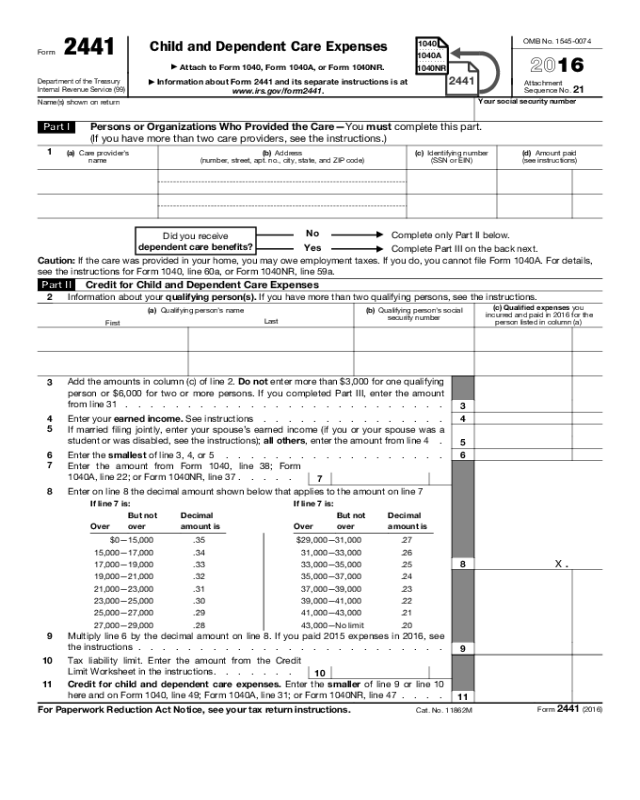

Form 2441 (2016)

