Fillable Printable Financial Statement Analysis Paper

Fillable Printable Financial Statement Analysis Paper

Financial Statement Analysis Paper

Financial Statement Analysis Paper

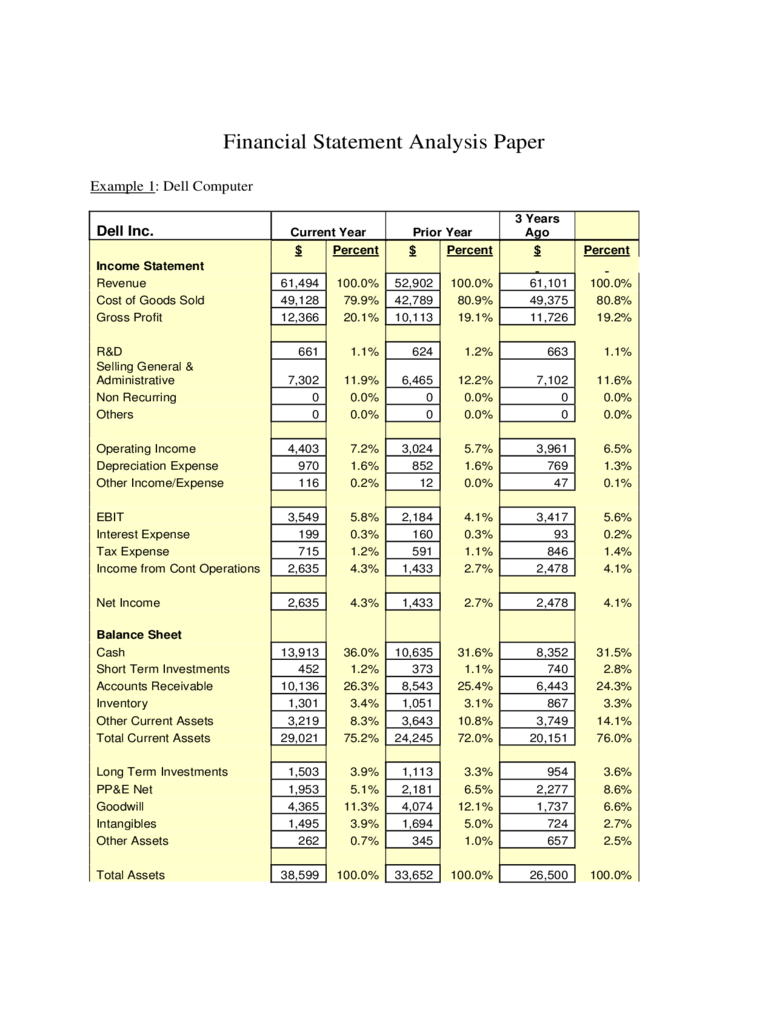

Example 1: Dell Computer

Dell Inc.

