Fillable Printable Flexible Spending Account Health Care Reimbursement

Fillable Printable Flexible Spending Account Health Care Reimbursement

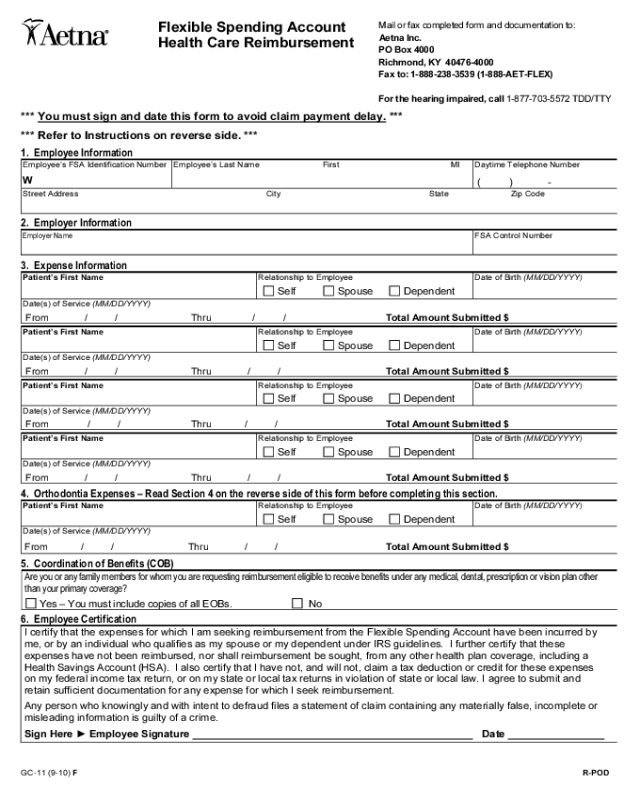

Flexible Spending Account Health Care Reimbursement

Flexible Spending Account

Health Care Reimbursement

Mail or fax completed form and documentation to:

0BAetna Inc.

PO Box 4000

Richmond, KY 40476-4000

Fax to: 1-888-238-3539 (1-888-AET-FLEX)

For the hearing impaired, call 1-877-703-5572 TDD/TTY

*** UYou must sign and date this form to avoid claim payment delay.U ***

*** Refer to Instructions on reverse side. ***

1. Employee Information

Employee’s FSA Identification Number

W

Employee’s Last Name First MI

Daytime Telephone Number

( ) -

Street Address City State Zip Code

2. Employer Information

Employer Name

FSA Control Number

3. Expense Information

Patient’s First Name

Relationship to Employee

Self Spouse Dependent

Date of Birth (MM/DD/YYYY)

Date(s) of Service (MM/DD/YYYY)

From / / Thru / / Total Amount Submitted $

Patient’s First Name

Relationship to Employee

Self Spouse Dependent

Date of Birth (MM/DD/YYYY)

Date(s) of Service (MM/DD/YYYY)

From / / Thru / / Total Amount Submitted $

Patient’s First Name

Relationship to Employee

Self Spouse Dependent

Date of Birth (MM/DD/YYYY)

Date(s) of Service (MM/DD/YYYY)

From / / Thru / / Total Amount Submitted $

Patient’s First Name

Relationship to Employee

Self Spouse Dependent

Date of Birth (MM/DD/YYYY)

Date(s) of Service (MM/DD/YYYY)

From / / Thru / / Total Amount Submitted $

4. Orthodontia Expenses – Read Section 4 on the reverse side of this form before completing this section.

Patient’s First Name

Relationship to Employee

Self Spouse Dependent

Date of Birth (MM/DD/YYYY)

Date(s) of Service (MM/DD/YYYY)

From / / Thru / / Total Amount Submitted $

5. Coordination of Benefits (COB)

Are you or any family members for whom you are requesting reimbursement eligible to receive benefits under any medical, dental, prescription or vision plan other

than your primary coverage?

