Fillable Printable Financial Statement Template

Fillable Printable Financial Statement Template

Financial Statement Template

Galapagos Conservancy

Financial Report

March 31, 2013

Contents

Independent Auditor’s Report

1

Financial Statements

Balance Sheet

2

Statement Of Activities

3

Statement Of Functional Expenses

4

Statement Of Cash Flows

5

Notes To Financial Statements

6 – 12

1

Independent Auditor’s Report

To the Board of Directors

Galapagos Conservancy

Fairfax, Virginia

Report on the Financial Statements

We have audited the accompanying financial statements of Galapagos Conservancy which comprise the

balance sheet as of March 31, 2013, and the related statements of activities, functional expenses and

cash flows for the year then ended and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in

accordance with accounting principles generally accepted in the United States of America; this includes

the design, implementation, and maintenance of internal control relevant to the preparation and fair

presentation of financial statements that are free from material misstatement, whether due to fraud or

error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We

conducted our audits in accordance with auditing standards generally accepted in the United States of

America. Those standards require that we plan and perform the audit to obtain reasonable assurance

about whether the financial statements are free of material misstatement. An audit involves performing

procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The

procedures selected depend on the auditor’s judgment, including the assessment of the risks of material

misstatement of the financial statements, whether due to fraud or error. In making those risk

assessments, the auditor considers internal control relevant to the entity’s preparation and fair

presentation of the financial statements in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s

internal control. Accordingly, we express no such opinion. An audit also includes evaluating the

appropriateness of accounting policies used and the reasonableness of significant accounting estimates

made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a reasonable

basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the

financial position of Galapagos Conservancy as of March 31, 2013, and the changes in its net assets and

its cash flows for the year then ended in accordance with accounting principles generally accepted in the

United States of America.

