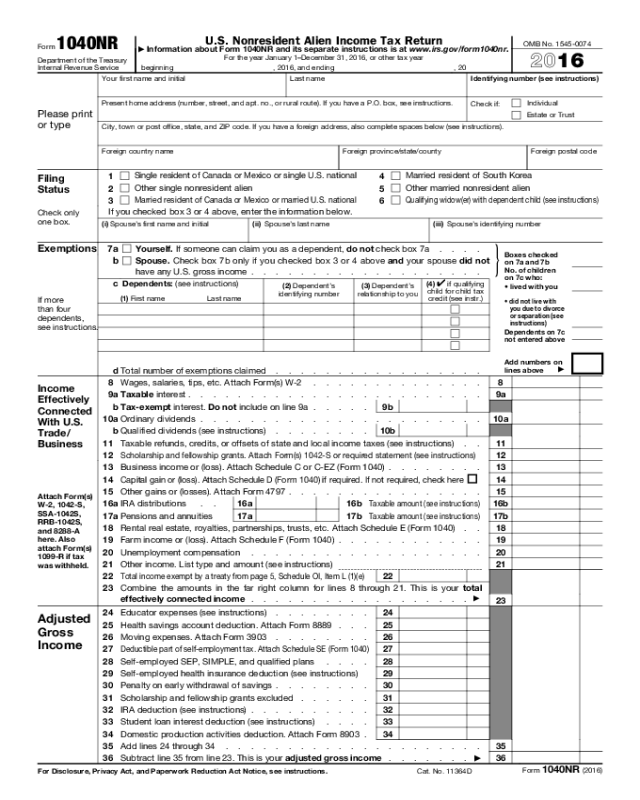

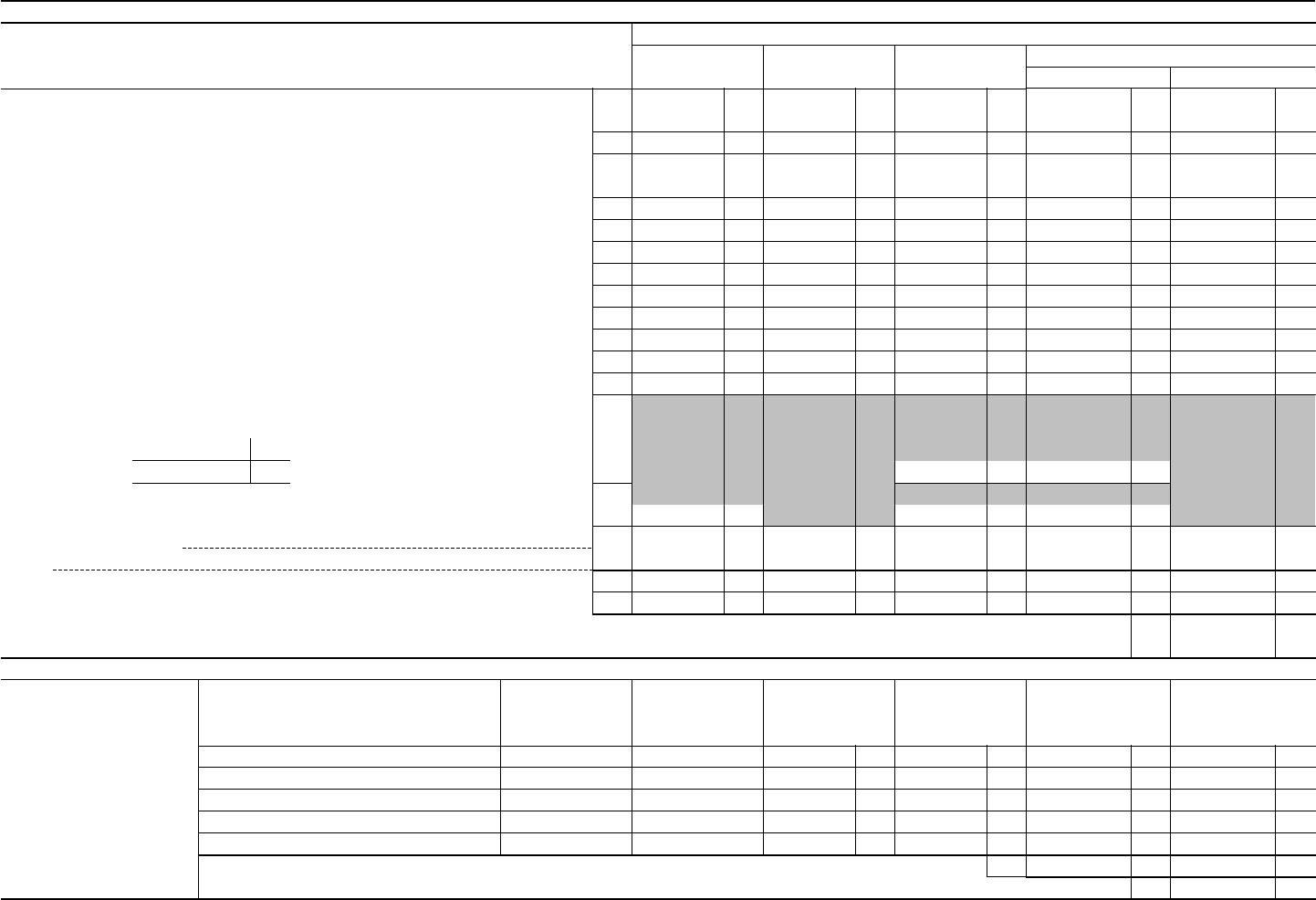

Form 1040NR

Department of the Treasury

Internal Revenue Service

U.S. Nonresident Alien Income Tax Return

▶

Information about Form 1040NR and its separate instructions is at www.irs.gov/form1040nr.

