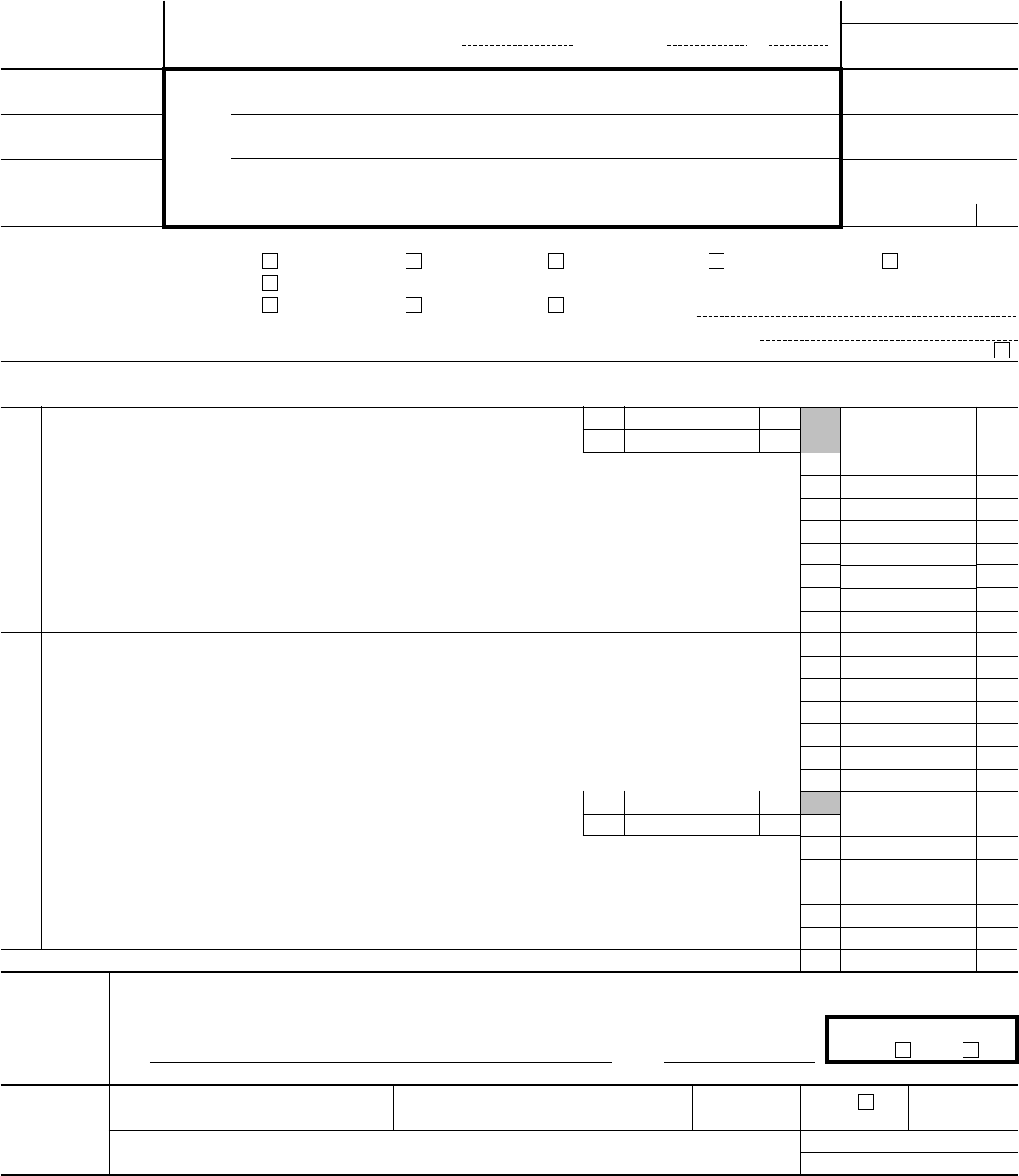

