Form 3115 (Rev. 12-2015)

Page 8

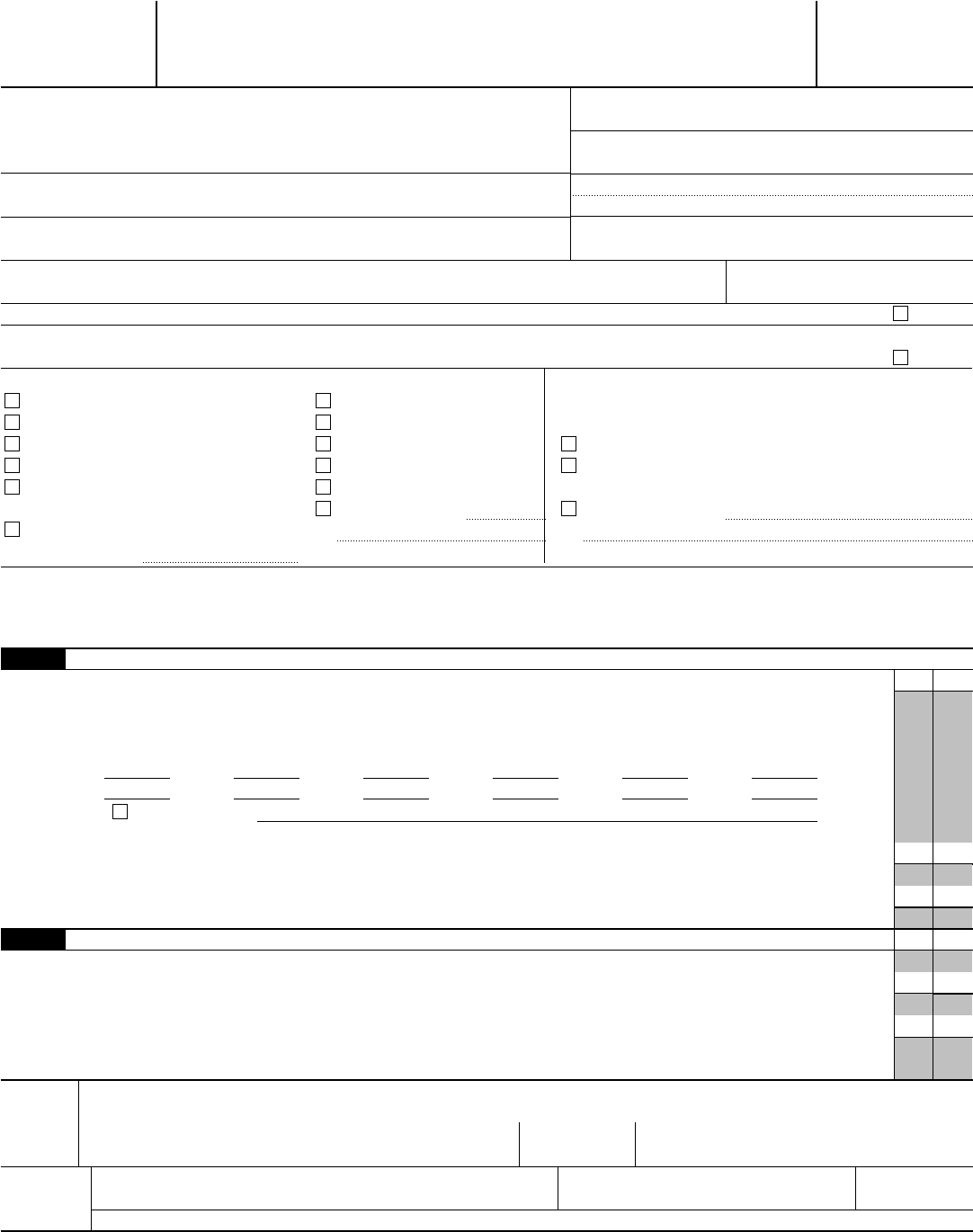

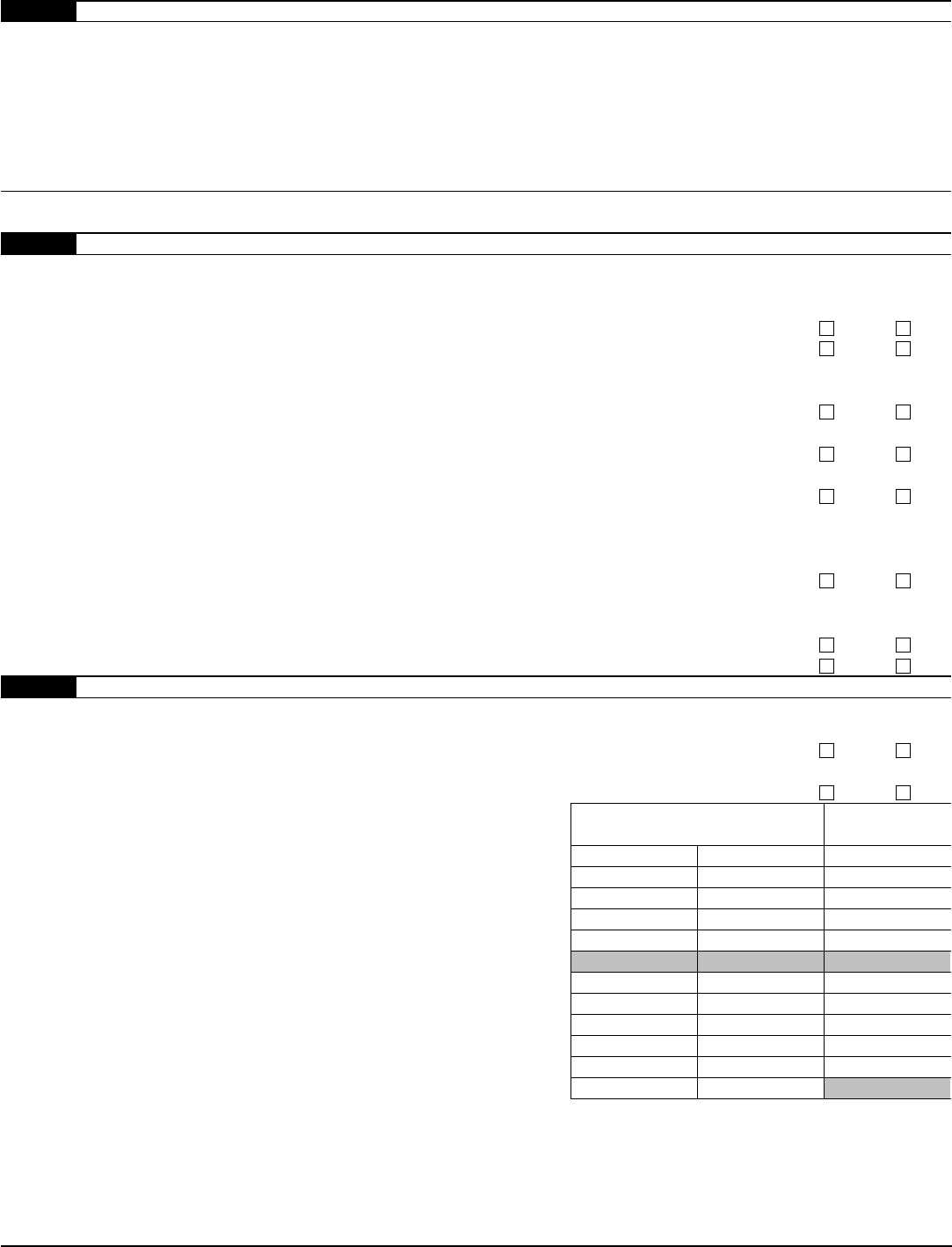

