Fillable Printable Form 1099-Q

Fillable Printable Form 1099-Q

Form 1099-Q

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable, but the online version of it, printed from this website, is not. Do not print and file

copy A downloaded from this website; a penalty may be imposed for filing with the IRS

information return forms that can’t be scanned. See part O in the current General

Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more

information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be

downloaded and printed and used to satisfy the requirement to provide the information to

the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with

the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms

. Click on

Employer and Information Returns, and we’ll mail you the forms you request and their

instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns

Electronically (FIRE) system (visit www.IRS.gov/FIRE

) or the IRS Affordable Care Act

Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax

forms.

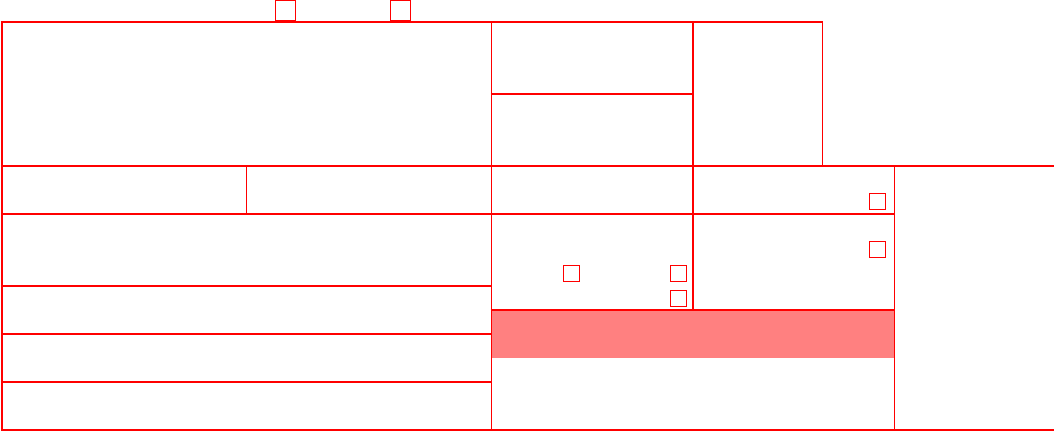

3131

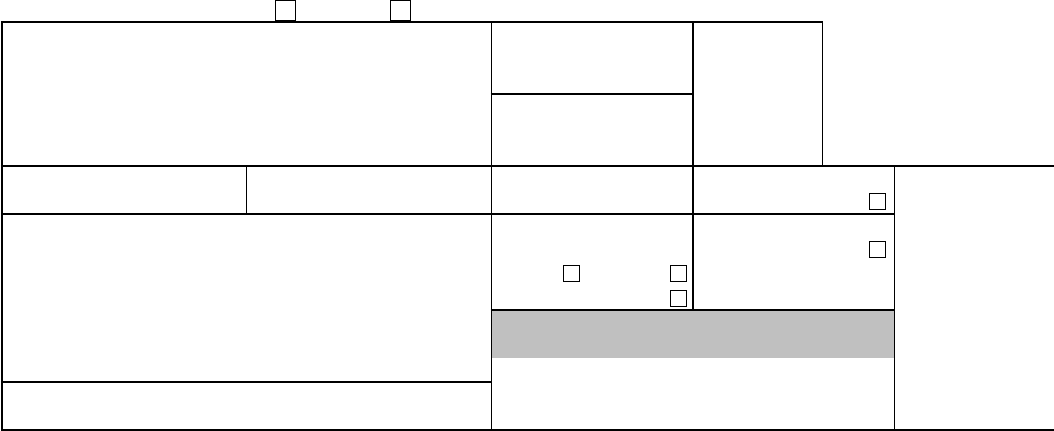

VOID CORRECTED

Form 1099-Q

2017

Cat. No. 32223J

Payments From

Qualified

Education

Programs

(Under Sections

529 and 530)

Copy A

For

Internal Revenue

Service Center

Department of the Treasury - Internal Revenue Service

File with Form 1096.

OMB No. 1545-1760

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2017 General

Instructions for

Certain Information

Returns.