Current Year

Prior Year

3 Years

Ago

$

Percent

$

Percent

$

Percent

Income Statement

Revenue

61,494

100.0%

52,902

100.0%

61,101

100.0%

Cost of Goods Sold

49,128

79.9%

42,789

80.9%

49,375

80.8%

Gross Profit

12,366

20.1%

10,113

19.1%

11,726

19.2%

R&D

661

1.1%

624

1.2%

663

1.1%

Selling General &

Administrative

7,302

11.9%

6,465

12.2%

7,102

11.6%

Non Recurring

0

0.0%

0

0.0%

0

0.0%

Others

0

0.0%

0

0.0%

0

0.0%

Operating Income

4,403

7.2%

3,024

5.7%

3,961

6.5%

Depreciation Expense

970

1.6%

852

1.6%

769

1.3%

Other Income/Expense

116

0.2%

12

0.0%

47

0.1%

EBIT

3,549

5.8%

2,184

4.1%

3,417

5.6%

Interest Expense

199

0.3%

160

0.3%

93

0.2%

Tax Expense

715

1.2%

591

1.1%

846

1.4%

Income from Cont Operations

2,635

4.3%

1,433

2.7%

2,478

4.1%

Net Income

2,635

4.3%

1,433

2.7%

2,478

4.1%

Balance Sheet

Cash

13,913

36.0%

10,635

31.6%

8,352

31.5%

Short Term Investments

452

1.2%

373

1.1%

740

2.8%

Accounts Receivable

10,136

26.3%

8,543

25.4%

6,443

24.3%

Inventory

1,301

3.4%

1,051

3.1%

867

3.3%

Other Current Assets

3,219

8.3%

3,643

10.8%

3,749

14.1%

Total Current Assets

29,021

75.2%

24,245

72.0%

20,151

76.0%

Long Term Investments

1,503

3.9%

1,113

3.3%

954

3.6%

PP&E Net

1,953

5.1%

2,181

6.5%

2,277

8.6%

Goodwill

4,365

11.3%

4,074

12.1%

1,737

6.6%

Intangibles

1,495

3.9%

1,694

5.0%

724

2.7%

Other Assets

262

0.7%

345

1.0%

