Form 2555 (2016)

Page 3

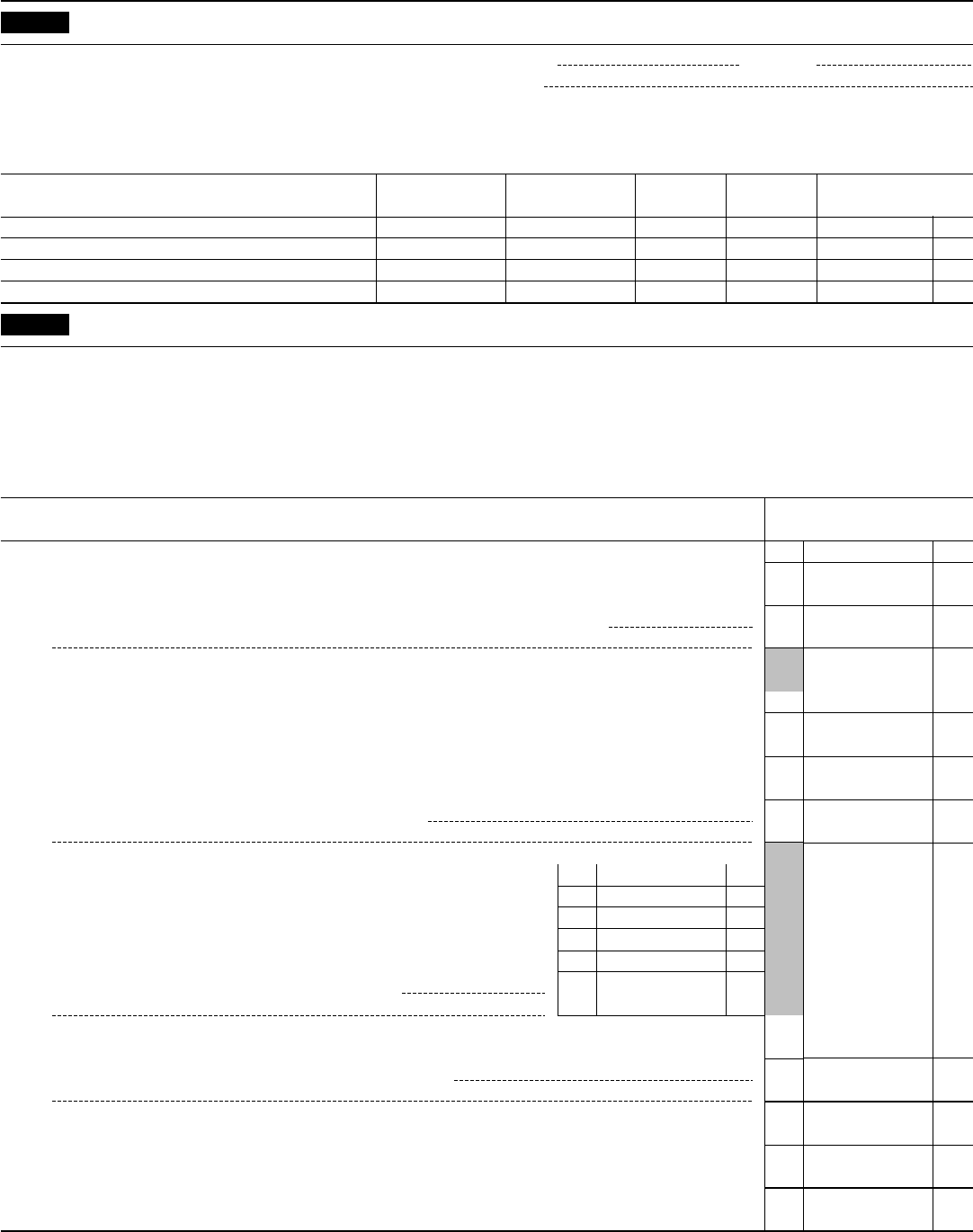

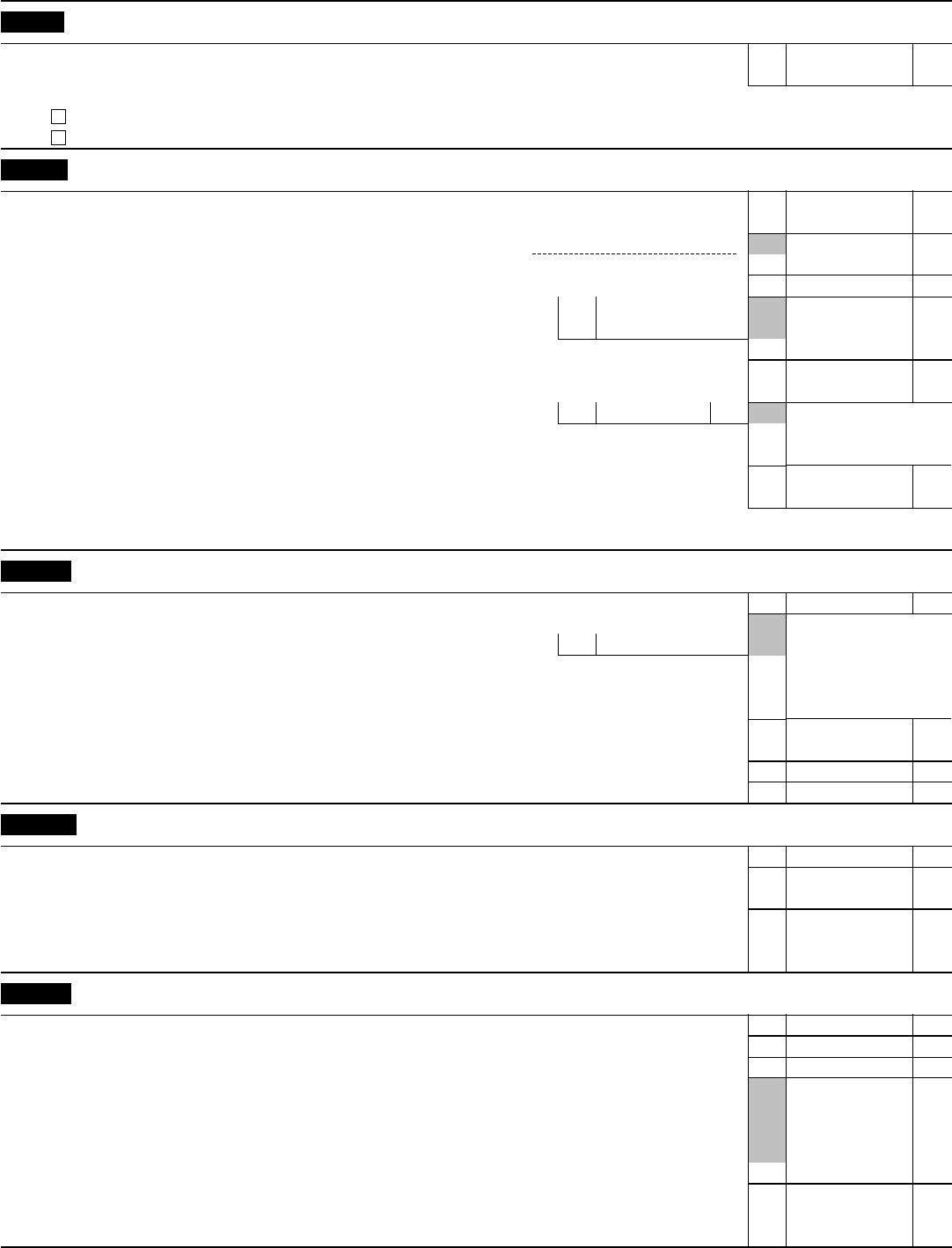

Part V

All Taxpayers

27 Enter the amount from line 26 . . . . . . . . . . . . . . . . . . . . . . 27

Are you claiming the housing exclusion or housing deduction?