PAYER’S/TRUSTEE'S name, street address, city or town, state or province, country,

ZIP or foreign postal code, and telephone no.

PAYER’S/TRUSTEE'S federal identification no.

RECIPIENT’S taxpayer identification no.

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Gross distribution

$

2 Earnings

$

3 Basis

$

4 Trustee-to-trustee

transfer

5 Check one:

• Qualified tuition program—

Private

or State

• Coverdell ESA

6 Check if the recipient is

not the designated

beneficiary

Form 1099-Q

www.irs.gov/form1099q

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

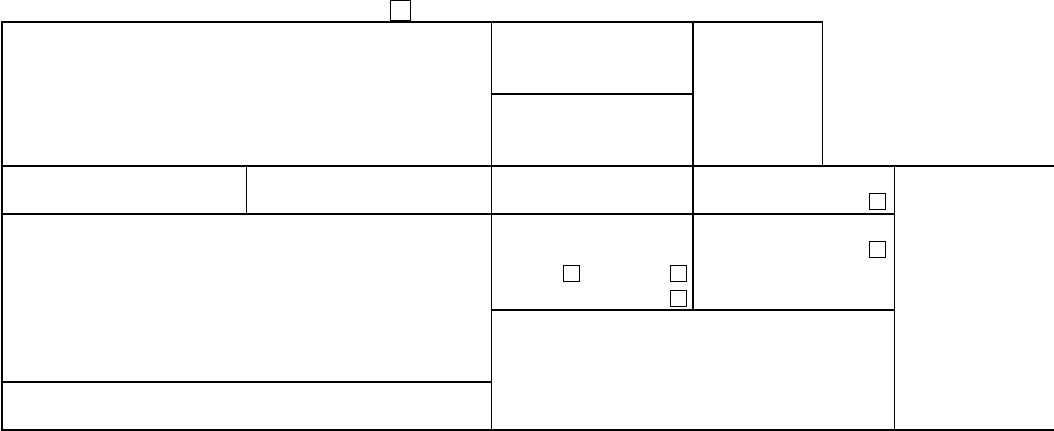

Form 1099-Q

2017

Payments From

Qualified

Education

Programs

(Under Sections

529 and 530)

Copy B

For Recipient

Department of the Treasury - Internal Revenue Service

This is important tax

information and is

being furnished to the

Internal Revenue

Service. If you are

required to file a return,

a negligence penalty or

other sanction may be

imposed on you if this

income is taxable and

the IRS determines that

it has not been

reported.

OMB No. 1545-1760

CORRECTED (if checked)

PAYER’S/TRUSTEE'S name, street address, city or town, state or province, country,

ZIP or foreign postal code, and telephone no.

PAYER’S/TRUSTEE'S federal identification no.

RECIPIENT’S taxpayer identification no.

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Gross distribution

$

2 Earnings

$

3 Basis

$

4 Trustee-to-trustee

transfer

5 Check one:

• Qualified tuition program—

Private

or State

• Coverdell ESA

6 If this box is checked, the

recipient is not the

designated beneficiary

If the fair market value (FMV) is shown below, see Pub. 970,

Tax Benefits for Education, for how to figure earnings.

Form 1099-Q

(keep for your records)

www.irs.gov/form1099q

Instructions for Recipient

Note: Nontaxable distributions from Coverdell education savings accounts

(CESAs) under section 530, and qualified tuition programs (QTPs) under section

529, including rollovers, are not required to be reported on your income tax

return. You must determine the taxability of any distribution. See Pub. 970 for

more information.

Recipient's taxpayer identification no. For your protection, this form may

show only the last four digits of your SSN, ITIN, ATIN, or EIN. However, the

payer or trustee has reported your complete identification number to the IRS.

Account number. May show an account or other unique number the payer has

assigned to distinguish your account.

Box 1. Shows the gross distribution (including in-kind distributions) paid to you

this year from a QTP or a CESA. This amount is the total of the amounts shown

in box 2 and box 3. See Pub. 970 for more information.

