Form 1099-DIV

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable, but the online version of it, printed from this website, is not. Do not print and file

copy A downloaded from this website; a penalty may be imposed for filing with the IRS

information return forms that can’t be scanned. See part O in the current General

Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more

information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be

downloaded and printed and used to satisfy the requirement to provide the information to

the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with

the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms

. Click on

Employer and Information Returns, and we’ll mail you the forms you request and their

instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns

Electronically (FIRE) system (visit www.IRS.gov/FIRE

) or the IRS Affordable Care Act

Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax

forms.

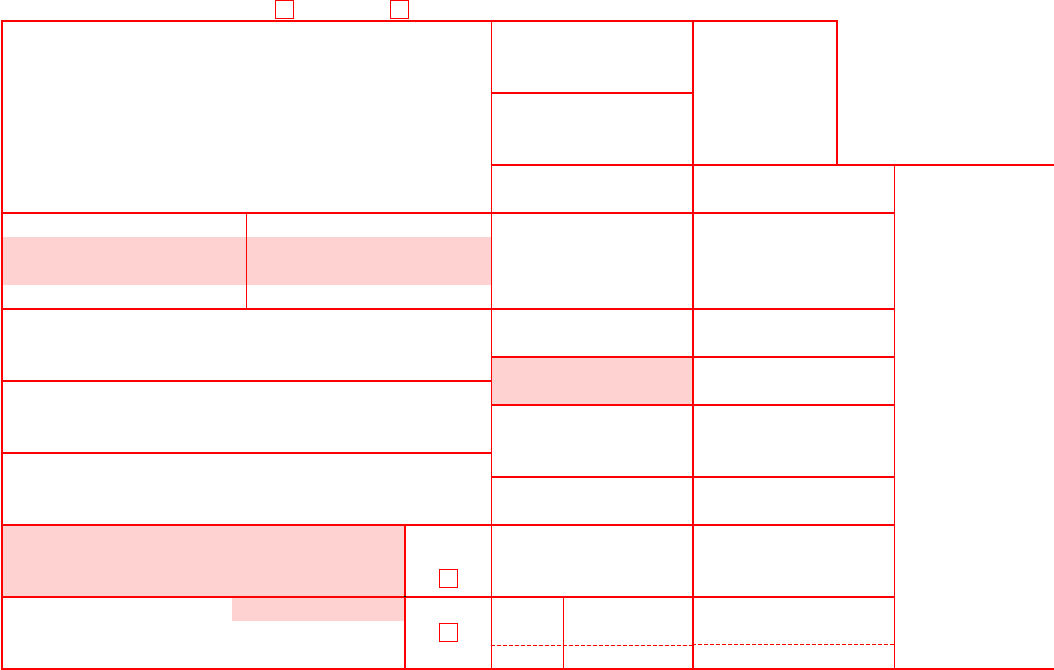

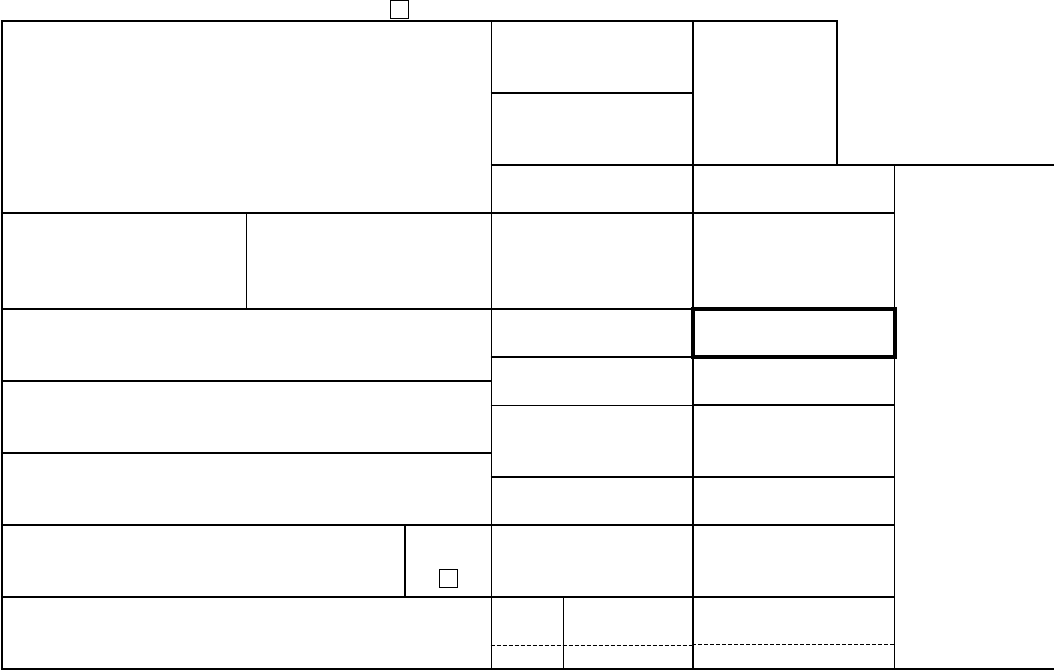

Form 1099-DIV

2017

Cat. No. 14415N

Dividends and

Distributions

Copy A

For

Internal Revenue

Service Center

Department of the Treasury - Internal Revenue Service

File with Form 1096.

OMB No. 1545-0110

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2017 General

Instructions for

Certain

Information

Returns.

9191

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S federal identification number

RECIPIENT’S identification number

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

FATCA filing

requirement

Account number (see instructions)

2nd TIN not.

1a Total ordinary dividends

$

1b Qualified dividends

$

2a Total capital gain distr.

$

2b Unrecap. Sec. 1250 gain

$

2c Section 1202 gain

$

2d Collectibles (28%) gain

$

3 Nondividend distributions

$

4

Federal income tax withheld

$

5 Investment expenses

$

6 Foreign tax paid

$

7 Foreign country or U.S. possession

8 Cash liquidation distributions

$

9

Noncash liquidation distributions

$

10 Exempt-interest dividends

$

11

Specified private activity

bond interest dividends

$

12 State 13

State identification no.

