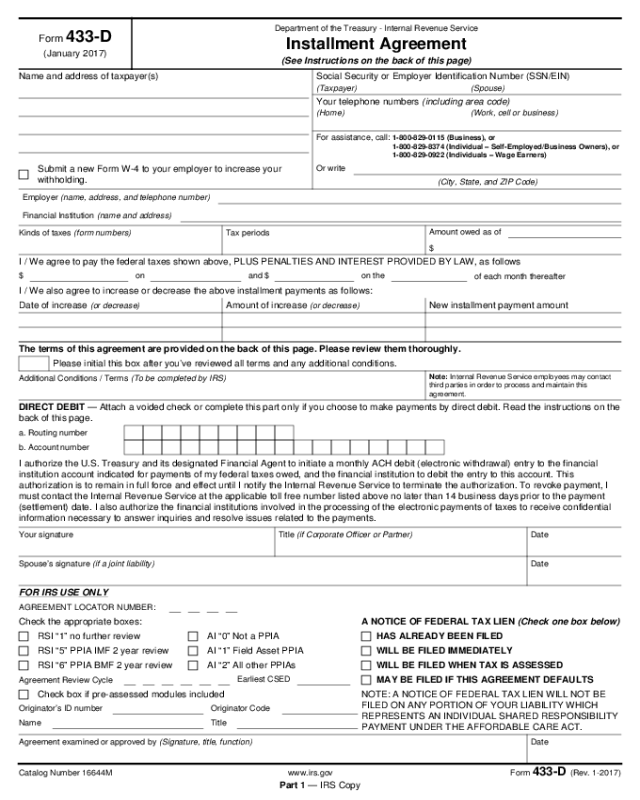

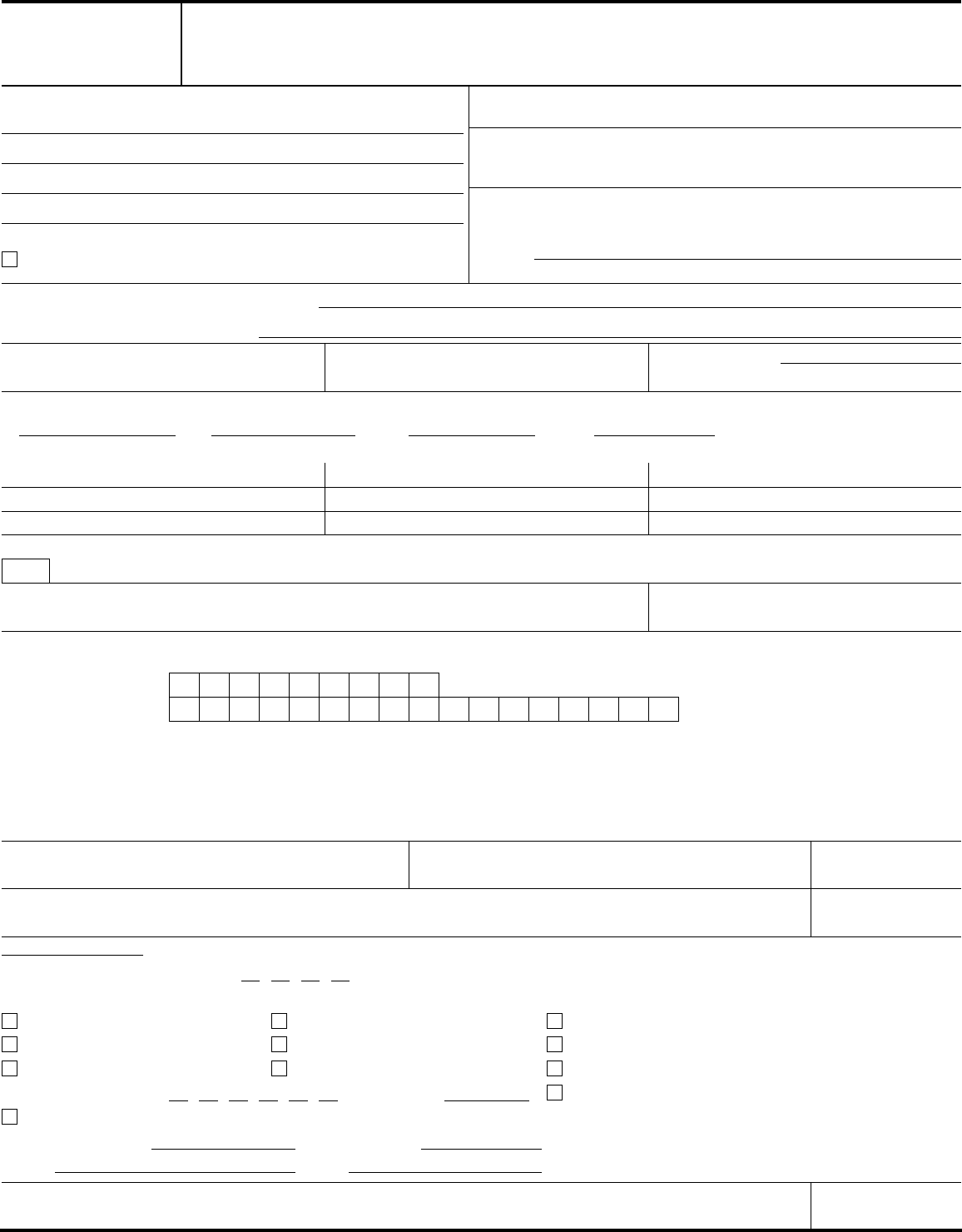

Catalog Number 16644M www.irs.gov

Form

433-D (Rev. 1-2017)

Part 2 — Taxpayer’s Copy

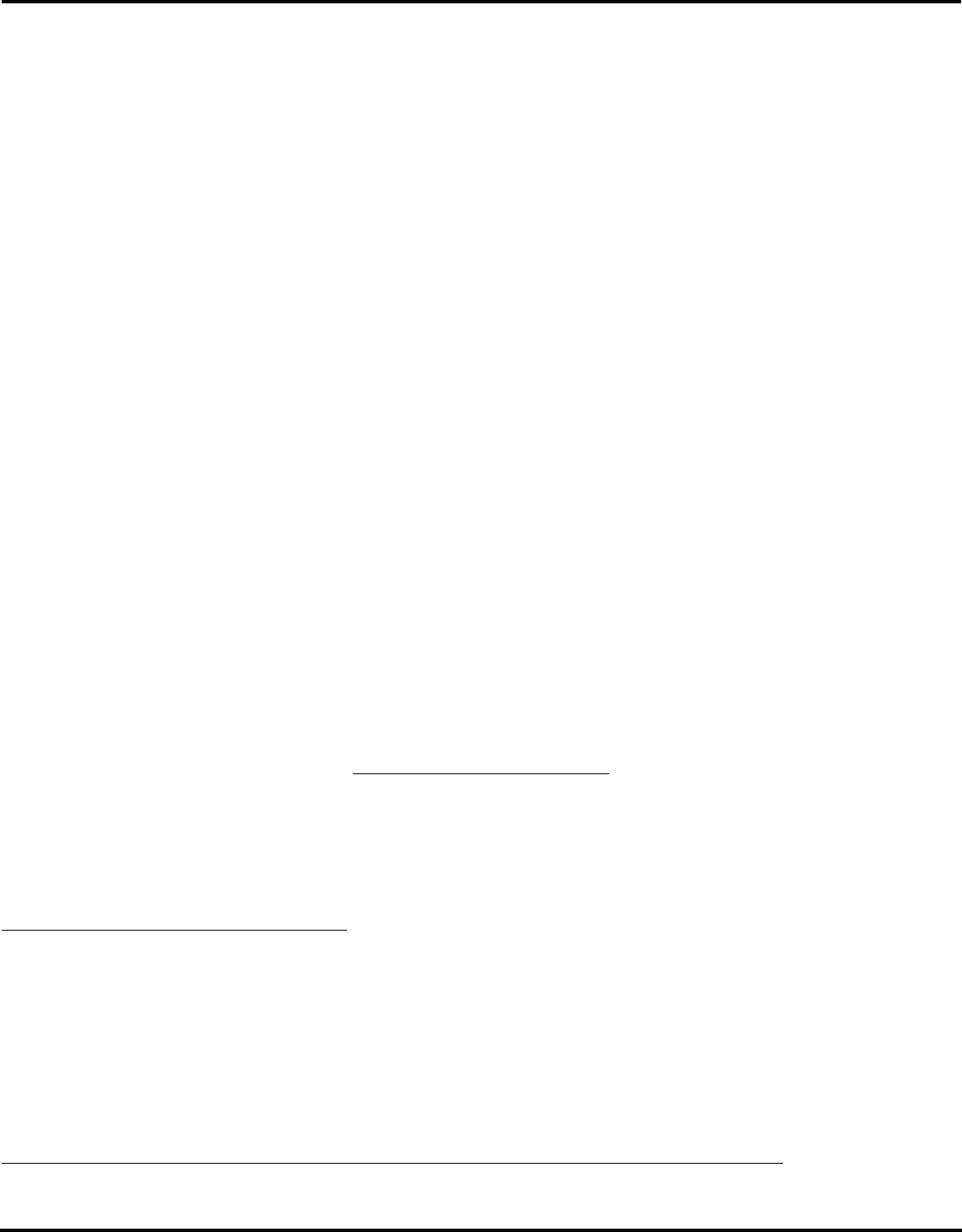

INSTRUCTIONS TO TAXPAYER

If not already completed by an IRS employee, please fill in the information in the spaces provided on the front of this form for:

• Your name (include spouse’s name if a joint return) and current address;

• Your social security number and/or employer identification number (whichever applies to your tax liability);

• Your home and work, cell or business telephone numbers;

• The complete name, address and phone number of your employer and your financial institution;

• The amount you can pay now as a partial payment;

• The amount you can pay each month (or the amount determined by IRS personnel); and

• The date you prefer to make this payment (This must be the same day for each month, from the 1st to the 28th). We must receive your payment by this date.

