Fillable Printable Financial/Source Of Funds Statement

Fillable Printable Financial/Source Of Funds Statement

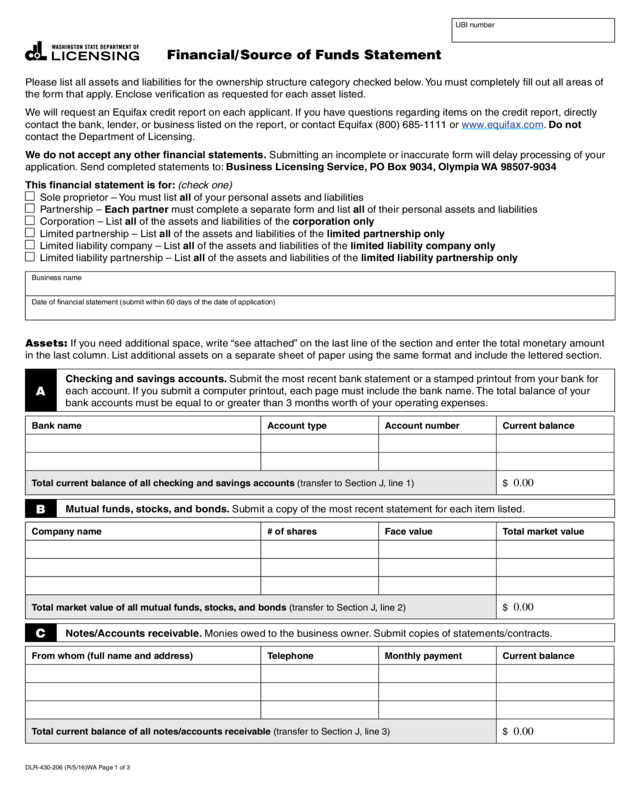

Financial/Source Of Funds Statement

UBI number

DLR-430-206 (R/5/16)WA Page 1 of 3

Financial/ Source of Funds Statement

Please list all assets and liabilities for the ownership structure category checked below. You must completely fill out all areas of

the form that apply. Enclose verification as requested for each asset listed.

We will request an Equifax credit report on each applicant. If you have questions regarding items on the credit report, directly

contact the bank, lender, or business listed on the report, or contact Equifax (800) 685-1111 or www.equifax.com. Do not

contact the Department of Licensing.

We do not accept any other financial statements. Submitting an incomplete or inaccurate form will delay processing of your

application. Send completed statements to: Business Licensing Service, PO Box 9034, Olympia WA 98507-9034

This financial statement is for: (check one)

Sole proprietor – You must list all of your personal assets and liabilities

Partnership – Each partner must complete a separate form and list all of their personal assets and liabilities

Corporation – List all of the assets and liabilities of the corporation only

Limited partnership – List all of the assets and liabilities of the limited partnership only

Limited liability company – List all of the assets and liabilities of the limited liability company only

Limited liability partnership – List all of the assets and liabilities of the limited liability partnership only

Business name

Date of financial statement (submit within 60 days of the date of application)

Assets: If you need additional space, write “see attached” on the last line of the section and enter the total monetary amount

in the last column. List additional assets on a separate sheet of paper using the same format and include the lettered section.

A

Checking and savings accounts. Submit the most recent bank statement or a stamped printout from your bank for

each account. If you submit a computer printout, each page must include the bank name. The total balance of your

bank accounts must be equal to or greater than 3 months worth of your operating expenses.

Bank name Account type Account number Current balance

Total current balance of all checking and savings accounts (transfer to Section J, line 1) $

B

Mutual funds, stocks, and bonds. Submit a copy of the most recent statement for each item listed.

Company name # of shares Face value Total market value

Total market value of all mutual funds, stocks, and bonds (transfer to Section J, line 2) $

C

Notes/Accounts receivable. Monies owed to the business owner. Submit copies of statements/contracts.

From whom (full name and address) Telephone Monthly payment Current balance

Total current balance of all notes/accounts receivable (transfer to Section J, line 3) $