14 State tax withheld

$

$

Form 1099-DIV

www.irs.gov/form1099div

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

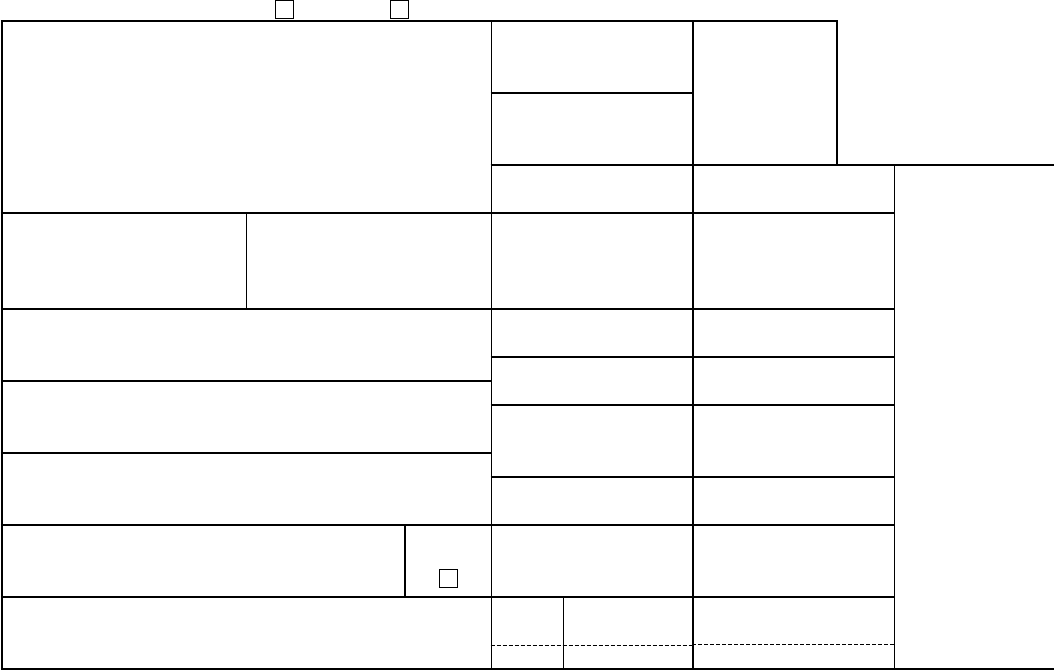

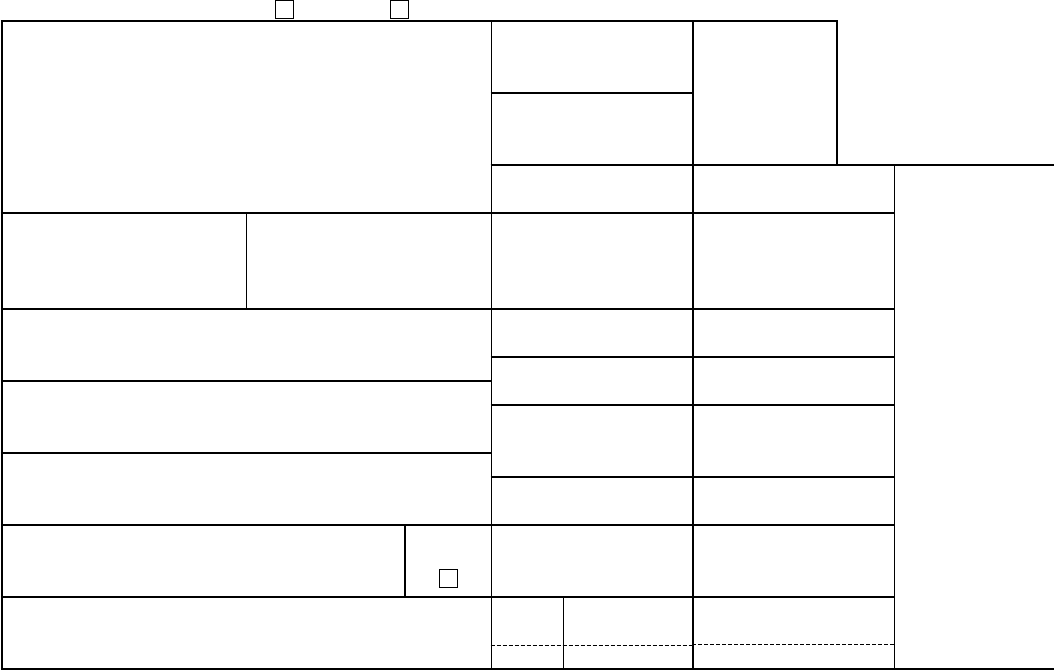

Form 1099-DIV

2017

Dividends and

Distributions

Copy 1

For State Tax

Department

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0110

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S federal identification number

RECIPIENT’S identification number

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

FATCA filing

requirement

Account number (see instructions)

1a Total ordinary dividends

$

1b Qualified dividends

$

2a Total capital gain distr.

$

2b Unrecap. Sec. 1250 gain

$

2c Section 1202 gain

$

2d Collectibles (28%) gain

$

3 Nondividend distributions

$

4

Federal income tax withheld

$

5 Investment expenses

$

6 Foreign tax paid

$

7 Foreign country or U.S. possession

8 Cash liquidation distributions

$

9

Noncash liquidation distributions

$

10 Exempt-interest dividends

$

11

Specified private activity

bond interest dividends

$

12 State 13

State identification no.

14 State tax withheld

$

$

Form 1099-DIV

www.irs.gov/form1099div

Form 1099-DIV

2017

Dividends and

Distributions

Copy B

For Recipient

Department of the Treasury - Internal Revenue Service

This is important tax

information and is

being furnished to

the Internal Revenue

Service. If you are

required to file a

return, a negligence

penalty or other

sanction may be

imposed on you if

this income is taxable

and the IRS

determines that it has

not been reported.

OMB No. 1545-0110

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S federal identification number