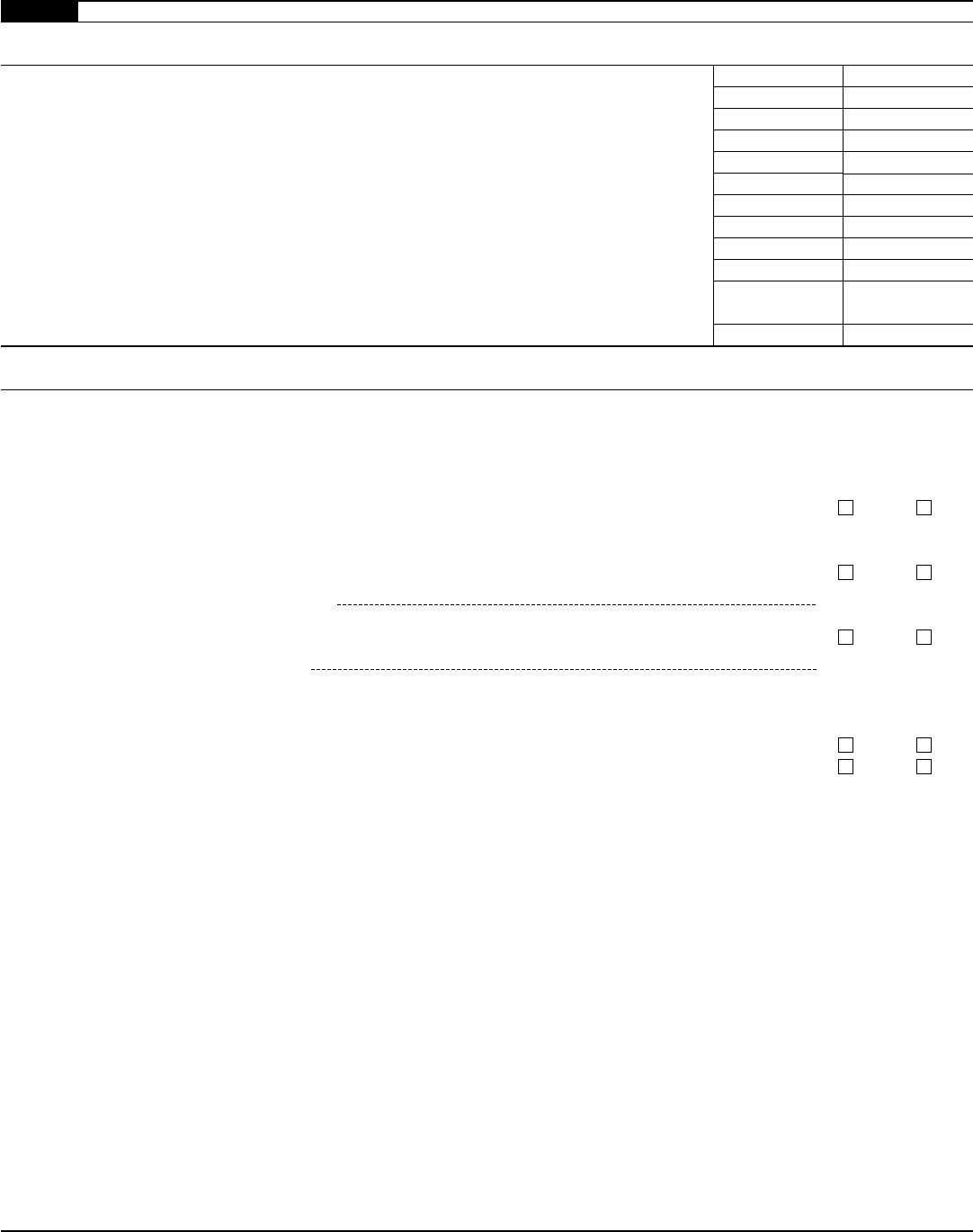

Part III Method of Cost Allocation (continued) See instructions.

Section C—Other Costs Not Required To Be Allocated (Complete Section C only if the applicant is requesting to change its

method for these costs.)