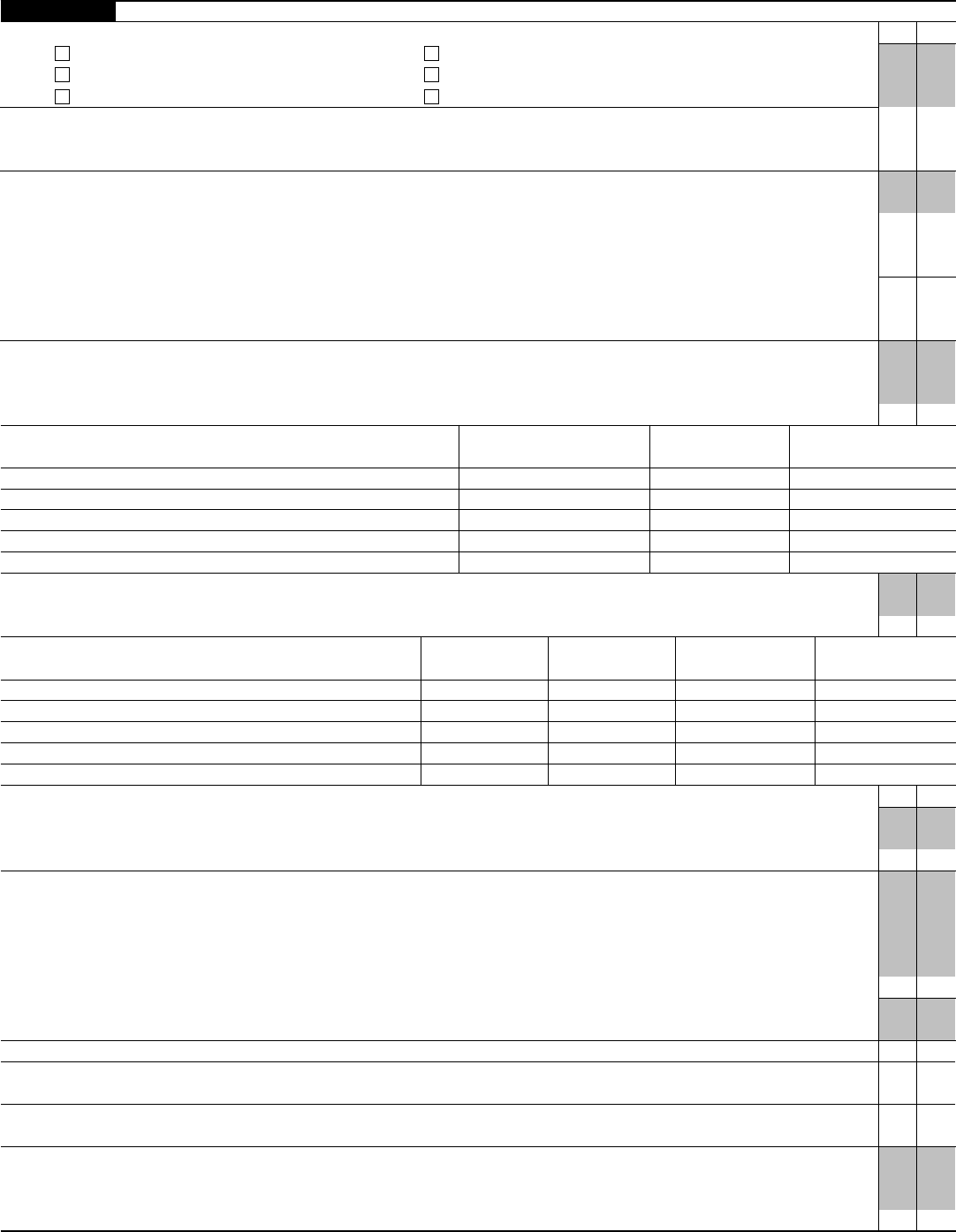

Form 1065 (2016)