0.00

0.00

0.00

Click here to START or CLEAR, then hit the TAB button

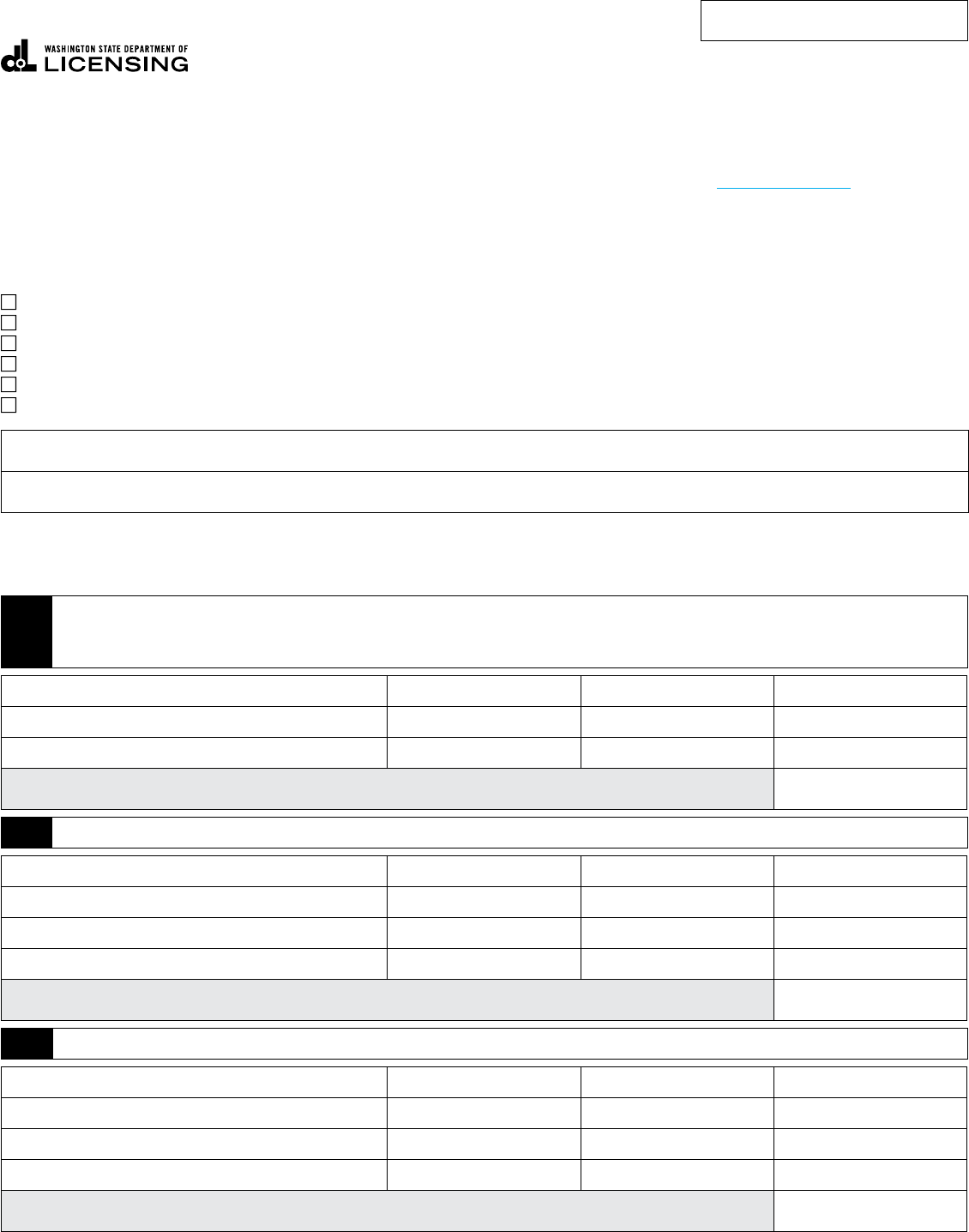

UBI number

DLR-430-206 (R/5/16)WA Page 2 of 3

D

Real estate owned. For each property, submit a copy of current tax assessment statement showing

value of land and buildings.

Property address

Number

of acres

Monthly

rental

income

Monthly

mortgage

payment

Mortgage

balance Total assessed value

Total assessed value of all properties (transfer to Section J, line 4) $

E

Vehicles owned. Submit copies of the title/registration for each vehicle listed.

Year Make Model Vehicle identification number (VIN) Market value

Total market value of all vehicles (transfer to Section J, line 5) $

F

Other. Describe other assets and submit appropriate verification of asset value.

Description of asset Current value

Total current value of all other assets (transfer to Section J, line 6) $

Liabilities: If you need additional space, write “see attached” on the last line of the section and enter the total monetary

amount in the last column. List additional liabilities on a separate sheet of paper using the same format and include the

lettered section.

G

Notes (loans), accounts, bills, and credit card payable.