Present method Proposed method

1 Marketing, selling, advertising, and distribution expenses . . . . . . . . . . .

2 Research and experimental expenses not included in Section B, line 26 . . . . . .

3 Bidding expenses not included in Section B, line 22 . . . . . . . . . . . .

4 General and administrative costs not included in Section B . . . . . . . . . .

5 Income taxes . . . . . . . . . . . . . . . . . . . . . . . . .

6 Cost of strikes . . . . . . . . . . . . . . . . . . . . . . . . .

7 Warranty and product liability costs . . . . . . . . . . . . . . . . . .

8 Section 179 costs . . . . . . . . . . . . . . . . . . . . . . . .

9 On-site storage . . . . . . . . . . . . . . . . . . . . . . . . .

10

Depreciation, amortization, and cost recovery allowance not included in Section B,

line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Other costs (Attach a list of these costs.) . . . . . . . . . . . . . . . .

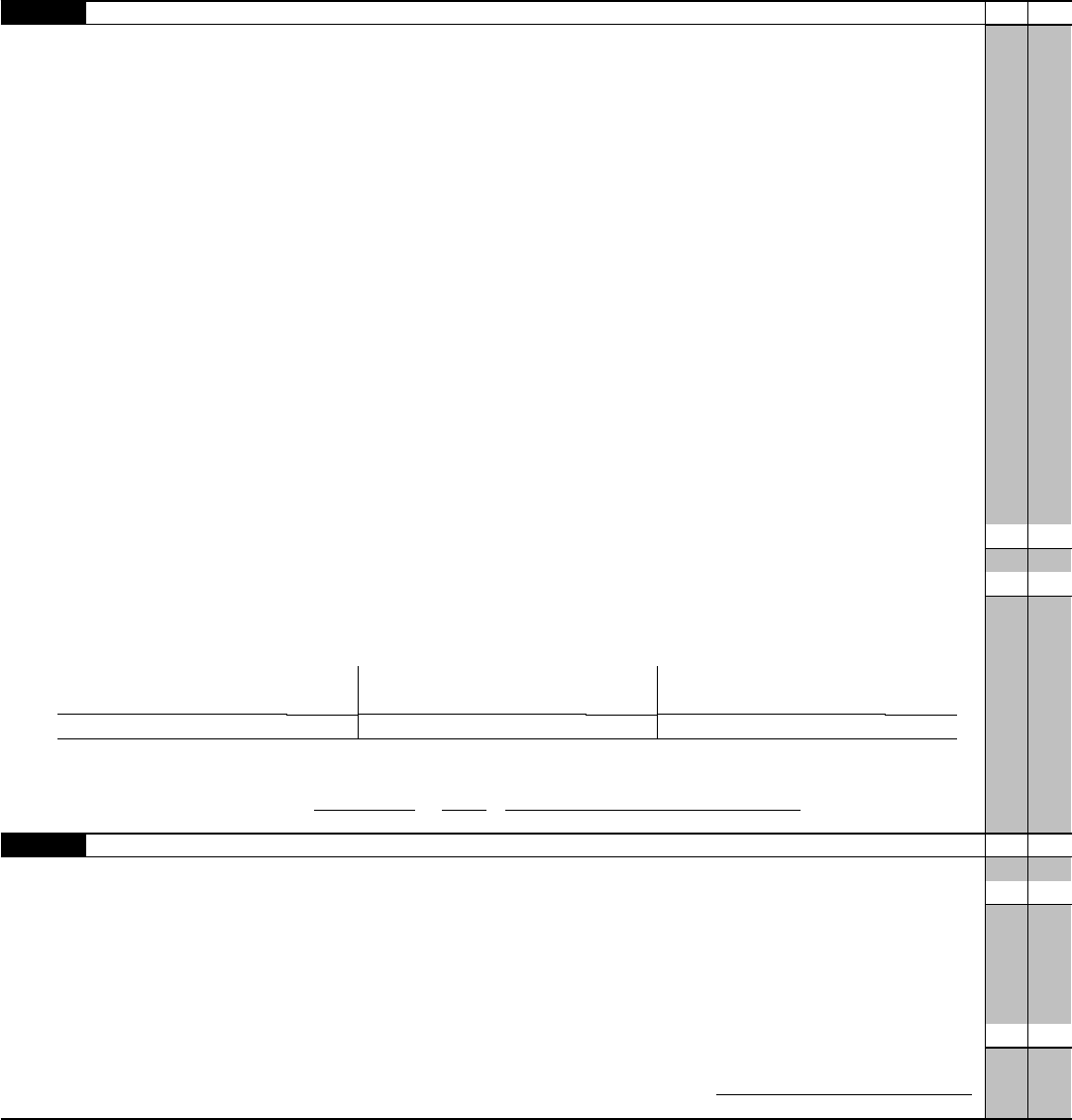

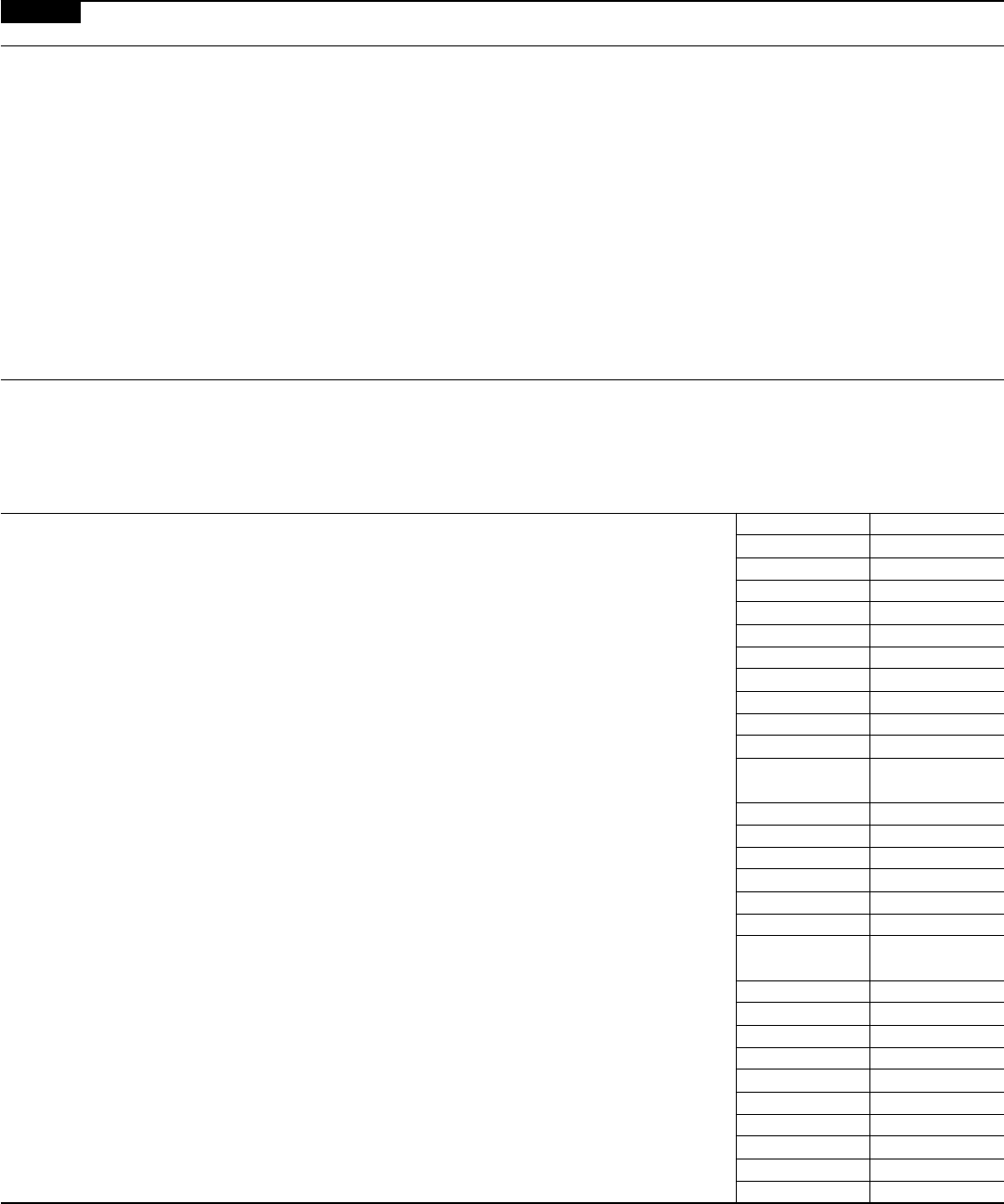

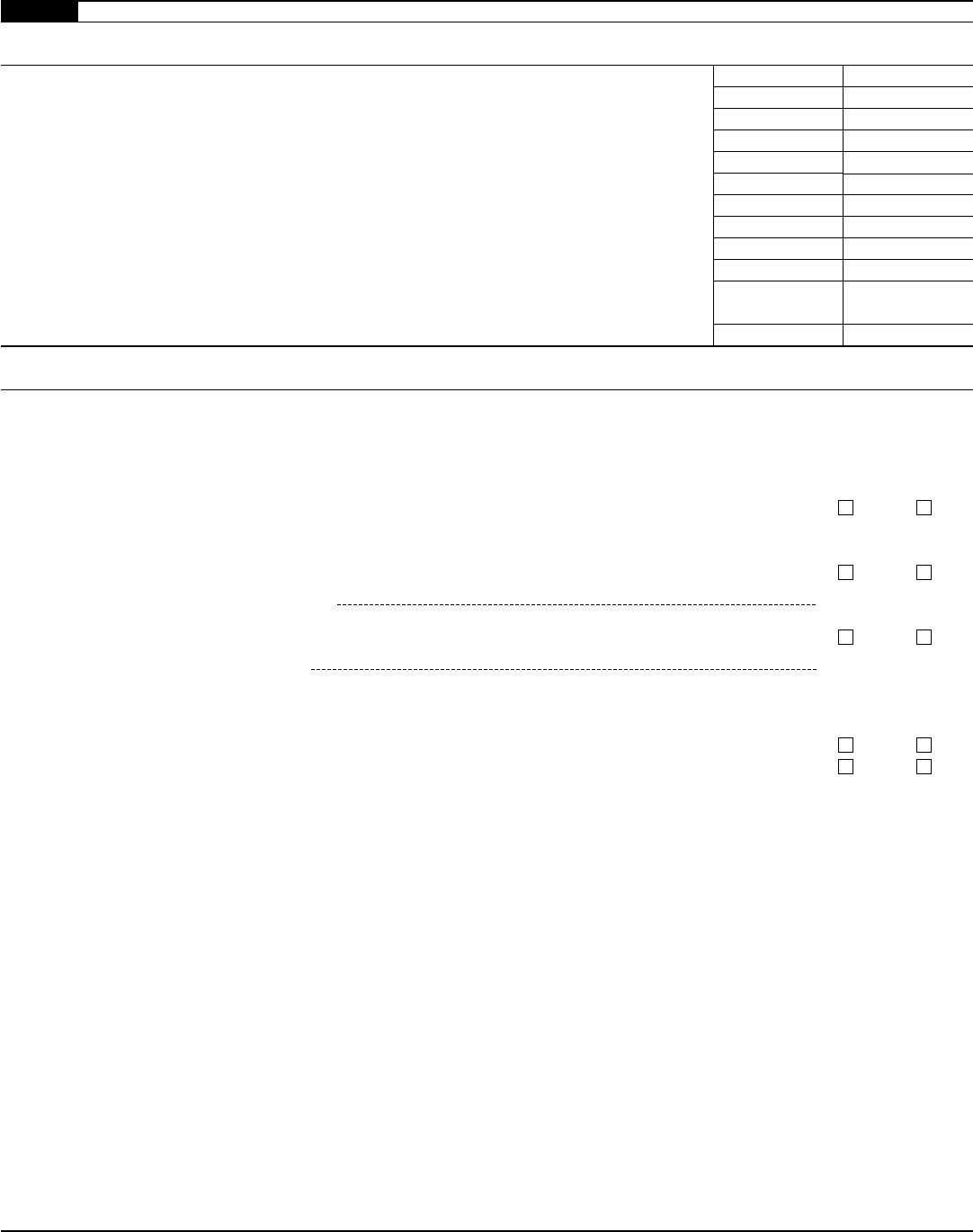

Schedule E—Change in Depreciation or Amortization. See instructions.

Applicants requesting approval to change their method of accounting for depreciation or amortization complete this section.

Applicants must provide this information for each item or class of property for which a change is requested.

Note: See the Summary of the List of Automatic Accounting Method Changes in the instructions for information regarding

automatic changes under sections 56, 167, 168, 197, 1400I, 1400L, or former section 168. Do not file Form 3115 with respect to

certain late elections and election revocations. See instructions.

1 Is depreciation for the property determined under Regulations section 1.167(a)-11 (CLADR)? . . . .

Yes No

If “Yes,” the only changes permitted are under Regulations section 1.167(a)-11(c)(1)(iii).

2 Is any of the depreciation or amortization required to be capitalized under any Code section such as,

section 263A? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” enter the applicable section

▶

3 Has a depreciation, amortization, expense, or disposition election been made for the property such as,

the election under sections 168(f)(1), 168(i)(4), 179, 179C, or Regulations section 1.168(i)-8(d)? . . . .

Yes No

If “Yes,” state the election made

▶

4 a

To the extent not already provided, attach a statement describing the property subject to the change. Include in the description

the type of property, the year the property was placed in service, and the property’s use in the applicant’s trade or business or

income-producing activity.

b If the property is residential rental property, did the applicant live in the property before renting it? . .

Yes No

c Is the property public utility property? . . . . . . . . . . . . . . . . . . . . . .