Vienna, Virginia

May 29, 2013

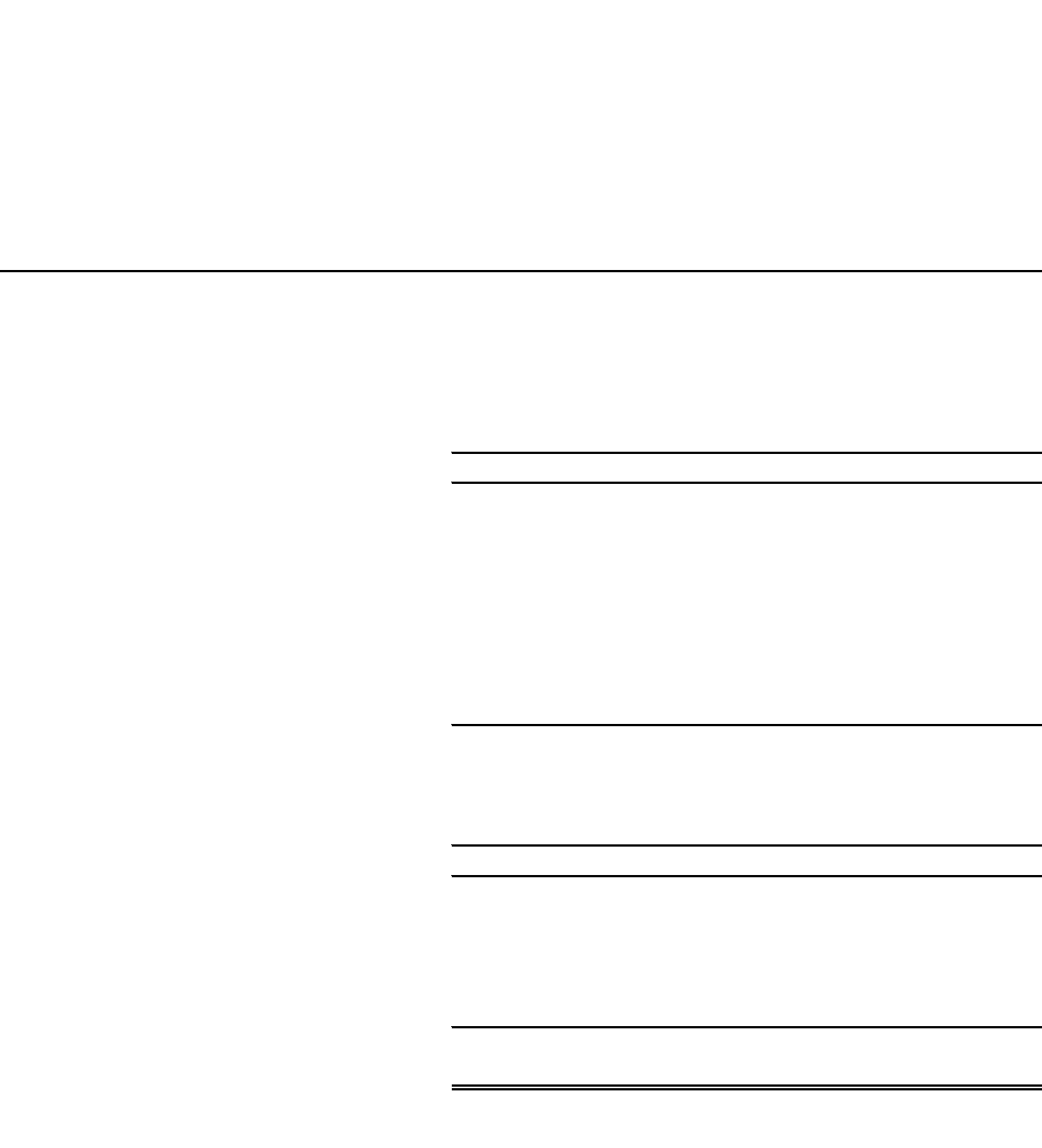

2

Galapagos Conservancy

Balance Sheet

March 31, 2013

Assets

Current Assets

Cash and cash equivalents 384,231 $

Prepaid expenses 117,079

Inventory 14,230

Total current assets

515,540

Investments 4,516,147

Property And Equipment

Furniture 2,266

Equipment and software 78,705

80,971

Less accumulated depreciation (36,410)

44,561

5,076,248 $

Liabilities And Net Assets

Current Liabilities

Accounts payable and accrued expenses 34,081 $

Grants payable 696,538

Total current liabilities

730,619

Commitments

Net Assets

Unrestricted 1,577,277

Temporarily restricted 296,539

Permanently restricted 2,471,813

4,345,629

5,076,248 $

See Notes To Financial Statements.