Yes – You must include copies of all EOBs. No

6. Employee Certification

I certify that the expenses for which I am seeking reimbursement from the Flexible Spending Account have been incurred by

me, or by an individual who qualifies as my spouse or my dependent under IRS guidelines. I further certify that these

expenses have not been reimbursed, nor shall reimbursement be sought, from any other health plan coverage, including a

Health Savings Account (HSA). I also certify that I have not, and will not, claim a tax deduction or credit for these expenses

on my federal income tax return, or on my state or local tax returns in violation of state or local law. I agree to submit and

retain sufficient documentation for any expense for which I seek reimbursement.

Any person who knowingly and with intent to defraud files a statement of claim containing any materially false, incomplete or

misleading information is guilty of a crime.

Sign Here ► Employee Signature Date U

GC-11 (9-10) F R-POD

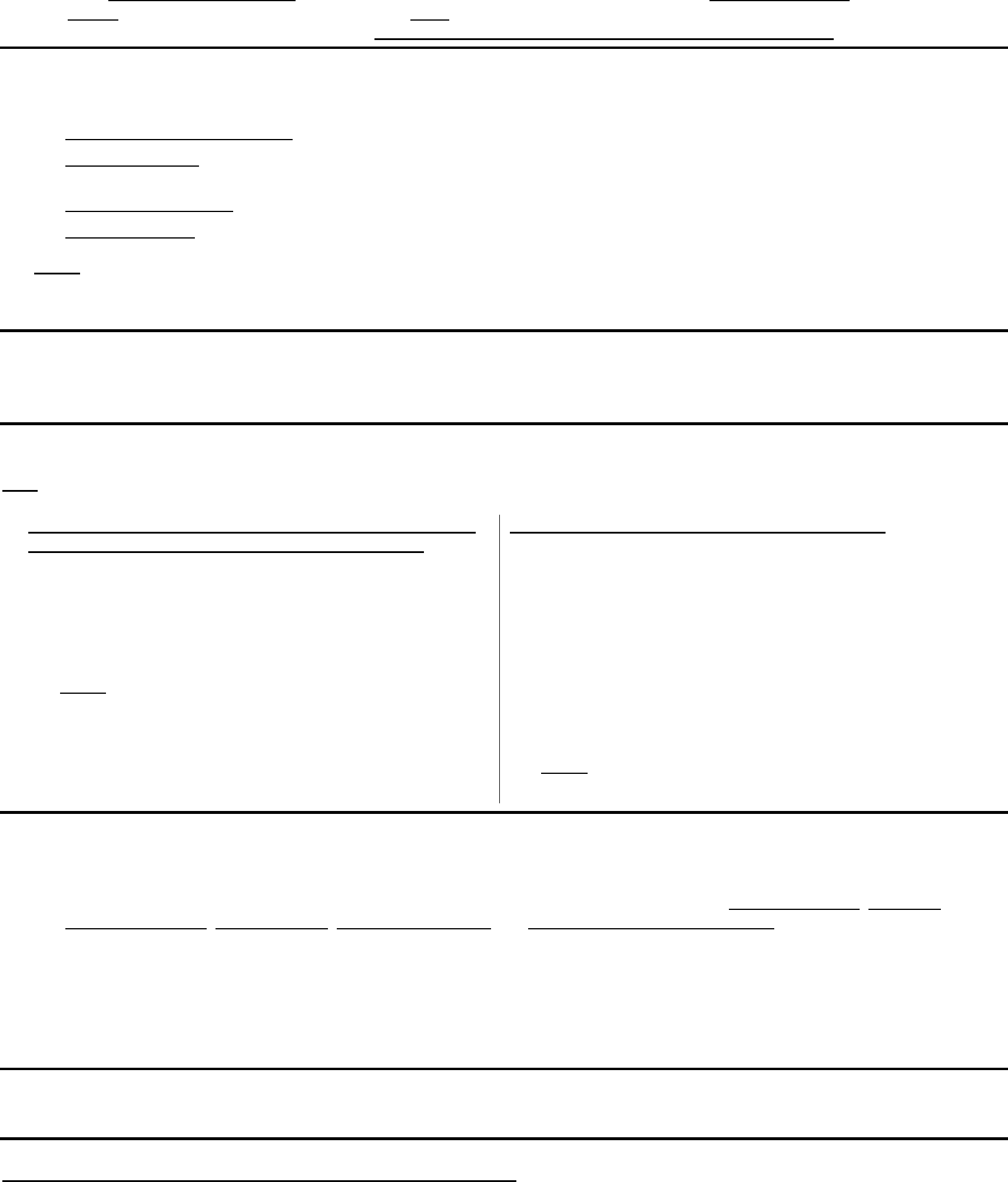

SUBMITTING YOUR CLAIM & PREPARING YOUR CLAIM FORM

- Retain copies for your files. Claim information cannot be returned.

