Fillable Printable Form 211

Fillable Printable Form 211

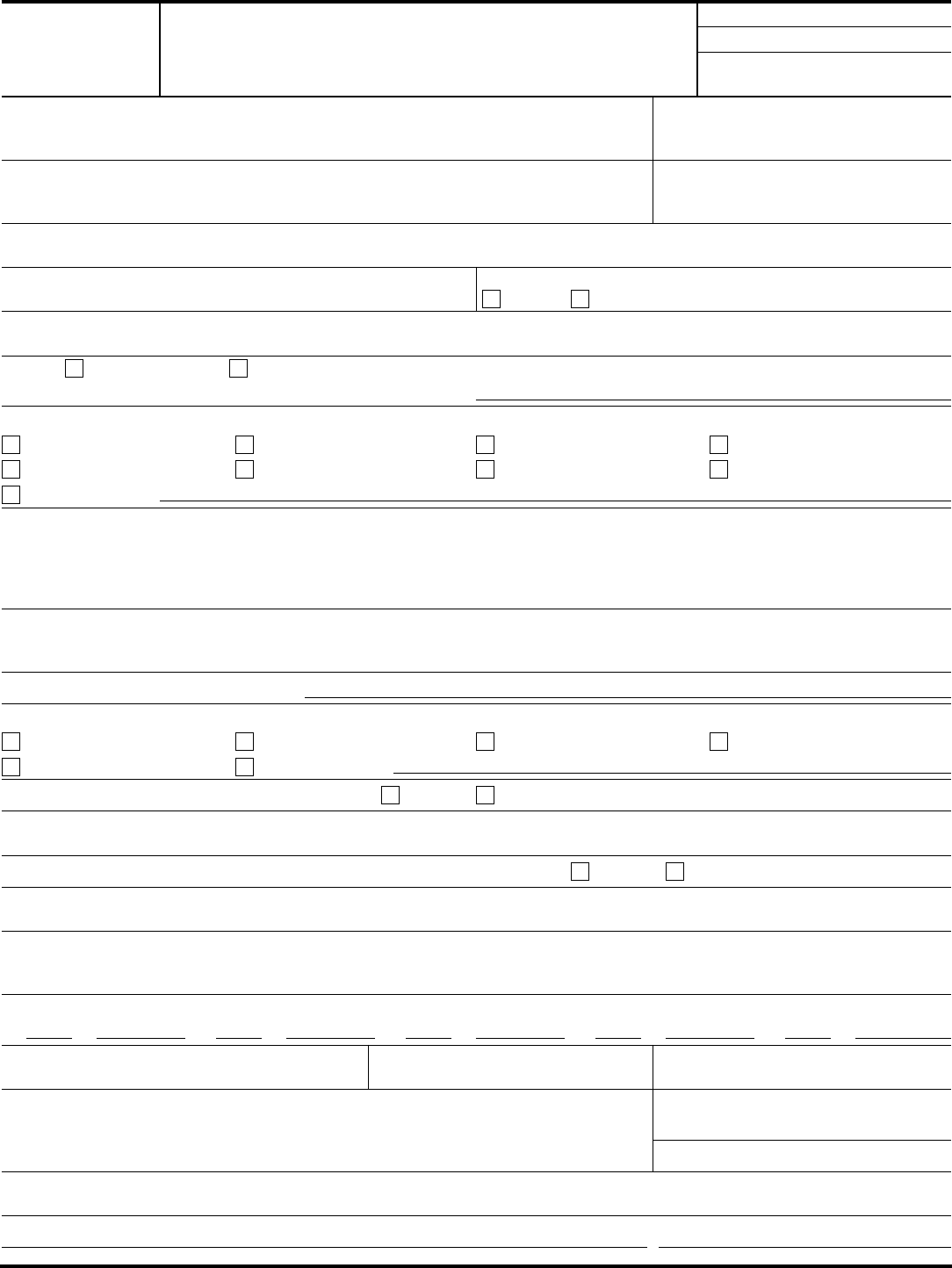

Form 211

Catalog Number 16571S www.irs.gov

Form

211 (Rev. 3-2014)

Form 211

(March 2014)

Department of the Treasury - Internal Revenue Service

Application for Award for

Original Information

OMB Number 1545-0409

Date Claim received

Claim number (completed by IRS)

1. Name of taxpayer (include aliases) and any related taxpayers who committed the violation

2. Last 4 digits of Taxpayer Identification

Number(s) (e.g., SSN, ITIN, or EIN)

3. Taxpayer's address, including ZIP code 4. Taxpayer's date of birth or approximate age

5. Name and title and contact information of IRS employee to whom violation was first reported, if known

6. Date violation reported (in number 5), if applicable

7. Did you submit this information to other Federal or State Agencies

Yes No

8. If yes in number 7, list the Agency Name and date submitted

9. Is this New submission or Supplemental submission

If a supplemental submission, list previously assigned claim number(s)

10. Alleged Violation of Tax Law (check all that apply)

Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds

Employee Plans Governmental Entities Exempt Organizations Excise

Other (identify)

11. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information

in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you

believe the act described constitutes a violation of the tax laws

12. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed)