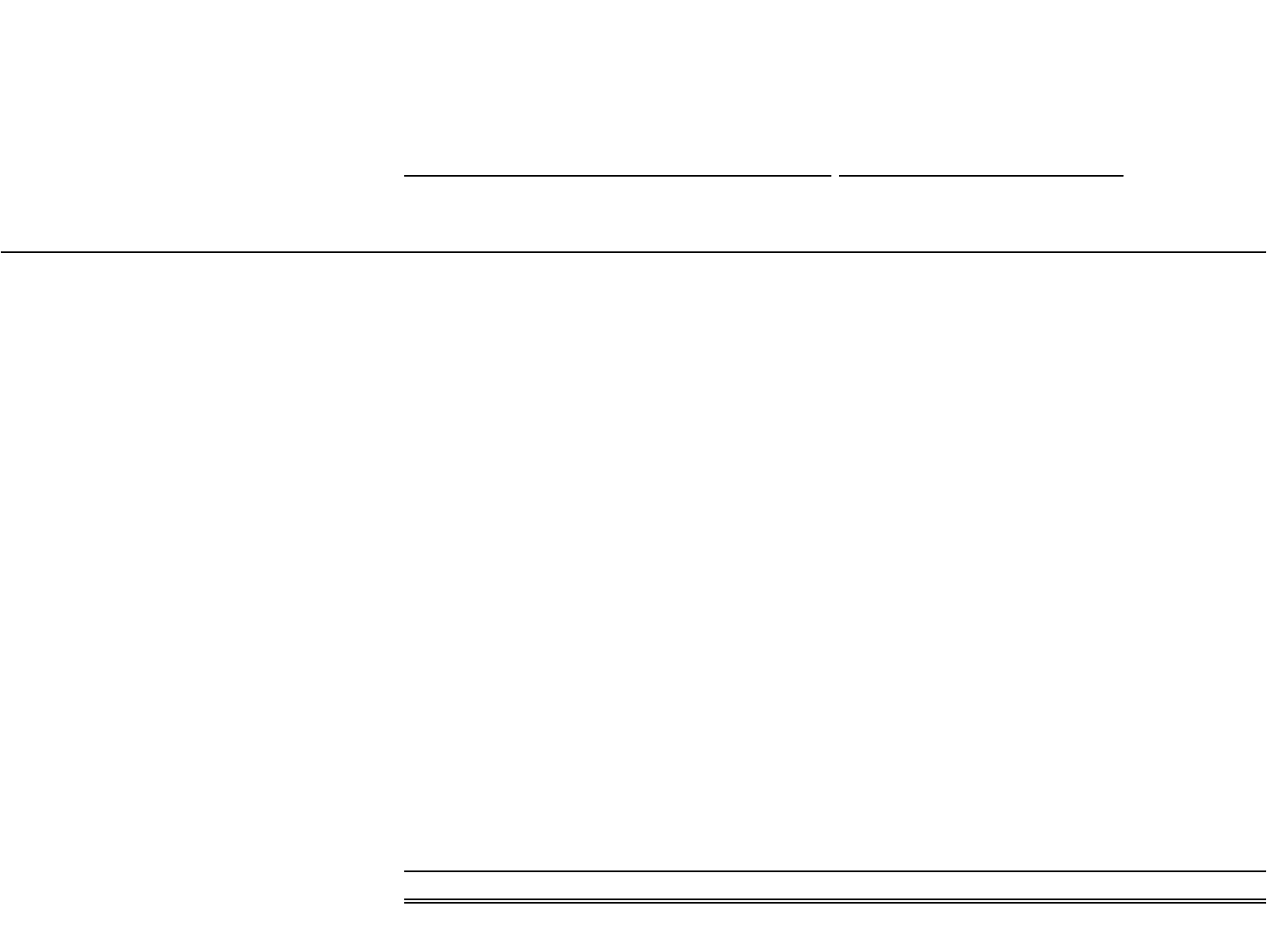

3

Galapagos Conservancy

Statement Of Activities

Year Ended March 31, 2013

Temporarily Permanently

Unrestricted Restricted Restricted Total

Revenue and support:

Contributions 1,557,453 $ 680,534 $ 38,625 $ 2,276,612 $

Investment income 347,639 - 347,639

Sales 22,355 - - 22,355

Net assets released from

restrictions 521,567 (521,567) - -

Total revenue and support 2,449,014 158,967 38,625 2,646,606

Expenses:

Program services:

Strategic Partnerships 835,979 - - 835,979

Allocated program costs 458,396 - - 458,396

Ecosystem Restoration 357,642 - - 357,642

Sustainable Society 270,214 - - 270,214

Cost of goods sold 12,155 - - 12,155

1,934,386 - - 1,934,386

Support services:

Management and general 198,217 - - 198,217

Fundraising 530,813 - - 530,813

Total expenses 2,663,416 - - 2,663,416

Change in net assets (214,402) 158,967 38,625 (16,810)

Net assets:

Beginning 1,791,679 137,572 2,433,188 4,362,439

Ending 1,577,277 $ 296,539 $ 2,471,813 $ 4,345,629 $

See Notes To Financial Statements.