Page 2

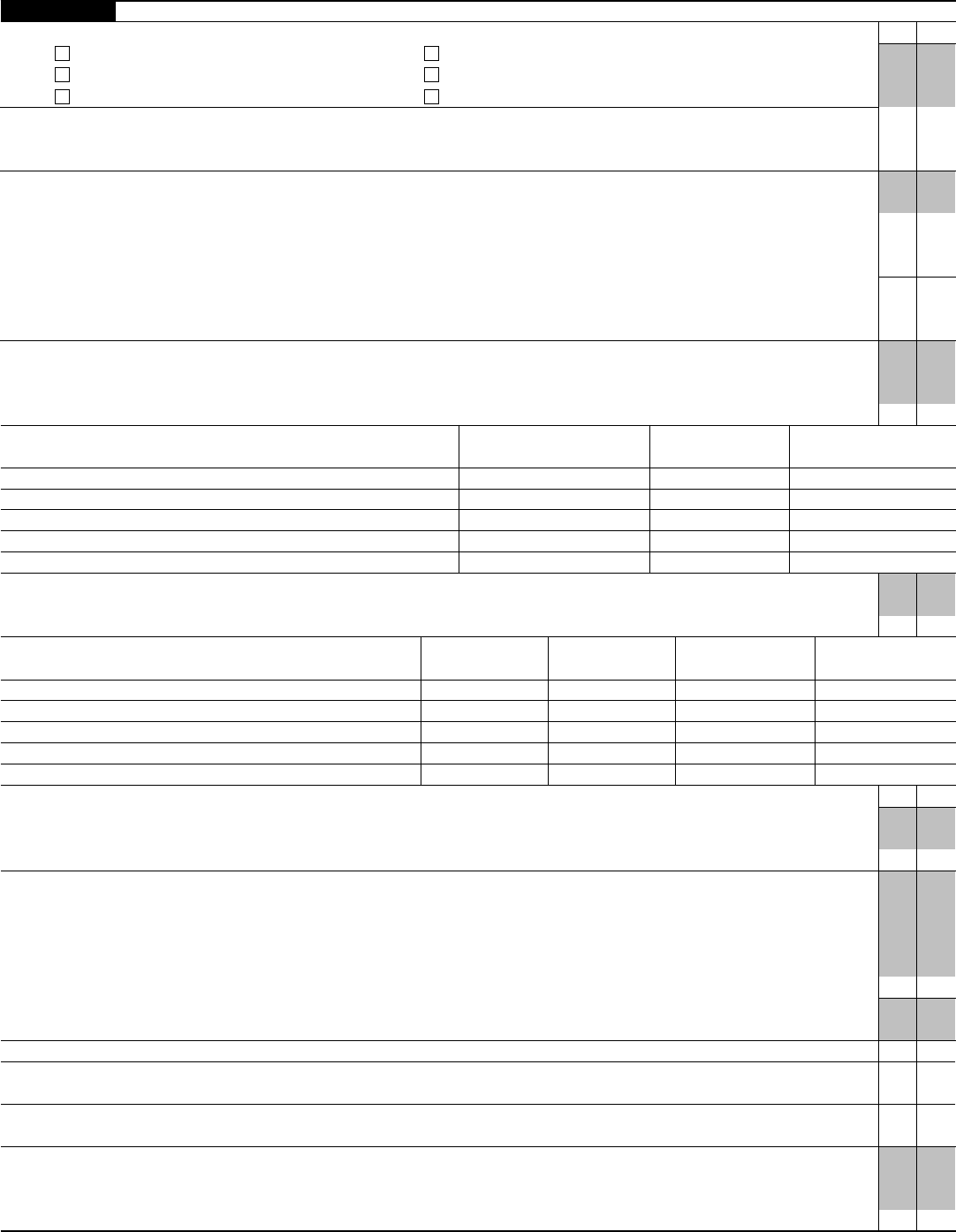

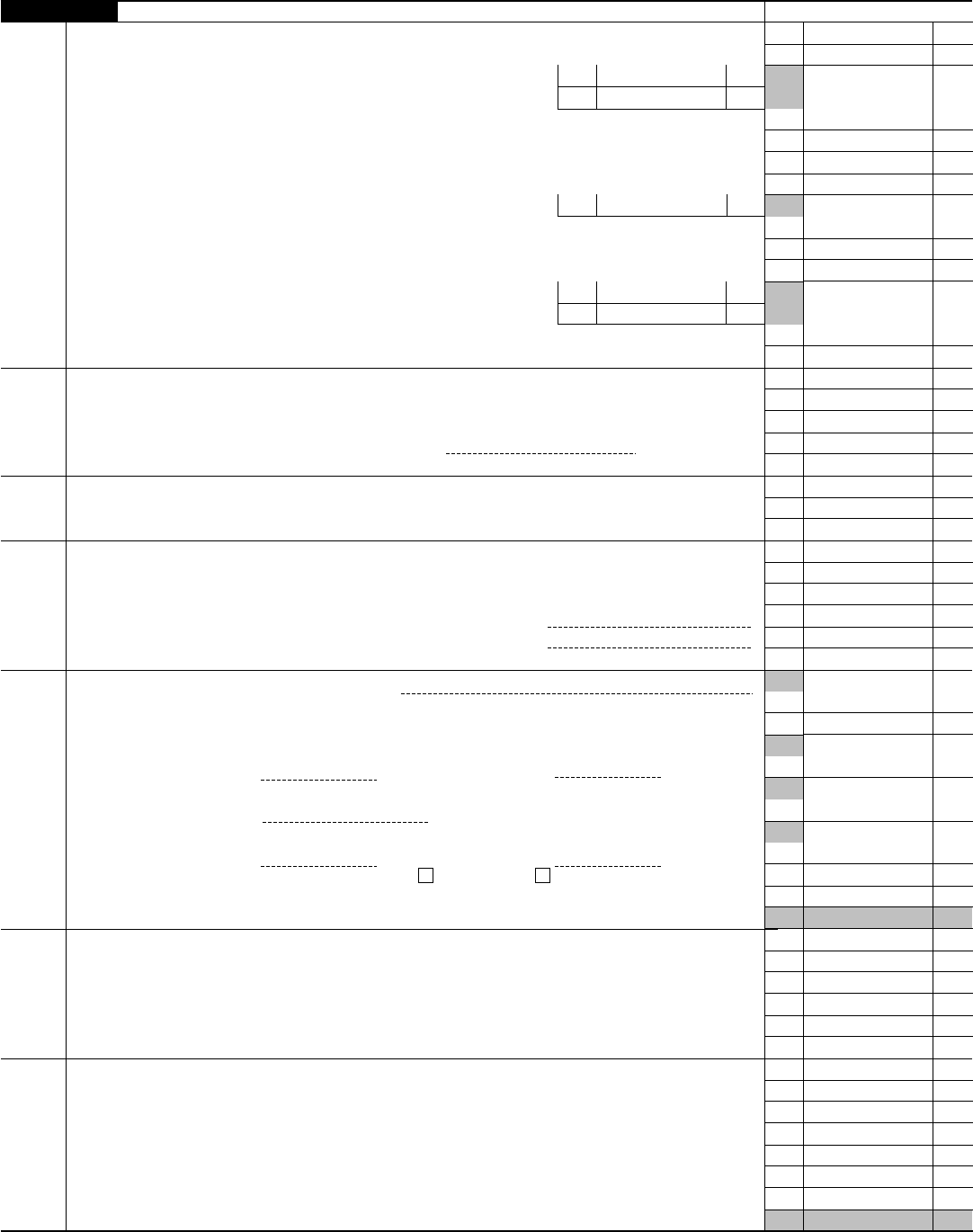

Schedule B

Other Information

1 What type of entity is filing this return? Check the applicable box:

Yes No

a Domestic general partnership b Domestic limited partnership

c Domestic limited liability company d Domestic limited liability partnership

e

Foreign partnership f Other

▶

2

At any time during the tax year, was any partner in the partnership a disregarded entity, a partnership (including

an entity treated as a partnership), a trust, an S corporation, an estate (other than an estate of a deceased partner),

or a nominee or similar person? . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 At the end of the tax year:

a

Did any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or tax-

exempt organization, or any foreign government own, directly or indirectly, an interest of 50% or more in the profit,

loss, or capital of the partnership? For rules of constructive ownership, see instructions. If “Yes,” attach Schedule

B-1, Information on Partners Owning 50% or More of the Partnership . . . . . . . . . . . . . . .

b

Did any individual or estate own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of

the partnership? For rules of constructive ownership, see instructions. If “Yes,” attach Schedule B-1, Information

on Partners Owning 50% or More of the Partnership . . . . . . . . . . . . . . . . . . . .

4 At the end of the tax year, did the partnership:

a

Own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of

stock entitled to vote of any foreign or domestic corporation? For rules of constructive ownership, see

instructions. If “Yes,” complete (i) through (iv) below . . . . . . . . . . . . . . . . . . . . .

(i) Name of Corporation

(ii) Employer Identification

Number (if any)

(iii) Country of

Incorporation

(iv) Percentage

Owned in Voting Stock

b

Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss,

or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial

interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v) below . .