657

2.5%

Total Assets

38,599

100.0%

33,652

100.0%

26,500

100.0%

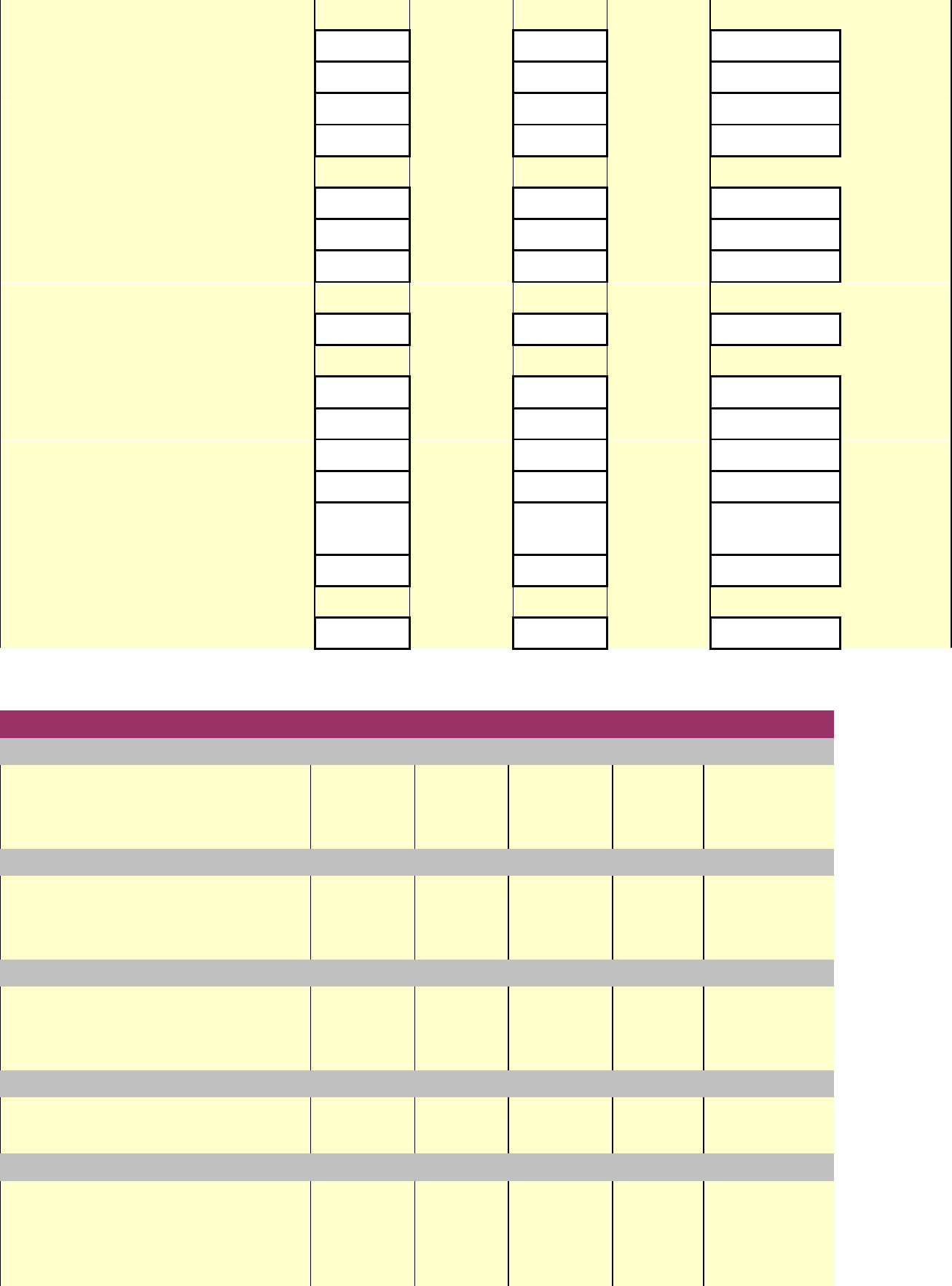

Accounts Payable

15,474

40.1%

15,257

45.3%

12,045

45.5%

Short/Current L.T. Debt

851

2.2%

663

2.0%

113

0.4%

Other Current Liabilities

3,158

8.2%

3,040

9.0%

2,701

10.2%

Total Current Liabilities

19,483

50.5%

18,960

56.3%

14,859

56.1%

Long Term Debt

5,146

13.3%

3,417

10.2%

1,898

7.2%

Other Liabilities

6,204

16.1%

5,634

16.7%

5,472

20.6%

Minority Interest

0

0.0%

0

0.0%

0

0.0%

Total Liabilities

30,833

79.9%

28,011

83.2%

22,229

83.9%

Preferred Stock

0

0

0

0.0%

Common Stock

11,797

11,472

11,189

42.2%

Additional Paid In Capital

0

0

0

0.0%

Retained Earnings

24,744

22,110

20,677

78.0%

Treasury Stock (-)

-

28,704

-

27,904

-27,904

-105.3%

Other Equity

-71

-37

309

1.2%

Total Stockholders' Equity

7,766

20.1%

5,641

16.8%

4,271

16.1%

RATIO ANALYSIS

Growth Ratios

Sales Growth

16.2%

-13.4%

-0.1%

Income Growth

83.9%

-42.2%

-15.9%

Asset Growth

14.7%

27.0%

-3.8%

Activity Ratios

Receivable Turnover

6.6

7.1

8.6

Inventory Turnover

41.8

44.6

48.2

Fixed Asset Turnover

31.5

24.3

26.8

Profit Ratios

Profit Margin

4.3%

2.7%

4.1%

Return on Assets

7.3%

4.8%

9.2%

Return on Equity

39.3%

28.9%

61.9%

Liquidity Ratios

Current Ratio

1.49

1.28

1.36

Quick Ratio

1.42

1.22

1.30

Solvency Ratios

Debt to Total Assets

0.80

0.83

0.84

Times Interest Earned

(Accrual)