RECIPIENT’S identification number

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

FATCA filing

requirement

Account number (see instructions)

1a Total ordinary dividends

$

1b Qualified dividends

$

2a Total capital gain distr.

$

2b Unrecap. Sec. 1250 gain

$

2c Section 1202 gain

$

2d Collectibles (28%) gain

$

3 Nondividend distributions

$

4

Federal income tax withheld

$

5 Investment expenses

$

6 Foreign tax paid

$

7 Foreign country or U.S. possession

8 Cash liquidation distributions

$

9

Noncash liquidation distributions

$

10 Exempt-interest dividends

$

11

Specified private activity

bond interest dividends

$

12 State 13

State identification no.

14 State tax withheld

$

$

Form 1099-DIV

(keep for your records)

www.irs.gov/form1099div

Instructions for Recipient

Recipient's taxpayer identification number. For your protection, this form may

show only the last four digits of your social security number (SSN), individual

taxpayer identification number (ITIN), adoption taxpayer identification number

(ATIN), or employer identification number (EIN). However, the issuer has

reported your complete identification number to the IRS.

FATCA filing requirement. If the FATCA filing requirement box is checked, the

payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting

requirement. You also may have a filing requirement. See the Instructions for

Form 8938.

Account number. May show an account or other unique number the payer

assigned to distinguish your account.

Box 1a. Shows total ordinary dividends that are taxable. Include this amount on

line 9a of Form 1040 or 1040A. Also, report it on Schedule B (1040A or 1040), if

required.