To whom (full name and address) Monthly payment Current balance

Total monthly payment on notes/accounts/bills/credit cards (to Section J, line 7)

$

0.00

0.00

0.00

0.00

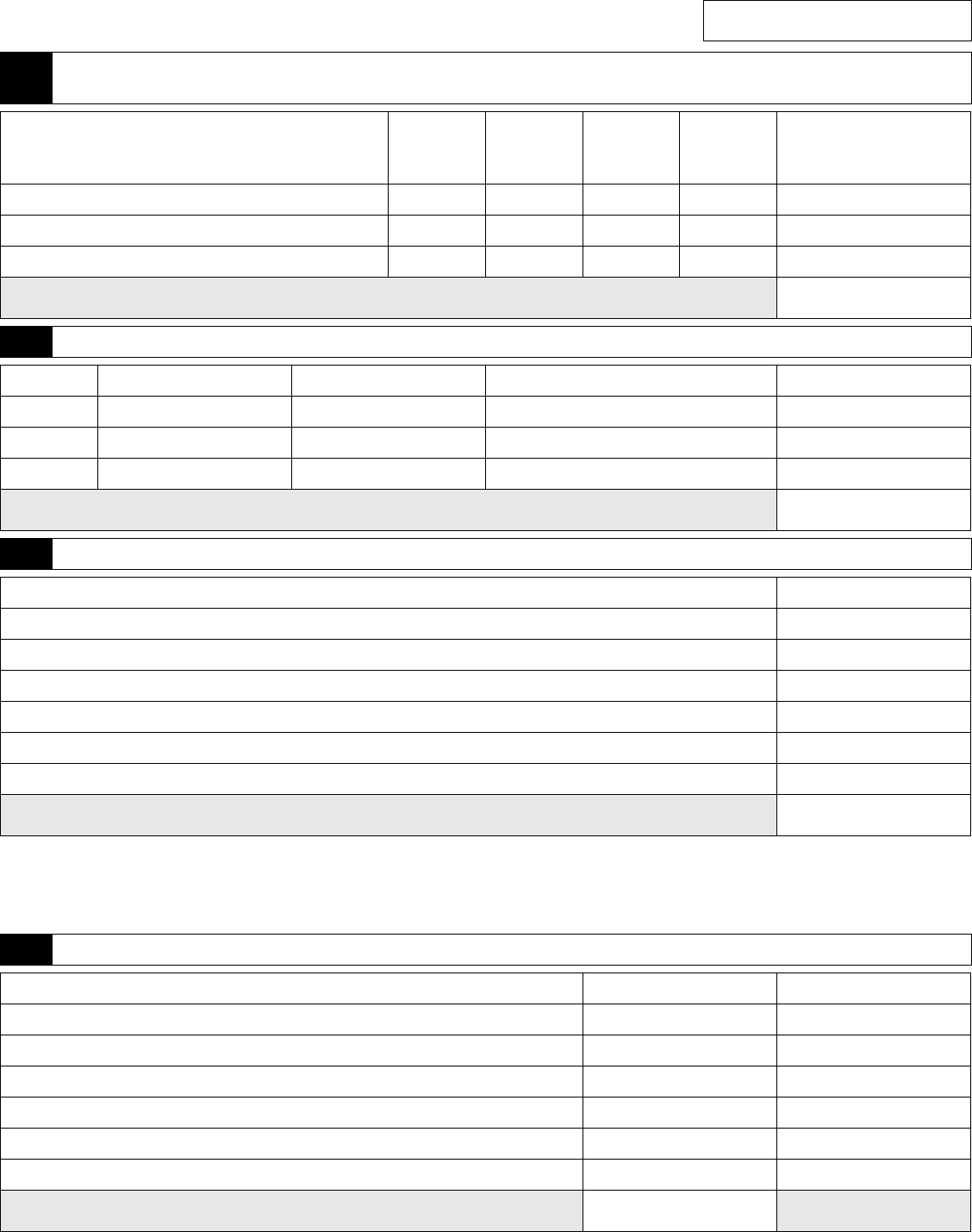

UBI number

H

Real estate mortgages and contracts owing (payable) OR monthly lease/rent payment.

(If listing a lease/rent payment, enter amount in monthly payment and current balance.)

Property address Full name of lender

Original

balance

Monthly

payment Current balance

Total monthly payment on all real estate or monthly lease/rent payment (to Section J, line 8) $

I

Other. Describe liability and provide applicable information.

Description

Original

balance

Monthly

payment Current balance

Total monthly payment owed on all other liabilities (transfer to Section J, line 9) $

Total assets and liabilities

J

Enter totals from each section and calculate your net worth (total assets minus total liabilities).