Yes No

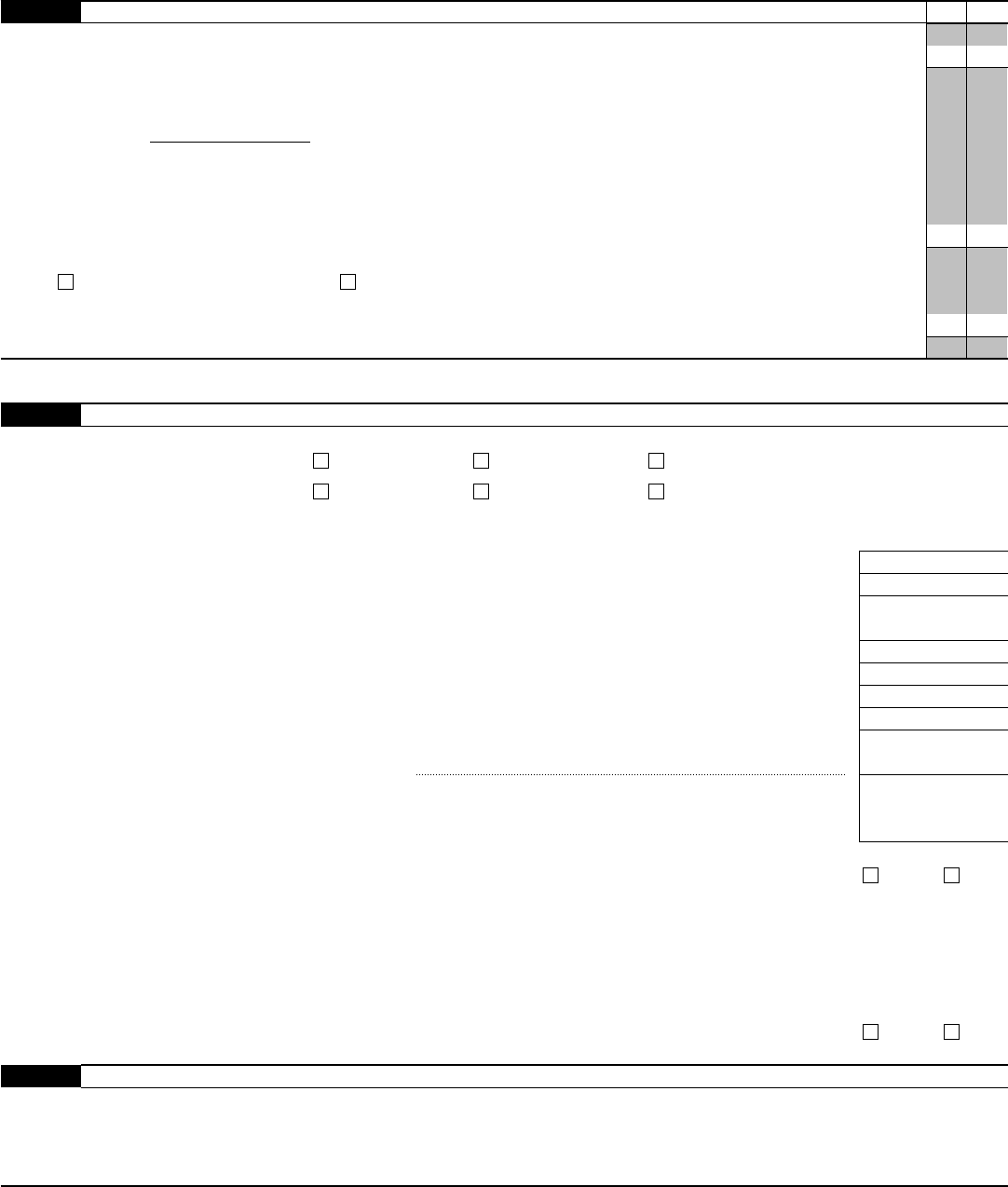

5

To the extent not already provided in the applicant’s description of its present method, attach a statement explaining how the

property is treated under the applicant’s present method (for example, depreciable property, inventory property, supplies

under Regulations section 1.162-3, nondepreciable section 263(a) property, property deductible as a current expense, etc.).

6 If the property is not currently treated as depreciable or amortizable property, attach a statement of the facts supporting the

proposed change to depreciate or amortize the property.

7 If the property is currently treated and/or will be treated as depreciable or amortizable property, provide the following

information for both the present (if applicable) and proposed methods:

a The Code section under which the property is or will be depreciated or amortized (for example, section 168(g)).

b

The applicable asset class from Rev. Proc. 87-56, 1987-2 C.B. 674, for each asset depreciated under section 168 (MACRS) or

under section 1400L; the applicable asset class from Rev. Proc. 83-35, 1983-1 C.B. 745, for each asset depreciated under

former section 168 (ACRS); an explanation why no asset class is identified for each asset for which an asset class has not

been identified by the applicant.

c The facts to support the asset class for the proposed method.

d The depreciation or amortization method of the property, including the applicable Code section (for example, 200% declining

balance method under section 168(b)(1)).

e The useful life, recovery period, or amortization period of the property.

f The applicable convention of the property.

g

Whether the additional first-year special depreciation allowance (for example, as provided by section 168(k), 168(l), 168(m),

168(n), 1400L(b), or 1400N(d)) was or will be claimed for the property. If not, also provide an explanation as to why no special

depreciation allowance was or will be claimed.

h Whether the property was or will be in a single asset account, a multiple asset account, or a general asset account.

Form 3115 (Rev. 12-2015)