Yes. Complete Part VI.

No. Go to Part VII.

Part VI

Taxpayers Claiming the Housing Exclusion and/or Deduction

28 Qualified housing expenses for the tax year (see instructions) . . . . . . . . . . . . 28

29a

Enter location where housing expenses incurred (see instructions)

▶

b Enter limit on housing expenses (see instructions) . . . . . . . . . . . . . . . 29b

30 Enter the smaller of line 28 or line 29b . . . . . . . . . . . . . . . . . . . 30

31

Number of days in your qualifying period that fall within your 2016 tax

year (see instructions) . . . . . . . . . . . . . . . .

31 days

32

Multiply $44.28 by the number of days on line 31. If 366 is entered on line 31, enter $16,208 here

32

33

Subtract line 32 from line 30. If the result is zero or less, don't complete the rest of this part or

any of Part IX . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34 Enter employer-provided amounts (see instructions) . . . . . . 34

35

Divide line 34 by line 27. Enter the result as a decimal (rounded to at least three places), but

don't enter more than “1.000” . . . . . . . . . . . . . . . . . . . . . .

35

×

.

36

Housing exclusion. Multiply line 33 by line 35. Enter the result but don't enter more than the

amount on line 34. Also, complete Part VIII . . . . . . . . . . . . . . . . .

▶

36

Note: The housing deduction is figured in Part IX. If you choose to claim the foreign earned

income exclusion, complete Parts VII and VIII before Part IX.

Part VII

Taxpayers Claiming the Foreign Earned Income Exclusion

37 Maximum foreign earned income exclusion . . . . . . . . . . . . . . . . . 37

38 • If you completed Part VI, enter the number from line 31.

• All others, enter the number of days in your qualifying period that

fall within your 2016 tax year (see the instructions for line 31).

}

38 days

39 • If line 38 and the number of days in your 2016 tax year (usually 366) are the same, enter “1.000.”

• Otherwise, divide line 38 by the number of days in your 2016 tax year and enter the result as

a decimal (rounded to at least three places).

}

39

×

.

40 Multiply line 37 by line 39 . . . . . . . . . . . . . . . . . . . . . . .

40

41 Subtract line 36 from line 27 . . . . . . . . . . . . . . . . . . . . . . 41

42

Foreign earned income exclusion. Enter the smaller of line 40 or line 41. Also, complete Part VIII

▶

42

Part VIII

Taxpayers Claiming the Housing Exclusion, Foreign Earned Income Exclusion, or Both

43 Add lines 36 and 42 . . . . . . . . . . . . . . . . . . . . . . . . . 43

44

Deductions allowed in figuring your adjusted g

ross income (Form 1040, line 37) that are

allocable

to the excluded income. See instructions and attach computation . . . . . . . . . .

44

45

Subtract line 44 from line 43. Enter the result here and in parentheses on Form 1040, line 21.

Next to the amount enter “Form 2555.” On Form 1040, subtract this amount from your income

to arrive at total income on Form 1040, line 22 . . . . . . . . . . . . . . . .

