

6. Monthly Expenses - Support for Others means child support or alimony you are paying under court order for children other than

the children of the parties, or for alimony for another ex-sp ouse. Health Insurance means the actual amount paid for medical

insurance coverag e for the children of the parties.

Case Name:

Case Number:

FINANCI AL AFFIDAVIT

NHJB-2065-F (08/01/2015) Page 5 of 5

7/8. Asset Inform ation - Y ou must list a ll of your a ssets in t hese sections. In section 7, t he first column is for your good-faith estimat e

of the total fair market value of assets i n each category. Fair Market Value is what you coul d sell an asset for, not the purchase

price or replacement cost. It is not necessary to have every asset appraised. However, you must consider all factors known to

you when stating values. The second column is to list any debts that are owed against the asset, such as a mortgage or a

vehicle loan. You may put any additional information in the third column.

Motor Ve hicles means c ars, trucks, m otorcycles, airplanes, boats, snowmobiles and the like.

Investments means savings accounts, certificates of deposit, stocks, savings bonds, other bonds, money market acc ounts,

and the like.

Life insurance means the cash value of any life insurance poli cy that you own or have an i nterest in.

Pension means a defined benefit retirement plan. What you receive is ba sed on ye ars of service a nd pay.

Retirement Account means a defined contribution plan or other retirement account in your name.

Examples are: 401(k) plans, thrift/savings plans, Keoghs, IRAs.

The extra lines are for other categories of assets that are not listed on the form, or for providing more details on listed assets. You

must list all assets. Assets include, but are not limited to, the following:

Any asset in w hich you hav e an interest, but that is being held in t he name of someone else. For example, if a relat ive

is holding money or an asset that you own, or can get back under any circumstances, you must include it.

Any assets t ha t are owned partly by you and partly by someon e else, such as a j ointly owned bank acco unt, motorcycle,

or piece of real estate.

Any asset of substantial value that y ou either gave away or sold for less than fair market val ue, within 6 months of the

date of th e Financial Affid avit.

Any debt that anyone owes you, whether or not repayment is expected or likely.

9. Tax Return Information - Tota l W-2s and 1099s refer to those tax forms from work done by you and from assets in your

name. Do not include those that result from your spous e's i ncome.

10. Insurance - List all insurance coverage y ou have. Description means any deductibles and co-pays.

11. Debts - List all debts i n yo ur name or joint n ames. Debt means lo ans, credit cards, pa st due bills, a nd the like. For each

debt, list the name of the person or busine ss you owe the debt to, wheth er the debt is in your name or i n j oint names,

and the amount curr ently ow ed.

12. Pension and Retirement Acc ounts - Name your retirement plans or account s. On the second line, note if your retirement

account is a 401(k) plan, profit-sharing plan, defined be nefit plan, or other specific ty pe of pla n. A defined benefit pla n is one

where what you receive is based upon years of service and pay. Value at filing refers to the value of your retirement plan at the

time the divorce was filed, and needs to be filled in only in divorce cases.

13. List of Attachments - Check off which forms and documents you are attac hing to your Financial Affidavit. If the attachment is not

listed, check of f other and write in what it is.

14. Additional Information - Use this space to provide information that will not fit in prior sections and to provide additional

informati on that you wish the Court to consider.

Certification of Copies - You must give a copy of your Financial Affidavit with all attachments to the other s id e. The other side means

the lawyer representing your s po use, ex-spouse, or the other parent. If he or she does not have a lawyer, give it to your spouse, ex-

spouse, or the other parent. If the State is a party, also give a copy to Office of Chi ld Support Enforcement (OCSE). Write in the

names of each person you have given a copy to.

Monthly Expenses - Section D above explains who must complete the Monthly Expenses form.