17.83

13.65

36.74

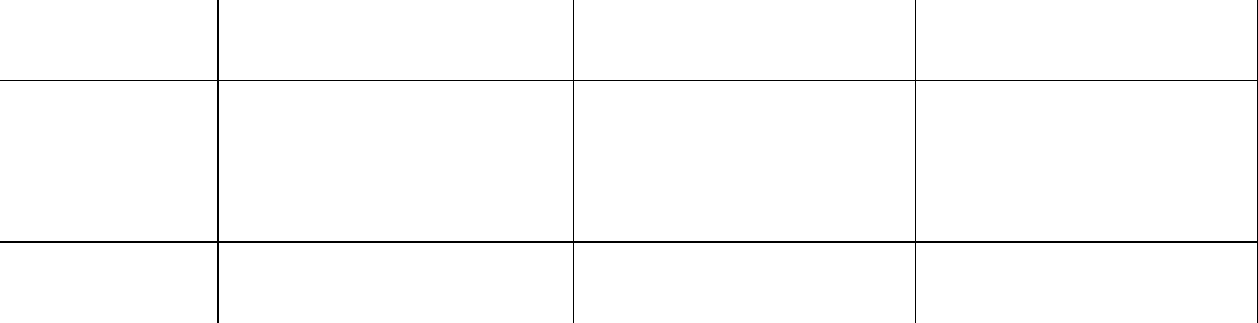

Industry

Measures

Jan-11

Jan-10

Jan-09

Product

Revenue

$ 50,002.0

81.31%

$ 43,697

82.60%

$ 52,337

85.66%

Services

Revenue

$ 11,492.0

18.69%

$ 9,205

17.40%

$ 8,764

14.34%

Total

Revenue

$ 61,494.0

100.00%

$ 52,902

100.00%

$ 61,101

100.00%

Revenues come from the sale of Dell’s products and services. Revenues increased a

combined 16% from January 2010 to January 2011 primarily because of the recovery in the

economy. The health of the economy is critical for the company because its products are not

primary products; so during a recession, people will rather save money for food than buy a

computer. This explains the big decline in revenues for the 2009 fiscal year (a 13.4% drop

compared to the previous year). The increase in 2010 is also due to a change in business strategy.

Dell is growing its enterprise solutions and services business which changed the revenue stream

of the company. Services revenue has weighted more on total revenues year after year. It went

from 14.3% of revenues in January 2009 to 18.7% of revenues in January 2011. Also, services

revenue has been profitable with a 25% growth in 2010 and 5% growth in 2009. (Part 2, Item 7,

Form 10-K, Dell Inc., January 2011)

Cost of goods and services have been relatively stable as a percentage of revenue for the

past three years. Other expenses such as selling and administrative expenses, R&D expenses,

depreciation expenses and more have also been relatively constant in the last three years.

However, the company did have higher costs on a dollar basis. This increase in amortization of

intangible assets and other cost is due to the increase in intangible assets from the Perot Systems

in Fiscal 2010. Also, the company had a migration to contract manufacturers and closures of

certain manufacturing facilities that caused an increase in severance and facility action costs.

Even with all these value increases, the company has done a good job keeping their costs stable

as a percentage of revenues. Dell is well managed and knows how to control their costs. The

company is on top of every detail and there are no surprise costs to harm the company. (Part 2,

Item 7, Form 10-K, Dell Inc. 2011)

The net income performance of the company has been excellent for fiscal 2011 with an

84% increase from the previous year. This big increase in net income resulted in a 1.6% growth

in profit margin and a 2.5% growth in ROA (return on asset). Higher revenues and good cost

control are responsible for these growths. Another reason for the growth in net income is the

change in the business operation of the company. Its service operations are expanding and have a

lower cost than manufacturing the products. Fiscal 2010 had a decrease in net income of 42.2%

mainly due to the drop in revenue and the acquisition of Perot Systems. Dell is planning to keep

expanding specially on the services aspect of their business, which will help the company on the

long run. (Part 2, Item 7, Form 10-K, Dell Inc. 2011)

Current assets accounts increased $4,776 billion from the previous year, from

representing 72% of total assets in fiscal 2010 to 75.2% in fiscal 2011 (a 3.2% growth). The cash

and cash equivalent account is mostly responsible for this change as the account rose by more

than $3 billion or 4.4% of total assets. The company recognizes all highly liquid investments,

including credit card receivables due from banks, with original maturities of three months or less

at date of purchase. This rise is explained by an increase in revenues so cash provided by

operations, and mainly by a decrease in cash used in investing activities. Cash used for investing

activities totaled $1.165 billion in fiscal 2011, a $2,644 billion drop from fiscal 2010. The

decrease is primarily due to the lack of material importance for the acquisitions in fiscal 2011

compared to the acquisition of Perot Systems in fiscal 2010. This also reflects lower proceeds

from sales of investments and property (partly offset by lower capital expenditures). (Part 2, Item

8 & 9, Form 10-K, Dell Inc. 2011)

In general, the company had a good fiscal year. It improved its ability to generate profit.

