Form 2553 (Rev. 12-2013)

Page 3

Part II Selection of Fiscal Tax Year (see instructions)

Note. All corporations using this part must complete item O and item P, Q, or R.

O Check the applicable box to indicate whether the corporation is:

1.

A new corporation adopting the tax year entered in item F, Part I.

2.

An existing corporation retaining the tax year entered in item F, Part I.

3.

An existing corporation changing to the tax year entered in item F, Part I.

P

Complete item P if the corporation is using the automatic approval provisions of Rev. Proc. 2006-46, 2006-45 I.R.B. 859, to request (1) a

natural business year (as defined in section 5.07 of Rev. Proc. 2006-46) or (2) a year that satisfies the ownership tax year test (as defined in

section 5.08 of Rev. Proc. 2006-46). Check the applicable box below to indicate the representation statement the corporation is making.

1. Natural Business Year

▶

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies as its natural

business year (as defined in section 5.07 of Rev. Proc. 2006-46) and has attached a statement showing separately for each month the gross

receipts for the most recent 47 months (see instructions). I also represent that the corporation is not precluded by section 4.02 of Rev. Proc.

2006-46 from obtaining automatic approval of such adoption, retention, or change in tax year.

2. Ownership Tax Year

▶

I represent that shareholders (as described in section 5.08 of Rev. Proc. 2006-46) holding more than half of

the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are

concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies

the requirement of section 4.01(3) of Rev. Proc. 2006-46. I also represent that the corporation is not precluded by section 4.02 of Rev. Proc.

2006-46 from obtaining automatic approval of such adoption, retention, or change in tax year.

Note. If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal

tax year based on a business purpose and to make a back-up section 444 election. Item R is used to make a regular section 444 election.

Q Business Purpose—To request a fiscal tax year based on a business purpose, check box Q1. See instructions for details including payment

of a user fee. You may also check box Q2 and/or box Q3.

1. Check here

▶

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc. 2002-39,

2002-22 I.R.B. 1046. Attach to Form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts

from sales and services necessary to establish a business purpose. See the instructions for details regarding the gross receipts from sales

and services. If the IRS proposes to disapprove the requested fiscal year, do you want a conference with the IRS National Office?

Yes No

2. Check here

▶

to show that the corporation intends to make a back-up section 444 election in the event the corporation’s business

purpose request is not approved by the IRS. (See instructions for more information.)

3. Check here

▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS

to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the

corporation makes a back-up section 444 election, but is ultimately not qualified to make a section 444 election, or (2) the corporation’s

business purpose request is not approved and the corporation did not make a back-up section 444 election.

R Section 444 Election—To make a section 444 election, check box R1. You may also check box R2.

1. Check here

▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F,

Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either

attach it to Form 2553 or file it separately.

2. Check here

▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS

to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

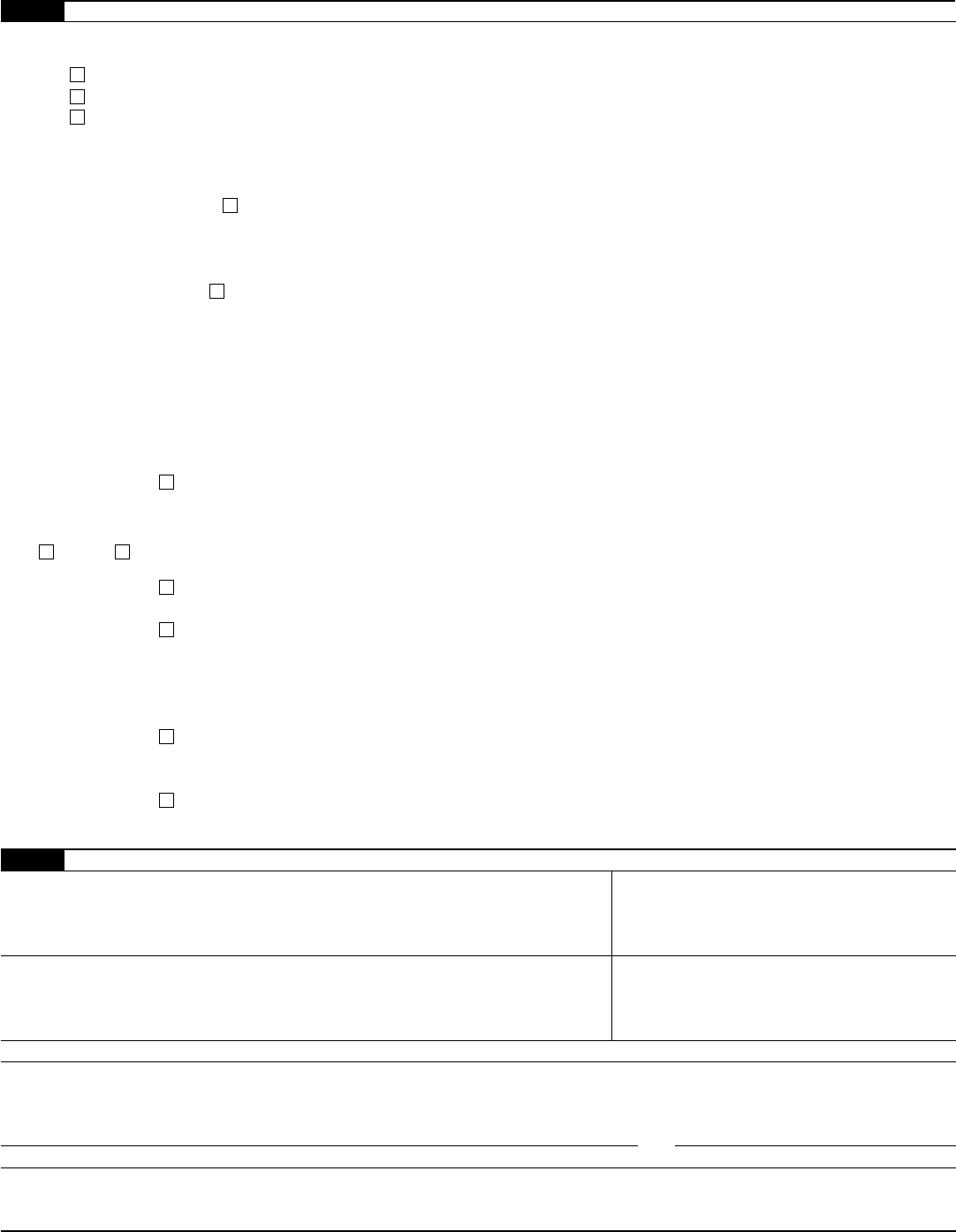

Part III Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)*

Income beneficiary’s name and address Social security number

Trust’s name and address Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) . . . . . . . . . . .

▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed, I hereby make

the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional requirements of section 1361(d)(3) and that

all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election

Date

*Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation

makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the corporation is transferred to the trust

after the date on which the corporation makes the S election.

Form 2553 (Rev. 12-2013)