Fillable Printable Form 4162

Fillable Printable Form 4162

Form 4162

Page 1 of 1

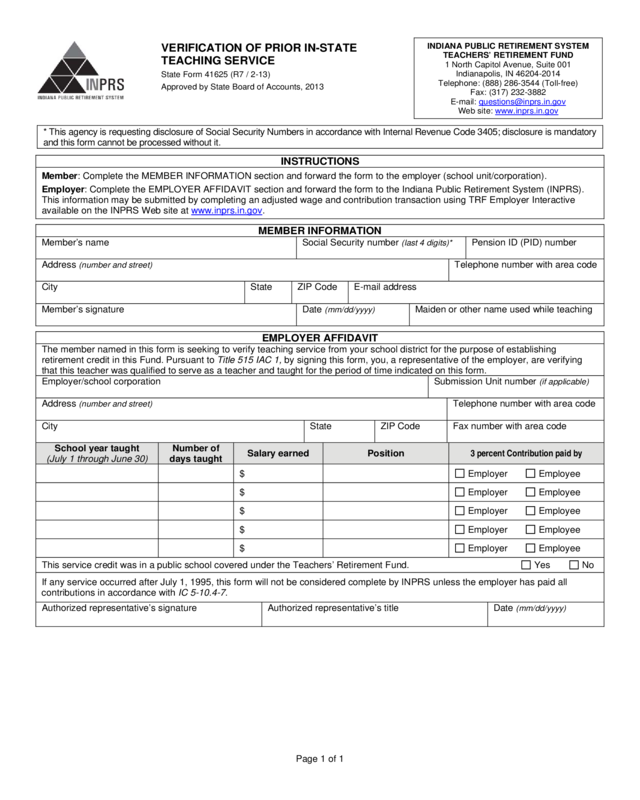

VERIFICATION OF PRIOR IN-STATE

TEACHING SERVICE

State Form 41625 (R7 / 2-13)

Approved by State Board of Accounts, 2013

INDIANA PUBLIC RETIREMENT SYSTEM

TEACHERS’ RETIREMENT FUND

1 North Capitol Avenue, Suite 001

Indianapolis, IN 46204-2014

Telephone: (888) 286-3544 (Toll-free)

Fax: (317) 232-3882

E-mail: [email protected]

Web site: www.inprs.in.gov

* This agency is requesting disclosure of Social Security Numbe rs in accordance w ith Internal Revenue Code 3405; disclosure is mandatory

and this form cannot be processed w ithout it.

INSTRUCTIONS

Member: Complete the MEMBER INFORMATION section and forward the form to the employer (school unit/corporation).

Employer: Complete the EMPLOYER AFFIDAVIT section and forward the form to the Indiana Public Retirement System (INPRS).

This information may be submitted by completing an adjusted wage and contribution transaction using TRF Employer Interactive

available on the INPRS Web site at www.inprs.in.gov

.

MEMBER INFORMATION

Member’s name

Social Security number (last 4 digits)*

Pension ID (PID) number

Address (number and street)

Telephone number with area code

City

State

ZIP Code

E-mail address

Member’s signature

Date (mm/dd/yyyy)

Maiden or other name used while teaching

EMPLOYER AFFIDAVIT

The member named in this form is seeking to verify teachin g service from your school district for the purpose of establishing

retirement credit in this Fund. Pursuant to Title 515 IAC 1, by signing this form, you, a representative of the emp loyer, are verifying

that this teacher was qualified to serve as a teacher and taught for the period of time indic ated on this form.

Employer/school corporation

Submission Unit number (if applicable)

Address (number and street)

Telephone number with area code

City

State

ZIP Code

Fax number with area code

School year taught

(July 1 through June 30)

Number of

days taught

Salary earned Position 3 percent Contribution paid by

$ Employer Employee

$ Employer Employee

$ Employer Employee

$ Employer Employee

$ Employer Employee

This service credit was in a public school covered under the Teachers’ Retirement Fund. Yes No

If any service occurred after July 1, 1995, this form will not be considered compl ete b y INPRS unless the employer has paid all

contributions in accordance with IC 5-10.4-7.

Authorized representativ e’s signature

Authorized representativ e’s title

Date (mm/dd/yyyy)