Caution: For CESA distributions (other than earnings on excess contributions)

made during 2017, the payer/trustee is not required to report amounts in boxes

2 and 3. Instead, the payer/trustee may report the fair market value of the CESA

as of December 31, 2017, in the blank box below boxes 5 and 6. To figure your

earnings and basis, use the Coverdell ESA—Taxable Distributions and Basis

worksheet in Pub. 970.

Box 2. Shows the earnings part of the gross distribution shown in box 1.

Generally, amounts distributed that are used to pay for qualified education

expenses, transferred between trustees, or rolled over to another qualified

education program within 60 days, are not included in income. Report taxable

amounts as “Other Income” on Form 1040. Also see Form 5329 and its separate

instructions.

Under a QTP, the amount in box 2 is included in income if there has been

(a) more than one transfer or rollover within any 12-month period with respect

to the same beneficiary, or (b) a change in the designated beneficiary and the

new designated beneficiary is not a family member.

Under a CESA, the amount in box 2 is included in income if there has been a

change in the designated beneficiary and the new designated beneficiary is not

a family member or is over age 30 (except for beneficiaries with special needs).

Also, an additional 10% tax may apply to part or all of any amount included in

income from the CESA or QTP. See Form 5329 and your tax return instructions

for more information.

If a final (total) distribution is made from your account and you have not

recovered your contributions, see Pub. 970 to determine if you have a

deductible loss and how to claim it.

Box 3. Shows your basis in the gross distribution reported in box 1.

Box 4. This box is checked if a trustee-to-trustee transfer was made from one

QTP to another QTP, from one CESA to another CESA, or from a CESA to a

QTP. However, in certain transfers from a CESA, the box will be blank.

Box 5. Shows whether the gross distribution was from a QTP (private or state)

or from a CESA.

Box 6. The designated beneficiary is the individual named in the document

creating the trust or custodial account to receive the benefit of the funds in the

account. If you are not the designated beneficiary, see Pub. 970 and the

Instructions for Form 1040.

Distribution codes. For 2017, the payer/trustee may, but is not required to,

report (in the box below boxes 5 and 6) one of the following codes to identify the

distribution you received: 1—Distributions (including transfers); 2—Excess

contributions plus earnings taxable in 2017; 3—Excess contributions plus

earnings taxable in 2016; 4—Disability; 5—Death; 6—Prohibited transaction.

Form 1099-Q

2017

Payments From

Qualified

Education

Programs

(Under Sections

529 and 530)

Copy C

For Payer

Department of the Treasury - Internal Revenue Service

OMB No. 1545-1760

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2017 General

Instructions for

Certain

Information

Returns.

VOID CORRECTED

PAYER’S/TRUSTEE'S name, street address, city or town, state or province, country,

ZIP or foreign postal code, and telephone no.

PAYER’S/TRUSTEE'S federal identification no.

RECIPIENT’S taxpayer identification no.

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Gross distribution

$

2 Earnings

$

3 Basis

$

4 Trustee-to-trustee

transfer

5 Check one:

• Qualified tuition program—

Private

or State

• Coverdell ESA

6 Check if the recipient is

not the designated

beneficiary

Form 1099-Q

www.irs.gov/form1099q

Instructions for Payer/Trustee

To complete Form 1099-Q, use:

• the 2017 General Instructions for Certain Information

Returns, and

• the 2017 Instructions for Form 1099-Q.

To order these instructions and additional forms, go

to www.irs.gov/form1099q.

Caution: Because paper forms are scanned during

processing, you cannot file with the IRS Forms 1096,

1097, 1098, 1099, 3921, 3922, or 5498 that you

download from the IRS website.

Due dates. Furnish Copy B of this form to the recipient

by January 31, 2018.

File Copy A of this form with the IRS by February 28,

2018. If you file electronically, the due date is April 2,

2018. To file electronically, you must have software that

generates a file according to the specifications in Pub.

1220. The IRS does not provide a fill-in form option.

Need help? If you have questions about reporting on

Form 1099-Q, call the information reporting customer

service site toll free at 1-866-455-7438 or 304-263-8700

(not toll free). Persons with a hearing or speech

disability with access to TTY/TDD equipment can call

304-579-4827 (not toll free).