Box 1b. Shows the portion of the amount in box 1a that may be eligible for

reduced capital gains rates. See Form 1040/1040A instructions for how to

determine this amount. Report the eligible amount on line 9b, Form 1040 or

1040A.

The amount shown may be dividends a corporation paid directly to you as a

participant (or beneficiary of a participant) in an employee stock ownership plan

(ESOP). Report it as a dividend on your Form 1040/1040A but treat it as a plan

distribution, not as investment income, for any other purpose.

Box 2a. Shows total capital gain distributions from a regulated investment

company or real estate investment trust. Report the amounts shown in box 2a

on Schedule D (Form 1040), line 13. But, if no amount is shown in boxes 2c–2d

and your only capital gains and losses are capital gain distributions, you may be

able to report the amounts shown in box 2a on line 13 of Form 1040 (line 10 of

Form 1040A) rather than Schedule D. See the Form 1040/1040A instructions.

Box 2b. Shows the portion of the amount in box 2a that is unrecaptured section

1250 gain from certain depreciable real property. Report this amount on the

Unrecaptured Section 1250 Gain Worksheet—Line 19 in the Schedule D

instructions (Form 1040).

Box 2c. Shows the portion of the amount in box 2a that is section 1202 gain

from certain small business stock that may be subject to an exclusion. See the

Schedule D (Form 1040) instructions.

Box 2d. Shows 28% rate gain from sales or exchanges of collectibles. If

required, use this amount when completing the 28% Rate Gain Worksheet—

Line 18 in the instructions for Schedule D (Form 1040).

Box 3. Shows the part of the distribution that is nontaxable because it is a return

of your cost (or other basis). You must reduce your cost (or other basis) by this

amount for figuring gain or loss when you sell your stock. But if you get back all

your cost (or other basis), report future distributions as capital gains. See Pub.

550.

Box 4. Shows backup withholding. A payer must backup withhold on certain

payments if you did not give your taxpayer identification number to the payer.

See Form W-9, Request for Taxpayer Identification Number and Certification, for

information on backup withholding. Include this amount on your income tax

return as tax withheld.

Box 5. Shows your share of expenses of a nonpublicly offered regulated

investment company, generally a nonpublicly offered mutual fund. If you file

Form 1040, you may deduct these expenses on the “Other expenses” line on

Schedule A (Form 1040) subject to the 2% limit. This amount is included in

box 1a.

Box 6. Shows the foreign tax that you may be able to claim as a deduction or a

credit on Form 1040. See the Form 1040 instructions.

Box 7. This box should be left blank if a regulated investment company reported

the foreign tax shown in box 6.

Boxes 8 and 9. Shows cash and noncash liquidation distributions.

Box 10. Shows exempt-interest dividends from a mutual fund or other regulated

investment company paid to you during the calendar year. Include this amount

on line 8b of Form 1040 or 1040A as tax-exempt interest. This amount may be

subject to backup withholding. See box 4.

Box 11. Shows exempt-interest dividends subject to the alternative minimum

tax. This amount is included in box 10. See the Instructions for Form 6251.

Boxes 12–14. State income tax withheld reporting boxes.

Nominees. If this form includes amounts belonging to another person, you are

considered a nominee recipient. You must file Form 1099-DIV (with a

Form 1096) with the IRS for each of the other owners to show their share of the

income, and you must furnish a Form 1099-DIV to each. A spouse is not

required to file a nominee return to show amounts owned by the other spouse.

See the 2017 General Instructions for Certain Information Returns.

Future developments. For the latest information about the developments

related to Form 1099-DIV and its instructions, such as legislation enacted after

they were published, go to www.irs.gov/form1099div.