Reset Form

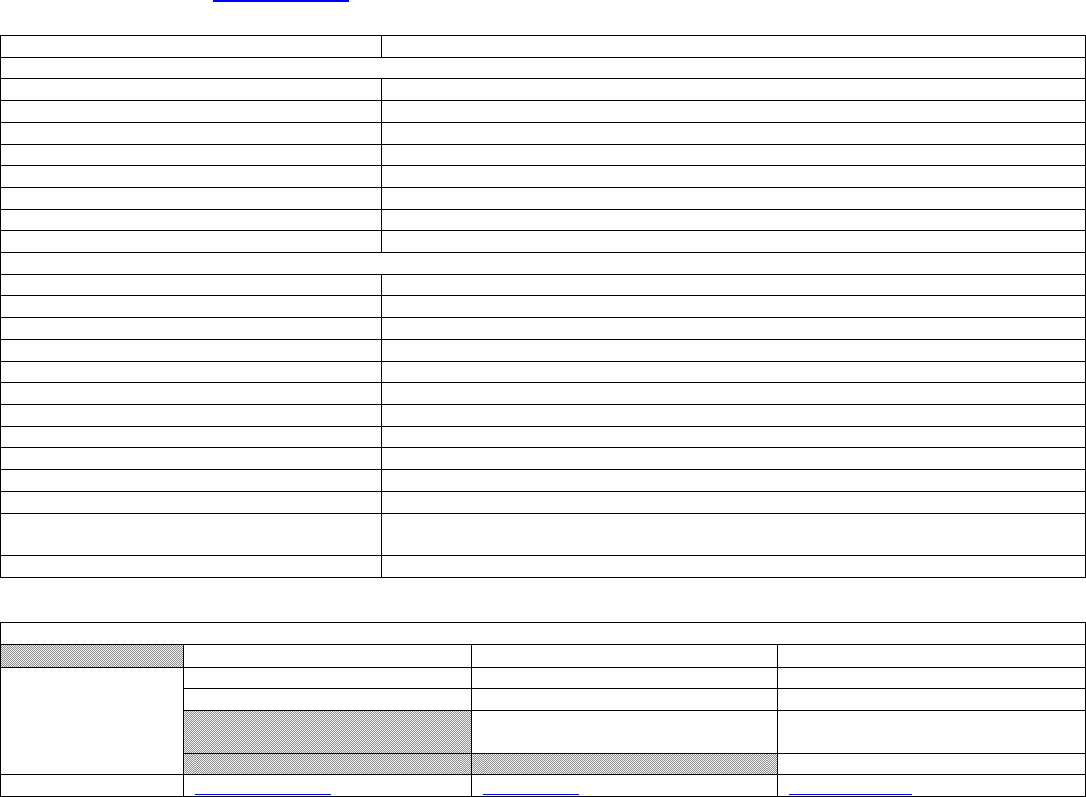

INSTRUCTIONS FOR

VERIFICATION OF IN-STATE TEACHING SERVICE

State Form 41625 (R7 / 2-13)

Page 1 of 1

IMPORTANT

Member: Complete the MEMBER INFORMATION section and forward the form to the employer (school unit/corporation).

Employer: Complete the EMPLOYER AFFIDAVIT section and forward the form to the Indiana Public Retirement S ystem (INPRS). This

information may be submitted by compl eting an adjusted wage and contri bution transaction using TRF Employer Interactive available

on the INPRS Web site at www.inprs.in.gov

.

1. Questions or changes? Call customer service, toll-free, at (888) 286-3544, Monday – Frid ay, 8 a.m.- 8 p.m. EST.

Entry field Field description

MEMBER INFORMATION

Member’s name Enter the member’s complete name.

Social Security number Enter the last 4 digits of the member’s Social Security number.

Pension ID (PID) number Enter the member’s Pension ID (PID) number.

Address, City, State, ZIP Code Enter the member’s street or mailing address.

Telephone number Enter the member’s telephone number including area code .

E-mail address Enter the member’s e-mail address, if applicable.

Maiden/Other name used while teaching Enter the member’s maiden or other name, if applicable.

Signature and date Sign and date the form; format = mm/dd/yyyy.

EMPLOYER

A

FFIDAVIT

School corporation’s name Enter the full name of the school corporation.

Submission unit number Enter the school’s submission unit number.

Address, City, State, ZIP Code Enter the school’s street or mailing address, city, state, and ZIP Code.

Telephone number Enter the school’s telephone number incl uding area code.

Fax number Enter the school’s fax number including area code.

School year taught Enter each year of teaching for the employee.

Number of days taught Enter the number of days taught for the year.

Salary earned Enter the employee’s salary earned for the year.

Position Enter the employee’s position for the year.

3 percent Contribution paid by Check either employer or employee as the payer of the mandator y 3% contribution.

Service credit Check Yes or No whether previous service was with TRF.

Authorized representat ive’s signature and

date

This form must be signed and dated b y the employer’s authorized representative.

Authorized representativ e’s printed title Enter the employer’s authorized representative’s title.

HELPFUL INFORMATION

INPRS/TRF INTERNAL REVENUE SERVICE

INDIANA DEPARTMENT OF REVENUE

Telephone

numbers

(888) 286-3544 Toll-free (800) 829-1040 Toll-free (317) 233-4018 Indianapolis local

Fax: (317) 232-3882 (800) 829-4477 TeleTax (317) 232-2240 Tax questio ns

(800) 829-4059 TDD (hearin g

impaired)

(317) 233-4952 TDD (hearin g

impaired)

(317) 233-2329 Fax

Web site

www.inprs.in.gov

www.irs.gov www.in.gov/dor