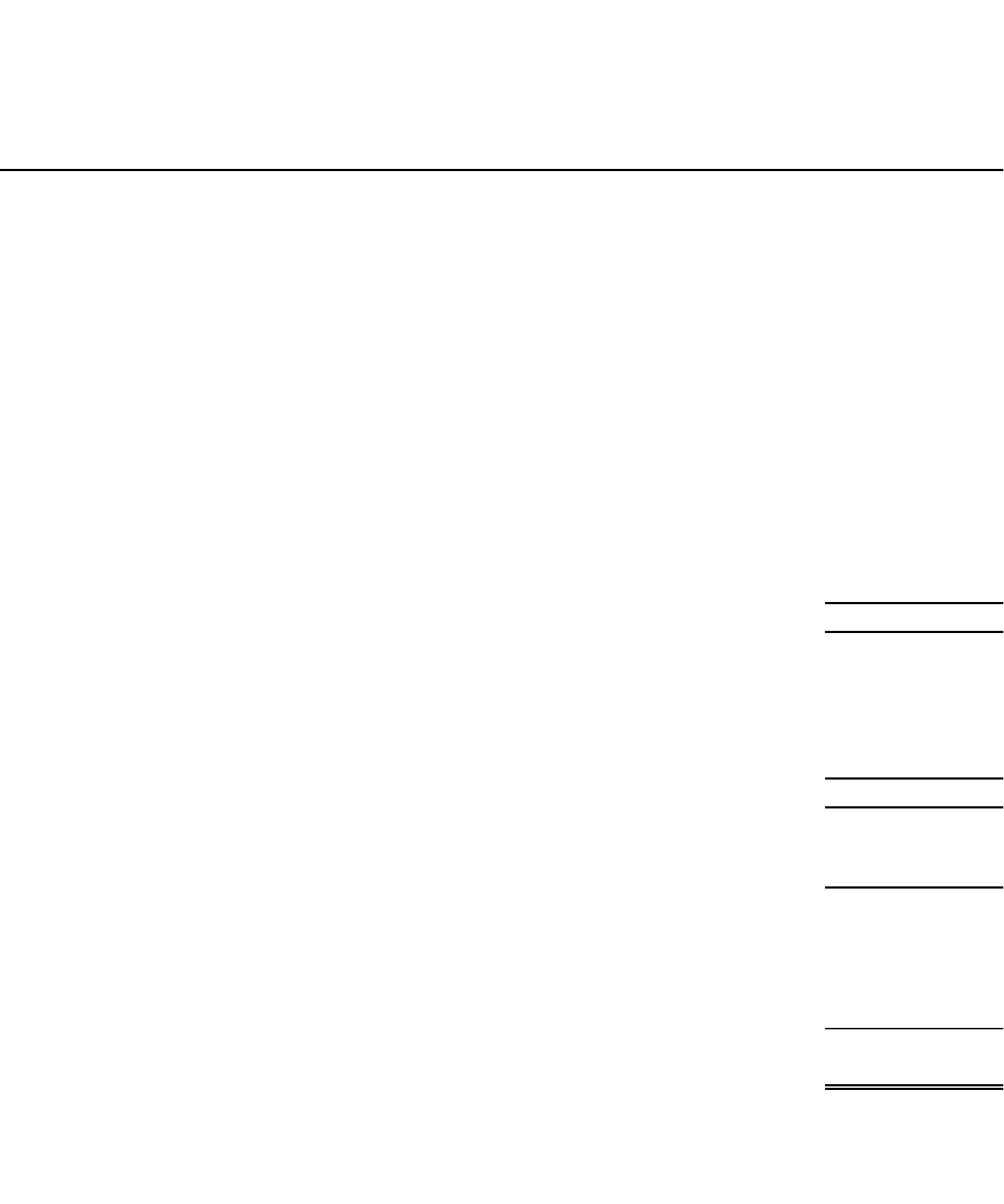

4

Galapagos Conservancy

Statement Of Functional Expenses

Year Ended March 31, 2013

Total Management

Environmental Outreach Program And

Programs Programs Services General Fundraising Total

Grants 1,463,835 $ -$ 1,463,835 $ -$ -$ 1,463,835 $

Salaries, benefits and taxes 235,898 - 235,898 101,893 123,655 461,446

Consultants 65,932 - 65,932 39,542 50,287 155,761

Printing - 21,584 21,584 - 111,498 133,082

Postage and shipping 4,704 17,880 22,584 2,821 77,835 103,240

Mail house - 3,897 3,897 - 61,571 65,468

Professional fees 25,219 - 25,219 15,125 18,355 58,699

Rent 24,402 - 24,402 14,635 17,761 56,798

Investment and management fees 11,977 - 11,977 7,242 8,635 27,854

Travel 19,394 2,020 21,414 1,652 3,338 26,404

Telemarketing - - - - 20,158 20,158

Cost of goods sold 12,155 - 12,155 - - 12,155

Premiums - - - - 11,476 11,476

Bank and caging fees 4,604 - 4,604 2,761 3,351 10,716

Depreciation 4,221 - 4,221 2,552 3,043 9,816

Permits 4,111 - 4,111 2,466 2,992 9,569

Dues and subscription 3,444 - 3,444 2,066 2,507 8,017

Computer and website expense - - - - 7,722 7,722

Office supplies 2,725 - 2,725 1,634 1,983 6,342

Miscellaneous 2,094 - 2,094 1,256 1,524 4,874

Telephone 1,720 - 1,720 1,031 1,252 4,003

Payroll fees 1,221 - 1,221 732 889 2,842

Insurance 993 - 993 595 722 2,310

Training 356 - 356 214 259 829

1,889,005 $ 45,381 $ 1,934,386 $ 198,217 $ 530,813 $ 2,663,416 $

See Notes To Financial Statements.