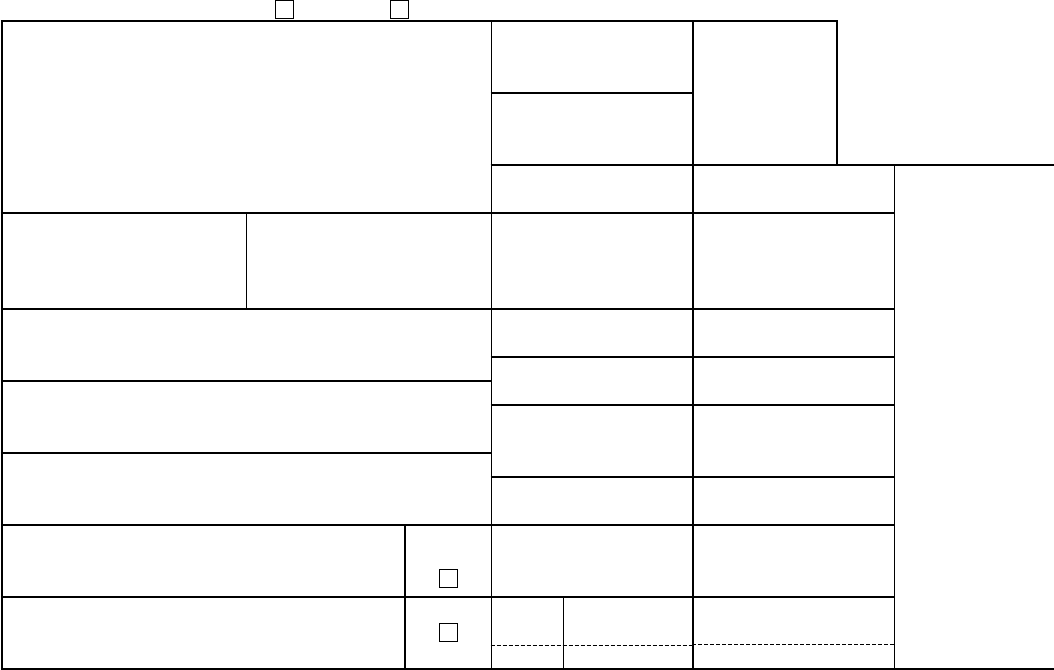

Form 1099-DIV

2017

Dividends and

Distributions

Copy 2

To be filed with

recipient's state

income tax return,

when required.

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0110

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S federal identification number

RECIPIENT’S identification number

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

FATCA filing

requirement

Account number (see instructions)

1a Total ordinary dividends

$

1b Qualified dividends

$

2a Total capital gain distr.

$

2b Unrecap. Sec. 1250 gain

$

2c Section 1202 gain

$

2d Collectibles (28%) gain

$

3 Nondividend distributions

$

4

Federal income tax withheld

$

5 Investment expenses

$

6 Foreign tax paid

$

7 Foreign country or U.S. possession

8 Cash liquidation distributions

$

9

Noncash liquidation distributions

$

10 Exempt-interest dividends

$

11

Specified private activity

bond interest dividends

$

12 State 13

State identification no.

14 State tax withheld

$

$

Form 1099-DIV

www.irs.gov/form1099div

Form 1099-DIV

2017

Dividends and

Distributions

Copy C

For Payer

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0110

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2017 General

Instructions for

Certain

Information

Returns.

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S federal identification number

RECIPIENT’S identification number

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

FATCA filing

requirement

Account number (see instructions) 2nd TIN not.

1a Total ordinary dividends

$

1b Qualified dividends

$

2a Total capital gain distr.

$

2b Unrecap. Sec. 1250 gain

$

2c Section 1202 gain

$

2d Collectibles (28%) gain

$

3 Nondividend distributions

$

4

Federal income tax withheld

$

5 Investment expenses

$

6 Foreign tax paid

$

7 Foreign country or U.S. possession

8 Cash liquidation distributions

$

9

Noncash liquidation distributions

$

10 Exempt-interest dividends

$

11

Specified private activity

bond interest dividends

$

12 State 13

State identification no.

14 State tax withheld

$

$

Form 1099-DIV

www.irs.gov/form1099div

Instructions for Payer

To complete Form 1099-DIV, use:

• the 2017 General Instructions for Certain Information

Returns, and

• the 2017 Instructions for Form 1099-DIV.

To order these instructions and additional forms, go

to www.irs.gov/form1099div.

Caution: Because paper forms are scanned during

processing, you cannot file Forms 1096, 1097, 1098,

1099, 3921, 3922, or 5498 that you print from the IRS

website.

Due dates. Furnish Copy B of this form to the recipient

by January 31, 2018.

File Copy A of this form with the IRS by February 28,

2018. If you file electronically, the due date is

April 2, 2018. To file electronically, you must have

software that generates a file according to the

specifications in Pub. 1220. The IRS does not provide a

fill-in form option.

Foreign dividend recipient. If the recipient of the

dividend is a nonresident alien, you may have to

withhold federal income tax and file Form 1042-S. See

the Instructions for Form 1042-S and Pub. 515.

Need help? If you have questions about reporting on

Form 1099-DIV, call the information reporting customer

service site toll free at 1-866-455-7438 or 304-263-8700

(not toll free). Persons with a hearing or speech

disability with access to TTY/TDD equipment can call

304-579-4827 (not toll free).