- Do not highlight or otherwise mark the form or enclosed documentation. Highlighting and other marks make scanned and faxed

documents difficult to read.

- Refer to HUwww.aetnanavigator.comUH for additional claim tips. Once in Navigator, click on the UClaims & BalancesU link and then click

on

UClaimsU. On the left side of the screen, click on UFormUs. Scroll down to Flexible Spending Account (FSA) and scroll to the

Reimbursement section. Click on the link for

UHealth Care and Dependent Care claim submission guidelinesU.

SECTION 1 – Employee Information

FSA Identification Number – As a participant with the FSA, you have been assigned a unique participant number. Your FSA ID

Number is a 9 digit number preceded with a “W”. If you do not know your W#, you can locate it from any one of the following sources:

• UExplanation of Payment (EOP)U – Paper EOPs always display your W#.

• UActivity StatementU – As an Aetna FSA participant you may receive an activity statement at least once a year; refer to this

statement for your W#.

• UAetna Medical ID CardU – If you have Aetna medical coverage, the W# displayed on your ID card is also used for your FSA.

• UMember ServicesU – Call FSA Member Services to inquire about your W#.

UNOTEU: If you prefer, you can use your Social Security Number in this field.

Employee’s Address – Report an address change to your employer. To avoid misdirected claim payments, your employer must notify

Aetna of your new address.

SECTION 2 – Employer Information

FSA Control Number – Your employer has been assigned a unique FSA plan number. If this form does not have that number pre-

printed, you can locate this number from any one of the sources (with the exception of the Aetna Medical ID card) listed above in

Section 1.

SECTION 3 – Expense Information

List and separate expenses by individual family members. Attach the appropriate documentation for each claim.

UNoteU: A canceled check is not adequate documentation.

UIf you have insurance that covers part of this expense or

your insurance does not cover this expense at all:

Submit the Explanation of Benefits (EOB) with your

completed claim form. You do not need to submit any

other documentation with the EOB. For a prescription

drug claim, refer to the instructions to the right.

UNOTEU: Any third party documentation that indicates

insurance has not yet paid (e.g., pre-treatment estimate)

will be returned to you. You will need to resubmit the

claim once you have received a final EOB; the EOB must

show that the insurance carrier has paid its portion of the

claim.

UFor an Rx claim or if you do not have insuranceU:

Submit the itemized receipt or statement from the

doctor/dentist/ pharmacist/health care professional. This

itemized receipt or statement must include:

Name & address of doctor/dentist/pharmacist/health

care professional

Patient’s name

Date(s) of service

Type of service

Dollar amount charged

UNOTEU: Receipt from doctor/dentist/pharmacist must clearly

document patient’s financial responsibility.

SECTION 4 – Orthodontia Expenses

For Orthodontia claims, please follow these guidelines.

• When submitting your first orthodontia claim, you must submit the orthodontia contract from the orthodontist along with a signed

Flexible Spending Account Health Care Reimbursement form. This contract must indicate

Uinitial fee chargedU, Uestimated

insurance paymentU, Uinitial start dateU, Uduration of treatmentU and Uproof partial or full down paymentU.

• For each monthly request for reimbursement, you must submit a completed and signed claim form with an itemized

bill/statement or receipt from the orthodontist. This statement must show the monthly charge consistent with the original

orthodontic contract.

• Future dates of services cannot be submitted. IRS guidelines require services to be incurred before you can be reimbursed. A

reimbursement request for a service that will occur in a subsequent plan year will be returned to you for resubmission in that

plan year.

SECTION 5 – Coordination of Benefits (COB)

When an expense is covered under more than one health plan, both Explanation of Benefits must be submitted in order to process the

reimbursement.

SECTION 6 – Employee Certification

UYou must sign and date this form to avoid claim payment delays.

GC-11 (9-10)