Support Services

Program Services

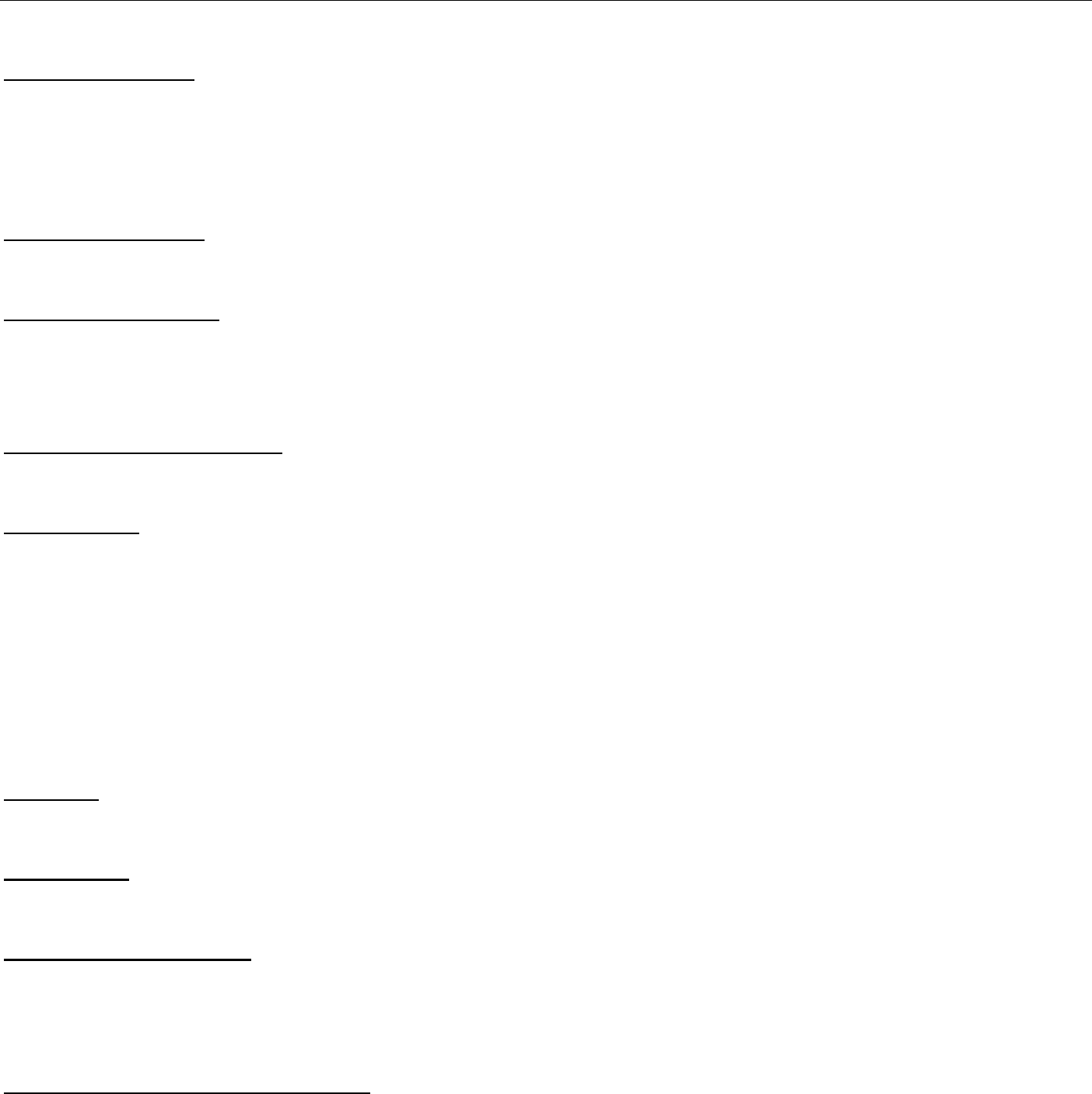

5

Galapagos Conservancy

Statement Of Cash Flows

Year Ended March 31, 2013

Cash Flows From Operating Activities

Change in net assets (16,810) $

Adjustments to reconcile change in net assets to

net cash used in operating activities:

Depreciation 9,816

Realized and unrealized gain on investments (187,322)

Contributions received for permanent endowment (38,625)

Changes in assets and liabilities:

(Increase) decrease in:

Prepaid expenses 14,899

Inventory (1,666)

Increase (decrease) in:

Accounts payable and accrued expenses 14,169

Deferred revenue (62,750)

Grants payable 180,722

Net cash used in operating activities

(87,567)

Cash Flows From Investing Activities

Proceeds from sale of investments 1,753,764

Purchase of property and equipment (21,107)

Purchases of investments (1,800,868)

Net cash used in investing activities

(68,211)

Cash Flows From Financing Activities

Contributions received for permanent endowment 38,625

Net decrease in cash and cash equivalents

(117,153)

Cash And Cash Equivalents

Beginning 501,384

Ending 384,231 $

See Notes To Financial Statements.

Galapagos Conservancy

Notes To Financial Statements

6

Note 1. Nature Of Activities And Significant Accounting Policies

Nature of activities: Galapagos Conservancy (the Conservancy) is a not-for-profit organization

incorporated under the laws of Delaware. The objectives of the Conservancy are to promote science,

conservation and environmental education in the Galapagos Islands and other island ecosystems.

A summary of the significant accounting policies of the Conservancy follows:

Basis of accounting: The financial statements are prepared on the accrual basis of accounting, whereby,

revenue is recognized when earned and expenses are recognized when incurred.

Basis of presentation: The Conservancy follows the Not-for-Profit Topic of the FASB Accounting

Standards Codification (the Codification). Under this topic, the Conservancy is required to report

information regarding its financial position and activities according to three classes of net assets:

unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets.

Cash and cash equivalents: For the purpose of reporting cash flows, the Conservancy considers all highly

liquid debt instruments purchased with a maturity of three months or less to be cash equivalents.

Financial risk: The Conservancy maintains its cash balances in bank deposit accounts which, at times,

may exceed federally insured limits. The Conservancy has not experienced any losses in such accounts.

The Conservancy believes it is not exposed to any significant credit risk on cash.

The Conservancy invests in shares of equity mutual funds (Note 2). Such investments are exposed to

various risks, such as market and credit. Due to the level of risk associated with such investments and the

level of uncertainty related to changes in the value of such investments, it is at least reasonably possible

that changes in risks in the near term would materially affect investment balances and the amounts

reported in the financial statements.

