Fillable Printable Form 1000 - Ownership Certificate Form (2005)

Fillable Printable Form 1000 - Ownership Certificate Form (2005)

Form 1000 - Ownership Certificate Form (2005)

2

INSTRUCTIONS TO PRINTERS

FORM 1000, PAGE 1 of 2

MARGINS: TOP 8mm (2/6"), CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE, WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203mm (8") x 92mm (3 2/3")

PERFORATE: (NONE)

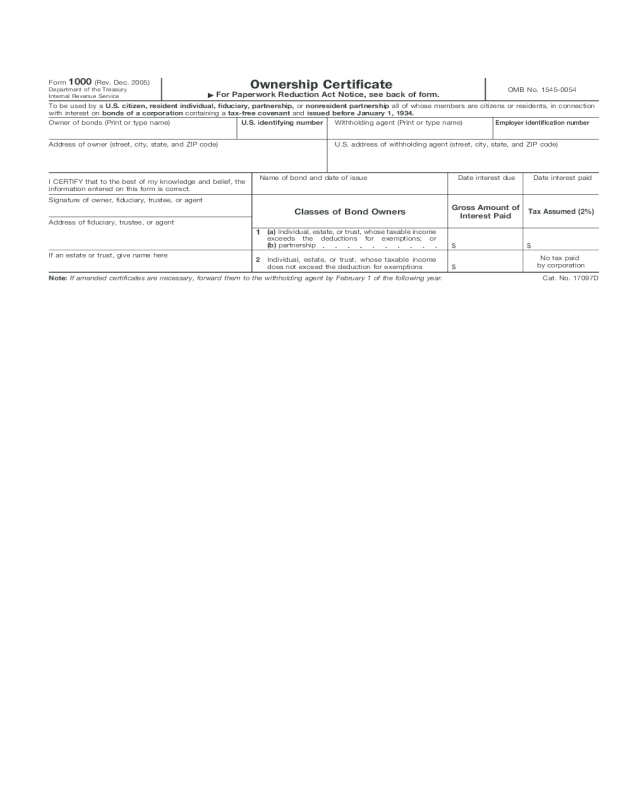

Form

1000 (Rev. Dec. 2005)

OMB No. 1545-0054

Ownership Certificate

Department of the Treasury

Internal Revenue Service

For Paperwork Reduction Act Notice, see back of form.

To be used by a U.S. citizen, resident individual, fiduciary, partnership, or nonresident partnership all of whose members are citizens or residents, in connection

with interest on bonds of a corporation containing a tax-free covenant and issued before January 1, 1934.

Withholding agent (Print or type name)

Employer identification number

U.S. identifying numberOwner of bonds (Print or type name)

U.S. address of withholding agent (street, city, state, and ZIP code)Address of owner (street, city, state, and ZIP code)

Name of bond and date of issue Date interest paidDate interest due

Signature of owner, fiduciary, trustee, or agent

Gross Amount of

Interest Paid

Tax Assumed (2%)

Classes of Bond Owners

Address of fiduciary, trustee, or agent

(a) Individual, estate, or trust, whose taxable income

exceeds the deductions for exemptions; or

(b) partnership

1

$$

If an estate or trust, give name here

No tax paid

by corporation

Individual, estate, or trust, whose taxable income

does not exceed the deduction for exemptions

2

$

Note: If amended certificates are necessary, forward them to the withholding agent by February 1 of the following year.

I CERTIFY that to the best of my knowledge and belief, the

information entered on this form is correct.

Cat. No. 17097D

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

TLS, have you

transmitted all R

text files for this

cycle update?

Date

Action

Revised proofs

requested

Date Signature

O.K. to print

2

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

INSTRUCTIONS TO PRINTERS

FORM 1000, PAGE 2 OF 2

MARGINS; TOP 13mm (

2

⁄6 "), CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 216mm (8

1

⁄2 ") x 279mm (11")

PERFORATE: ON FOLD

How To File. File this form with the withholding agent for

interest payments on bonds that have a tax-free covenant and

that were issued before 1934 by a domestic corporation or a

resident or nonresident foreign corporation.

Instructions to Owner, Fiduciary, Trustee,

or Agent

Paperwork Reduction Act Notice. We ask for the information

on this form to carry out the Internal Revenue laws of the United

Use a separate Form 1000 for each issue of bonds.

Instructions to Withholding Agents

Use Form 1042 to summarize Forms 1000. Do not send Form

1000 to the Internal Revenue Service. Keep Form 1000 for at

least 4 years after the end of the last calendar year in which the

income the form applies to is paid.

If a nonresident foreign corporation with a fiscal or paying

agent in the United States issues the obligation, modify Form

1000 to show the name and address of the nonresident debtor

corporation in addition to the name and address of the U.S.

fiscal or paying agent.

If you have comments concerning the accuracy of this time

estimate or suggestions for making this form simpler, we would

be happy to hear from you. You can write to the Internal

Revenue Service, Tax Products Coordinating Committee,

SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6406,

Washington, DC 20224. Do not send this form to this address.

Instead, see How To File on this page.

The time needed to complete and file this form will vary

depending on individual circumstances. The estimated average

time is 3 hours and 10 minutes.

You are not required to provide the information requested on a

form that is subject to the Paperwork Reduction Act unless the

form displays a valid OMB control number. Books or records

relating to a form or its instructions must be retained as long as

their contents may become material in the administration of any

Internal Revenue law. Generally, tax returns and return

information are confidential, as required by Internal Revenue

Code section 6103.

States. You are required to give us the information. We need it

to ensure that you are complying with these laws and to allow

us to figure and collect the right amount of tax.

Form 1000 (Rev. 12-05) Page 2