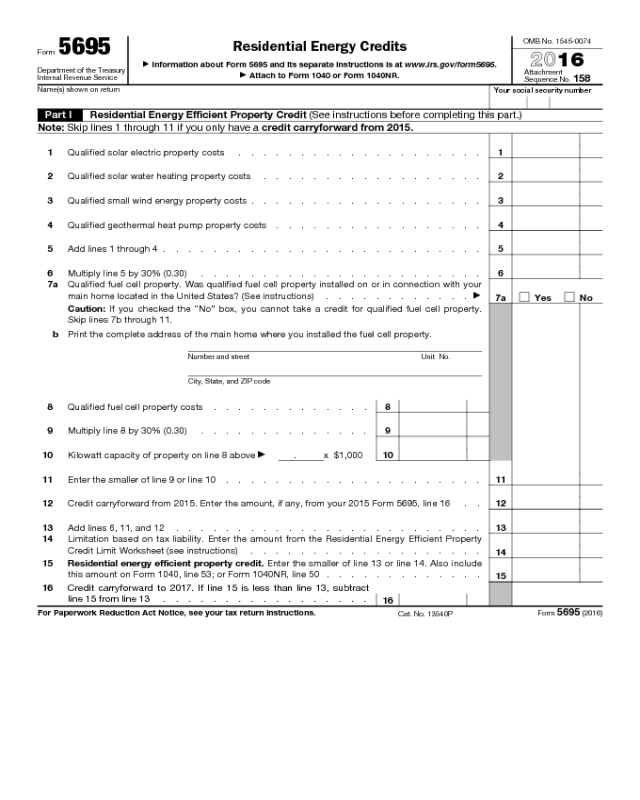

Form 5695

Form 5695

Department of the Treasury

Internal Revenue Service

Residential Energy Credits

▶

Information about Form 5695 and its separate instructions is at www.irs.gov/form5695.

▶

Attach to Form 1040 or Form 1040NR.

OMB No. 1545-0074

2016

Attachment

Sequence No.

158

Name(s) shown on return

Your social security number

Part I Residential Energy Efficient Property Credit (See instructions before completing this part.)

Note: Skip lines 1 through 11 if you only have a credit carryforward from 2015.

1 Qualified solar electric property costs . . . . . . . . . . . . . . . . . . . . 1

2 Qualified solar water heating property costs . . . . . . . . . . . . . . . . . . 2

3 Qualified small wind energy property costs . . . . . . . . . . . . . . . . . . . 3

4 Qualified geothermal heat pump property costs . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Multiply line 5 by 30% (0.30) . . . . . . . . . . . . . . . . . . . . . . . 6

7 a Qualified fuel cell property. Was qualified fuel cell property installed on or in connection with your

main home located in the United States? (See instructions) . . . . . . . . . . . .

▶

7a

Yes No

Caution: If you checked the “No” box, you cannot take a credit for qualified fuel cell property.

Skip lines 7b through 11.

b Print the complete address of the main home where you installed the fuel cell property.

Number and street Unit No.

City, State, and ZIP code

8 Qualified fuel cell property costs . . . . . . . . . . . . . 8

9 Multiply line 8 by 30% (0.30) . . . . . . . . . . . . . .

9

10 Kilowatt capacity of property on line 8 above

▶

. x $1,000 10

11 Enter the smaller of line 9 or line 10 . . . . . . . . . . . . . . . . . . . . .

11

12 Credit carryforward from 2015. Enter the amount, if any, from your 2015 Form 5695, line 16 . .

12

13 Add lines 6, 11, and 12 . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Limitation based on tax liability. Enter the amount from the Residential Energy Efficient Property

Credit Limit Worksheet (see instructions) . . . . . . . . . . . . . . . . . . .

14

15

Residential energy efficient property credit. Enter the smaller of line 13 or line 14. Also include

this amount on Form 1040, line 53; or Form 1040NR, line 50 . . . . . . . . . . . . .