Inventory: Inventory is available for sale to members and the general public and is recorded at the lower

of cost using first-in, first-out basis, or market.

Investments: Investments with readily determinable values are recorded at fair value. Unrealized gains

and losses are reported in the statement of activities as part of investment income.

Property and equipment: Property and equipment purchases are recorded at cost and, if donated at fair

value, depreciation is computed on the straight-line basis over their estimated useful lives. All property

and equipment purchases with an estimated useful life over one year and cost greater than $500 are

capitalized.

Restricted and unrestricted revenue: Contributions received are recorded as unrestricted, temporarily

restricted or permanently restricted revenue, depending on the existence and/or nature of any donor

restrictions.

All donor-restricted revenue is reported as an increase in temporarily or permanently restricted net assets,

depending on the nature of the restriction. When a restriction expires (that is, when a stipulated time

restriction ends or purpose of restriction is accomplished), temporarily restricted net assets are

reclassified to unrestricted net assets and reported in the statement of activities as net assets released

from restrictions.

Unconditional promises to give are measured at fair value and reported as increases in net assets.

Conditional promises to give are recognized when the conditions on which they depend are substantially

met.

Galapagos Conservancy

Notes To Financial Statements

7

Note 1. Nature Of Activities And Significant Accounting Policies (Continued)

Functional allocation of expenses: The costs of providing the various programs and other activities have

been summarized on a functional basis in the statement of activities. Costs which could be directly

identified with a specific program were charged to that program, but items for general use or not directly

identifiable were allocated to each program based on direct labor hours.

Income taxes: The Conservancy is exempt from income taxes on income derived from any sources

related to its exempt purposes under Section 501(c)(3) of the Internal Revenue Code (IRC). Income

which is not related to exempt purposes, less applicable deductions, is subject to federal and state

corporate income taxes. The Conservancy had no unrelated business income for the year ended

March 31, 2013. In addition, the Conservancy has been determined by the Internal Revenue Service not

to be a private foundation as defined in IRC Section 509(a)(2).

The accounting standard on accounting for uncertainty in income taxes, which addresses the

determination of whether tax benefits claimed or expected to be claimed on a tax return should be

recorded in the financial statements. Under this guidance, the Conservancy may recognize the tax benefit

from an uncertain tax position only if it is more likely than not that the tax position will be sustained on

examination by taxing authorities, based on the technical merits of the position. The tax benefits

recognized in the financial statements from such a position are measured based on the largest benefit

that has a greater than 50% likelihood of being realized upon ultimate settlement. The guidance on

accounting for uncertainty in income taxes also addresses de-recognition, classification, interest and

penalties on income taxes, and accounting in interim periods.

Management evaluated the Conservancy’s tax positions and concluded that the Conservancy had taken

no uncertain tax positions that require adjustment to the financial statements to comply with the

provisions of this guidance. With few exceptions, the Conservancy is no longer subject to income tax

examinations by the U.S. federal, state or local tax authorities for years before 2010.

Use of estimates: The preparation of the financial statements requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent

assets and liabilities at the date of the financial statements, and the reported amounts of revenue and

expenses during the reporting period. Actual results could differ from those estimates.

Subsequent events: The Conservancy evaluated subsequent events through May 29, 2013, which is the

date the financial statements were available to be issued.

Note 2. Investments

Investments consist of the following at March 31, 2013:

Mutual funds 3,773,554 $

Bonds 460,563

Money market 282,030

4,516,147 $

Investment income consists of the following for the year ended March 31, 2013:

Interest 160,317 $

Unrealized gain on investments 187,322

347,639 $

Galapagos Conservancy

Notes To Financial Statements

8

Note 3. Line Of Credit

The Galapagos Conservancy has a $200,000 line of credit that expires on October 5, 2013. The line of

credit accrues interest at the bank’s prime lending rate of 5.25% and is secured by all assets of the

Conservancy. The bank also requires the Conservancy to comply with certain administrative covenants.

There was no outstanding balance on the line at March 31, 2013.