If you elect the direct debit option, this is the day you want your payment electronically withdrawn from your financial institution account.

Review the terms of this agreement.

When you’ve completed this agreement form, please sign and date it. Then, return Part 1 to IRS at the address on the letter

that came with it or the address shown in the “For assistance” box on the front of the form.

Terms of this agreement

By completing and submitting this agreement, you (the taxpayer) agree to the following terms:

• This agreement will remain in effect until your liabilities (including penalties and interest) are paid in full, the statutory period for collection has expired, or the

agreement is terminated. You will receive a notice from us prior to termination of your agreement.

• You will make each payment so that we (IRS) receive it by the monthly due date stated on the front of this form. If you cannot make a scheduled payment,

contact us immediately.

• This agreement is based on your current financial condition. We may modify or terminate the agreement if our information shows that your ability to pay has

significantly changed. You must provide updated financial information when requested.

• While this agreement is in effect, you must file all federal tax returns and pay any (federal) taxes you owe on time.

• We will apply your federal tax refunds or overpayments (if any) to the entire amount you owe, including the shared responsibility payment under the

Affordable Care Act, until it is fully paid or the statutory period for collection has expired.

• You must pay a $225 user fee, which we have authority to deduct from your first payment(s) ($107 for Direct Debit).

• In lieu of the above user fees, you may be eligible for a reduced user fee of $43. See Form 13844 for qualifications and instructions.

• If you default on your installment agreement, you must pay a $89 reinstatement fee if we reinstate the agreement. We have the authority to deduct this fee

from your first payment(s) after the agreement is reinstated.

• We will apply all payments on this agreement in the best interests of the United States. Generally we will apply the payment to the oldest collection statute,

which is normally the oldest tax year or period.

• We can terminate your installment agreement if:

• You do not make monthly installment payments as agreed. You do not pay any other federal tax debt when due. You do not provide financial information

when requested.

• If we terminate your agreement, we may collect the entire amount you owe, EXCEPT the Individual Shared Responsibility Payment under the Affordable Care

Act, by levy on your income, bank accounts or other assets, or by seizing your property.

• We may terminate this agreement at any time if we find that collection of the tax is in jeopardy.

• This agreement may require managerial approval. We’ll notify you when we approve or don’t approve the agreement.

• We may file a Notice of Federal Tax Lien if one has not been filed previously which, may negatively impact your credit rating, but we will not file a Notice of

Federal Tax Lien with respect to the individual shared responsibility payment under the Affordable Care Act.

HOW TO PAY BY DIRECT DEBIT

Instead of sending us a check, you can pay by direct debit (electronic withdrawal) from your checking account at a financial institution (such as a bank, mutual

fund, brokerage firm, or credit union). To do so, fill in Lines a and b. Contact your financial institution to make sure that a direct debit is allowed and to get the

correct routing and account numbers.

Line a. The first two digits of the routing number must be 01 through 12 or 21 through 32. Don’t use a deposit slip to verify the number because it may contain

internal routing numbers that are not part of the actual routing number.

Line b. The account number can be up to 17 characters. Include hyphens but omit spaces and special symbols. Enter the number from left to right and leave any

unused boxes blank.

CHECKLIST FOR MAKING INSTALLMENT PAYMENTS:

1. Write your social security or employer identification number on each payment.

2. Make your check or money order payable to “United States Treasury.”

3. Make each payment in an amount at least equal to the amount specified in this agreement.

4. Don’t double one payment and skip the next without contacting us first.

5. Enclose a copy of the reminder notice, if you received one, with each payment using the envelope provided. Make a payment even if you do not receive a

reminder notice, write the type of tax, the tax period and "Installment Agreement" on your payment. For example, "1040, 12/31/2014, Installment Agreement”.

You should choose the oldest unpaid tax period on your agreement. Mail the payment to the IRS address indicated on the front of this form.

6. If you didn’t receive an envelope, call the number below.

This agreement will not affect your liability (if any) for backup withholding under Public Law 98-67, the Interest and Dividend Compliance Act of 1983

QUESTIONS? — If you have any questions, about the direct debit process or completing this form, please call the applicable telephone number below for

assistance.

1-800-829-0115 (Business)

1-800-829-8374 (Individuals – Self-Employed / Business Owners)

1-800-829-0922 (Individuals – Wage Earners)

NOTE: If you are unable to make your monthly payments or if you accrue additional liability, please contact us immediately.