Page 2

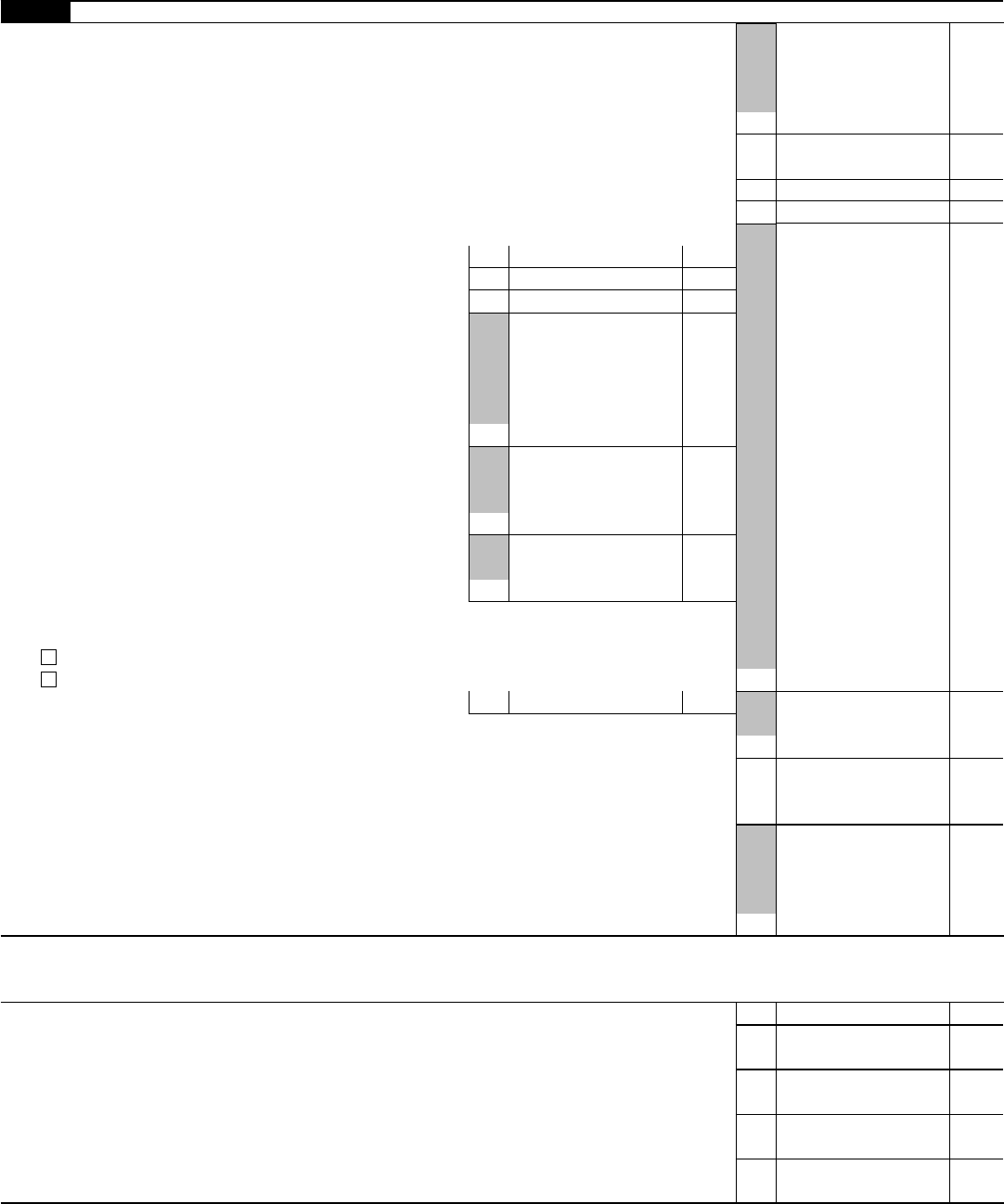

Part III Dependent Care Benefits

12

Enter the total amount of dependent care benefits you received in 2016. Amounts you

received as an employee should be shown in box 10 of your Form(s) W-2. Do not include

amounts reported as wages in box 1 of Form(s) W-2. If you were self-employed or a

partner, include amounts you received under a dependent care assistance program from

your sole proprietorship or partnership . . . . . . . . . . . . . . . . . .

12

13 Enter the amount, if any, you carried over from 2015 and used in 2016 during the grace

period. See instructions . . . . . . . . . . . . . . . . . . . . . . .

13

14 Enter the amount, if any, you forfeited or carried forward to 2017. See instructions . . . 14

( )

15 Combine lines 12 through 14. See instructions . . . . . . . . . . . . . . .

15

16 Enter the total amount of qualified expenses incurred

in 2016 for the care of the qualifying person(s) . . .

16

17 Enter the smaller of line 15 or 16 . . . . . . . . 17

18 Enter your earned income. See instructions . . . . 18

19 Enter the amount shown below that applies

to you.

• If married filing jointly, enter your

spouse’s earned income (if you or your

spouse was a student or was disabled,

see the instructions for line 5).

• If married filing separately, see

instructions.

• All others, enter the amount from line 18.

}

. . .

19

20 Enter the smallest of line 17, 18, or 19 . . . . . . 20

21

Enter $5,000 ($2,500 if married filing separately and

you were required to enter your spouse’s earned

income on line 19). . . . . . . . . . . . .

21

22 Is any amount on line 12 from your sole proprietorship or partnership? (Form 1040A filers

go to line 25.)

No. Enter -0-.

Yes. Enter the amount here . . . . . . . . . . . . . . . . . . . .

22

23 Subtract line 22 from line 15 . . . . . . . . .

23

24 Deductible benefits. Enter the smallest of line 20, 21, or 22. Also, include this amount on

the appropriate line(s) of your return. See instructions . . . . . . . . . . . . .

24

25

Excluded benefits. Form 1040 and 1040NR filers: If you checked “No” on line 22, enter

the smaller of line 20 or 21. Otherwise, subtract line 24 from the smaller of line 20 or line

21. If zero or less, enter -0-. Form 1040A filers: Enter the smaller of line 20 or line 21 . .

25

26

Taxable benefits. Form 1040 and 1040NR filers: Subtract line 25 from line 23. If zero or

less, enter -0-. Also, include this amount on Form 1040, line 7, or Form 1040NR, line 8. On

the dotted line next to Form 1040, line 7, or Form 1040NR, line 8, enter “DCB.”

Form 1040A filers: Subtract line 25 from line 15. Also, include this amount on Form 1040A,

line 7. In the space to the left of line 7, enter “DCB” . . . . . . . . . . . . . .

26

To claim the child and dependent care

credit, complete lines 27 through 31 below.

27 Enter $3,000 ($6,000 if two or more qualifying persons) . . . . . . . . . . . . 27

28 Form 1040 and 1040NR filers: Add lines 24 and 25. Form 1040A filers: Enter the amount

from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29

Subtract line 28 from line 27. If zero or less, stop. You cannot take the credit.

Exception. If you paid 2015 expenses in 2016, see the instructions for line 9 . . . . .

29

30 Complete line 2 on the front of this form. Do not include in column (c) any benefits shown

on line 28 above. Then, add the amounts in column (c) and enter the total here. . . . .

30

31 Enter the smaller of line 29 or 30. Also, enter this amount on line 3 on the front of this form

and complete lines 4 through 11 . . . . . . . . . . . . . . . . . . . .

31

Form 2441 (2016)