45

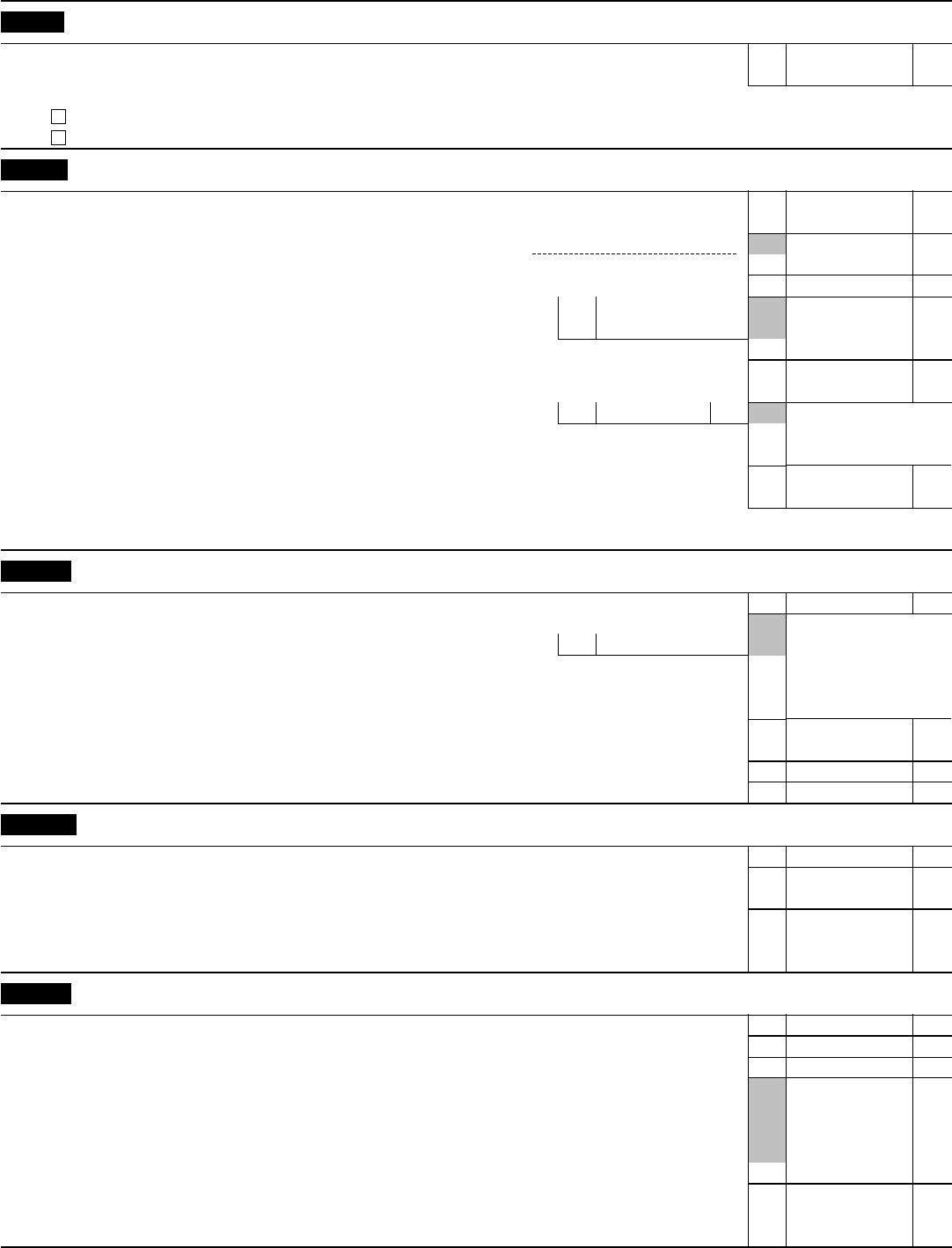

Part IX

Taxpayers Claiming the Housing Deduction—Complete this part only if (a) line 33 is more than line 36 and

(b) line 27 is more than line 43.

46 Subtract line 36 from line 33 . . . . . . . . . . . . . . . . . . . . . . 46

47 Subtract line 43 from line 27 . . . . . . . . . . . . . . . . . . . . . . 47

48 Enter the smaller of line 46 or line 47 . . . . . . . . . . . . . . . . . . . 48

Note: If line 47 is more than line 48 and you couldn't deduct all of your 2015 housing

deduction

because of the 2015 limit, use the housing deduction carryover worksheet in the instructions to

figure the amount to enter on line 49. Otherwise, go to line 50.

49

Housing deduction carryover from 2015 (from the housing deduction carryover worksheet in the

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

49

50

Housing deduction. Add lines 48 and 49. Enter the total here and on Form 1040 to the left of

line 36. Next to the amount on Form 1040, enter “Form 2555.” Add it to the total adjustments

reported on that line

. . . . . . . . . . . . . . . . . . . . . . . .

▶

50

Form 2555 (2016)