Assets Total amount Liabilities Total amount

1. Checking and savings (from Section A) $

7. Notes (loans), accounts, bills, and credit

cards payable (from Section G)

$

2. Mutual funds, stocks, and bonds

(from Section B)

$

8. Real estate mortgages and liens OR

monthly lease/rent payment

(from Section H)

$

3. Notes/accounts receivable

(from Section C)

$

9. Other (from Section I) $

4. Real estate owned (from Section D) $

5. Vehicles owned (from Section E) $ Total liabilities (total of this column) $

6. Other (from Section F) $

Net worth

(total assets minus total liabilities)

$

Total assets (total of this column) $

Total liabilities + Net worth

(must equal total assets)

$

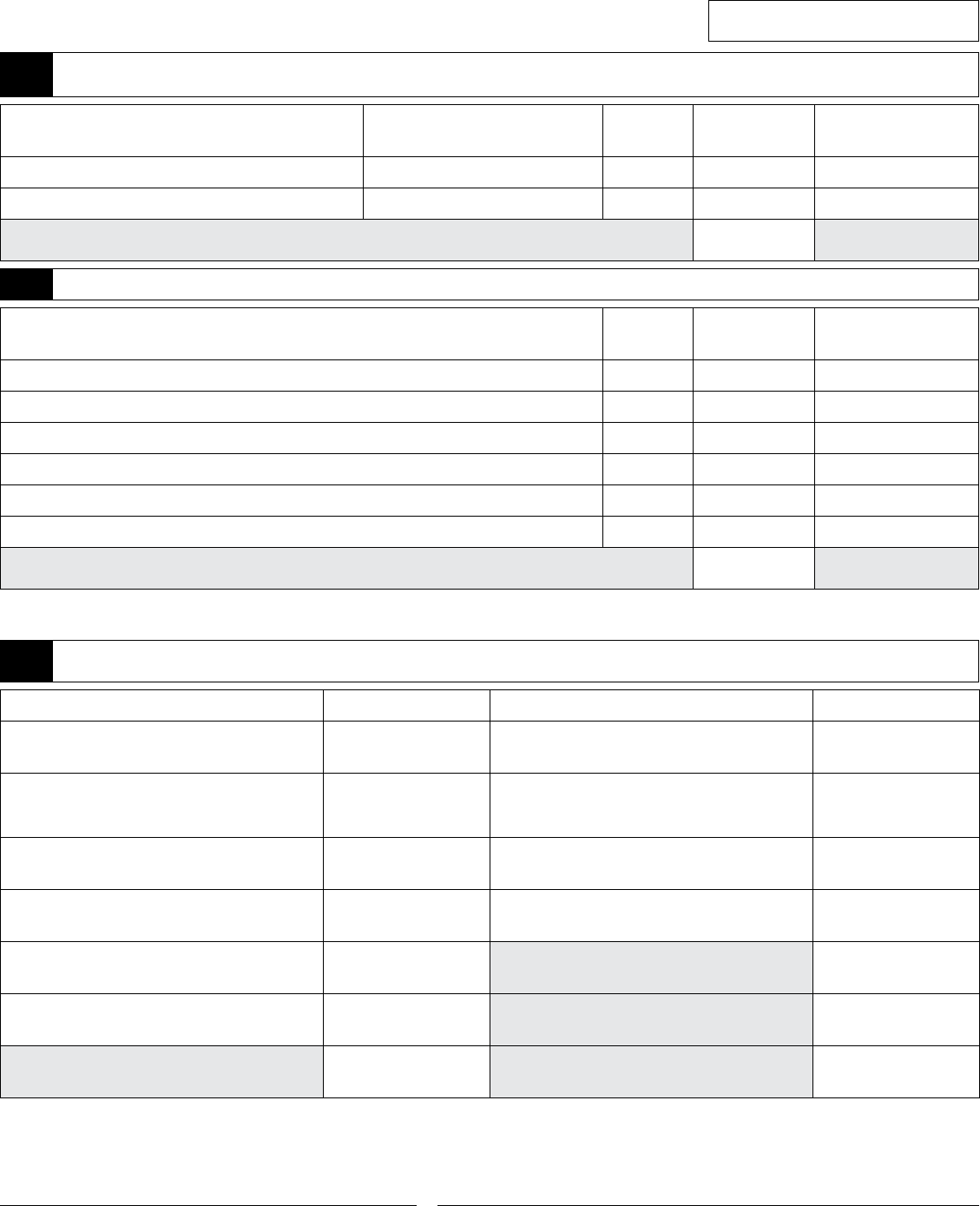

Certification

I certify under penalty of perjury under the laws of the state of Washington that the foregoing is true and correct.

Date and place Signature and title

DLR-430-206 (R/5/16)WA Page 3 of 3

X

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

When you have completed this form, please print it out and sign here.