For the year January 1–December 31, 2016, or other tax year

beginning , 2016, and ending , 20

OMB No. 1545-0074

2016

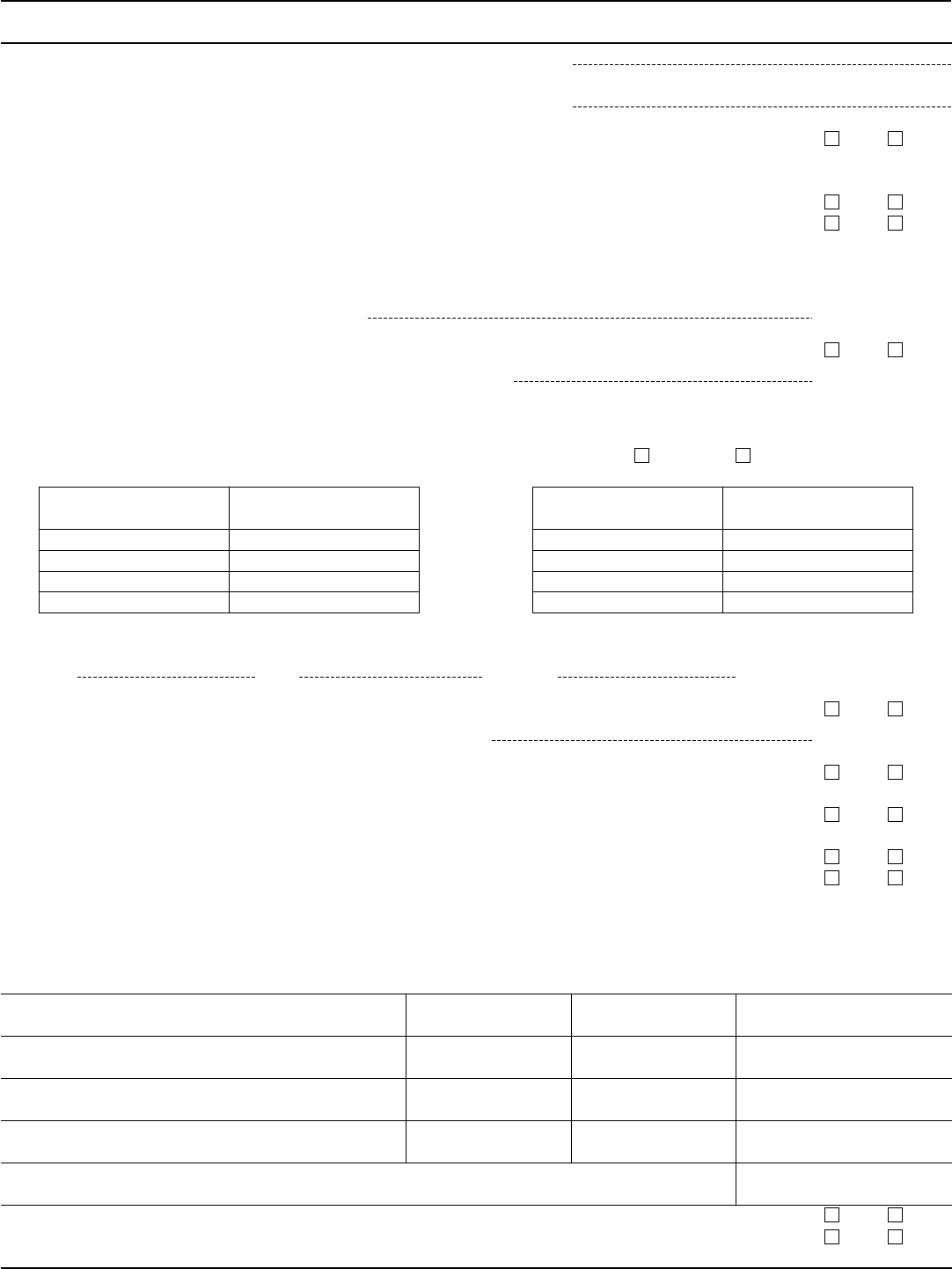

Please print

or type

Your first name and initial Last name Identifying number (see instructions)

Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions.

Check if:

Individual

Estate or Trust

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Foreign country name Foreign province/state/county Foreign postal code

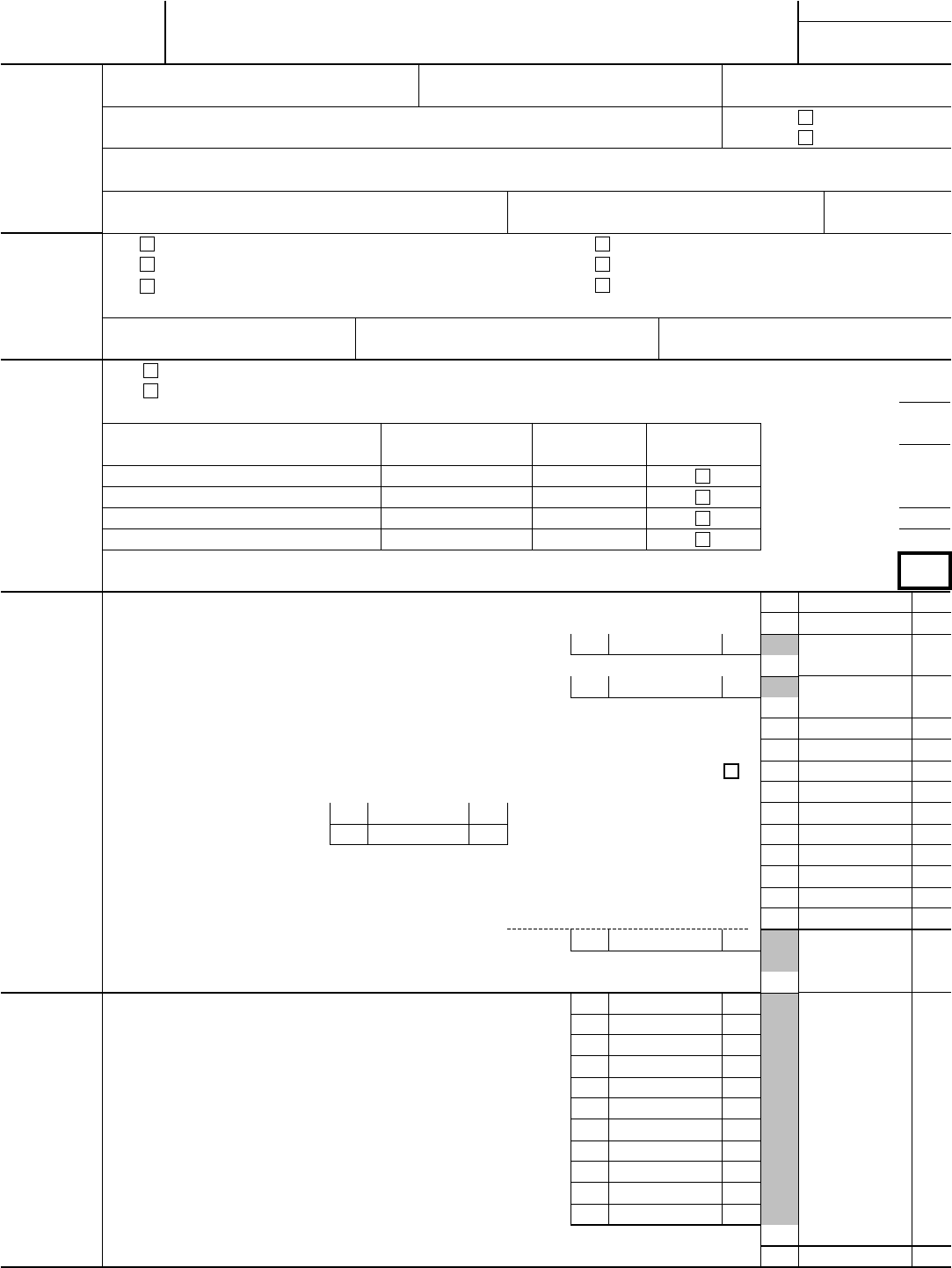

Filing

Status

Check only

one box.

