Form 4868 (2016)

Page 3

Specific Instructions

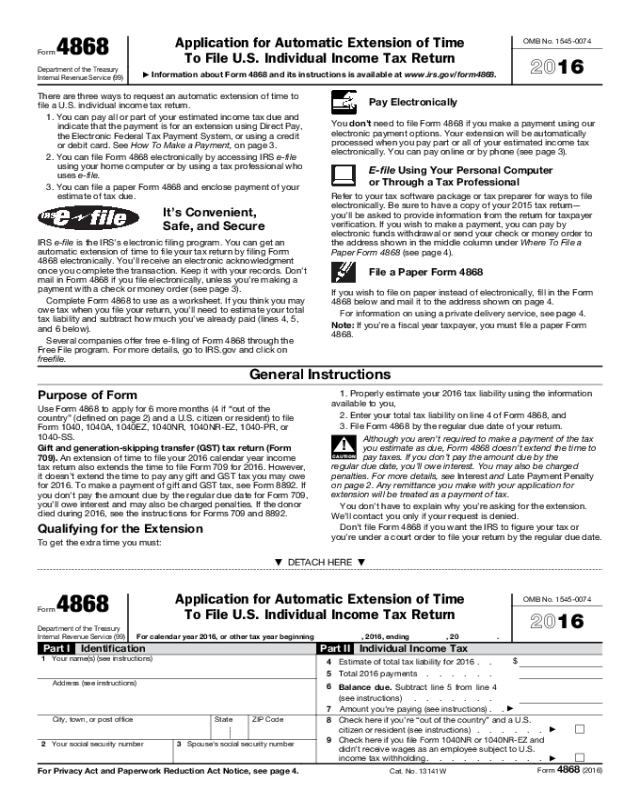

How To Complete Form 4868

Part I—Identification

Enter your name(s) and address. If you plan to file a joint return,

include both spouses’ names in the order in which they will appear

on the return.

If you want correspondence regarding this extension to be sent to

you at an address other than your own, enter that address. If you

want the correspondence sent to an agent acting for you, include

the agent’s name (as well as your own) and the agent’s address.

If you changed your name after you filed your last return because

of marriage, divorce, etc., be sure to report this to the Social

Security Administration before filing Form 4868. This prevents

delays in processing your extension request.

If you changed your mailing address after you filed your last

return, you should use Form 8822, Change of Address, to notify the

IRS of the change. Showing a new address on Form 4868 won’t

update your record. You can download or order IRS forms at

www.irs.gov/formspubs.

If you plan to file a joint return, enter on line 2 the SSN that you’ll

show first on your return. Enter on line 3 the other SSN to be shown

on the joint return. If you’re filing Form 1040NR as an estate or trust,

enter your employer identification number (EIN) instead of an SSN

on line 2. In the left margin, next to the EIN, write “estate” or “trust.”

IRS individual taxpayer identification numbers (ITINs) for aliens.

If you’re a nonresident or resident alien and you don’t have and

aren’t eligible to get an SSN, you must apply for an ITIN. Although

an ITIN isn’t required to file Form 4868, you’ll need one to file your

income tax return. For details on how to apply for an ITIN, see Form

W-7 and its instructions. If you already have an ITIN, enter it

wherever an SSN is requested. If you don’t have an ITIN, enter “ITIN

TO BE REQUESTED” wherever an SSN is requested.

▲

!

CAUTION

An ITIN is for tax use only. It doesn’t entitle you to social

security benefits or change your employment or

immigration status under U.S. law.

Part II—Individual Income Tax

Rounding off to whole dollars. You can round off cents to whole

dollars on Form 4868. If you do round to whole dollars, you must

round all amounts. To round, drop amounts under 50 cents and

increase amounts from 50 to 99 cents to the next dollar. For

example, $1.39 becomes $1 and $2.50 becomes $3. If you have to

add two or more amounts to figure the amount to enter on a line,

include cents when adding the amounts and round off only the total.

Line 4—Estimate of Total Tax Liability for 2016

Enter on line 4 the total tax liability you expect to report on your

2016.

• Form 1040, line 63.

• Form 1040A, line 39.

• Form 1040EZ, line 12.

• Form 1040NR, line 61.

• Form 1040NR-EZ, line 17.

• Form 1040-PR, line 6.

• Form 1040-SS, line 6.

If you expect this amount to be zero, enter -0-.

▲

!

CAUTION

Make your estimate as accurate as you can with the

information you have. If we later find that the estimate

wasn’t reasonable, the extension will be null and void.

Line 5—Estimate of Total Payments for 2016

Enter on line 5 the total payments you expect to report on your

2016.

• Form 1040, line 74 (excluding line 70).

• Form 1040A, line 46.

• Form 1040EZ, line 9.

• Form 1040NR, line 71 (excluding line 66).

• Form 1040NR-EZ, line 21.

• Form 1040-PR, line 11.

• Form 1040-SS, line 11.

▲

!

CAUTION

For Forms 1040A, 1040EZ, 1040NR-EZ, 1040-PR, and

1040-SS, don’t include on line 5 the amount you’re paying

with this Form 4868.

Line 6—Balance Due

Subtract line 5 from line 4. If line 5 is more than line 4, enter -0-.

Line 7—Amount You Are Paying

If you find you can’t pay the amount shown on line 6, you can still

get the extension. But you should pay as much as you can to limit

the amount of interest you’ll owe. Also, you may be charged the late

payment penalty on the unpaid tax from the regular due date of

your return. See Late Payment Penalty on page 2.

Line 8—Out of the Country

If you’re out of the country on the regular due date of your return,

check the box on line 8. “Out of the country” is defined on page 2.

Line 9—Form 1040NR or 1040NR-EZ Filers

If you didn’t receive wages subject to U.S. income tax withholding,

and your return is due June 15, 2017, check the box on line 9.

How To Make a Payment

Making Payments Electronically

You can pay online with a direct transfer from your bank

account using Direct Pay, the Electronic Federal Tax Payment

System, or by debit or credit card. You can also pay by phone

using the Electronic Federal Tax Payment System or by debit or

credit card. For more information, go to www.irs.gov/payments.

Confirmation number. You’ll receive a confirmation number when

you pay online or by phone. Enter the confirmation number below

and keep it for your records.

Enter confirmation number here

▶

Note: If you use an electronic payment method and indicate the

payment is for an extension, you don't have to file Form 4868. You

should pay the entire estimated tax owed or you could be subject to

a penalty. Your extension will be automatically processed when you

pay part or all of your estimated income tax electronically.

Pay by Check or Money Order

• When paying by check or money order with Form 4868, use the

appropriate address in the middle column under Where To File a

Paper Form 4868 on page 4.

• Make your check or money order payable to the “United States

Treasury.” Don’t send cash.

• Write your SSN, daytime phone number, and “2016 Form 4868”

on your check or money order.

• Don’t staple or attach your payment to Form 4868.

Note: If you e-file Form 4868 and mail a check or money order to

the IRS for payment, use a completed paper Form 4868 as a

voucher. Please note with your payment that your extension request

was originally filed electronically.

No checks of $100 million or more accepted. The IRS cannot

accept a single check (including a cashier's check) for amounts of

$100,000,000 ($100 million) or more. If you're sending $100 million

or more by check, you'll need to spread the payments over two or

more checks with each check made out for an amount less than

$100 million. The $100 million or more amount limit does not apply

to other methods of payment (such as electronic payments), so

please consider paying by means other than checks.