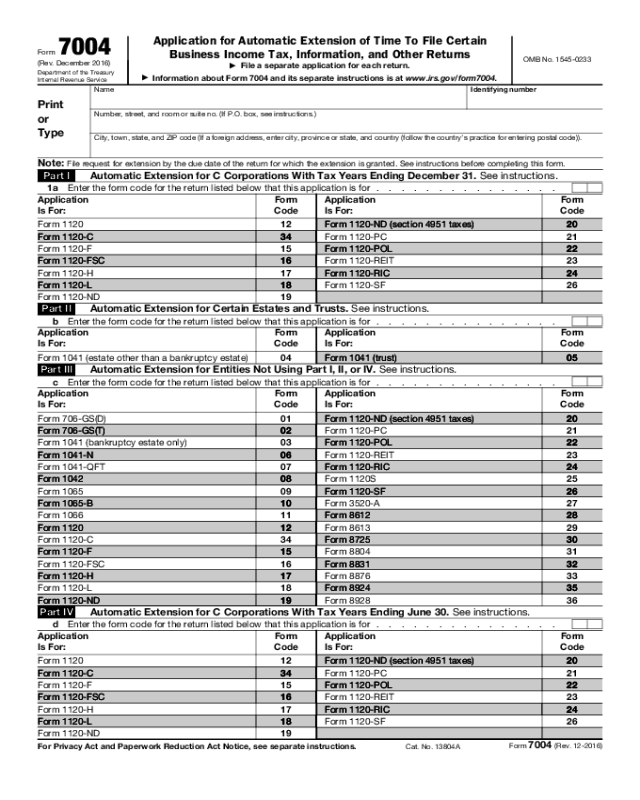

Form 7004

(Rev. December 2016)

Department of the Treasury

Internal Revenue Service

Application for Automatic Extension of Time To File Certain

Business Income Tax, Information, and Other Returns

▶

File a separate application for each return.

▶

Information about Form 7004 and its separate instructions is at www.irs.gov/form7004.

OMB No. 1545-0233

Print

or

Type

Name Identifying number

Number, street, and room or suite no. (If P.O. box, see instructions.)

City, town, state, and ZIP code (If a foreign address, enter city, province or state, and country (follow the country’s practice for entering postal code)).

Note: File request for extension by the due date of the return for which the extension is granted. See instructions before completing this form.

Part I Automatic Extension for C Corporations With Tax Years Ending December 31. See instructions.

1a Enter the form code for the return listed below that this application is for . . . . . . . . . . . . . . .

Application

Is For:

Form

Code

Form 1120

12

Form 1120-C 34

Form 1120-F 15

Form 1120-FSC 16

Form 1120-H 17

Form 1120-L 18

Form 1120-ND 19

Application

Is For:

Form

Code

Form 1120-ND (section 4951 taxes) 20

Form 1120-PC 21

Form 1120-POL 22

Form 1120-REIT 23

Form 1120-RIC 24

Form 1120-SF 26

Part II Automatic Extension for Certain Estates and Trusts. See instructions.

b Enter the form code for the return listed below that this application is for . . . . . . . . . . . . . . .

Application

Is For:

Form

Code

Form 1041 (estate other than a bankruptcy estate)

04

Application

Is For:

Form

Code

Form 1041 (trust) 05

Part III Automatic Extension for Entities Not Using Part I, II, or IV. See instructions.

c

Enter the form code for the return listed below that this application is for . . . . . . . . . . . . . . .

Application

Is For:

Form

Code

Form 706-GS(D)

01

Form 706-GS(T) 02

Form 1041 (bankruptcy estate only)

03

Form 1041-N 06

Form 1041-QFT

07

Form 1042 08

Form 1065

09

Form 1065-B 10

Form 1066

11

Form 1120 12

Form 1120-C

34

Form 1120-F 15

Form 1120-FSC

16

Form 1120-H 17

Form 1120-L 18

Form 1120-ND 19

Application

Is For:

Form

Code

Form 1120-ND (section 4951 taxes) 20

Form 1120-PC 21

Form 1120-POL 22

Form 1120-REIT 23

Form 1120-RIC 24

Form 1120S 25

Form 1120-SF 26

Form 3520-A 27

Form 8612 28

Form 8613 29

Form 8725 30

Form 8804 31

Form 8831 32

Form 8876 33

Form 8924 35

Form 8928 36

Part IV Automatic Extension for C Corporations With Tax Years Ending June 30. See instructions.

d Enter the form code for the return listed below that this application is for . . . . . . . . . . . . . . .

Application

Is For:

Form

Code

Form 1120

12

Form 1120-C 34

Form 1120-F 15

Form 1120-FSC 16

Form 1120-H 17

Form 1120-L 18

Form 1120-ND 19

Application

Is For:

Form

Code

Form 1120-ND (section 4951 taxes) 20

Form 1120-PC 21

Form 1120-POL 22

Form 1120-REIT 23

Form 1120-RIC 24

Form 1120-SF 26

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 13804A

Form 7004 (Rev. 12-2016)