13. What date did you acquire this information

14. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed)

Current Employee Former Employee Attorney CPA

Relative/Family Member Other (describe)

15. Do you still maintain a relationship with the taxpayer Yes No

16. If yes to number 15, describe your relationship with the taxpayer

17. Are you involved with any governmental or legal proceeding involving the taxpayer Yes No

18. If yes to number 17, Explain in detail. (Attach sheet if needed)

19. Describe the amount of tax owed by the taxpayer(s). Provide a summary of the information you have that supports your claim as to the amount owed

(i.e. books, ledgers, records, receipts, tax returns, etc). (Attach sheet if needed)

20. Fill in Tax Year (TY) and Dollar Amount ($), if known

TY $ TY $ TY $ TY $ TY $

21. Name of individual claimant

22. Claimant's date of birth (MMDDYYYY)

23. Last 4 digits of Claimant's SSN or ITIN

24. Address of claimant, including ZIP code

25. Telephone number (including area code)

26. Email address

27. Declaration under Penalty of Perjury I declare that I have examined this application, all accompanying statement and supporting documentation, and,

to the best of my knowledge and belief, they are true, correct, and complete

Signature of Claimant Date

Page 2

Catalog Number 16571S www.irs.gov

Form

211 (Rev. 3-2014)

Instructions for Form 211, Application for Award for Original Information

General Information: The Whistleblower Office has responsibility for the administration of the whistleblower award program under

section 7623 of the Internal Revenue Code. Section 7623 authorizes the payment of awards from the proceeds of amounts the

Government collects as a result of the information provided by the whistleblower. Only written applications are accepted in this

program.

Send completed form along with any supporting information to: Internal Revenue Service

Whistleblower Office - ICE

1973 N. Rulon White Blvd.

M/S 4110

Ogden, UT 84404

Instructions for Completion of Form 211:

Questions 1 – 4 Information about the Taxpayer – Provide the taxpayer’s name, address, taxpayer identification number – last 4

digits (if known), and the taxpayer’s date of birth or approximate age.

Question 5 – 6 If you reported the violation to an IRS employee; please provide the employee’s name, title and the date the violation

was reported. If known, provide contact information.

Questions 7 – 8 If you reported the violation to another Federal or State Agency, please indicate so and identify which agency (es) the

violation was reported. Note: Information related to this claim will not be shared with any other agency.

Question 9 If you have not previously submitted a Form 211 regarding the same or similar non-compliant activities, or the taxpayer(s)

identified in this information have no known relationship to the taxpayer(s) identified in a previously submitted Form 211, check the box

for “new submission.”

If you are providing additional information regarding the same or similar non-compliant activities identified in a previous submission, and

are identifying additional non-complaint activities by the same taxpayer(s), check the box for “supplemental submission.” If you are

identifying additional taxpayers involved in the same or similar tax non-compliance identified on a previously submitted Form 211, and

those additional taxpayers are related to the taxpayer(s) identified on a previously submitted Form 211, check the box for “supplemental

submission.” A Form 211 helps the Whistleblower Office and the IRS in evaluating a supplemental submission, but is not required. If

this is supplemental information list previously assigned claim number(s).

Questions 10 – 11 Indicate the type of tax that has not been paid or the tax liability that has not been reported and describe the alleged

violation. Explain why you believe the act described constitutes a violation of the tax laws. Attach all supporting documentation (for

example, books and records) to substantiate the claim. If documents or supporting evidence are not in your possession, describe these

documents and their location.

Questions 12 – 19 These questions ask how and when you learned of the alleged violation and what relationship, if any, you have to

the taxpayer.

Questions 20 – 21 These questions are asking for an estimate of the tax owed and the years/periods that the tax applies.

Questions 22 – 26 Information about the claimant – Provide the claimant’s name, address, date of birth, Taxpayer Identification

Number (last 4 digits), email address, and telephone number.

Question 27 Information provided in connection with a claim under this provision of law must be made under an original signed

Declaration under Penalty of Perjury. Joint/multiple claimants must be signed by each claimant.

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the internal revenue laws of the United States. Our authority to ask for this information is 26 USC 6109 and

7623. We collect this information for use in determining the correct amount of any award payable to you under 26 USC 7623. We may disclose this information

as authorized by 26 USC 6103, including to the subject taxpayer(s) as needed in a tax compliance investigation and to the Department of Justice for civil and

criminal litigation. You are not required to apply for an award. However, if you apply for an award you must provide as much of the requested information as

possible. Failure to provide information may delay or prevent processing your request for an award; providing false information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB

control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of

any internal revenue law. Generally, tax returns and return information are confidential, as required by 26 U.S.C. 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is 45 minutes. If you have comments

concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can email us at

*[email protected] (please type "Forms Comment" on the subject line) or write to the Internal Revenue Service, Tax Forms Coordinating Committee, SE: W:

CAR: MP: T: T: SP, 1111 Constitution Ave. NW, IR-6406, Washington, DC 20224.

Send the completed Form 211 to the above Ogden address of the Whistleblower Office. Do NOT send the Form 211 to the Tax Forms Coordinating

Committee.