(i) Name of Entity

(ii) Employer

Identification

Number (if any)

(iii) Type of

Entity

(iv) Country of

Organization

(v) Maximum

Percentage Owned in

Profit, Loss, or Capital

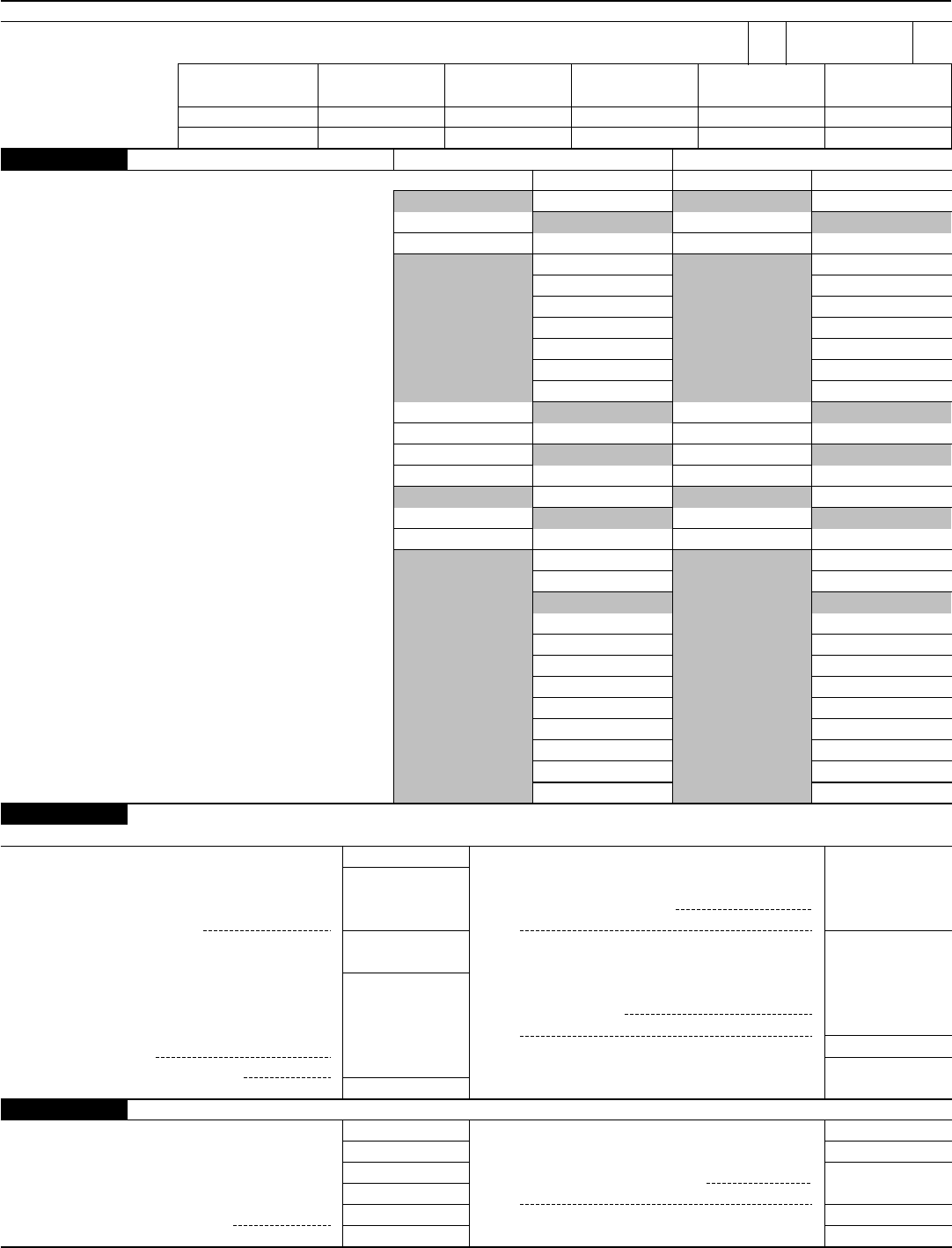

Yes No

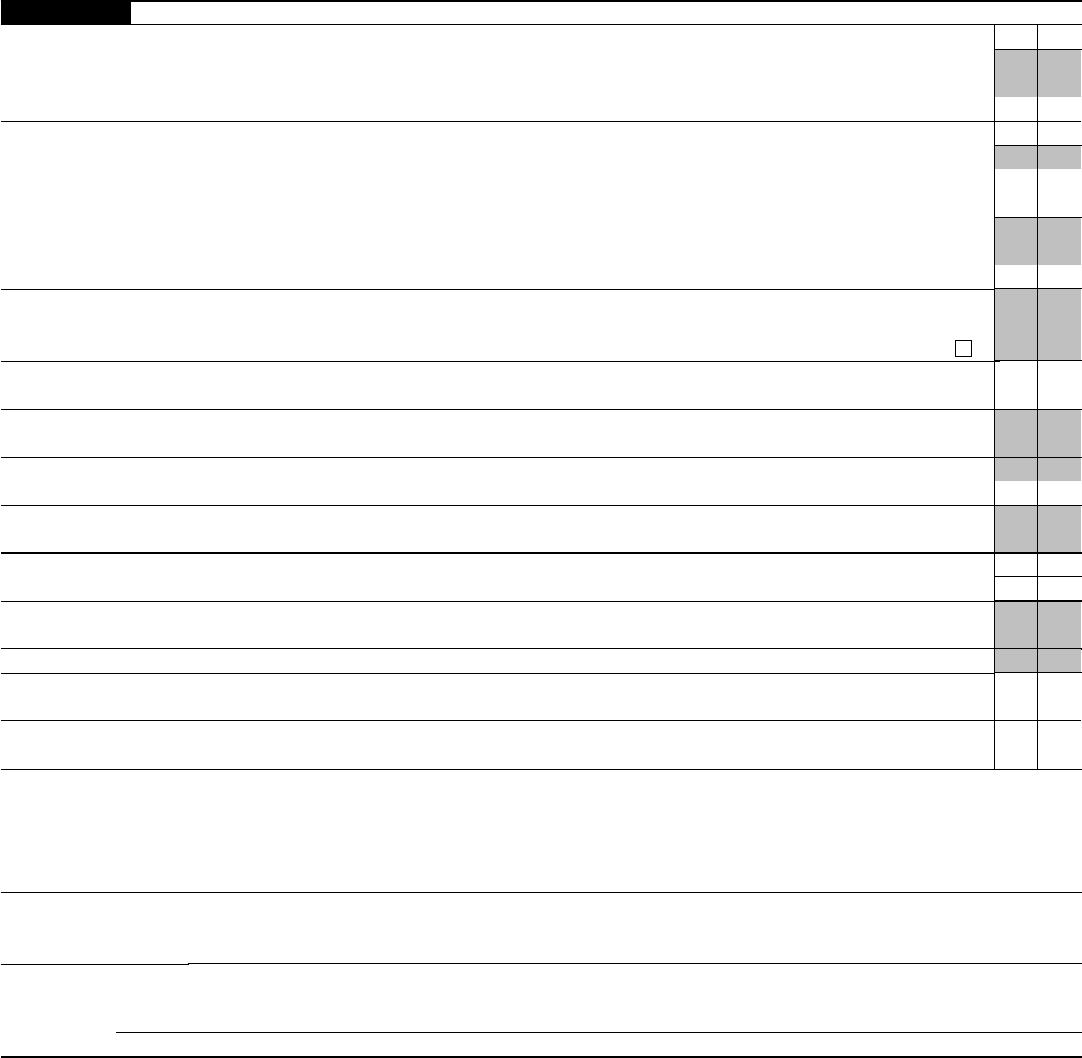

5

Did the partnership file Form 8893, Election of Partnership Level Tax Treatment, or an election statement under

section 6231(a)(1)(B)(ii) for partnership-level tax treatment, that is in effect for this tax year? See Form 8893 for

more details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Does the partnership satisfy all four of the following conditions?

a The partnership’s total receipts for the tax year were less than $250,000.

b The partnership’s total assets at the end of the tax year were less than $1 million.

c

Schedules K-1 are filed with the return and furnished to the partners on or before the due date (including

extensions) for the partnership return.

d The partnership is not filing and is not required to file Schedule M-3 . . . . . . . . . . . . . . .

If “Yes,” the partnership is not required to complete Schedules L, M-1, and M-2; Item F on page 1 of Form 1065;

or Item L on Schedule K-1.

7

Is this partnership a publicly traded partnership as defined in section 469(k)(2)? . . . . . . . . . . . .

8

During the tax year, did the partnership have any debt that was cancelled, was forgiven, or had the terms

modified so as to reduce the principal amount of the debt? . . . . . . . . . . . . . . . . . .

9

Has this partnership filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

information on any reportable transaction? . . . . . . . . . . . . . . . . . . . . . . . .

10

At any time during calendar year 2016, did the partnership have an interest in or a signature or other authority over a financial

account in a foreign country (such as a bank account, securities account, or other financial account)? See the instructions for

exceptions and filing requirements for FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). If “Yes,”

enter the name of the foreign country

.

▶

Form 1065 (2016)