Note 4. Temporarily Restricted Net Assets

Temporarily restricted net assets as of March 31, 2013, are available for the following purposes or

periods.

March 31, Restricted Restriction

March 31,

Program 2012 Contributions Accomplished

2013

Library Fund

-$ 100,000 $ -$

100,000 $

Celebrity Expeditions

103,719 48,137 72,077

79,779

Education

19,380 101,500 71,015

49,865

Lonesome George

- 31,000 9,000

22,000

Web Cams

- 20,000 -

20,000

Botany

- 10,000 -

10,000

Knowledge Management – Tinker

7,098 1,000 -

8,098

Tortoise Workshop/Restoration

5,000 3,397 5,000

3,397

Galapagos Travel

2,375 2,150 2,475

2,050

Operation

- 108,350 107,000

1,350

Marine – Offield

- 250,000 250,000

-

Peter Kramer

- 5,000 5,000

-

137,572 $ 680,534 $ 521,567 $

296,539 $

Note 5. Permanently Restricted Net Assets

Permanently restricted net assets are restricted to investments in perpetuity, the income from which is

expendable to support various scientific researches of the Galapagos Islands:

March 31,

March 31,

2012 Contributions

2013

General Endowment 1,583,535 $ -$

1,583,535 $

USAID Endowment 500,000 -

500,000

Marine Endowment 319,653 38,625

358,278

Darwin Scholars Endowment 30,000 -

30,000

2,433,188 $ 38,625 $

2,471,813 $

Galapagos Conservancy

Notes To Financial Statements

9

Note 5. Permanently Restricted Net Assets (Continued)

Endowment Activity for the year ended March 31, 2013, consists of the following:

Temporarily Permanently

Restricted Restricted

Endowment net assets, beginning of year -$ 2,433,188 $

Contributions - 38,625

Investment income:

Net realized and unrealized gains 106,601 -

Interest and dividends 91,233 -

Appropriated for expenditure (197,834) -

Endowment net assets, end of year -$ 2,471,813 $

In August 2008, the Codification on Endowments of Not-for-Profit Organizations: Net Asset Classification

of Funds Subject to an Enacted Version of the Uniform Prudent Management of Institutional Funds Act,

and Enhanced Disclosures for All Endowment Fund was issued. The Codification addresses accounting

issues related to guidelines in the Uniform Prudent Management of Institutional Funds Act of 2006

(UPMIFA), which was adopted by the National Conferences of Commissioners on Uniform State Laws in

July 2006 and enacted in the Commonwealth of Virginia on July 1, 2008. The Management of the

Conservancy has interpreted UPMIFA as requiring the preservation of the fair value of original donor-

restricted endowment gifts as of the date of the gift absent explicit donor stipulations to the contrary. As a

result of this interpretation, the Conservancy classifies as permanently restricted net assets (a) the

original value of gifts donated to the permanent endowment, (b) the original value of subsequent gifts to

the permanent endowment, and (c) accumulations to the permanent endowment made in accordance

with the direction of the applicable donor gift instrument at the time the accumulation is added to the fund.

The remaining portion of donor-restricted endowment funds not classified in permanently restricted net

assets is classified as temporarily restricted net assets until those amounts are appropriated for

expenditure by the Conservancy in a manner consistent with the standard of prudence prescribed by

UPMIFA. In accordance with UPMIFA, the Conservancy considers the following factors in making a

determination to appropriate or accumulate donor-restricted endowment funds:

The duration and preservation of the fund

The purposes of the Conservancy endowment fund

General economic conditions

The possible effect of inflation and deflation

The expected total return from income and the appreciation of investments

Investment policies

Return objective and risk parameters: The Conservancy’s objective is to earn a respectable, long-term,

risk-adjusted total rate of return to support their programs. The Conservancy is primarily invested in

publicly traded mutual funds, equities, and corporate bonds.

Spending policies: The earnings from these endowments are available in support of programs of the

Conservancy. The Board of Directors appropriates the entire balance of the annual earnings to be

available for grants in support of the Conservancy’s mission.