15

16

Credit carryforward to 2017. If line 15 is less than line 13, subtract

line 15 from line 13 . . . . . . . . . . . . . . . . .

16

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 13540P

Form 5695 (2016)

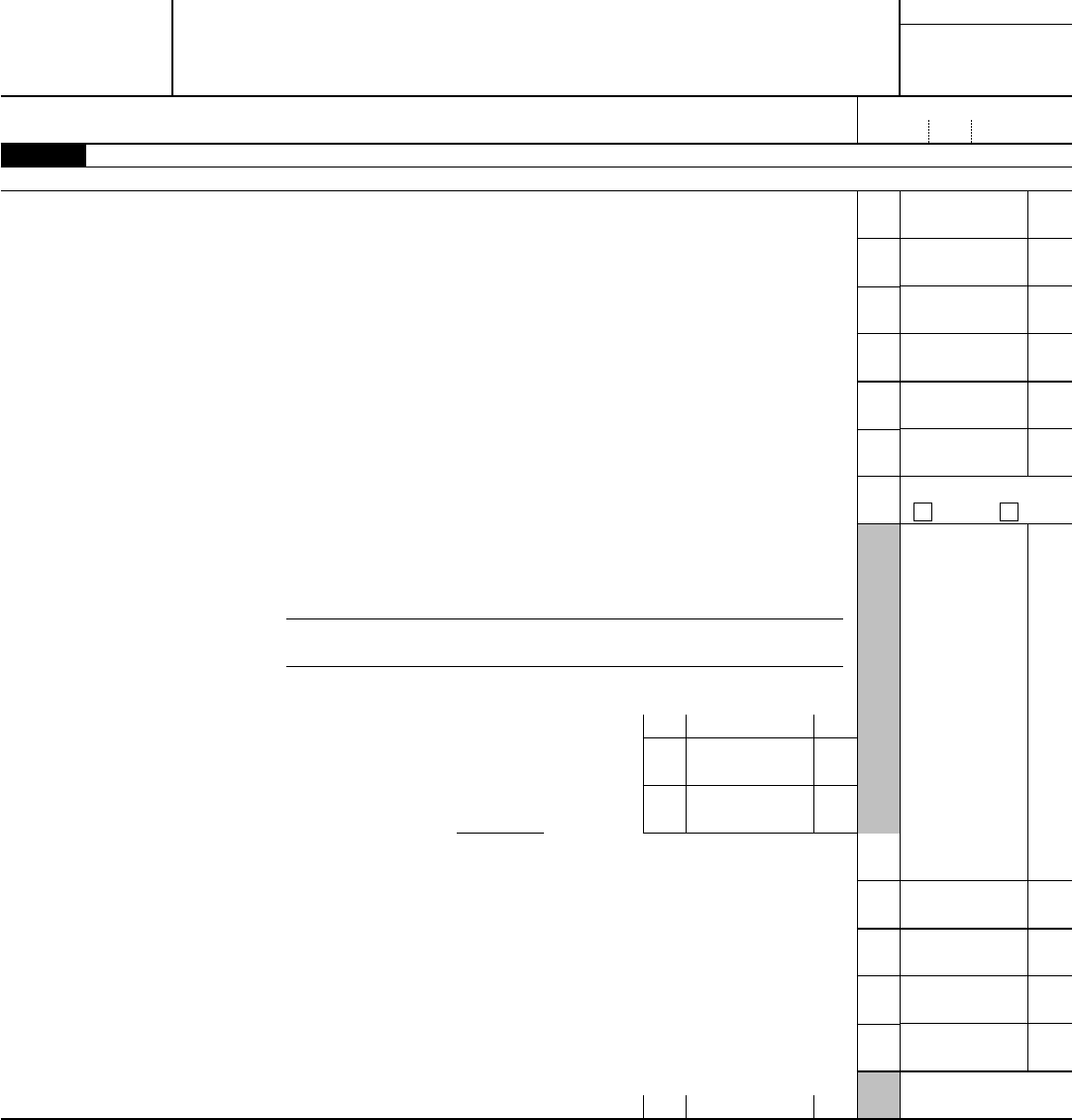

Form 5695 (2016)

Page 2

Part II Nonbusiness Energy Property Credit

17

a Were the qualified energy efficiency improvements or residential energy property costs for your

main home located in the United States? (see instructions) . . . . . . . . . . . .