All three of the main profitability’s ratio (profit margin, return on assets and return on equity)

have increased from the previous year; it means that the company is using its resources more

efficiently. Contingencies such as lawsuits and federal, state and local regulations are reasonably

possible because they are not in Dell’s control and can occur at any time; the company believes

that they will have a material adverse effect on its financial condition or results of operations if

some of them occur. Also, the company received an unqualified opinion by its auditor,

PricewaterhouseCoopers LLP, who is responsible to obtain reasonable assurance about whether

the financial statement are free of material misstatement and verify the internal control of Dell

over financial reporting. (Part 2, Item 8, Form 10-K, Dell Inc. 2011)

The property, plant and equipment (PPE) account is not very heavy in the company’s

balance sheet. It only represents 5.1% of Dell’s total assets. The company uses lease and cash to

acquire PPE. As of January 2011, Dell had approximately 18.1 million square feet of office,

manufacturing, and warehouse space worldwide, with 8.3 million of these square feet located in

the U.S. Also, 68% of these square feet are owned by Dell and the rest of the 32% are leased.

Depreciation is provided using the straight-line method over the estimated economic lives of the

assets, which range from ten to thirty years for buildings and two to five years for all other

assets. Leasehold improvements are amortized over the shorter of five years or the lease term.

During Fiscal 2011, the company closed a manufacturing plant in Winston-Salem (North

Carolina), consolidated space on their Austin (Texas) campus that allowed them to close one

building, and sold their fulfillment center in Nashville (Tennessee). Currently, a business center

in Coimbatore, India and a data center in Washington are under construction. The company has

also announced the sale of its manufacturing facility in Lodz, Poland. All these activities during

fiscal 2011 resulted to a drop of 1.4% in PPE. The fixed asset turnover ratio is 31.5 times,

compared to 24.3times in the previous year. This big jump shows that the company is using its

fixed assets more efficiently to generate revenue and it’s a positive aspect for the future. The

company is increasing revenues by offering various services that require less fixed assets. It’s a

change in their business operations and a shift of their revenue stream. (Part 1 & 2, Item 2 & 8,

Form 10-K, Dell Inc. 2011)

Another strong aspect of the company’s operations is its liquidity. As current assets

increased and current liabilities decreased, both current ratio and quick ratio increased from 1.28

and 1.22 in fiscal 2010 to 1.49 and 1.42 respectively. On a dollar standpoint current liabilities

stayed relatively stable. However, due the increase in total assets, current liabilities decreased

5.8% as percentage of total assets. These changes help Dell become more liquid and this is

definitely an advantage. (Part 2, Item 8, Form 10-K, Dell Inc. 2011)

The Company generally borrows on a long-term basis and is exposed to the impact of

interest rate changes and foreign currency fluctuations. The fair value of its debt obligations at

January 28, 2011 totaled $5.1 billion, compared with $3.4 billion at January 29, 2010. The net

increase in fiscal 2011 was primarily due to net issuances of approximately $1.5 billion. No debt

is maturing in fiscal 2012. This gives the company a little room to breathe and not issue any

commercial paper or long-term debt to refinance maturing debts. The Company uses derivative

instruments such as forward contracts and purchased options to hedge certain foreign currency

exposures, and interest rate swaps to manage the exposure of its debt portfolio to interest rate

risk. As stated in its 10-K document: “Dell's objective is to offset gains and losses resulting from

these exposures with gains and losses on the derivative contracts used to hedge the exposures,

thereby reducing volatility of earnings and protecting fair values of assets and liabilities. Dell

assesses hedge effectiveness both at the onset of the hedge and at regular intervals throughout

the life of the derivative and recognizes any ineffective portion of the hedge, as well as amounts

not included in the assessment of effectiveness, in earnings as a component of interest and other,

net.” (Part 2, Item 8, Note 5, Form 10-K, Dell Inc. 2011)

The company’s stockholder’s equity went up $2 billion. This increase is due to an

increase in retained earning. As net income increased more than the stockholder’s equity, ROE

(return on equity) went from 28.9% in fiscal 2010 to 39.3% in fiscal 2011. During this fiscal

year, Dell also bought back $800 million of shares which increased its level of treasury stock.

Dell doesn’t pay dividends so the stockholders can make profit in the market with stock price

variations. (Part 2, Item 8, Form 10-K, Dell Inc. 2011)