1

Single resident of Canada or Mexico or single U.S. national

2

Other single nonresident alien

3

Married resident of Canada or Mexico or married U.S. national

4

Married resident of South Korea

5

Other married nonresident alien

6

Qualifying widow(er) with dependent child (see instructions)

If you checked box 3 or 4 above, enter the information below.

(i) Spouse’s first name and initial (ii) Spouse’s last name (iii) Spouse’s identifying number

Exemptions

If more

than four

dependents,

see instructions.

7 a

Yourself. If someone can claim you as a dependent, do not check box 7a . . . .

b

Spouse. Check box 7b only if you checked box 3 or 4 above and your spouse did not

have any U.S. gross income . . . . . . . . . . . . . . . . . . .

}

Boxes checked

on 7a and 7b

c

Dependents: (see instructions)

(1) First name Last name

(2) Dependent’s

identifying number

(3) Dependent’s

relationship to you

(4) ✔ if qualifying

child for child tax

credit (see instr.)

No. of children

on 7c who:

• lived with you

• did not live with

you due to divorce

or separation (see

instructions)

Dependents on 7c

not entered above

d Total number of exemptions claimed . . . . . . . . . . . . . . . . .

Add numbers on

lines above

▶

Income

Effectively

Connected

With U.S.

Trade/

Business

Attach Form(s)

W-2, 1042-S,

SSA-1042S,

RRB-1042S,

and 8288-A

here. Also

attach Form(s)

1099-R if tax

was withheld.

8 Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . 8

9a Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . 9a

b Tax-exempt interest. Do not include on line 9a . . . . . 9b

10a Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . 10a

b Qualified dividends (see instructions) . . . . . . . . 10b

11 Taxable refunds, credits, or offsets of state and local income taxes (see instructions) . . 11

12

Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement (see instructions)

12

13 Business income or (loss). Attach Schedule C or C-EZ (Form 1040) . . . . . . . . 13

14

Capital gain or (loss). Attach Schedule D (Form 1040) if required. If not required, check here

14

15 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . 15

16a IRA distributions . . 16a 16b

Taxable amount (see instructions)

16b

17a Pensions and annuities 17a 17b

Taxable amount (see instructions)

17b

18 Rental real estate, royalties, partnerships, trusts, etc. Attach Schedule E (Form 1040) . . 18

19 Farm income or (loss). Attach Schedule F (Form 1040) . . . . . . . . . . . . 19

20 Unemployment compensation . . . . . . . . . . . . . . . . . . . 20

21 Other income. List type and amount (see instructions) 21

22

Total income exempt by a treaty from page 5, Schedule OI, Item L (1)(e)

22

23 Combine the amounts in the far right column for lines 8 through 21. This is your total

effectively connected income . . . . . . . . . . . . . . . . . .

▶

23

Adjusted

Gross

Income

24 Educator expenses (see instructions) . . . . . . . . 24

25 Health savings account deduction. Attach Form 8889 . . . 25

26 Moving expenses. Attach Form 3903 . . . . . . . . 26

27

Deductible part of self-employment tax. Attach Schedule SE (Form 1040)

27

28 Self-employed SEP, SIMPLE, and qualified plans . . . . 28

29 Self-employed health insurance deduction (see instructions) 29

30 Penalty on early withdrawal of savings . . . . . . . . 30

31 Scholarship and fellowship grants excluded . . . . . . 31

32 IRA deduction (see instructions) . . . . . . . . . . 32

33 Student loan interest deduction (see instructions) . . . . 33

34 Domestic production activities deduction. Attach Form 8903 . 34

35 Add lines 24 through 34 . . . . . . . . . . . . . . . . . . . . . 35

36 Subtract line 35 from line 23. This is your adjusted gross income . . . . . . .

▶

36

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions. Cat. No. 11364D

Form 1040NR (2016)