▶

17a Yes No

Caution: If you checked the “No” box, you cannot claim the nonbusiness energy property credit.

Do not complete Part II.

b Print the complete address of the main home where you made the qualifying improvements.

Caution: You can only have one main home at a time.

Number and street Unit No.

City, State, and ZIP code

c

Were any of these improvements related to the construction of this main home? . . . . .

▶

17c Yes No

Caution: If you checked the “Yes” box, you can only claim the nonbusiness energy property

credit for qualifying improvements that were not related to the construction of the home. Do not

include expenses related to the construction of your main home, even if the improvements were

made after you moved into the home.

18 Lifetime limitation. Enter the amount from the Lifetime Limitation Worksheet (see instructions) . . 18

19

Qualified energy efficiency improvements (original use must begin with you and the component must

reasonably be expected to last for at least 5 years; do not include labor costs) (see instructions).

a Insulation material or system specifically and primarily designed to reduce heat loss or gain of

your home that meets the prescriptive criteria established by the 2009 IECC . . . . . . . .

19a

b Exterior doors that meet or exceed the version 6.0 Energy Star program requirements . . . . 19b

c

Metal or asphalt roof that meets or exceeds the Energy Star program requirements and has

appropriate pigmented coatings or cooling granules which are specifically and primarily designed

to reduce the heat gain of your home . . . . . . . . . . . . . . . . . . . .

19c

d Exterior windows and skylights that meet or exceed the version 6.0

Energy Star program requirements . . . . . . . . . . . .

19d

e Maximum amount of cost on which the credit can be figured . . . . 19e

f

If you claimed window expenses on your Form 5695 prior to 2016,

enter the amount from the Window Expense Worksheet (see

instructions); otherwise enter -0- . . . . . . . . . . . . .

19f

g Subtract line 19f from line 19e. If zero or less, enter -0- . . . . . . 19g

h Enter the smaller of line 19d or line 19g . . . . . . . . . . . . . . . . . . . . 19h

20 Add lines 19a, 19b, 19c, and 19h . . . . . . . . . . . . . . . . . . . . . . 20

21 Multiply line 20 by 10% (0.10) . . . . . . . . . . . . . . . . . . . . . . . 21

22

Residential energy property costs (must be placed in service by you; include labor costs for onsite

preparation, assembly, and original installation) (see instructions).

a Energy-efficient building property. Do not enter more than $300 . . . . . . . . . . . . 22a

b Qualified natural gas, propane, or oil furnace or hot water boiler. Do not enter more than $150 . .

22b

c

Advanced main air circulating fan used in a natural gas, propane, or oil furnace. Do not enter more

than $50 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22c

23 Add lines 22a through 22c . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Add lines 21 and 23 . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Maximum credit amount. (If you jointly occupied the home, see instructions) . . . . . . . . 25

26 Enter the amount, if any, from line 18 . . . . . . . . . . . . . . . . . . . . . 26

27

Subtract line 26 from line 25. If zero or less, stop; you cannot take the nonbusiness energy

property credit . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Enter the smaller of line 24 or line 27 . . . . . . . . . . . . . . . . . . . . . 28

29

Limitation based on tax liability. Enter the amount from the Nonbusiness Energy Property Credit

Limit Worksheet (see instructions) . . . . . . . . . . . . . . . . . . . . . .

29

30

Nonbusiness energy property credit. Enter the smaller of line 28 or line 29. Also include this

amount on Form 1040, line 53; or Form 1040NR, line 50 . . . . . . . . . . . . . .

30

Form 5695 (2016)

$2,000

$500